Drilling services company DDH1 received two ratings downgrades from two separate brokers after global mining services group Perenti entered a binding scheme of arrangement with the company, whereby Perenti will acquire 100% of DDH1’s ordinary shares.

Bell Potter set its target at 94c, the current implied acquisition price, and downgraded its rating to Hold from Buy, while Macquarie also downgraded to Neutral from Outperform as the share price was approaching the bid price.

Bega Cheese received three downgrades from three separate brokers after issuing a trading update with FY23 earnings now expected at the low end of prior $160-190m guidance.

Morgans downgraded to Hold from Add explaining there has been a material fall in global dairy prices and Australian processors are overpaying for milk given fierce competition. The challenging operating environment will result in the company impairing assets.

Dairy farmers are winning out at the expense of Bega Cheese shareholders, explains Morgans, as the company’s Bulk dairy ingredients business becomes structurally challenged. At the same time, the higher-quality Branded business is thought to be performing strongly.

There will be ongoing pressure on FY24 and FY25 earnings, particularly for the Bega business, forecasts Ord Minnett, which downgraded to Lighten from Hold.

Bell Potter also downgraded to Hold from Buy. This broker observed a growing gap between international and domestic pricing and suggested lower cost international milk solids will penetrate domestic retail and foodservice channels and may replace domestic milk solids.

On the flipside, Collins Foods received the largest percentage increase to average target price following the release of FY23 results above broker expectations largely due to increased margins for KFC Europe. Management also released details of brisk trading in the early weeks of FY24.

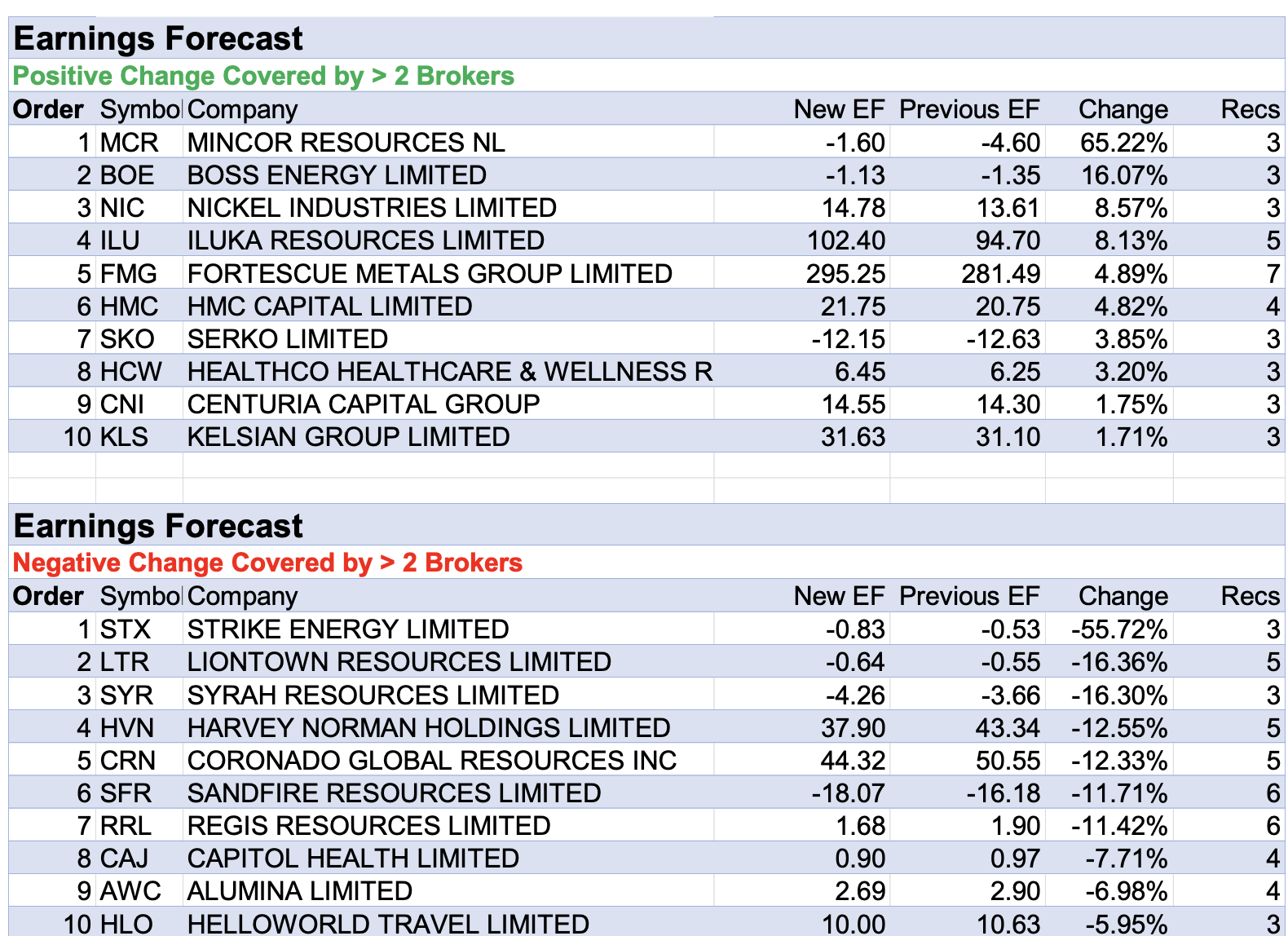

As can be seen in the tables below, seven of the ten largest percentage downgrades to average earnings forecasts in the FNArena database last week related to companies in the Materials sector, after Macquarie revised its latest commodity prices outlook.

Near-term price forecasts were largely downgraded, particularly for bulk commodities and base metals. The most notable changes were to zinc (forecasts falling by -7-10%) and thermal coal which was downgraded by -8-21% over the next three years. Gold forecasts were increased by 4% in 2024.

Forecast earnings downgrades in the table below ranged from nearly -56% for Strike Energy to around -7% for Alumina Ltd.

Harvey Norman was the only non-materials company with a noteworthy downgrade to forecast earnings last week.

Following a trading update, Ord Minnett concluded earnings for the company are deteriorating faster than previously expected, while Citi noted industry feedback suggesting a further decline in the sale of large appliances and furniture during May and June.

Despite weak earnings momentum, Citi noted strong valuation support and a strong balance sheet, which combine to limit further downside to the share price. Macquarie agreed and suggested the share price is probably being supported by significant property holdings.

Morgan Stanley upgraded its rating for Harvey Norman to Equal-weight from Underweight after noting a valuation differential had opened over time in favour of JB Hi-Fi, which was simultaneously downgraded to Underweight from Equal-weight.

Since management called out category weakness (outdoor furniture) at first half results in late-February, the Harvey Norman share price has significantly underperformed discretionary goods retail peers, noted Morgan Stanley.

The Macquarie research updating materials price forecasts mentioned above also resulted in Mincor Resources topping the percentage earnings upgrade table.

Boss Energy had the next largest percentage upgrade to average forecast earnings by brokers after Shaw and Partners suggested the uranium price is set to surge higher, potentially reaching and exceeding US$80/lb over the next two years.

Shaw’s rating for Boss Energy was lowered to Hold from Buy after a strong share price performance, though its target was raised to $3.40 from $3.20. The Honeymoon Uranium project is on track to restart in the last quarter of 2023.

Based upon such factors as uranium price leverage, underlying quality and project lifecycle phase, Shaw’s preferred exposures from stocks under its coverage are Paladin Energy, Silex Systems and Lotus Resources.

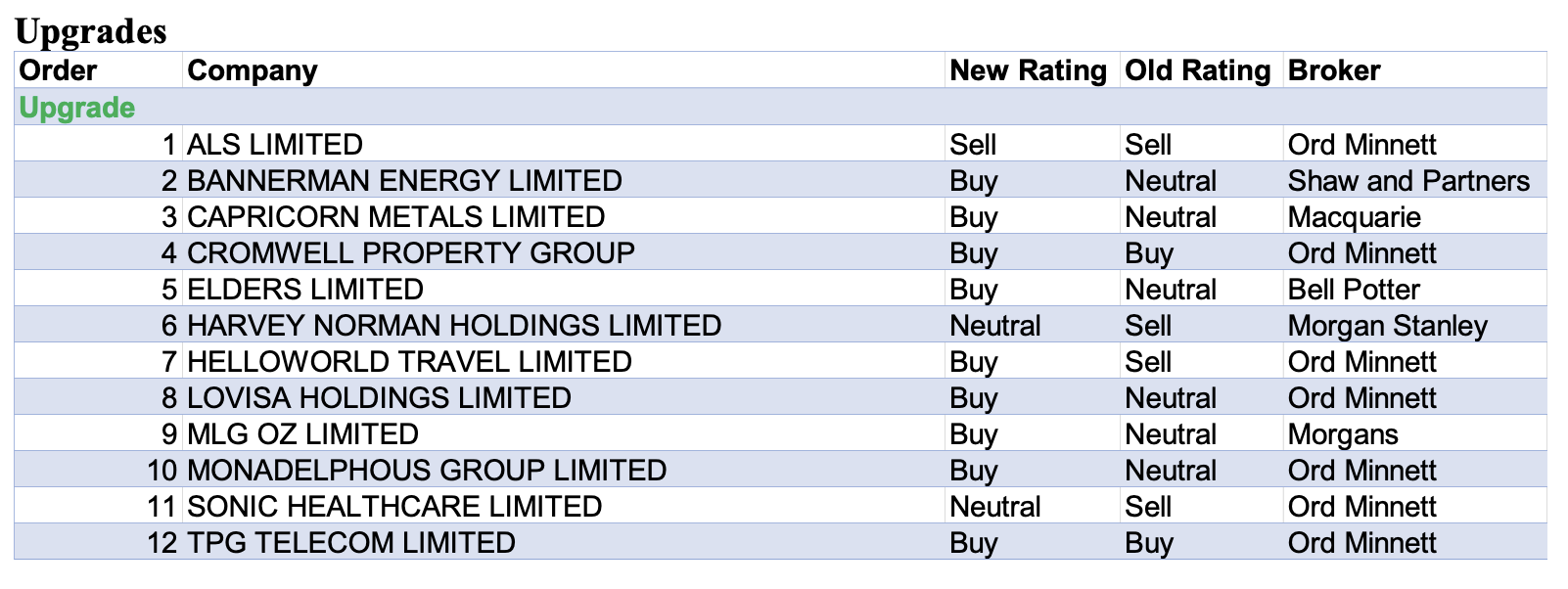

IN THE GOOD BOOKS

ALS LIMITED ((ALQ)) was upgraded to Lighten from Sell by Ord Minnett. B/H/S: 2/1/0

As the share price of ALS Ltd has moved through the trigger level Ord Minnett raises the rating to Lighten from Sell. Target is $8.40.

BANNERMAN ENERGY LIMITED ((BMN)) was upgraded to Buy from Hold by Shaw and Partners. B/H/S: 1/0/0

Shaw and Partners believes the uranium price is set to surge higher with pricing likely to reach and exceed US$80/lb over the next two years. Currently, the spot price is at US$57/lb and term contract pricing is approaching US$60/lb.

The broker suggests limitations on transmission, batteries and firming capacity means governments will realise current investment in renewables will not meet decarbonisation objectives.

Based upon such factors as uranium price leverage, underlying quality and project lifecycle phase, Shaw and Partners’ preferred exposures from stocks under coverage are Paladin Energy, Silex Systems and Lotus Resources.

Bannerman Energy is the most leveraged play to the uranium price under the broker’s coverage. The 95%-owned open pit Etango-8 project in Namibia is lower grade but higher volume compared to its peers. The rating is upgraded to Buy from Hold. Target $3.20.

CAPRICORN METALS LIMITED ((CMM)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 2/0/0

Macquarie updates earnings forecasts to incorporate its latest commodity price outlook. Short-term price forecasts have been downgraded, particularly for bulks and base metals, notably zinc. Gold price forecasts are increased by 4% in 2024.

Amid recent share price weakness Capricorn Metals is upgraded to Outperform from Neutral and the $4.80 target is retained.

CROMWELL PROPERTY GROUP ((CMW)) was upgraded to Buy from Accumulate by Ord Minnett. B/H/S: 1/1/0

Ord Minnett upgrades its rating for Cromwell Property to Buy from Accumulate on valuation after a recent share price retracement.

No changes are made to the broker’s forecasts and the 90c target is unchanged.

ELDERS LIMITED ((ELD)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 2/3/0

Bell Potter observes most forward indicators for Elders in the March quarter resumed their downward trajectory and in many instances are now trading beneath what the broker perceives to be normalised.

While earnings risk remains high, the broker observes Elders is trading at a fairly hefty -25% discount to its post-recapitalisation average and therefore upgrades to Buy from Hold.

However, given continuing pressures in livestock markets and rising input prices, the broker lowers its target price to $7.25 from $7.45.

HELLOWORLD TRAVEL LIMITED ((HLO)) was upgraded to Accumulate from Lighten by Ord Minnett. B/H/S: 3/0/0

Ord Minnett upgrades its rating for Helloworld Travel by two notches to Accumulate from Lighten on valuation after a recent share price fall. It’s suggested prospective investors adopt a buy on weakness approach.

Moreover, the broker has a positive view on the acquisition of Express Travel Group for $70m target for cash and scrip. The company is considered one of the most well-regarded and managed unlisted travel agency groups in the Australian market.

The target is increased to $2.84 from $2.62. The analysts also notes the large scale of Helloworld Travel’s business is an advantage, as highlighted by Qantas Airways ((QAN)) recently playing hard ball on agency distribution costs.

HARVEY NORMAN HOLDINGS LIMITED ((HVN)) was upgraded to Equal weight from Underweight by Morgan Stanley. B/H/S: 1/3/1

Morgan Stanley expects the upcoming results season will not be pleasant for discretionary goods retailers for several reasons including demand weakness and margin pressure.

Within the category, the broker highlights a valuation differential has opened up in favour of JB Hi-Fi over Harvey Norman. The former is downgraded to Underweight from Equal-weight while the latter is upgraded to Equal-weight from Underweight.

Since management called out category weakness (outdoor furniture) at 1H results, the Harvey Norman share price has significantly underperformed discretionary goods retail peers, notes Morgan Stanley. The $3.50 target price is unchanged.

LOVISA HOLDINGS LIMITED ((LOV)) was upgraded to Accumulate from Hold by Ord Minnett. B/H/S: 5/1/1

Ord Minnett upgrades its rating for Lovisa Holdings to Accumulate from Hold on valuation after a recent share price fall.

No changes are made to the broker’s forecasts and the $22 target is unchanged.

MLG OZ LIMITED ((MLG)) was upgraded to Add from Hold by Morgans. B/H/S: 1/0/0

As key management initiatives are gaining momentum and Morgans sees early signs of easing cost pressures, the rating for MLG Oz is upgraded to Add from Hold.

Proactive steps by the company to counter cost pressures and tight labour market conditions have included Designated Area Migration Agreements and new programs for training/in-house recruitment.

Moreover, around $17m in proceeds from the sale of a crusher helps de-gear the balance sheet, explains the analyst. The target rises to $1.01 from 90c in the expectation of improved earnings.

MONADELPHOUS GROUP LIMITED ((MND)) was upgraded to Accumulate from Hold by Ord Minnett. B/H/S: 1/3/0

Ord Minnett upgrades its rating for Monadelphous Group to Accumulate from Hold on valuation.

No changes are made to the broker’s forecasts and the $14.25 target is unchanged.

SONIC HEALTHCARE LIMITED ((SHL)) was upgraded to Hold from Lighten by Ord Minnett. B/H/S: 3/1/2

As a result of a weakening of the Australian dollar relative to Sonic Healthcare’s offshore currencies, particularly in Europe, Ord Minnett increases its target to $34 from $32. Rating is upgraded to Hold from Lighten.

The broker still expects margins will contract further in the second half because of lower coronavirus testing. The long-term group EBITDA margin forecast of 23% is unchanged, as increased operating leverage from higher volumes in the base business will offset the lower coronavirus testing.

Ord Minnett forecasts the base Australian pathology and imaging revenue will grow at 5% per annum over a 10-year forecast period.

TPG TELECOM LIMITED ((TPG)) was upgraded to Buy from Accumulate by Ord Minnett. B/H/S: 2/3/0

As the share price of TPG Telecom has moved through the trigger level Ord Minnett upgrades the rating to Buy from Accumulate. Target is $7.40.

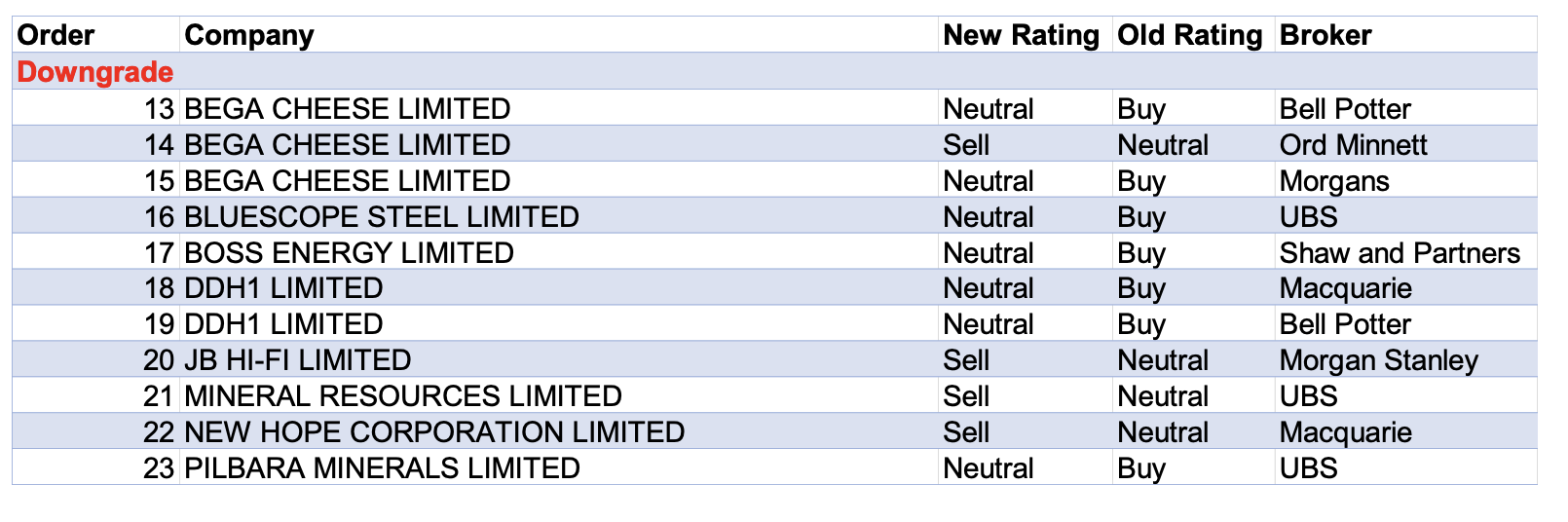

IN THE NOT-SO-GOOD BOOKS

Downgrades

BEGA CHEESE LIMITED ((BGA)) was downgraded to Hold from Buy by Bell Potter and to Lighten from Hold by Ord Minnett and Hold from Add by Morgans. B/H/S: 0/3/0

Bell Potter observes a growing gap between international and domestic pricing and expects lower cost international milk solids will penetrate domestic retail and foodservice channels and may replace domestic milk solids.

The broker says farmers need a reality check and appear slow to respond to high farmgate returns. Given excess processing continues, domestic solids are now mispriced, which is likely to suppress returns in bulk ingredients, says the broker.

Rating downgraded to Hold from Buy. Target price falls to $3.50 from $4.

Ord Minnett expects continued pressure on FY24 and FY25 earnings, particularly for Bega Cheese’s bulk dairy ingredients business. The company has confirmed FY23 guidance with EBITDA to be at the lower end of the $160-190m range.

The broker points out significant price rises in FY23 were required to offset higher input costs and this took time to take effect. Moreover, further declines in milk production and strong competition for milk supply could mean increased upward pressure on farmgate milk prices.

Ord Minnett downgrades to Lighten from Hold and reduces the target to $3.10 from $3.50.

Dairy farmers are winning out at the expense of Bega Cheese shareholders, explains Morgans, as the company’s Bulk business becomes structurally challenged. At the same time, the higher-quality Branded business is considered to be performing strongly.

The broker explains there has been a material fall in global dairy prices and Australian processors are overpaying for milk given fierce competition. The challenging operating environment will result in the company impairing assets.

Management has announced a -$21m cost-out program though Morgans fears the majority of these savings will flow to the dairy farmers, in the form of higher farmgate milk prices.

The analysts make material downgrades to FY24 and FY25 EPS forecasts and the target falls to $3.45 from $4.05, while the rating is downgraded to Hold from Add.

BOSS ENERGY LIMITED ((BOE)) was downgraded to Hold from Buy by Shaw and Partners. B/H/S: 2/1/0

Shaw and Partners believes the uranium price is set to surge higher with pricing likely to reach and exceed US$80/lb over the next two years. Currently, the spot price is at US$57/lb and term contract pricing is approaching US$60/lb.

The broker suggests limitations on transmission, batteries and firming capacity means governments will realise current investment in renewables will not meet decarbonisation objectives.

Based upon such factors as uranium price leverage, underlying quality and project lifecycle phase, Shaw and Partners’ preferred exposures from stocks under coverage are Paladin Energy, Silex Systems and Lotus Resources.

The broker downgrades its rating for Boss Energy to Hold from Buy after a strong share price performance, though raises its target to $3.40 from $3.20. The Honeymoon Uranium project is on track to restart in the 4Q this year.

BLUESCOPE STEEL LIMITED ((BSL)) was downgraded to Neutral from Buy by UBS. B/H/S: 1/3/0

UBS assesses BlueScope Steel’s performance in FY23 has been largely driven by North Star, as US spreads are well above expectations. The tailwinds have now ended, and US demand indicators are anaemic.

Hence, the broker downgrades to Neutral from Buy, believing spreads will return to normal faster than consensus estimates.

Moreover, the spread recovery in East Asia was short lived, having declined -22% over the past month. UBS does not envisage any reprieve, with a weak Chinese property sector and an increasingly uncertain Australian macro outlook. Target is reduced to $20.80 from $23.20.

DDH1 LIMITED ((DDH)) was downgraded to Neutral from Outperform by Macquarie and to Hold from Buy by Bell Potter. B/H/S: 0/2/0

Perenti ((PRN)) has bid for DDH1 at $0.1238 cash plus 0.7111 Perenti shares for each share, a 17% premium to the five-day VWAP. DDH1 will be integrated into the former’s existing Ausdrill business.

Macquarie downgrades to Neutral from Outperform as the current share price is approaching the bid price. Target is reduced -4% to $1.01. The broker notes FY23 guidance is softer, with the company expecting FY23 EBITDA of $117-121m, but utilisation continues to improve.

Perenti ((PRN)) and DDH1 have entered into a binding scheme of arrangement, whereby Perenti will acquire 100% of DDH1’s ordinary shares. Bell Potter sets its target at 94c, the current implied acquisition price, and downgrades its rating to Hold from Buy.

Shareholders can elect maximum scrip or cash alternatives, with the formal consideration being $0.1238 cash and 0.7111 Perenti

shares per DDH1 share held.

Following deal completion, Perenti and DDH1 shareholders will hold 71% and 29%, respectively, of the diluted share capital of the combined entity.

The DDH1 board has unanimously recommended the scheme. There is also currently major shareholder support from around 38% of DDH1’s equity base.

JB HI-FI LIMITED ((JBH)) was downgraded to Underweight from Equal weight by Morgan Stanley. B/H/S: 1/2/2

Morgan Stanley expects the upcoming results season will not be pleasant for discretionary goods retailers for several reasons including demand weakness and margin pressure.

Within the category, the broker highlights a valuation differential has opened up in favour of JB Hi-Fi over Harvey Norman. The former is downgraded to Underweight from Equal-weight while the latter is upgraded to Equal-weight from Underweight.

The target for JB Hi-Fi falls to $38.90 from $44.30 as the analysts feel FY24 consensus estimates are underestimating the additional downside risk created by a weaker consumer.

MINERAL RESOURCES LIMITED ((MIN)) was downgraded to Sell from Neutral by UBS. B/H/S: 3/3/1

Mineral Resources has downgraded growth several times over recent months because of delays. UBS notes earnings are further under pressure from lower commodity prices and higher costs.

Moreover, a large capital expenditure program puts pressure on free cash flow yields and the stock is considered expensive relative to lithium peers.

The broker reduces estimates for earnings per share by -5-18% across FY23-25 and downgrades the rating to Sell from Neutral. Target is lowered to $66 from $80.

NEW HOPE CORPORATION LIMITED ((NHC)) was downgraded to Underperform from Neutral by Macquarie. B/H/S: 2/0/2

Macquarie updates earnings forecasts to incorporate its latest commodity price outlook. Short-term price forecasts have been downgraded, particularly for bulks and base metals.

Thermal coal is downgraded -8-21% over the next three years. Hence, New Hope is downgraded to Underperform from Neutral. Target price is reduced to $4.50 from $5.40.

PILBARA MINERALS LIMITED ((PLS)) was downgraded to Neutral from Buy by UBS. B/H/S: 3/1/1

UBS notes lithium prices continue to recover from the trough while spodumene is stabilising and following with a lag. The broker believes there is evidence the recent destocking cycle has passed and adjusts 2023/24 prices 5-17% higher.

This means FY24/25 earnings are up to 30% higher across lithium names. Pilbara Minerals is downgraded to Neutral from Buy following its recent run, and despite moving the target to $5.20 from $4.50 because of improved market conditions and a more favourable view on downstream options.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.