It’s easy to overlook other airline and airport stocks on ASX amid never-ending commentary on Qantas Airways and earlier speculation of a Virgin Australia IPO.

I’ve been positive on Qantas for a few years, principally for its leverage to a travel recovery, its weakened competition and the latent value in its frequent-flier business.

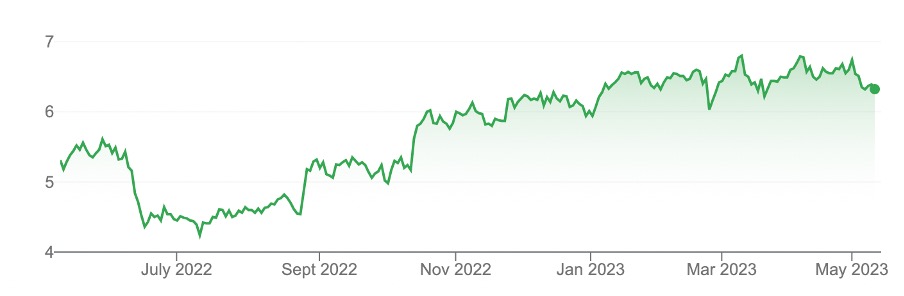

At $6.34, Qantas is nearing fair value, but might have a bit left in the tank for investors this year if jet-fuel prices fall further and the economy avoids recession.

Chart 1: Qantas Airways

Source: Google Finance

Still, I understand why some fund managers avoid airline stocks. Over the years, many airlines have burned investors. But there’s a lot more to airlines these days than planes.

Look at Qantas’s frequent-flyer program and its growing push into financial services, via home loans. Some people I know treat Qantas frequent-flyer points like Australia’s second currency, linking every payment they make to the points scheme.

The amount of data collected in that scheme is immensely valuable for Qantas and retailers connected to its points program. I’ve often thought the Qantas Frequent Flyer business would be worth more as a standalone business (once mooted).

Elsewhere, Alliance Aviation Services has been another featured airline stocks in this column over the past few years. In late 2021, I highlighted Alliance in this report: “My two favourite airline stocks: Qantas and Alliance Aviation.”

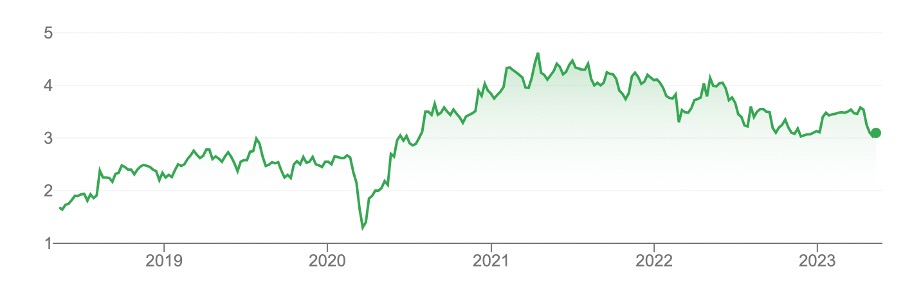

Alliance has fallen from a 52-week high of $4.15 to $3.01. The competition watchdog’s recent decision to block Qantas’s proposed acquisition of Alliance Aviation has weighed on the stock (Qantas is a 19.9% shareholder in Alliance Aviation).

Chart 2: Alliance Aviation Services

Source: Google Finance

The price fall has also made Alliance more attractive on valuation grounds. The fundamentals of its fly-in, fly-out charter business appeal and there is a chance that the Australian Competition and Consumer Commission’s decision will be appealed.

Over the years, Alliance has done a good job of buying planes cheaply from other airlines and leasing them for a higher rate of return. The underlying strength of mining activity and Alliance’s position on regional routes bodes well for the airline.

Airlines aside, I’ve also favoured airport stocks, mainly Sydney Airport before it was acquired. Some airports are fabulous, monopoly-style assets – and a safer way to play a recovery in travel demand compared to more volatile airline stocks.

Here are two other aviation-related stocks to consider: Auckland International Airport and Air New Zealand. Of the two, I prefer Auckland International. Both stocks are dual listed on the New Zealand Exchange and ASX.

- Auckland International Airport (ASX: AIA)

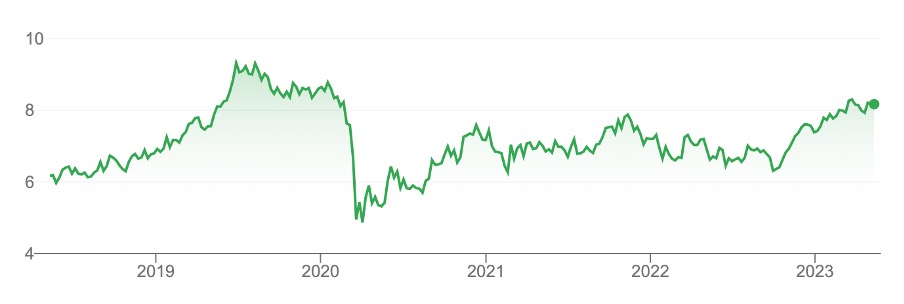

I have written about AIA positively a few times for this report as a COVID-19 recovery play but haven’t covered the stock for a while. AIA has had a good run, up from $6.24 in October 2022 to $8.16 this week.

To recap, AIA is NZ’s largest commercial airport and has a valuable strategic position: about two-thirds of all NZ domestic flights start or end in Auckland.

AIA is the hub for Air New Zealand (featured below). Like many airports these days, AIA has a suite of retail, hotel and commercial-property assets. AIA also owns almost a quarter of Queenstown Airport, a key gateway for NZ tourism.

Like all airports, AIA was belted during COVID-19 as travel activity stalled. In the year to end-June 2019, AIA processed 9.6 million passengers. In the year to end-December 2022, AIA processed 6.9 million passengers.

In its latest presentation, AIA said international passenger numbers are back to 75% of pre-COVID levels (FY19). Domestic passenger volumes are at 88%.

AIA expects passenger numbers to return to pre-pandemic levels by 2025. That could be a touch conservative as NZ’s travel recovery unfolds and as more international airlines restart previous routes to Auckland or start new ones there.

A medium-term recovery in passenger volumes is a good tailwind for AIA. But the main upside is development of its property portfolio and large land bank.

AIA has a number of eye-catching property developments underway. In March, AIA confirmed the replacement of its 57-year-old terminal. The multi-billion-dollar investment will be the largest in the airport’s history.

Expected to open in 2028 or 2029, the new combined terminal will increase passenger capacity and provide numerous retail-leasing opportunities due to larger floor space.

A project of this size also creates construction risk. However, the well-run AIA has been building towards a new terminal for a long time.

Consensus analyst estimates suggest AIA is fully valued at $8.16. Share-price gains this year could be slower from here, but there’s still plenty to like about AIA’s longer-term prospects and having exposure to a monopoly-like infrastructure asset that is being redeveloped during a domestic and international travel recovery.

Chart 3. Auckland International Airport

Source: Google Finance

- Air New Zealand (ASX: AIZ)

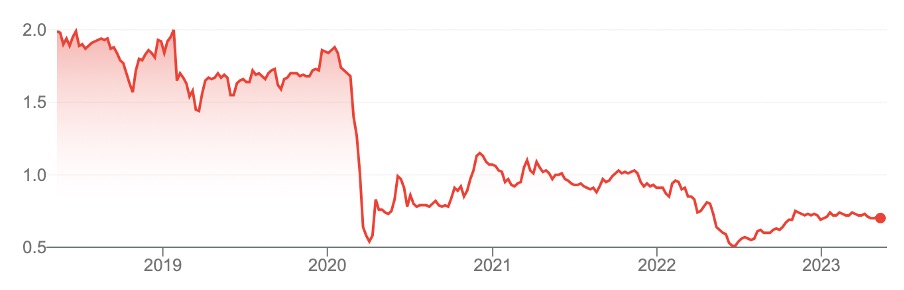

NZ’s national carrier has been a frustrating stock for a long time. Like other airline stocks, Air New Zealand was pummelled during COVID-19. But the company’s recovery after COVID-19 has lagged. Air New Zealand currently trades at 70 cents.

Poor results, capital raisings and high oil prices last year crunched the share price. At one point, Air New Zealand traded at around 50 cents, in Australian-dollar terms, in mid-2022.

Still, every stock has its price. In its investor update last month, Air New Zealand reported a 144% increase in passenger volumes year-to-date in FY23 (off a low base in FY22). That’s 12% below pre-COVID levels (FY19) and moving in the right direction.

Encouragingly, Air New Zealand upgraded its earnings guidance for FY23 to NZ$510-$560 million, from NZ$450-530 million previously.

Air New Zealand said: “… The airline has continued to experience strong levels of demand on both the domestic and international networks. US-dollar jet-fuel prices have also declined below those assumed in earnings guidance provided in February 2023.”

A weaker New Zealand dollar and softer trade cargoes dulled some of the gains from lower jet-fuel prices for the airline.

Perhaps the best sign is the airline wants to hire 400 additional employees and has increased wage rates. After years of airlines savagely shedding staff to cut costs, it is pleasing to see airline employment rise, although it will affect Air New Zealand’s costs.

At A70 cents, Air New Zealand is on a forward Price Earnings multiple (P/E) of just over eight times, according to Morningstar. That seems undemanding given the airline’s potential for faster earning growth in the next few years.

Air New Zealand has had its share of problems for investors. But the company’s current market valuation seems more focused on the past than the future.

Chart 4: Air New Zealand

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 10 May 2023.