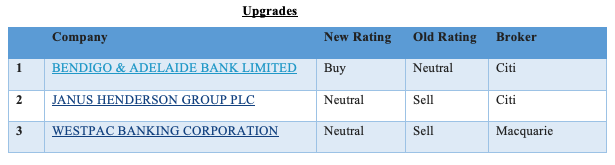

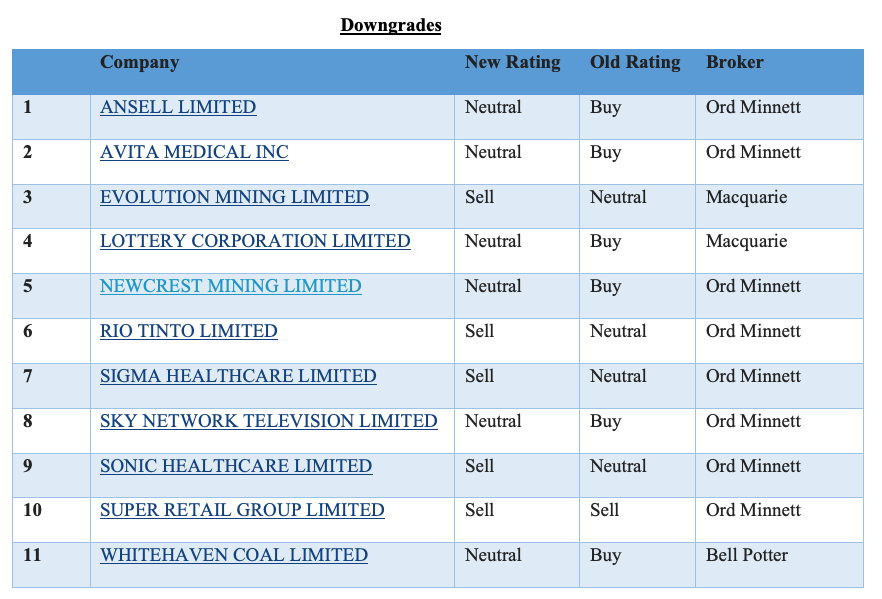

For the shortened week ending Friday April 14 there were three upgrades and eleven downgrades to ASX-listed companies by brokers in the FNArena database.

In an indication of a strong recent performance by the stock market, seven of the downgrades related to valuation concerns after company share prices moved higher.

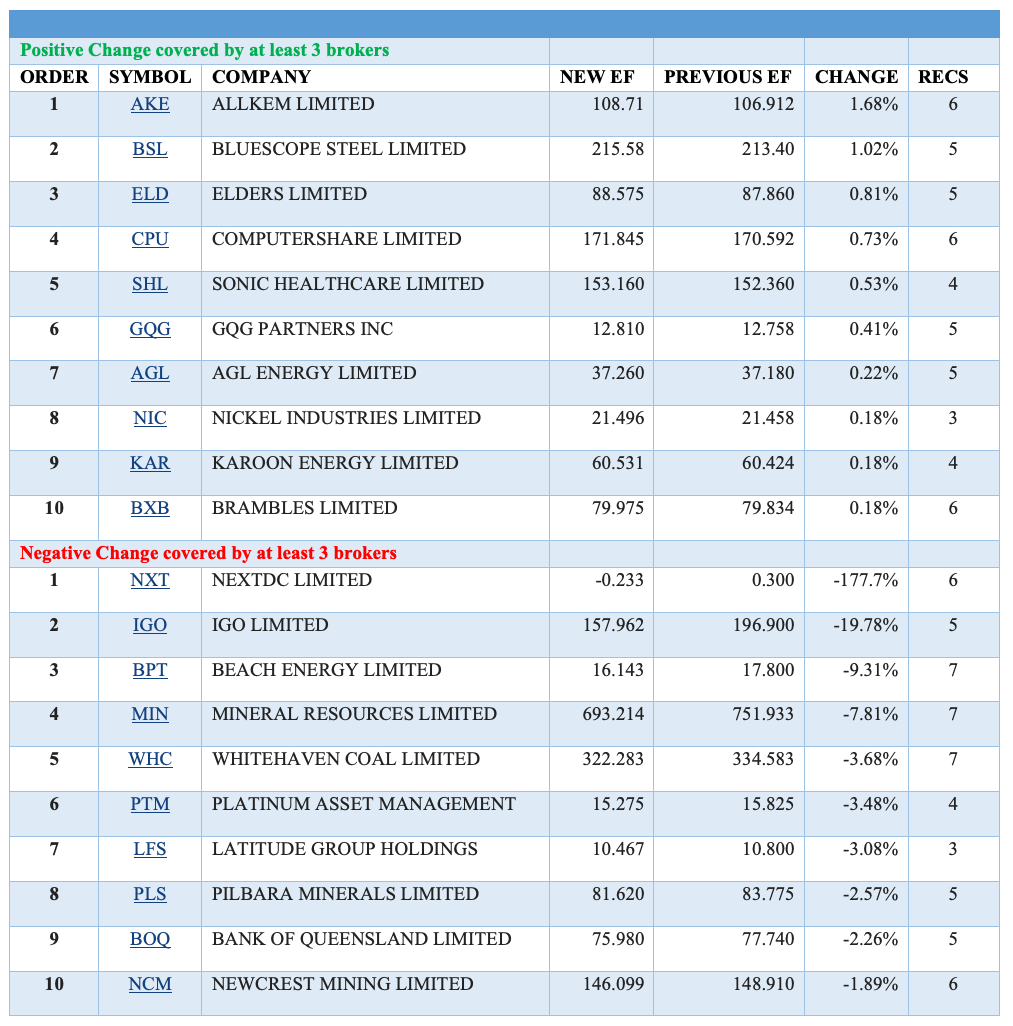

The only material positive change in average target price in the tables below was for NextDC, with an over 10% rise to $13.57 from $12.58 following a contracted utilisation update by management, which revealed a large hyperscale contract win.

Earnings forecasts were lowered in the near term to reflect a slower than expected billing ramp for the new hyperscale contract. Then, beginning in the second half of FY24, the contract will increase fairly evenly over a six-year period with around 6MW of billing capacity per year, explains Morgans.

Prior to the announced win, the new 80MW S3 site in Sydney was largely empty, and, according to Morgans, many investors were becoming nervous about the fill rate. Macquarie suggests the new contact win of around 36MW, the largest in the company’s history, helps de-risk S3 as it is now 46% contracted.

The Whitehaven Coal average target price fell by just under -10% last week after FY23 run-of-mine (ROM) production guidance was lowered for the Maules Creek coal open cut black coal mine in north west NSW.

Management cited labour shortages, operating constraints and weather disruptions as reasons for the production downgrade, and also commented unit costs would be 5% higher than prior guidance.

As a result of these changes for production and costs, Bell Potter decided to downgrade its rating for Whitehaven to Hold from Buy. The discount on the Vickery extension project was also increased as its development is expected to create further labour issues.

While Overweight-rated Morgan Stanley was disappointed by Whitehaven’s announcement, the stock is considered cheap. The broker’s base case valuation indicated around 30% upside to the prevailing share price at the time of the new research.

IGO received the second largest percentage downgrade to forecast earnings last week, after Morgan Stanley updated its outlook for the Lithium sector.

In a well-supplied lithium market, the broker prefers more fully integrated producers, and also see EPS growth in the medium term coming from companies with the highest volume expansions. Both IGO and Pilbara Minerals are thought to offer the least volume growth and are rated Underweight.

Overweight-rated Allkem’s implied lithium price is trading the closest to Morgan Stanley’s long-term price forecast, whereas IGO and Pilbara Minerals imply the highest spodumene prices and trade around 2-2.5 times above the broker’s long-term price forecast.

Overall, Morgan Stanley is cautious about the demand for lithium as well as battery inventory de-stocking over the short term, which in turn is putting downward pressure on lithium prices.

In the good books

BENDIGO & ADELAIDE BANK LIMITED ((BEN)) was upgraded to Buy from Neutral by Citi .B/H/S: 3/1/1

Citi maintains its positive outlook for the Banking sector, with the resilience of net interest margins (NIMs) and asset quality in the remainder of 2023 likely to deliver a positive surprise. Lower bond yields and a lower peak cash rate are forecast.

While peak bank NIMs have arrived, a dramatic fall away is unlikely as the broker forecasts a longer hiatus at the RBA cash rate of 3.6%, before rates are cut in 2024.

On average, Citi lowers its FY23-25 earnings forecasts for the Banking sector by -5-10%.

For Bendigo & Adelaide Bank, the broker lowers its target to $9.75 from $10.40 and upgrades its rating to Buy from Neutral on valuation and the relative strength of its deposit franchise.

JANUS HENDERSON GROUP PLC ((JHG)) was upgraded to Neutral from Sell by Citi .B/H/S: 0/4/0

Citi observes some progress has occurred in Janus Henderson’s strategy and stability should be demonstrated in the management fee margin.

Reduced outflows are likely and the broker lifts its rating to Neutral from Sell ahead of the first quarter result on May 3.

As the two main contributing funds, Research and Forty, a close to or at maximum negative, Citi considers it unlikely the drag from fulcrum fees will materially worsen. Target is raised to $37.80 from $34.50.

WESTPAC BANKING CORPORATION ((WBC)) was upgraded to Neutral from Underperform by Macquarie .B/H/S: 4/2/0

Macquarie envisages a diminished risk of further underperformance by Westpac at the upcoming results and upgrades to Neutral from Underperform.

The bank’s lagged price response on mortgages and deposits means upside risk for margins in the first half, although margin pressures are likely to catch up in the second half, the broker asserts.

Management is also expected to gradually walk away from cost targets and, in Macquarie’s view, ultimately the sustainable cost base is likely to be more than $1bn above current guidance. Target is reduced to $23.00 from $23.50.

In the not so good books

ANSELL LIMITED ((ANN)) was downgraded to Hold from Accumulate by Ord Minnett .B/H/S: 0/5/0

As the share price has moved through the trigger level Ord Minnett downgrades Ansell to Hold from Accumulate. Target is $30.

AVITA MEDICAL INC ((AVH)) was downgraded to Hold from Accumulate by Ord Minnett .B/H/S: 2/1/0

As the share price has moved through the trigger level, Ord Minnett downgrades to Hold from Accumulate. Target is $5.60.

The broker expects Avita Medical will be free cash flow positive by FY26.

EVOLUTION MINING LIMITED ((EVN)) was downgraded to Underperform from Neutral by Macquarie .B/H/S: 2/1/3

Evolution Mining’s preliminary 3Q gold production and copper output missed Macquarie’s forecasts by -6% and -11%, respectively, due to a larger-than-expected impact from a weather event at Ernest Henry. All-in sustaining costs (AISC) were a 2% beat.

Management advised the weather event will impact gold production by -17koz and copper output by -10kt in FY23.

After updating forecasts for costs and production, the broker’s FY23 EPS forecast falls by -7% though the $3.00 target price is unchanged. The rating is downgraded to Underperform from Neutral given the recent share price rally.

NEWCREST MINING LIMITED ((NCM)) was downgraded to Hold from Accumulate by Ord Minnett .B/H/S: 2/4/0

Newcrest Mining has received a higher indicative proposal from Newmont. Ord Minnett notes this is Newmont’s best and final offer in the absence of a competing proposal.

Under the proposal shareholders would receive 0.4 Newmont shares for every Newcrest share they hold and Newcrest can pay a further fully franked dividend of up to US$1.10 if a scheme of arrangement is implemented.

The broker raises its target to $32 from $31 and assumes a 75% chance the proposal is successful. Rating is downgraded to Hold from Accumulate.

RIO TINTO LIMITED ((RIO)) was downgraded to Lighten from Hold by Ord Minnett .B/H/S: 1/3/1

As the share price has moved through the trigger level, Ord Minnett downgrades to Lighten from Hold. Target is $107.

SONIC HEALTHCARE LIMITED ((SHL)) was downgraded to Lighten from Hold by Ord Minnett .B/H/S: 2/0/1

As the share price of Sonic Healthcare has moved through the trigger level, Ord Minnett downgrades to Lighten from Hold.

While coronavirus testing has been a boon for the business over the longer term the broker assesses high vaccination rates and testing fatigue will lead to fewer tests related to travel and compliance while the majority will be related to symptomatic infection.

Over a 10-year outlook Ord Minnett forecasts underlying non-coronavirus revenue growth of 4% for the base business. Target is $32.

SIGMA HEALTHCARE LIMITED ((SIG)) was downgraded to Lighten from Hold by Ord Minnett .B/H/S: 0/2/0

As the Sigma Healthcare share price has moved through the trigger level, Ord Minnett downgrades to Lighten from Hold. Target is $0.63.

The broker projects subdued organic growth for the pharmaceutical industry, given ongoing PBS price reform and excess industry capacity.

SKY NETWORK TELEVISION LIMITED ((SKT)) was downgraded to Hold from Accumulate by Ord Minnett .B/H/S: 1/1/0

As the share price has moved through the trigger level, Ord Minnett downgrades to Hold from Accumulate. Target is $2.75.

SUPER RETAIL GROUP LIMITED ((SUL)) was downgraded to Sell from Lighten by Ord Minnett .B/H/S: 2/2/1

As the share price of Super Retail has moved through Ord Minnett’s trigger level the rating is downgraded to Sell from Lighten. Target is $9.50.

THE LOTTERY CORPORATION LIMITED ((TLC)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 3/1/0

Macquarie observes Australian lotteries have experienced low jackpot activity in the financial year to date. While downgrades are likely for FY23 the broker expects FY24 to benefit from normalised jackpot activity as well as digital growth and higher commissions.

Macquarie assesses Lottery Corp is one of the more defensive ASX discretionary stocks, having outperformed the ASX100 index by 8% since listing in May 2022.

Now the valuation is considered fair the rating is downgraded to Neutral from Outperform. Target is reduced to $5.35 from $5.50.

WHITEHAVEN COAL LIMITED ((WHC)) was downgraded to Hold from Buy by Bell Potter .B/H/S: 5/2/0

Whitehaven Coal has downgraded FY23 guidance for Maules Creek, citing labour shortages and operating constraints as well as weather disruptions. The company now expects managed run of mine (ROM) production of 18-19.2mt. Unit costs will be around 5% higher than previously guided.

Bell Potter aligns its FY23 estimates with the updated guidance and downgrades to Hold from Buy. The risk discount on the undeveloped Vickery extension project is also increased, as its development could only create further labour issues. Target is reduced to $7.05 from $8.15.

Recent events in the US and Europe in UBS’ view have lowered the confidence threshold of investors for banks in their portfolios and Australia is no different. The broker now expects funding costs to move higher, fiercer deposit competition, bad debts higher than expected, and tightening bank regulation.

UBS updates earnings forecasts to reflect some of these dynamics in estimates.

Westpac target falls to $22.50 from $27.00. Downgrade to Neutral from Buy.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.