One of my financial planning clients likes to pick my brains before investing and recently told me: “I’m not interested in speculative stocks with no cash flow. I’m agnostic about sectors. Obviously, good quality companies that represent good value i.e., have been punished in this market, are the ones I’m really interested in.”

So, I’ve been investigating quality companies with good cash flow that have been beaten up by the market. When someone asks me for a ‘tip’, I work out if they want a huge return and are prepared to take risks. Then I look at tech stocks of the future, but these are for thrill-seekers.

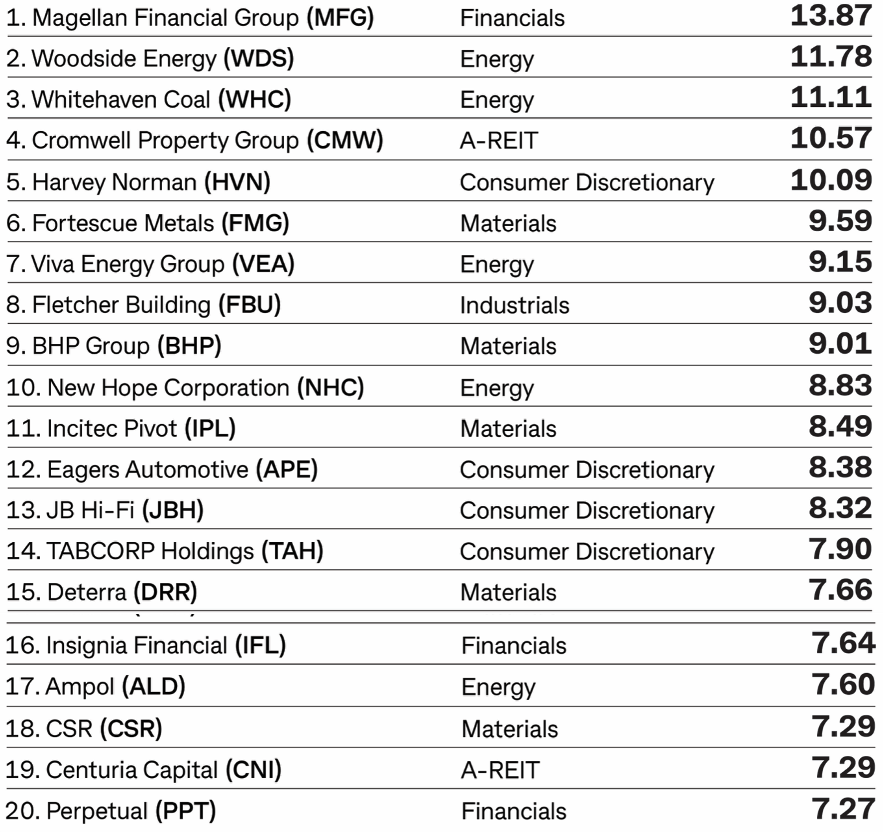

When I’m narrowing down the potential field of investible companies, I like to see what big names are paying great dividends. CommSec recently published a list of top dividend-payers and I’ve used this as a starting point in my investigation for one great stock.

Here it is:

The above list gets you thinking about issues such as:

- Do you want to gamble on Magellan (MFG)? The consensus say there’s a 15% upside. And three out of five analysts see rises betweeb 20% and 45%, but two see falls of 19% and 5%. It was a quality company but the jury is out on this one.

- Woodside, New Hope and Whitehaven look more shorter-term plays. While I think 2023-24 will be OK for these energy plays, if oil prices fall (say with an end to the Ukraine War), then share prices will go with it. For Woodside (WDS), the consensus rise is 6.4% but Ord Minnett sees a 32% jump ahead. I like the company but I wouldn’t buy any more except for a short-term play at these prices.

- The above anlysis applies to BHP and Fortescue. I like them for the year ahead as I see global growth dipping before surging in 2024, and the market will buy into this story in late 2023, if not earlier. The anlysts only see a 0.5% for BHP and 22% downside for FMG!

- Cromwell Property Group is an A-REIT when property is on the nose. There will be a comeback, maybe in 2024. The analysts like it — up 53.4%, but you might have to wait a bit for gains of this magnitude. The plight of offices in a world full of work-from-homers worries me, though I do think these guys will navigate the tricky waters for commercial property.

- Viva Energy (VEA) is an oil refiner and supplier of fuel and related products through petrol stations under the Shell and Viva Energy brands. VEA owns and operates the Geelong Refinery in Victoria. The analysts seea consensus rise of 9.4% but Macquarie tips a 17.26% higher price..

- Ampol (ALD) has similar issues, but the 16.2% consensus rise and Macquarie’s 30% higher call makes it worth thinking about, on top of its 7.29% dividend.

- Incitec Pivott (IPL) with an 8.49% dividend, and a 20% consensus rise tipped by analysts, looks juicy but it is a company that can have trouble, as this 5-year chart shows

- Some companies have potential but I just don’t like them or their sector. For example, Tabcorp (TAH) pays a great dividend but it has a lot of competition. And analysts see only a 3% rise. CSR (+0.5%) and Fletcher (+26.8%) are good companies and the latter’s potential share price rise looks attractive but the building sector is unreliable and on a slide. That said, in 2024, I might be more interested in this sector, when rates are falling and the demand for building more homes in Australia booms as immigration surges.

- Financials such as Perpetual (PPT) with +25% upside and Insignia Financial with 24% upside (this is the old IOOF) clearly have fans in the analyst’s community but a lot can go wrong with these operations. If they were a part of a 20-stock portfolio, then you’d be happy to have them, but, as big holdings, they can let you down. This chart of Perpetual makes my point.

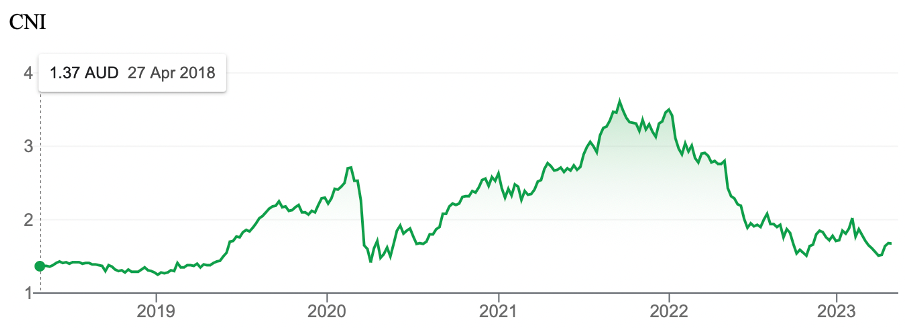

Centuria Capital (CNI) has links to real estate (which is a negative now) but also investment bonds (which are becoming more popular as governments make super less attractive for high net wealth Australians). The analysts tip a 31% rise. Morgan Stanley is more excited with a 49% call, which looks attractive with a 7.29% dividend. That said, it’s exposure to property could be a short-term issue, but, long-term, it has been a consistent performer. The five-year chart shows how the company climbs out of troughs, but ‘when’ that happens is something to look out for.

- I like the car business Eagers Automotive (APE) but not now. The analysts surveyed by FNArena only see a 3% upside. This industry has so many issues to deal with, including electric vehicles, oil prices and battles between car dealers and carmakers.

- Deterra (DRR) is a resource royalties business with 4.3% upside, according to the analysts. It’s not one of my companies but a 7.66% dividend looks to be reproduceable for a business like this.

- JBHi-Fi is one of my favoured companies and a dividend of 8.32% looks attractive. But right now, analysts can only see a 0.8% rise in its share price. It has seen an 8.78% rise in its share price year-to-date when most experts tipped retail would falter under the weight of 10 interest rate rises. They are yet to bite and JBH’s share price has defied the expert forecasts for retail. If its share price was 8% lower, I’d be recommending this for my quality-company seeking client.

Now for my selection. If you’d asked me what quality company with good share price upside I’d recommend, before I started my research I’d never thought about Harvey Norman. Gerry’s always talking up his company (like his racehorses!) but right now I think he might have a case for me to listen to him.

For starters, that 10.09% dividend looks compelling. Even if it was halved in a recession, it would still look good.

Year-to-date, HVN’s share price is down 11.25%, so it has copped the retail sell-off expected by economists. But the long-term chart for the company shows that buying on big dips has been rewarding.

In December 2012, its share price hit $1.75, but by August 2016, it was over $5, with good dividends paid along the way. That was a gain of 185% in less than four years!

Of course, there could be more downside if the mortgage cliff hits hard, but the pattern for this company shows it has a great capacity to rebound.

This is the biggest retailer of non-food and hardware products in Australia and is a go-to brand for many Australian shoppers. And when retail rebounds, HVN’s share price reflects that.

The analysts see a 4.7% rise ahead, but Citi has gone for 13% jump in the share price. The negative share price calls were only 3.58% and 0.83%, so we could be near the bottom of the current share price slide.

The combined big dividend and the history of share price rebounds make HVN look attractive for a cautious investor looking for steady returns, with potentially big upside over a number of years.

You could easily wait until we see how bad the mortgage cliff hits the economy but I’d be a buyer of any decent dips of Gerry’s precious HVN.

If you’re a gambler, you might ‘punt’ on Magellan, which I think will see many of its funds rebound on the eventual tech/growth stocks recovery in the US and with China’s leadership more supportive of its tech businesses, such as Alibaba. But this is a gamble. The timing of this rebound could be delayed until 2024 if the US goes into a deeper-than-expected recession.

Companies such as Centuria, Cromwell, Ampol, BHP and Woodside still make appeal but there are uncontrollable curve balls, such as central banks and OPEC+ that could undermine the value of your investments.

As a group, these 20 stocks would make a nice income-based portfolio, but remember, resource stocks don’t always pay dividends of the current magnitude. We’re living in a golden age for miners’ dividends and history bears this out.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances