With the black cloud of an Israel-Iran battle now hanging over stock markets and the ever-worrying potential of hurricane Trump that could blow an ill-wind for share players, it might be time to think a little defensive. That said, unless I’m really sure a crash is coming, I never go to cash though I am happy to become more income oriented.

Income stock funds will fall with the “let’s head for the exit” mentality, when fear grips Wall Street and global markets panic in sync. But they’re quick rebounders when sentiment says fear should be replaced by greed.

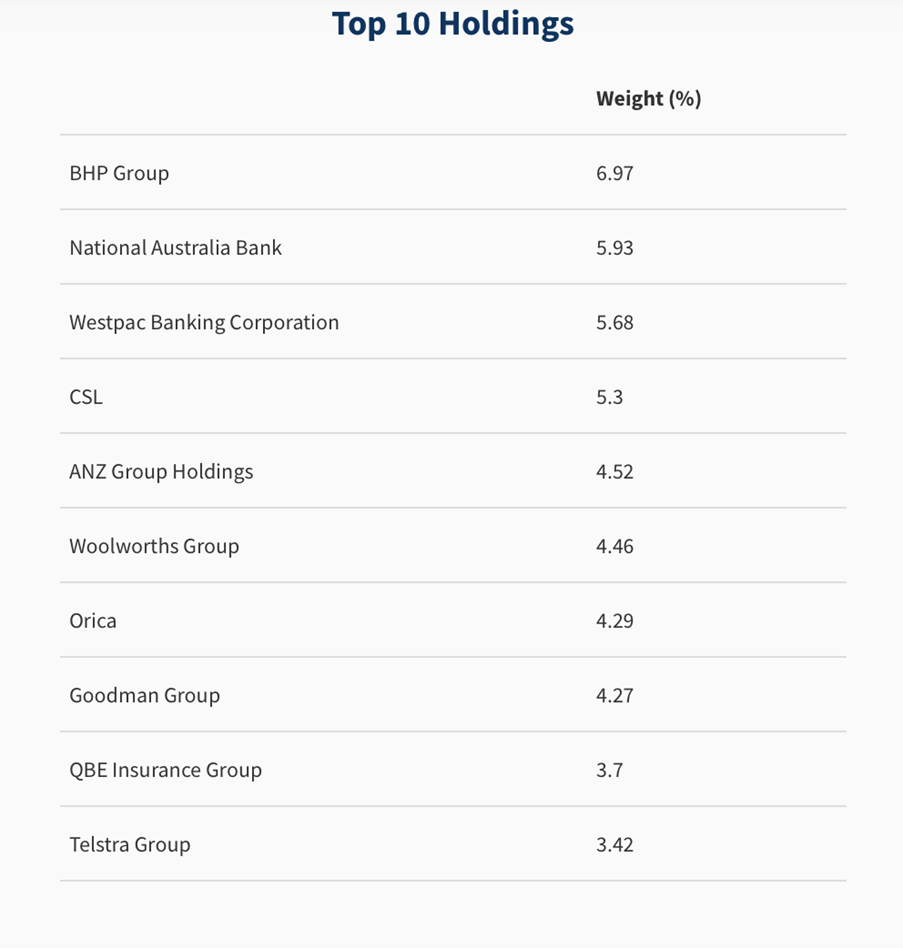

I thought I’d look at the major holdings of the likes of the Vanguard High Yield fund (VHY) and Switzer Dividend Growth Fund (SWTZ) to see what they are invested in.

Let’s start with Vertium’s Jason The, who manages the Switzer Dividend Growth Fund. Like many smart players, Jason got out of CBA too early and invested the fund for the stocks that would benefit when the historically big dividend stocks, like the banks, became out of fashion as interest rates fell.

While he copped it capital-wise last year, the table above shows he killed them income-wise, with a gain of 12.67% when you throw in franking credits.

Below are the top 10 holdings of SWTZ. I want to know what the analysts say about these stocks that might be a big help for income chasers, who are a little spooked right now.

Among these, which ones do the analysts tip for a good year ahead?

(Note some of these holdings may well have been bought at lower prices so the income yield could be a lot higher for SWTZ. And some of these stocks could be bought for capital gain and not simply because of a promising dividend.)

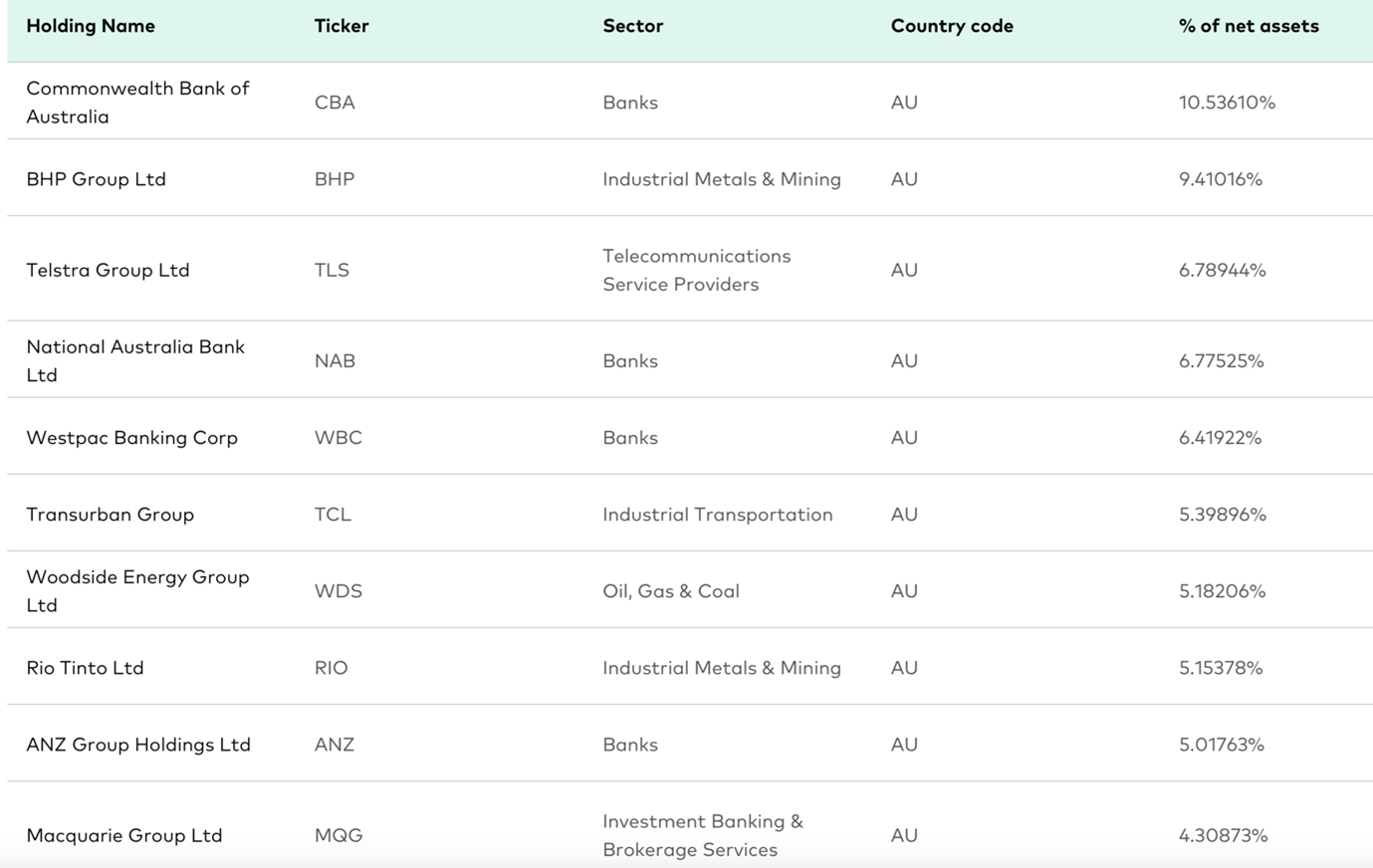

Now let’s look at VHY’s main holdings and try to identify a few different companies, compared to SWTZ, that analysts like. VHY had a gross total return of over 12% in the year to May.

These are VHY’s big holdings:

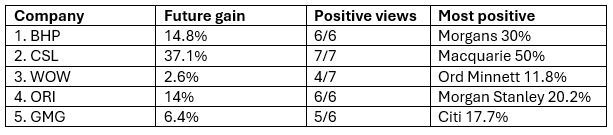

While Transurban (TCL) and Woodside (WDS) are liked, both have small negative outlooks from the analysts on FNArena. However, here are some with a positive outlook.

Summing it up, the stocks that income fund managers are holding with solid positive views from the analysts are BHP, CSL, Woolworths, Orica and Goodman Group.

Over the past week, I stumbled upon Orora (ORA), the forgotten packaging company that was once a great performer. The six out of six analysts have given the company the thumbs up, and Macquarie sees a 31.86% gain head.

Meanwhile, the dividend for this year is forecasted at 5.3%, and 5.5% for 2026. Here are all the views of the experts:

Orora (ORA)

While I remain positive on stocks, this new curve ball out of the Middle East really takes the edge off my optimism for the short term. That’s why I’d prefer to chase income rather than keep cash.

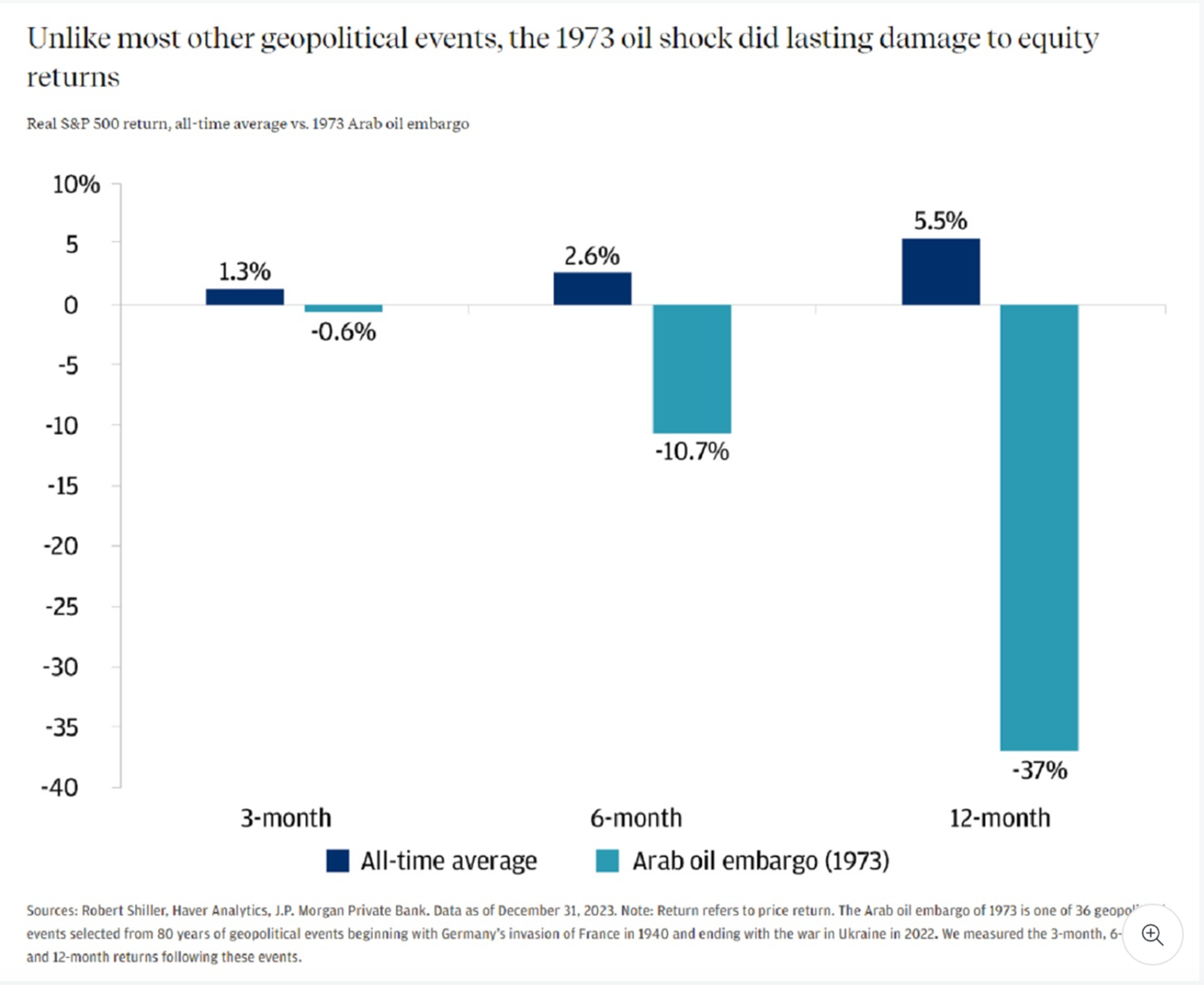

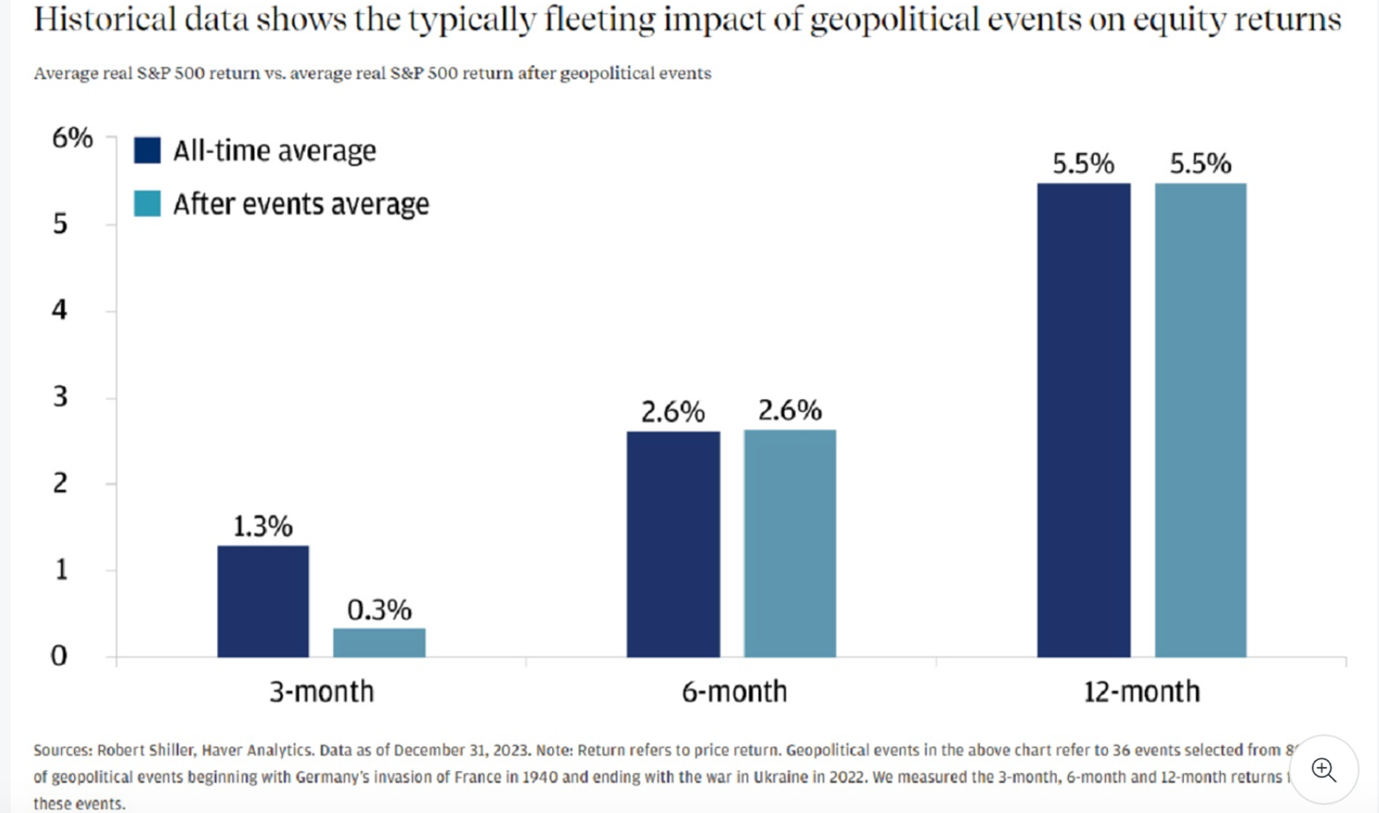

By the way, history shows that markets often throw off geopolitical crises after 12 months, but they can react more negatively in the short term, as the chart below shows.

That said, the worst geopolitical market reaction was after the 1973 oil shock, as the table below screams out. You want to hope that this Israel-Iran war doesn’t hit oil supply and prices too hard!