With good news on US inflation not only exciting Wall Street (with our S&P/ASX 200 Index up 3.7% for the week, and future interest rate rises being lowered by economists and those who play the bond market), let’s look for quality businesses that might be re-loved in future months. And let’s look for those with a 20% or more upside, so it’s worth the wait.

Patience is a stock market virtue

The 39% surge in Megaport’s share price last week shows the value of having patience when the stock market wants to dump good businesses. The same goes for Xero, which rose 7.23% last week and is up 66% in the past six months. That’s the reward for patience with quality stocks that fall out of favour because of a rotation out of a sector. In 2022, tech suffered a big rotation and rejection as rates rose.

Right now, the health sector is losing friends in the US because the many companies listed there are seen more as defensive investments, but our health stocks are more like growth plays.

- Let’s kick off with CSL

CSL is one of the best companies in the country, and in its field it’s just about the best in the world. FNArena’s survey of analysts tells me that the average expected share price rise in the year ahead is 25.7%, with UBS and Citi seeing a 30% gain out there.

It has been smashed recently and looks like a real buying opportunity for the patient investor.

- Let’s talk about Resmed

Next, I want to look at Resmed (RMD) where the average rise from the experts is 18.8% — that’s close enough to 20%. In fact, Ord Minnett tips a 21.95% rise while Citi sees a 26.64% jump ahead.

- Education stock could have big gain

Another that has copped it of late is IDP Education (IEL) but it has an average consensus rise of 19.1%. However, Morgan Stanley expects a 42.54% gain and four out of six analysts predict a rise greater than 20%. A lot of my TV fund manager guests like IEL despite a recent loss of business in Canada.

- QUBE is in the logistic business

QUBE holdings hasn’t been one of my companies, but the average rise is seen as 20.1%. More to the point, five out of five expert company watchers like the business and Citi has a price target 32% higher than the $3.41 today, meantime Ord Minnett has a 27.11% rise pencilled in.

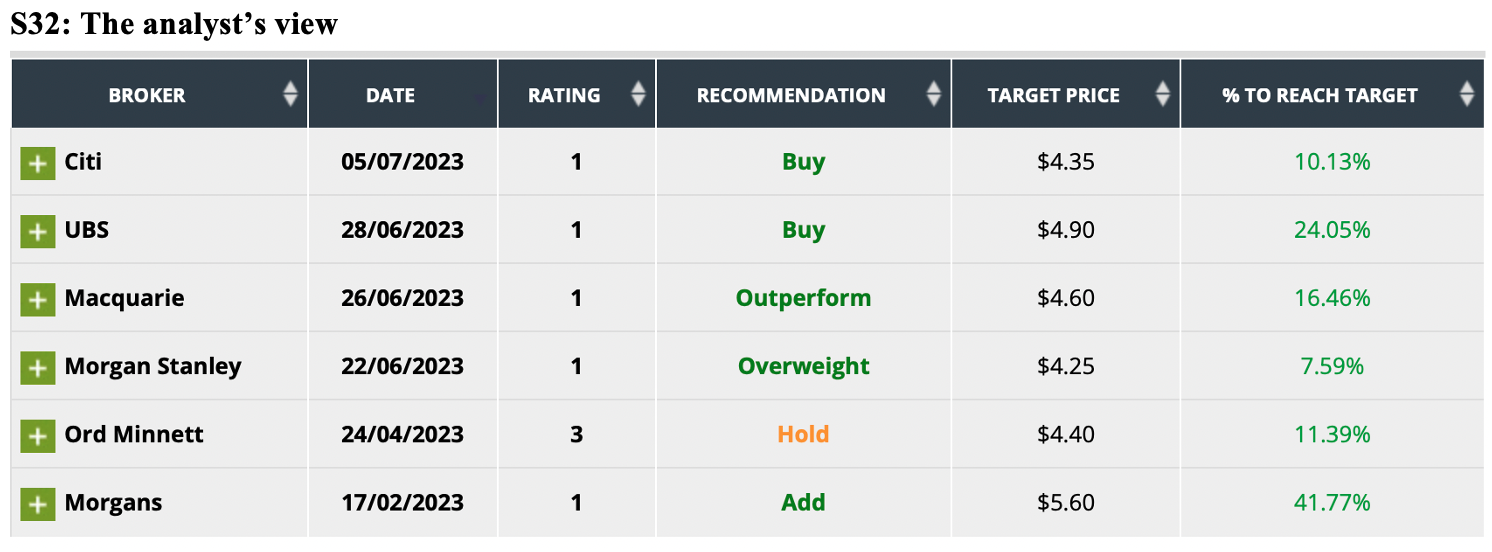

- South 32 has a big consensus call

South 32 has a rise of 18.6% consensus call ahead, but Morgans sees a 41% surge and six out of six analysts like the company. As a one-time BHP reject spinoff operation, S32 has a lot of the stuff modern industries will demand and looks to have a bright future. These include bauxite, alumina, aluminium, energy and metallurgical coal, manganese, nickel, silver, lead and zinc. Miners did well on Friday with the belief that good inflation news will reduce future interest rate rises that could help 2024 economic growth rates.

- Santos looking good

The eternal disappointer — Santos — fits the bill with a 21.7% expected consensus rise and six out of six analysts liking the company. Of late, there is an expectation that the oil price is heading northwards again, which is always good for gas prices as well. And backing Santos big time is Ord Minnett with a 55.8% higher call than the current market price of $7.70.

- Treasury Wine Estates is popping

Sneaking into my 20% club is Treasury Wine Estates, with a consensus rise of 17.3%, but three out of six analysts have 20% + rises factored into their expectations for the home of Penfolds Grange. Morgan Stanley tips a 24.4% rise, UBS 25.8% and Macquarie goes for 27.1%. Five out of six assessors give the company a solid thumbs up.

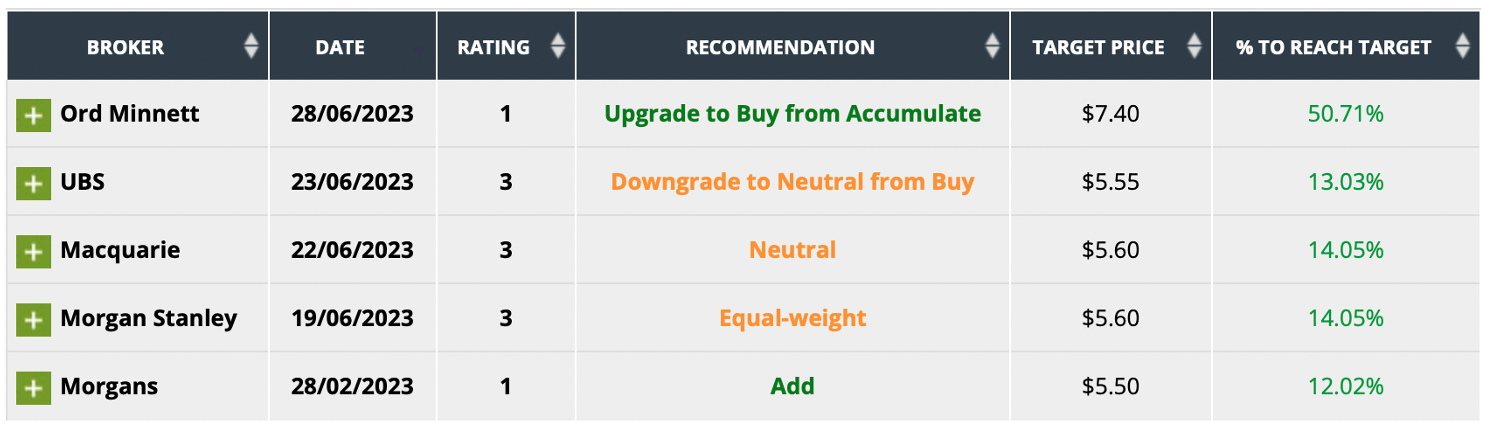

- The minor telco TPG

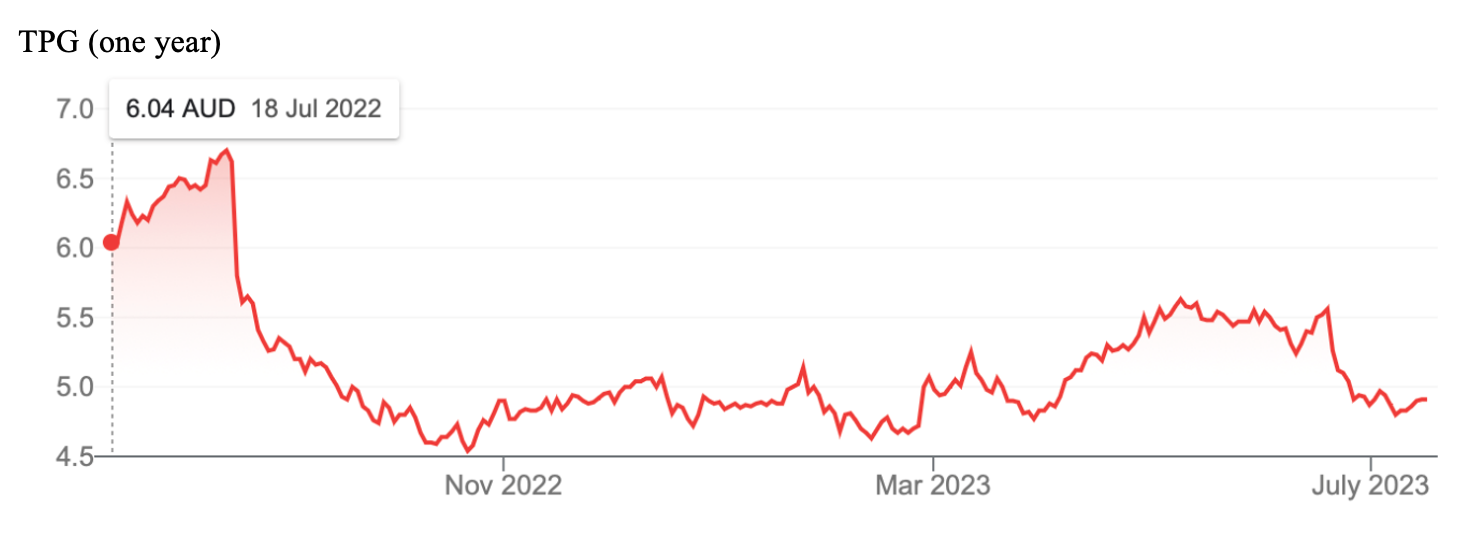

My eighth 20 percenter, which isn’t a company I’d select, but it has passed a number of tests I said I’d use in finding potentially investible operations. It’s TPG and the minor telco has a predicted 20.8% upside on average tipped by the experts, who do the numbers on listed companies. It also has five out of five analysts liking the company, with Ord Minnett very enthusiastic about the business’s future.

TPG’s chart isn’t pretty but it looks like its share price is trying to turnaround. It has risen 0.61% over the past six months, while the S&P/ASX 200 is down 1.1%. That said, I think I’d back an ETF for the overall index to outperform TPG over the next 12 months, but that’s only my best guess.

Clearly, picking one of these 20 percenters comes with risks. As a group, they do offer diversification. And most of them have a convincing argument to be interested in them as a reasonable investment over the next 12 months.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances