The big lesson of investing inside a super fund is to always remember that you’re investing for the long-term and that opportunities can present themselves when there are short-term sets against quality companies or potential quality companies.

Those who bought CBA at $58 when the Coronavirus crash of the market happened in March 2020, or who bought Xero in late 2022 for $69 have gained 78% with the stock now at $123, and that’s despite a near 8% fall over the past month.

Last year, I suggested that many quality companies looked well-priced and so I recommended:

- HNDQ, which is up 34% over the past 12 months.

- GEAR, up 11.84% over 12 months, but up 25% over six months.

- IHVV, up 22.68% over 12 months and 20.7% over six months.

- VAS, up 12% over the past six months.

- ResMed (RMD) up 23.84% over the last six months.

- Macquarie (MQG) up 18% over six months.

- CSL, up 10.5% over six months.

CSL has had to deal with the threat of diet drugs, which many suspect is an overdone threat. But it has also had to marry in its newly absorbed Nephrology kidney disease business. CSL is also seen as a growth company, so interest rate cuts (when they happen) could be a plus for the company’s share price.

OK, that was the past. What about the future? Where am I searching for the next big market take-off investment, or more correctly, speculation.

While VAS is a core investment for me (just like CBA, CSL, MQG and BHP) on the other hand GEAR and HNDQ are short-term speculators or satellite investments.

I could exit GEAR when it’s in the $30 plus region, while I’d get out of HNDQ when I think US tech stocks are set for a sell-off. By the way, I could switch from HNDQ to NDQ if I thought the Aussie dollar had topped out and a depreciation was on the cards.

I never buy individual overseas stocks, but Tesla looks interesting after a 36.5% dumping over the past six months. This is a company with a quality product (the Tesla cars), but it’s challenged by cheaper Chinese products and the erratic nature of Elon Musk, who’s both a genius but a leader who gets distracted by sideshows such as Twitter (now called X), robotaxis, flying to Mars and making his car driverless.

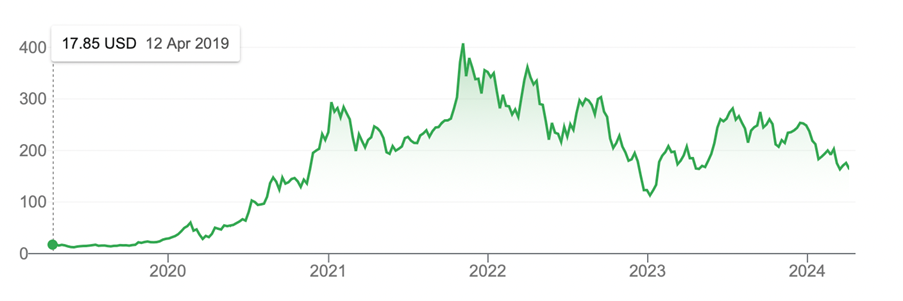

This five-year chart shows the ups and downs of this company that was US$407 in November 2021 but is now $164.90.

But the erraticism of this Musk creation could get worse if this hedge fund manager, who has been shorting Tesla since 2020 is right. Believe it or not but Per Lekander, the managing partner at investment management firm Clean Energy Transition, told CNBC this week that the company will “go bust” and the stock could fall to $14!

This is how CNBC’s Arjun Kharpal explained Lekander’s controversial view: “He said his call is based on an estimate that the company’s full-year earnings per share this year would be $1.40. Lekander contends that Tesla is a “no growth” stock and should be valued on 10 times forward earnings, versus around 58 times forward earnings currently. Forward earnings are an important metric used by traders to gauge the value of a stock.”

Lekander is out-of-step with the consensus view on Tesla, but hedge fund managers often are out-of-step with the mainstream view. Here’s the consensus view from tipranks.com: “The average price target for Tesla is $196.72. This is based on 35 Wall Street Analysts’ 12-month price targets, issued in the past 3 months. The highest analyst price target is $320, the lowest forecast is $23.53. The average price target represents an 18.06% increase from the current price of $166.63.

Tesla looks interesting but the time to nibble in would be when tech stocks pullback. And it’s worth reminding you that Musk has been on the frontline of AI development and that’s bound to be a plus for the company. Yes, Tesla looks interesting, but it comes with risks.

A related potentially rewarding investment could be lithium, which was in the news this week, with rival expert market watchers debating whether the commodity’s market is still oversupplied or moving into balance.

Earlier this week, CNBC highlighted an expert who disputed the view of Goldman Sachs that the lithium market was still oversupplied, explaining why the share price of Pilbara Minerals is down 30% since August of last year, while the share price of Liontown Resources is off 60% since October.

Oversupply saw lithium prices dive 80% from their peak, but the AFR’s Sarah Jones reports that “Ethical Partners’ proprietary model suggests the global market for lithium is moving “rapidly back” into balance and could even be undersupplied”.

Ethical Partners say they’ve talked one-on-one with producers and have solid information on costs, production plans and other key metrics that tell them the market is, at the very least, balanced.

OK, let’s say they’re right on supply. What’s happening with demand?

Ethical Partners believe there are “green shoots” when it comes to electric vehicle (EV) demand and that’s important to the demand for lithium. The views on demand for EVs aren’t consistent but what is consistent is the desire of car companies to make electric cars as this report about Kia proves: “Kia is prepared to fully invest in electric vehicles (EVs), despite growing concerns of slowing demand for EVs,” Maria Merano wrote for teslarati.com. “During Kia’s CEO Investor Day event, the Asian carmaker announced plans to sell 3.2 million EVs in the global market in 2024. Kia ultimately aims to boost its global EV sales to 4 million by 2027 and 4.3 million by 2030.

“Kia expects to sell 761,000 pure battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs) this year. The company expects BEV and HEV sales to account for 24% of total sales. Hyundai’s US EV sales jumped 62% year-over-year.”

This could be a real world example of the famous Say’s Law, which tells us that the very production of stuff (which economists call supply) can actually create the demand that buys it. How does that happen? The combined impact of seeing the product plus marketing and price lowering can mean non-buyers of an EV today could be buyers tomorrow.

And we long-term investors are waiting for tomorrow to make our bets/investments today look like really smart plays.

So, if I’m going to give lithium a go, which company will I go for? Tribeca portfolio manager Jun Bei Liu like Pilbara Minerals (PLS). As it’s the most-shorted stock on the Australian market, when lithium is back in, it will have the biggest squeeze play.

Liontown Resources (LTR) holds interest because Gina Rinehart owns nearly 20% of the company and she bought in around $3, while today it’s a $1.19 company! Meanwhile, Ethical Partners like IGO, which is down 42% over the past year.

IGO

Why IGO?

“Of all the lithium producers they speak to, Ethical Partners owns just IGO because it’s the only company in the sector that meets their cash flow criteria,” the AFR’s Sarah Jones recorded. “They have been topping up through the lithium rout.”

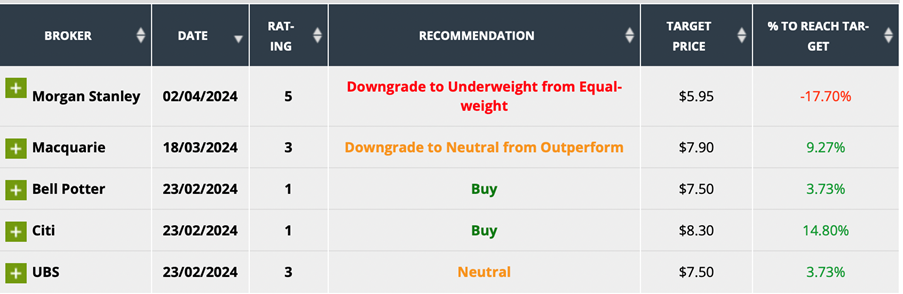

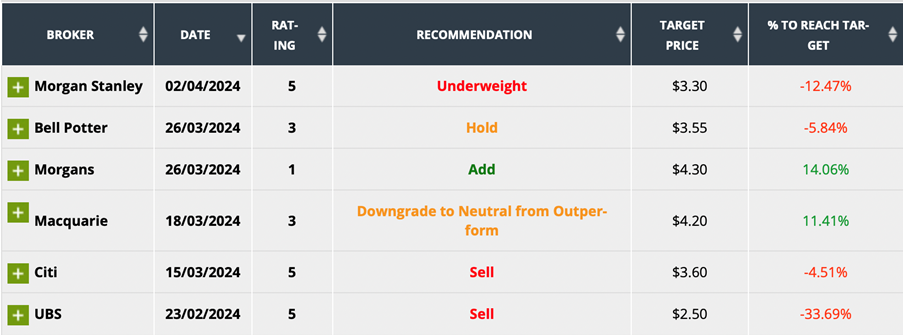

So, what do the analysts say about PLS, LTR and IGO?

IGO +2.8%

PLS -5.2%

LTR +13.4%

Liontown Resources looks the most attractive, but its big rise is driven by Bell Potter’s 59.66% predicted rise.

The best play might be to buy all three because they’re all bound to rise, if and when the EV/battery demand really kicks in. And given the increasing demands of voters for governments to ‘go green’ and the enthusiasm for car companies to ‘go electric’, this is a megatrend that investors shouldn’t ignore.

Megatrend? According to McKinsey Battery Insights, global battery cell demand for lithium will soar nearly seven-fold by 2030!

This led Eric Fry in investorplace.com to write: “If this eye-popping growth projection comes to fruition, battery demand for lithium would account for a whopping 95% of total global demand, and it would become a $400-billion industry.”

I believe when there are more charging stations and EVs can run further on a charged battery, demand for these electric cars and lithium will go through the roof.

One final point. Lithium is unique and valuable because it’s the lightest metal on earth. Since it’s the lightest material that can store energy, it has become indispensable for the batteries that power the new digital economy.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.