I recently looked at an investment product called GEAR and following the death of Warren Buffett’s investing colleague and close friend Charlie Munger, I wondered if this guru of investing would approve of such a risky product. I also wanted to make sure anyone who considers this ETF knows everything they should before investing in it.

Warren and Charlie were the brains behind the spectacular success of Berkshire Hathaway, which today you can buy into for $US542,414 for one share! This chart below paints the unbelievable story that is BRK.A, which is the ticker code for the A shares.

Berkshire Hathaway Inc Class A

In 1984, when this chart starts, the share price was US$1,235. About 55 years ago, Warren Buffett paid US$7.50 a share.

This numerical story alone has made me hang off every piece of investing education and wisdom that both Warren and Charlie were prepared to offer.

Interestingly, I was preparing to look at the pros and cons of using the Beta Shares GEAR product, which I have looked at before. I’ve always said it’s for risk-takers and thrill seekers.

Why now? Well, this week’s better inflation story gave us a sneak preview of what should happen to stocks when inflation is truly beaten here. Our market rose only 0.46% because that good inflation number for October, which saw annual inflation drop from 5.6% to 4.9% needs follow up falls to prove we’ve beaten inflation and rate rises are over.

In the US, they look like they’ve done it. The S&P 500 is up 5.4% for the month, while we’re up 1.08%.

I could be wrong, but I suspect when we slay the inflation dragon, growth/tech stocks will do well as the anticipation of rate cuts starts to take centre stage for market influencers.

So, my thinking is that if our market is bound to rise when inflation heads further down, why not get a bigger bang for your buck? However, as a financial educator, I do have to add this: the higher the return, the higher the risk. You can’t forget this!

By its very name, GEAR is a geared investment, but I like it because it doesn’t come with margin calls. So, if you buy in expecting a rise in the market and you get it wrong, you’ll lose money until the market turns around and heads up. In a sense, it’s a rational product for the patient risk-taker. That said, I have to remind you what J.M. Keynes said: “Markets can remain irrational longer than you can remain solvent!”

But what did Charlie Munger say about investing using debt? One of the funny observations (that he made when younger than the 99 years of age he was when he passed away) was: “Three things ruin people: drugs, liquor and leverage.”

However, in a recent interview on CNBC, he would’ve shocked a few disciples when he said: “Berkshire could easily be worth twice what it is now. And the extra risk you would’ve taken would’ve been practically nothing. All we had to do is just use a little more leverage that was easily available.”

To explain why these two smart investors dodged manageable debt to escalate Berkshire’s value, you have to look at what they saw as their responsibility to their co-owners. “The reason we didn’t is the idea of disappointing a lot of people who had trusted us when we were young … If we lost three quarters of our money, we were still very rich. That wasn’t true of every shareholder,” he told CNBC’s Becky Quick in the previously unaired interview. “Losing three quarters of the money would’ve been a big letdown.”

“There is simply no telling how far stocks can fall in a short period,” he wrote in his 2017 annual letter to shareholders. “Even if your borrowings are small and your positions aren’t immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary. And an unsettled mind will not make good decisions.”

“If Warren and I had owned Berkshire without any shareholders that we knew, we would’ve made more. We would’ve used more leverage,” Munger said in the CNBC special.

So, if you’re considering GEAR, you need to work out what kind of investor you are and then set the potential reward to the risk you’re prepared to take. And once you do that, I’d suggest you consider these other investing guidelines that I’ve taken from Charlie Munger:

- Avoid mental biases that cloud your objective judgement.

- Don’t invest on FOMO (fear of missing out) motivations.

- Pursue knowledge to ensure you invest wisely. He actually said: “Without the method of learning, you’re a one-legged man in an ass-kicking contest. It’s not going to work very well.”

- Don’t succumb to the “idiot” investment. In a nutshell, he advocated really testing out the company that you’re going to be owner of and that would be a good start to minimising mistakes.

So, let’s look at the guts of GEAR.

First, the Fund is ‘internally geared’, meaning all gearing obligations are met by the Fund. The Fund combines funds received from investors with borrowed funds and invests the proceeds in a broadly diversified share portfolio consisting of the largest 200 equity securities on the ASX by market capitalisation (as measured by the S&P/ASX 200 Index). The Fund’s gearing ratio (being the total amount borrowed expressed as a percentage of the total assets of the Fund) is managed between 50-65% on any given day.

Second, here are the benefits of GEAR.

1. Leveraged returns. This means when the market goes up, you’ll make bigger returns. But it works both ways so when the market falls, you fall further.

2. It’s easier and less costly than margin loans and CFDs. No need to borrow funds, no credit assessment, and diversified exposure in a single ASX trade.

3. No margin calls.

Third, here are the potential downsides:

- Big losses if the market tanks.

- It could take time for a market to rise and then you have to work out when you need to take your profit and run.

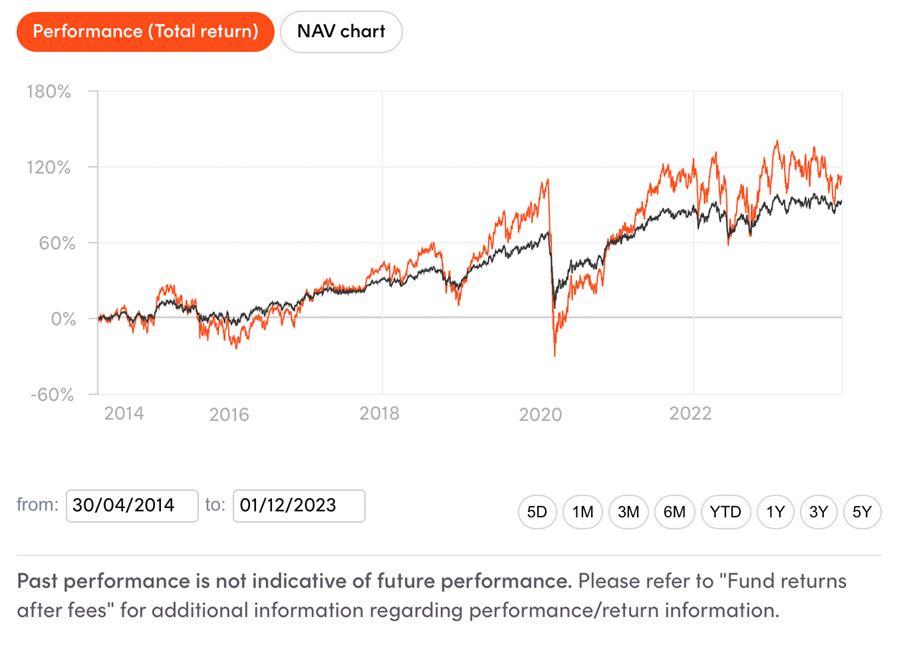

This chart of GEAR’s performance is quite instructive on how some investors might play this investment.

Before the Coronavirus crash, the unit price was $29.51, and it crashed to $10.91! That was a great time to buy GEAR. It’s now $23.42. If our market is poised for a nice run, then GEAR should be rewarding, but you’ll have to decide when you want to exit the investment.

The optimist might expect GEAR to one day hit $30. Buying in at $23 could mean close to a 30% gain, but as you can see, there could be a lot of ‘ifs’ and ‘buts’ that could make or break this interesting but risky way of playing 2024.

In the spirit of Charlie Munger, you have to question my assumption that inflation will fall enough in Australia to get interest rate cuts back into the news headlines. You also have to ask whether a recession could be in the wings and that could hurt stocks prices and the unit price of GEAR.

Any way you cut this, GEAR looks attractive, but also is risky. Munger did say he and Buffett could have made a lot more from leverage but as he pointed out, they could afford to lose a lot and still remain rich.

One final point. A leveraged exchange-traded fund (ETF), like GEAR, is a marketable security that uses financial derivatives and debt to amplify the returns of an underlying index. While a traditional exchange-traded fund typically tracks the securities in its underlying index on a one-to-one basis, a leveraged ETF may aim for a 2:1 or 3:1 ratio. This adds to the reward but also the risk.

For 2024, ETFs such as VAS, IOZ, A200 and STW will give you the market index rise plus dividends of around 4% before franking. And you get diversification. GEAR does the same but on steroids. But you must be careful of things like steroids. For more info go to: https://www.betashares.com.au/fund/geared-australian-equity-fund/

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.