Over the weekend I made the right choice that most of the new streaming service TV shows weren’t as good as Ted Lasso or Lucky Hank. While waiting for the latest episodes to arrive next week, I suggested to Maureen that we re-watch that Tom Hanks iconic film Forrest Gump.

Remembering how good the film was, Maureen gave the idea the thumbs up. After five minutes in, we both realised what a great idea this was. Among the many memorable moments (which we’d forgotten about since the film was released in November 1994 before collecting six Academy Awards) was the fact that Forrest’s fishing partner invested some of the proceeds of their profitable shrimp business (“Lieutenant Dan got me invested in some kind of fruit company”) in a relatively new organisation called Apple!

Looking for the next big thing in investing is always a goal for many investors, and as I always say: “Anything worth doing, is worth doing for money.”

I have an Aussie mate who’ll eventually list his Artificial Intelligence (AI) company but it’s “hush hush” right now. One day he’ll let me share the company name with you. Until then, we should be looking at getting exposure to this big business of the future.

How do I know that AI is going to be huge? Well, CEOs of listed companies know they can’t ignore AI for cost-saving possibilities alone, and, ultimately, even revenue-creating possibilities.

Over the weekend the AFR referred to the boss of law firm Minter Ellison, who said that the famous “billable hours” could be replaced by something from the AI world. Meanwhile, listed companies would now be recruiting AI experts to see how this technological innovation would offer advantages to their businesses.

And if they’re not, they shouldn’t be CEOs of listed companies.

In the US, here are the companies that have gone long investing in AI. They’re the ‘who’s who’ of US tech firms. Have a look and see if I’m right.

But don’t just believe me, here’s the AFR’s coverage of what JPMorgan thinks of AI: “Numbers from JPMorgan show that since the start of the year, the group of AI mega cap leaders – Microsoft, Alphabet, Amazon, Meta Platforms, NVIDIA and Salesforce – have added a staggering $US1.4 trillion ($2.1 trillion) in market capitalisation,” writes James Thomsen. “Those six companies account for 53 per cent of the S&P 500’s near 8 per cent gain in 2023. Microsoft, which is up 15 per cent year-to-date, deserves a special mention. It and Apple have become the most crowded trades in the world, and now account for 14 per cent of the S&P 500 index, a record.”

Bill Gates and Microsoft aren’t mucking around, as this from the AFR’s Dina Bass shows: “Microsoft is investing $US10 billion ($14 billion) in OpenAI, whose artificial intelligence tool ChatGPT has lit up the internet since its introduction in November, amassing more than a million users within days and touching off a fresh debate over the role of AI in the workplace.”

Bernie Fraser once said of industry funds were “the super of the future” and AI is the super innovation of the future. The money trail proves that point.

So how do we get on board the AI bullet train? Directly investing some of the big names on the list above is one way.

BetaShares has a robotics and AI fund with the ticker code RBTZ, and as the website explains: “RBTZ aims to track the performance of an index (before fees and expenses) that includes global companies involved in the production or use of robotics and A.I. products and services”.

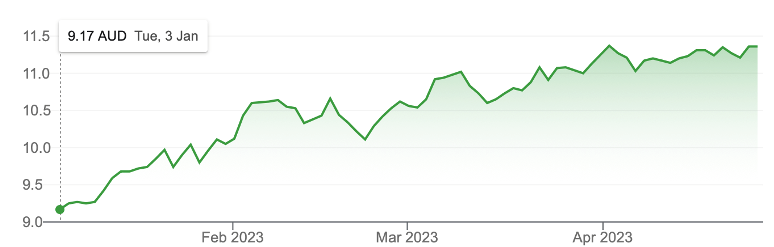

It collects companies in industrial robotics and automation, non-industrial robots, AI and Unmanned Vehicles, as well as drones.” And over the past year it is up over 10% but year-to-date, it has really got hot, up a nice 23.88%!

RBTZ

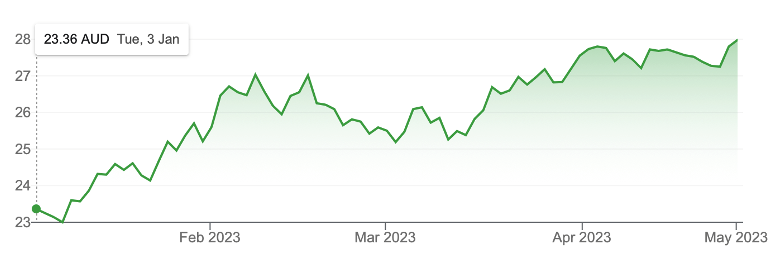

One of my favourites, HNDQ, would also give you exposure via the top 100 companies in the Nasdaq. Many of the companies on the list above are also in this hedged ETF. Not surprisingly, this ETF is up 19% year-to-date, which makes me happy given I did recommend this play late last year as a possible goer, along with the likes of Megaport (MP1), which had a nice rise on Friday, putting on some 41%.

The tech company rebound seems to be playing out. If a serious US recession can be avoided, with a sufficient economic slowdown along with lower inflation, then this trend could be sustained to year’s end and beyond. It will be given a tailwind from this next big thing called Artificial Intelligence.

HNDQ

Another indirect way to get an AI boost to your portfolio will be buying into an ETF such as IVV for 3 basis points, which gives you the S&P 500, which is driven dramatically by big tech.

In 2020 before Covid struck, Apple, Microsoft, Alphabet, Amazon and Facebook accounted for 17.5% of the S&P 500. Only three days ago, Bloomberg reported that Apple and Microsoft were 14% of the Index! And nationwidefinancial.com says that “…currently, the Information Technology sector is the largest S&P 500 sector by weight, accounting for around 27% of the S&P 500 Index. This is a significant increase from 1990, when the tech sector comprised just 6.3% of the Index”.

I believe the Aussie dollar is going to rise over the next 12 months so I’ve invested in IHVV, giving me a hedge against a currency appreciation for 10 basis points.

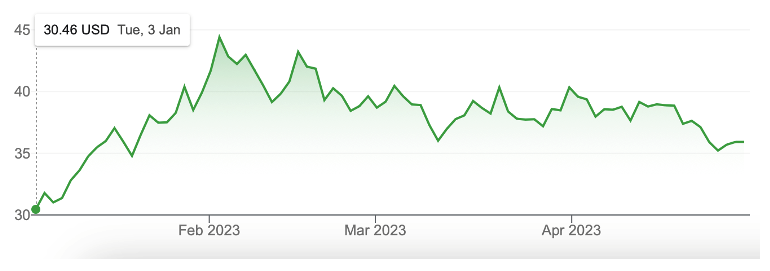

Another way to tap into AI would be via funds such as Cathie Wood’s ARK Innovation ETF (ARKK), which is up 17.9% year-to-date but is down 28% for the year!

ARKK

This is Woods’ view on AI, as explained in investorplace.com: “Wood’s Ark Invest recently published its 2023 edition of its Big Ideas report. AI played no small part of this year’s report, naturally. Ark argues on behalf of AI’s seemingly endless use-cases. And the decreasing costs to train AI models as evidence that the industry will continue to thrive in the coming years. And of the many tech stocks lining Wood’s balance sheet, there are five which investors would do well to keep aware of:

- ai (NYSE:AI)

- UiPath (NYSE:PATH)

- Exact Sciences (NASDAQ:EXAS)

- Upstart (NASDAQ:UPST)

- Tesla (NASDAQ:TSLA).”

There are many ways to access the AI uplift for stock prices and a diversified approach might be the safest way to get a nice return from what will be a big thing in coming years.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances