A new property trust specialising in self-storage will debut on the ASX at the start of August. Being spun out of the Abacus Property Group (ABP) by way of a demerger, it will own the Storage King brand of storage units and operating platform.

Demand for self-storage has been increasing due to the rising population and higher proportion of people living in smaller homes or apartments. Although this trend eased during the pandemic as people moved out into the regions, with the easing of Covid, the trend to urbanisation continues. The growth of the gig economy has also supported demand. Supply chain challenges, the rise of online retail and the growing importance of last-mile distribution are contributing to a supply imbalance relative to demand.

Abacus Storage King (ASK) provides an opportunity to participate in a sector with medium-term tailwinds. Here is my review of the new specialised trust.

Abacus Storage King to own $2.6 billion of storage units

Following the demerger from Abacus Property Group (ABP), Abacus Storage King (ASK) will own a $2.6 billion portfolio of storage units, $2.3 billion in Australia and $0.3 billion in New Zealand. This comprises 112 trading stores and a development portfolio of 23 future stores with a net lettable area of almost 600,000 square metres. 89% of the properties by net lettable area are located in metro areas and 11% in regional areas. While the portfolio of stores is spread across Australia and NZ, there is a heavy east coast bias with 37% in NSW.

In addition to owning and operating the portfolio of 135 stores, Abacus Storage King also provides services to Storage King stores that it doesn’t own through its Storage King Operating Platform. There are a further 86 stores that it manages or licenses to third parties.

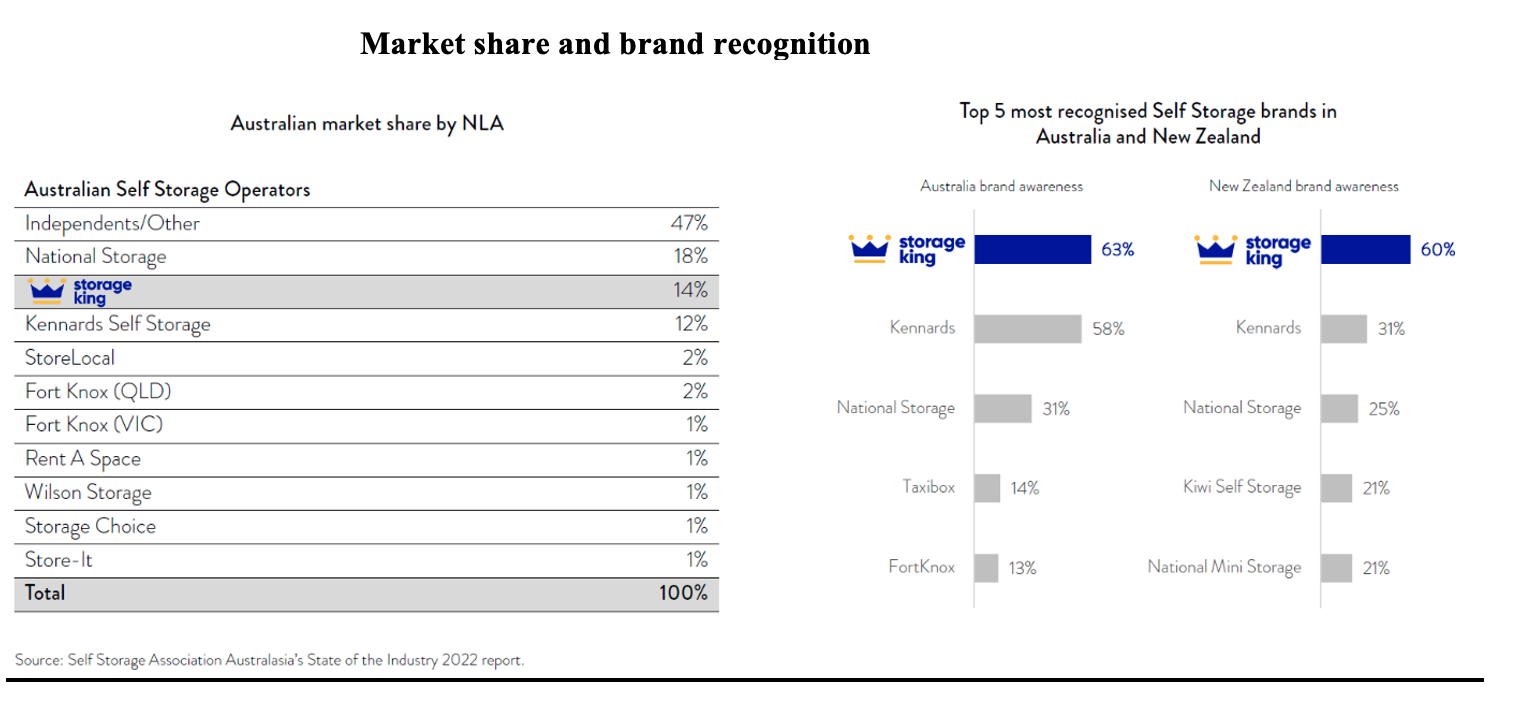

In the Australian self-storage market, Storage King says that it has 14% market share. This puts it third behind independent/other with 47% and its listed competitor National Storage (NSR), with 18%. Notwithstanding its “third” ranking, Storage King claims to have the highest brand awareness in both the Australian and NZ markets, considerably higher than National Storage.

Comparing itself to National Storage on some other key metrics, Abacus Storage King says that it has a higher occupancy rate of 91.7% for the first half of 2023 (87.2% for NSR) and a higher revenue per available metre (REVPAM) of $318 ($273 for NSR). Since financial year 2018, it has grown REVPAM at a compound annual growth rate of 5.8%, whereas NSR has only achieved a growth rate of 4.9%.

Abacus Storage King will have around $875 million of debt giving it a gearing ratio of 26.8% (NSR is geared at 24.0%). It is forecasting an operating margin of 65% for financial year 2024 (NSR is 66%) and funds from operations (FFO) per security of 6.3 cents. With a payout ratio of 90% to 100% of FFO, the forecast distribution is 6.0c per unit.

In terms of growth, ASK has a strong development pipeline of future stores and has pre-emptive rights to purchase stores from licensees. With 47% of stores in Australia in independent/other hands, there is a clear opportunity to “roll-up” some of these stores. Since 2018, Storage King has deployed $1.4 billion into self-storage acquisitions.

Abacus Property Group (ABP) will continue to provide corporate strategy, operational oversight and investment expertise to ASK. This will include corporate strategy and business planning, identifying acquisitions, development and divestment opportunities, managing development projects and providing financial and back office corporate support functions. It will receive a base management fee of 0.40% of ASK’s gross asset value plus other standard market fees.

ABP will also retain a 19.9% shareholding interest in ASK. ABP’s major shareholder, Calculator Australia, will own about 40% of ASK, meaning that the free float of shares will be around 41%.

To boost the free float and reduce debt, ASK is raising $225 million in capital through a security holder offer to ABP unitholders. Being done on a 1 for 5.6 basis, ABP unitholders can buy ASK shares at a price of $1.41. This represents a discount of 10.2% to ASK’s NTA (net tangible asset value) of $1.57 per unit. The institutional offer has already closed, but retail shareholders of ABP can invest until Thursday 27 July.

ASK units are scheduled to debut on the ASX on Tuesday 1 August.

What’s the bottom line?

On most metrics, ASK looks to be performing better than National Storage. The latter remains solidly bid, trading around a discount of 5% to its latest NTA. So, the $1.41 offer price for new securities (which represents a discount of 10.2%) should be a price that attracts support. Further, with almost 60% of shares held by two shareholders, the secondary market for shares will be fairly tight.

But the forecast distribution of 6.0 cents per unit puts the stock on yield of 4.3% (at $1.41). Interesting, but hardly compelling.

Growth prospects are good, either by acquisition and roll-up in a fragmented industry, or from increasing occupancy and rent (as demonstrated by the growth in REVPAM). Against this, interest costs will increase as interest rate hedges expire.

No bargain, but it’s a stock to watch. Certainly, it could be part of a defensive portfolio.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.