On a day most of us don’t work, thanks to King Charles, it’s time to take stock of where stock markets might be heading. Rather than focussing on what should be bought, let’s look at what might be sold.

Courageously I say that the stock to sell is CBA! Of course, not all of it. Many of you have made great capital gains and the dividend yield you’re getting is a lot more than someone who buys the stock at $179.90 price it is today. That yield is 2.7%, though its future total return might be smashed if its share price falls in line with what experts predict.

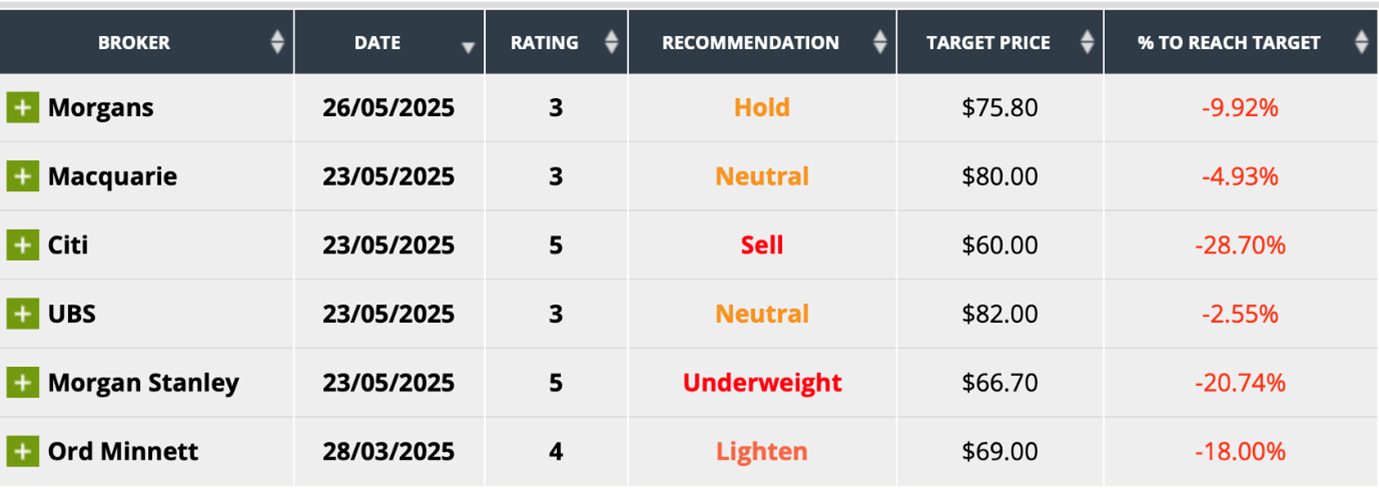

The consensus is a negative 39.3% fall/call to $109.24. Here are the views of the analysts surveyed by FNArena.

CBA

See how six out of six analysts give the country’s best bank the thumbs down? That’s because the share price is simply too high given what the bank is reporting and what the future looks like. The broking house Morgans sees CBA’s future share price at $97.49. I’d be a screaming buyer if that price ever emerges! In fact, I’d be a buyer at $140 because that would be a 20% slide from its current ‘silly’ price.

And that’s exactly what it is – a silly price. A recent news piece by news.com.au reporter Rohan Smith underlined why I make this ‘insulting’ claim on one of the best banks, not only in Australia but in the world!

Here are some of the important observations Smith made:

- The market cap of CBA is over $300 billion!

- CBA is more valuable than Westpac and NAB together!

- It’s more valuable than big Wall Street banks such as Citigroup!

- Its share price is up 44% over the year!

- Experts say CBA is “completely overvalued and the $300 billion figure ignores anaemic earnings growth.”

- In its latest results, CBA made $9.48 billion after tax, while Westpac made $7 billion, NAB made $6.96 billion and ANZ made $6.53 billion. These numbers don’t really justify such a big share price difference.

So, the objective numbers say $179.90 is MAD! While I wouldn’t be surprised to see this go to $200, because CBA madness prevails, one day it will slide.

Trader and stocks educator Alan Hull told news.com that the bank is a “a risky share to be buying”. He added: “Smart money is not buying CBA — it’s seriously overvalued. Its earnings growth is anaemic.”

Let’s look at why CBA’s share price has spiked. Here goes:

- Trump’s spooking of the market has helped defensive plays. CBA with its good dividend is seen as a safe pair of hands in challenging times. NAB is up 10% over the past year compared to CBA up 44%. That said, banks are usually seen as growth plays and don’t perform all that well as interest rates fall and economies slow, as we’re seeing now.

- The popularity of ETFs (especially ones such as VAS, A200, IOZ and STW from State Street) means when these are bought, the biggest cap stock in the share market gets bought automatically.

- The exit of money from US stocks could easily have made the CBA attractive to foreign investors and funds, especially with our currency being so low against the historical average of around 73US cents.

But what will make CBA’s share price fall?

Clearly, a big market sell-off because Trump tariffs trigger a global trade war. That’s when over-priced stocks could fall harder than others. Also, any curve ball development out of the bond market or linked to China and Taiwan could be big ‘spook’ factors for stock markets.

Another reason might be a good tariff outcome because President Trump wants stock markets to approve his presidency. This, combined with a number of rate cuts, could lead to a rotation out of stocks such as CBA, JB Hi-Fi, Wesfarmers and the other banks into mid- and small-cap stocks.

Year-to-date, the EX20 ETF (which captures stocks 21 to 200 in the ASX 200) has risen 12.31%, while the S&P/ASX 200 is up 9.8% and S&P/ASX 20 is up 8.06%. So, the trend away from very big cap stocks to smaller companies is happening.

I’d argue it’s not a question of ‘if’ CBA’s share price will fall notably, but ‘when’ it will fall? One important issue must be considered, and it’s an issue that’s not easy to respond to.

If CBA’s share price did fall by say 20%, ETFs such as VAS, STW, A200 and IOZ.AX would be taken down. Of course, while other stocks rising would soften the blow, in the early days, along with the market index, these would be negatively affected.

It might be wise to evaluate your portfolio for exposure to big cap stocks. Possibly EX20 could be a hedge play for when the ASX 20 sell-off occurs. In fact, EX20 plus some ASX 20 stocks that are likely to rise (e.g., BHP, Rio, FMG and CSL) could also help soften the blow when CBA and other top 20 companies start sliding south.

For the record, here are the views on JB Hi-Fi and Wesfarmers.

JBH: Consensus down 10.3%

WES: Consensus down 14.1%

Unlike the CBA, because both JBH and WES are in retail, they should benefit from lower interest rates. However, they’re still tipped to fall.