Those who invest in stocks hate it when they put their money into a stock that falls, and then it takes a long time to turnaround. Today I’m looking for quality businesses out of favour with the market, which will eventually benefit from a change in sentiment, possibly falling interest rates and the end of recession talk.

The important trick to investing in stocks that are lowly-priced but will see their prices surge one day is to stick to quality businesses. Because these outfits are first-class operations, it’s usually only a matter of time before the market falls in love with them again.

- Giving Xero a high mark!

The best recent case was our support for Xero. In November last year, those of you who believed us and went long must have been thinking we’d ‘sold’ you a dud. This chart shows what happened with Xero.

Xero (XRO)

On November 10, Xero’s share price plummeted to $64, but a year before (actually, in November 2021) it hit a high of over $154! It has rebounded to be now at $118.93 and shows the value of investing in quality companies when the market rejects them for short-term reasons. Xero got caught up in the tech-wreck following the rapid rise in interest rates, but now all seems forgiven or forgotten. The believers who bought in the $70s and felt sick when the stock price slumped to $64, have seen their investment surge over 65%. That’s the payoff of buying quality and being patient for a change in market attitudes.

So, what companies could do a Xero over the next year?

Two companies I’d be happy to buy now and wait for the time when interest rates fall in 2024 are JB Hi-Fi and Harvey Norman.

- Let’s talk JB Hi-Fi

JBH was a $49 stock at the start of this year. It’s now $43.75. The consensus view is that it will fall 0.6% but Citi sees a 25% gain! I think Citi will be right within a year, but the wait could even be longer than that, as it will depend on when rates are cut and whether we end up in a recession. By the way, the dividend forecast yield is 6.9% going to 5% next year, but both returns are good reasons to take a punt on JBH.

- What about Harvey Norman?

HVN has 2.3% upside but the most optimistic on the stock is Ord Minnett, which sees a 12% gain ahead, but the dividend yield is calculated to be 7.1% this year and 6.2% next. Gerry Harvey can be crotchety and a hard-nosed operator, but he pays good dividends, which explode when you buy in at low prices.

This long-term chart shows how (just like the retail cycle) HVN’s share price can slump ahead of a rebound. I can’t see any reason why that should change. In March this year, this $3.48 stock was $6. If that high is reached in coming years, that would be a 72% gain, and even if it took four years to happen, that would be an 18% gain per annum, plus those solid dividends.

HVN

Gerry is a horse racing man and I think the gee-gees are a four-legged lottery, but I’d be happy to ‘punt’ on HVN.

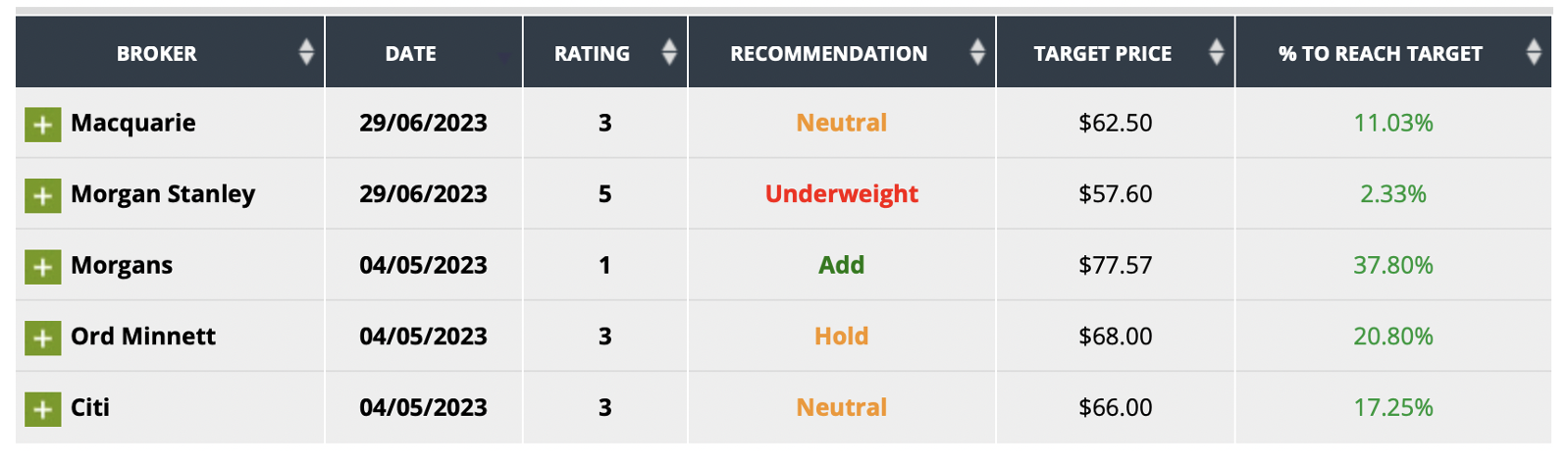

- What about Ramsay Health Care (RHC)?

Another quality business that should have upside has to be Ramsay Health Care (RHC). It jumped 7% on Tuesday but then only finished the week up 2.53%.

The current price is $56.29 but have a look at the analysts’ views where the consensus rise tipped is 17.8%.

Morgans has a very positive view on this business, expecting a 37.8% rise and putting it on their “add” list.

I can’t get out of my head that the very smart private equity giant KKR tried more than once to buy Ramsay at $88 a share. And I don’t think they thought they were overpaying for the business. They saw potential and lots of money out there waiting to roll into the business.

At the current price of $56, if an $88 stock price eventually shows up, that would be a 57% gain, which would be a very healthy profit that I’d be prepared to wait three years to realise.

- Here’s one s-c-r-e-a-m-i-n-g buy!

One business that remains a screaming buy is Macquarie Group (MQG), with the consensus rise a nice 8.9%. I like Morgan Stanley’s guess of 21% higher and the latter is a US competitor of Macquarie, not only here but in the Big Apple and worldwide.

I like local businesses that are best-of-breed, which earn good export income and can hold their own in global markets.

- Let’s look at CSL

CSL is a similar quality business (like Macquarie) that passes this best-of-breed test.

On that company, the consensus rise forecast is 18.3%, while the most positive experts on the company’s bottom line future are UBS and Citi, who both see 25.8% upside for the share price.

- One often forgotten

An interesting global butt-kicking business that’s often forgotten is Breville (BRG), which is seen as having a potential share price rise of 17.1%. All analysts surveyed like the company. The most enthusiastic is Morgan Stanley’s company watcher, who thinks a rise of 30.3% is on the cards.

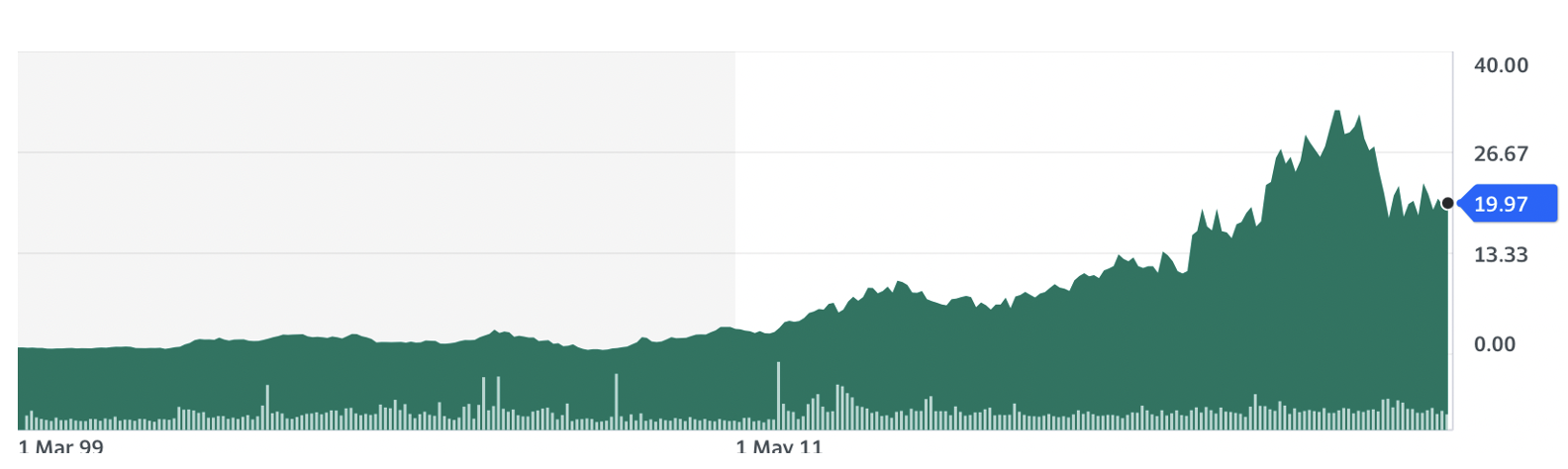

Companies such as Breville fall off a lot of share players radar screens, but this chart shows how it pays to look more broadly when it comes to looking for quality companies.

BRG

Since 1999, this stock has gone from 89 cents to $20, which is a 2,147% rise, or around 90% per annum!

The weeks ahead…

In coming weeks, I’ll keep shining the light on quality businesses out of favour with the market but that will sooner or later be re-loved.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances