In this Report on August 7, Raymond explained why Morgans added Orora Ltd ORA to its best stock idea list. Today he follows up with Morgans’ high conviction buy on ORA.

To recap, operating through Australasia and North America, ORA is an Australian-based company engaged in manufacturing and distributing packaging and visual solutions to customers, from the design and manufacture of packaging products such as glass bottles, beverage cans, and corrugated boxes to point of purchase displays and signage. On August 7, Raymond said that ORA is a defensive business with a healthy balance sheet and an experienced management team and that the company also has a good track record of exceeding market expectations. Today, he adds more to this view.

“Let’s follows up with our high conviction buy on Orora Ltd (ORA),” Raymond said.

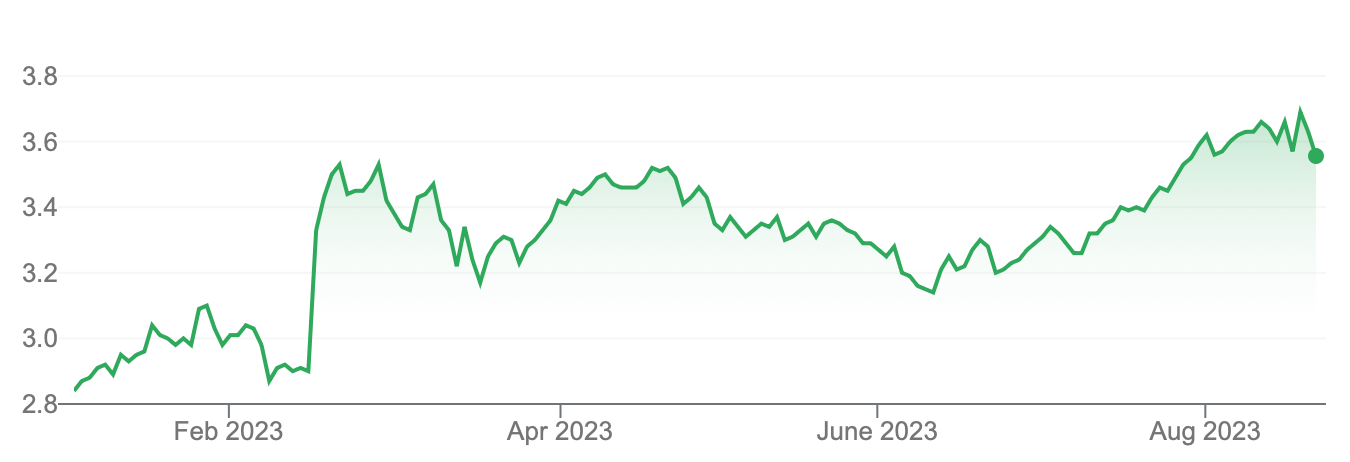

“We continue to see upside in ORA even after this week’s rally.

“ORA’s financial year 2023 result was above expectations, with earnings for both Australasia and North America ahead of our forecasts.

“Here are the key positives. First up, group earnings before interest and tax (EBIT) margin is plus 50 basis points to 7.5%. Its balance sheet remains healthy with net debt (ND) to EBITDA of 2 times at the bottom end of management’s 2 to 2.5 times target range.

“The key negatives are that revenue was softer than anticipated (-5% vs Morgans forecast and -4% vs Bloomberg’s consensus) and group return on funds employed (ROFE) fell 60 basis points to 21.6%.

“Management has guided to higher earnings in financial year 2024.

“We increase financial year 2024-2026F EBIT by 5%, while underlying net profit after tax (NPAT) rises by only 1-3% mainly due to higher interest costs.

“Our price earnings (PE)-based target price moves to $4.05 (from $3.75), and we maintain our Add rating.

“Trading on 15.5 times financial year 24F PE and 5% yield, we think the valuation remains attractive, despite the recent strong performance in the share price.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.