Led by a booming technology sector in the USA, the Australian share market continued to rally in May as trade worries were put to one side. With dividends, the Aussie market added 4.2% over the month. All sectors finished in the green, with technology starring

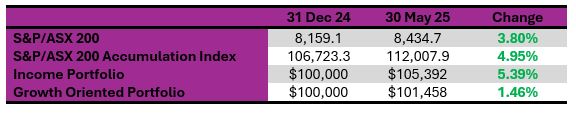

Our model portfolios finished considerably higher in the month. Year to date, the income portfolio continues to outperform.

At the beginning of the year, we updated our portfolios for 2025. There are two model portfolios – an income-oriented portfolio and a growth portfolio. The objectives, methodology, construction rules and underlying economic assumptions can be referenced here: (see: https://switzerreport.com.au/our-portfolios-for-2025/)

These are long-only model portfolios, and as such, they are assumed to be fully invested at all times. They are not “actively managed”, although adjustments are made from time to time.

In this article, we look at how they have performed so far in 2025. To do so, we will start by examining how the overall market has fared.

All sectors in the green, with small caps doing better

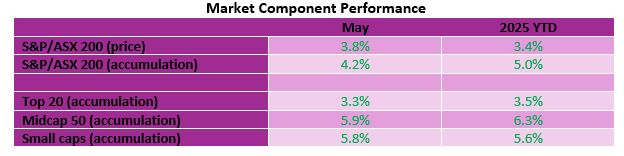

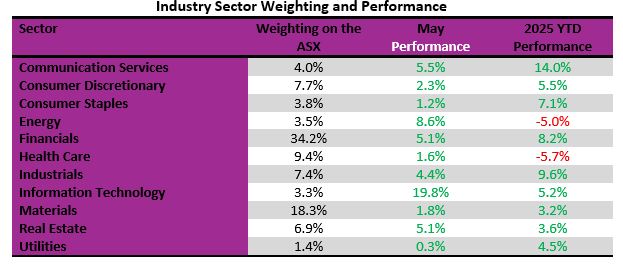

The tables below show the performances in May and calendar 2025 year-to-date of the components (large cap, mid cap, small cap etc.) and the industry sectors that make up the Australian share market.

Within the components (see table below), smaller cap stocks did better than large cap stocks in May, although the differences in performance are not that material. The S&P/ASX Small Ordinaries Index (an index which tracks stocks ranked 101st to 300th by market capitalisation size) returned 5.8% in May compared to the top 20’s return of 3.3%.

With the industry sectors (see table below), all sectors finished in the green for the month. The largest sector by market weight, financials, which makes up 34.2% of the overall S&P/ASX 200 index, added 5.1% in May, largely due to the ongoing out-performance of the Commonwealth Bank and recovery in share price for Macquarie. Year-to-date, financials is up by 8.2%, outperforming the overall index which is up by 5%.

Information technology starred, with a gain of 19.8% during May. This more than reversed March and April losses and took the year-to-date performance “back into the black” with a return of 5.2%. Energy also rebounded, adding 8.6%. Year-to-date, it is one of two sectors in the red, losing 5%. The other sector in the red is healthcare. It has lost 5.7% in 2025.

Most other sectors have year-to-date returns around 5%, on par with the market. The Communication services sector is doing well, thanks to the 21.5% return from Telstra in 2025.

The second largest sector by market capitalisation, materials, has recorded a small gain for the year of 3.2%. Soaring gold stocks in particular are offsetting losses for the iron ore miners and base metal stocks.

Portfolio Performance in 2025

The income portfolio to 30 May has returned 5.39% and the growth oriented portfolio has returned

1.46% (see tables at the end). Compared to the benchmark S&P/ASX 200 Accumulation Index (which adds back income from dividends), the income portfolio has outperformed by 0.44% and the growth portfolio has underperformed by 3.49%.

Income portfolio

The objective of the income portfolio is to deliver tax advantaged income whilst broadly tracking the S&P/ASX 200.

The income portfolio was forecast to deliver an income return of 4.3% (based on its opening value at the start of the year), franked at 71.2%. After five months, it has returned 1.73%, franked at 80%. The income return is lower than expected due to big cuts in resource and energy company dividends and may need to be downgraded.

The portfolio has a defensive orientation and a bias to yield style stocks. On a sector basis, the biases are fairly minor. It is overweight consumer services and utilities (to find income), and marginally underweight financials (particularly the major banks), given our view that Australian banks are expensive. It is underweight information technology (where there are very few medium yielding stocks). It is marginally overweight materials and energy.

In a bull market, we expect that the income portfolio will underperform relative to the broader market due to the underweight position in growth-oriented sectors and the stock selections being more defensive, and conversely in a bear market, it should moderately outperform.

In the month of May, the portfolio returned 3.55% compared to the index’s 4.2%. The strong performances of Telstra, Wesfarmers and Brambles in particular didn’t make up for underweight positions in information technology and the Commonwealth Bank, and underwhelming performances of material stocks. Year-to-date, the income portfolio has outperformed the benchmark index by 0.44%.

No changes to the portfolio are proposed at this point in time.

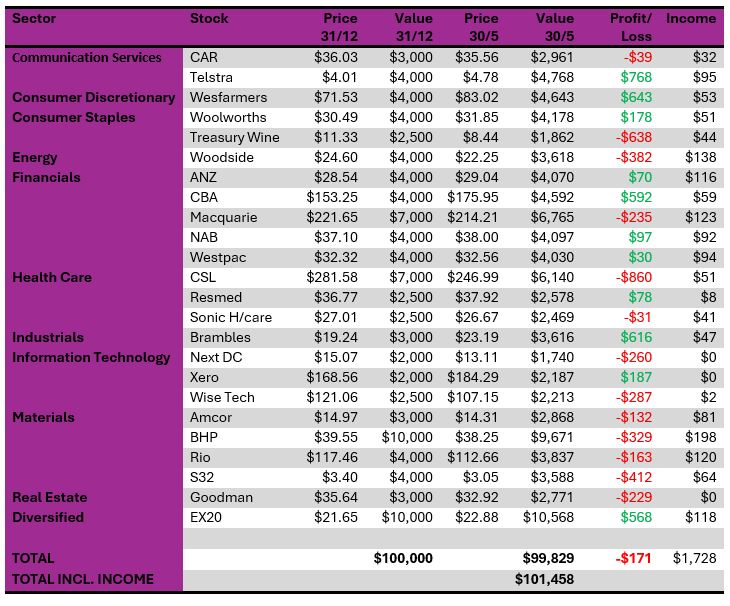

The income-biased portfolio per $100,000 invested (using prices as at the close of business 30 May 2025) is as follows:

₁ Suncorp return of capital of $3.00 per share, plus share consolidation of 1:0.8511 and special div of 22c

Growth portfolio

The objective of the growth portfolio is to outperform the S&P/ASX 200 market over the medium term, whilst closely tracking the index.

The growth portfolio in 2025 is moderately overweight communication services, health care, materials and information technology. It is underweight financials (particularly the major banks), consumer discretionary, industrials, real estate and utilities.

A major inclusion is the Betashares Portfolio Diversifier (EX20), weighted at 10% ($10,000). This ETF invests on an index-weight basis in stocks outside the top 20, providing ready and diversified exposure to mid and small cap stocks.

In the month of May, the growth portfolio returned 4.68% compared to the index’s 4.2%. A recovery in IT stocks, plus strong performances from Telstra, Macquarie, Wesfarmers, Brambles and Goodman drove the performance. Treasury Wine Estates continued to head south. Year-to-date, the portfolio has returned 1.46%, underperforming the benchmark index by -3.49%. An underweight position in Commonwealth Bank (relative to the index), plus overweight positions in healthcare, energy and resources, are the main drags.

No changes are proposed to the portfolio at this point in time.

Our growth oriented portfolio per $100,000 invested (using prices as at the close of business on 30 May 2025) is as follows: