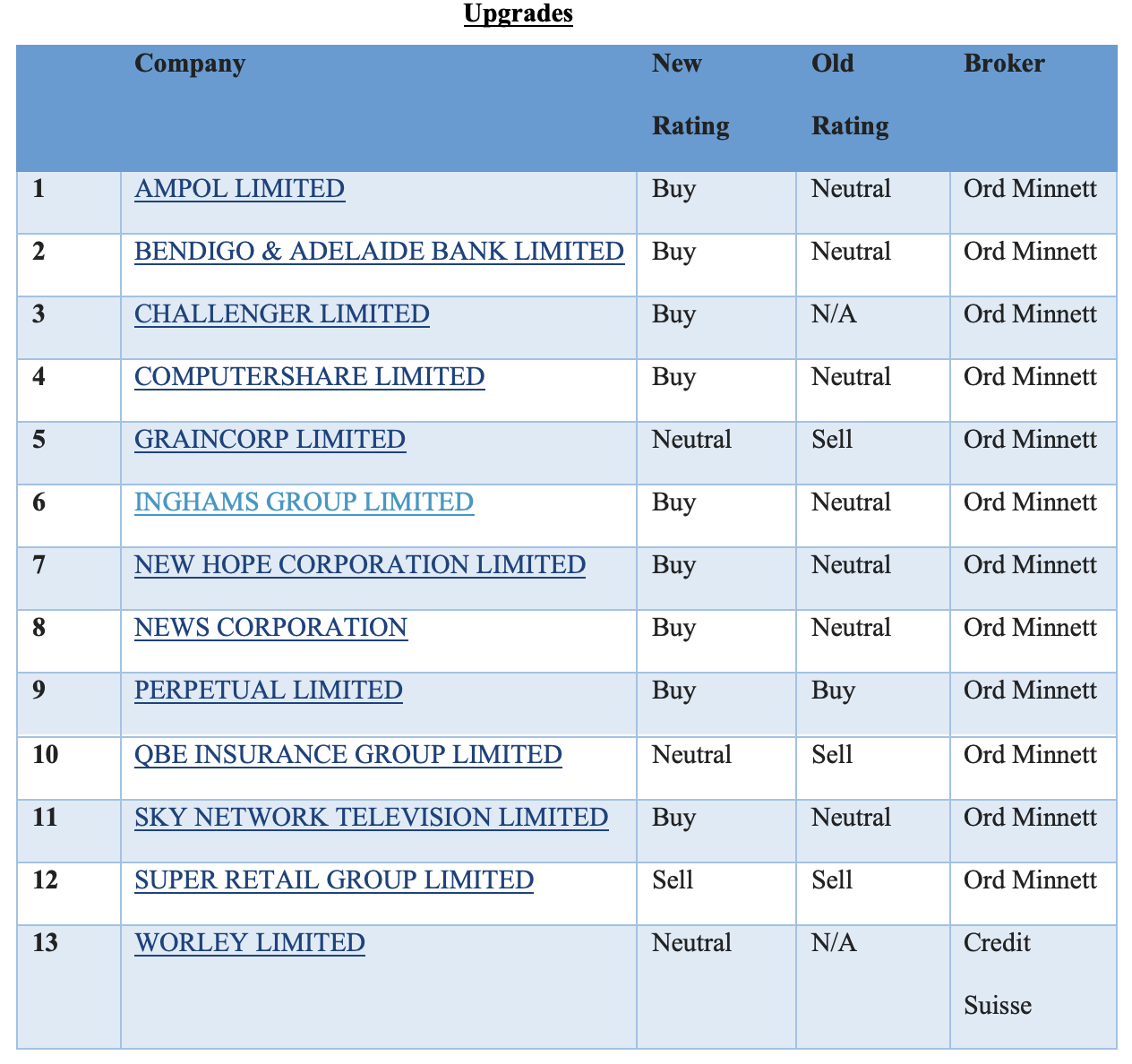

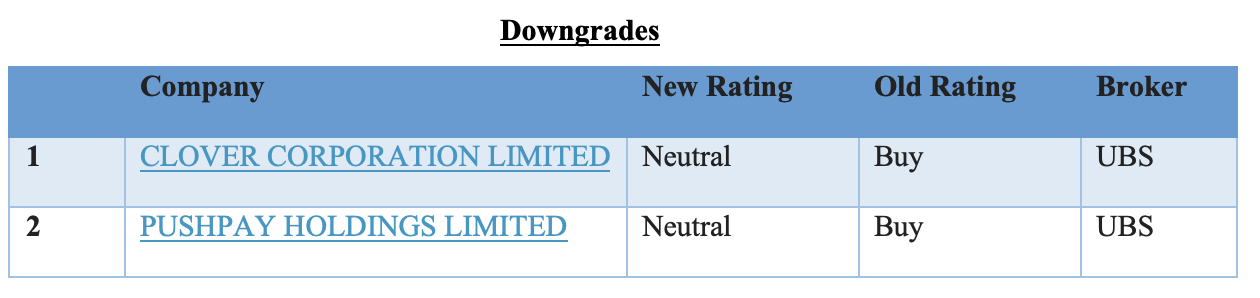

For the week ending Friday March 17 there were 13 upgrades and just two downgrades to ASX-listed companies by brokers in the FNArena database.

Twelve of those 13 upgrades were enacted by Ord Minnett on valuation alone (no forecast changes) following recent share price falls.

Auckland International Airport received the only material increase in average target price last week after announcing the single biggest redevelopment since opening in 1966.

Management has been consulting with its major airline customers since May 2011 on a replacement for the ageing domestic terminal and ways to integrate it with the international terminal.

Credit Suisse raised its target to $8.85 from $7.50 in the expectation of an attractive return on the NZ$6bn invested, due to the pricing power afforded by a light-touch regulatory structure.

The increased target is due to higher forecasts in the latter half of the broker’s ten-year forecast period.

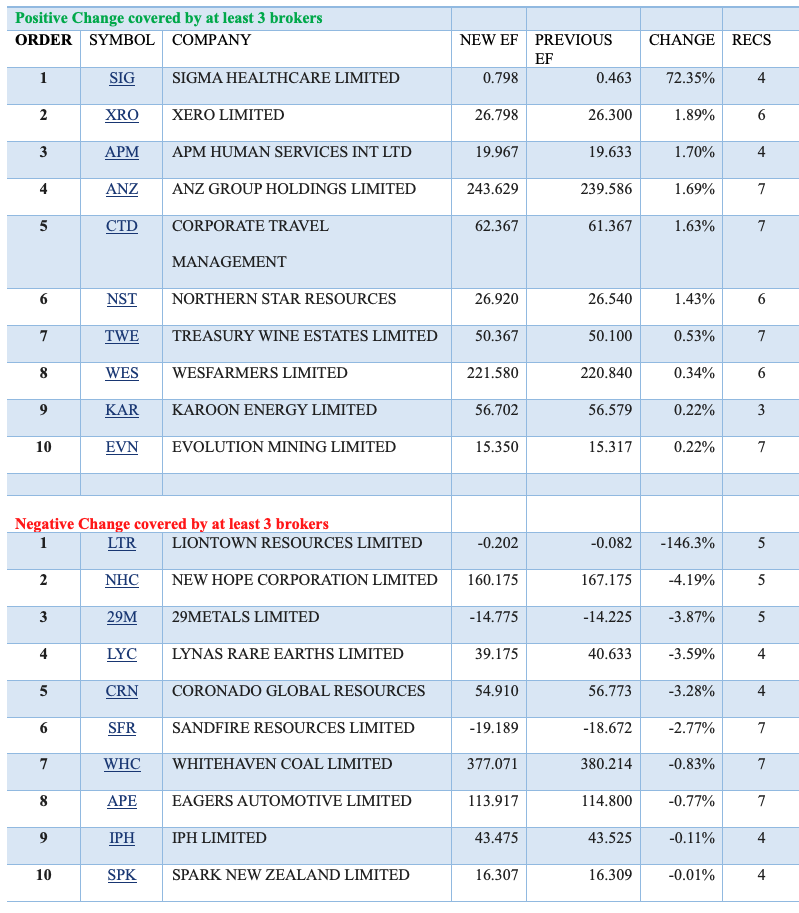

Sigma Healthcare received the largest percentage increase in average forecast earnings last week, though the size of the percentage change was exaggerated by the small forecast numbers involved.

Ord Minnett believes it is a strategically sound decision by management to exit its hospital distribution business given a lack of scale. Around $44m will be realised from the sale of assets and inventory.

Hospital distribution contributed around 10% of Sigma’s revenue, but the broker notes the business had a slightly lower margin compared to the core pharmacy distribution business.

Any negative valuation effect from the sale in the analyst’s financial model was offset by the sale proceeds, and the 63c target and Hold rating were left unchanged.

On the flipside, Liontown Resources received the largest percentage decrease in average forecast earnings. The company reported a first half loss wider than Macquarie forecast, while cash flow performance was in line.

The timeline to first production was unchanged and the broker believes delivering the Kathleen Valley project on schedule remains a key catalyst.

While first half results were in line with its expectations, Citi had previously stated opex forecasts need to be reset, and now anticipates an update by management for both opex and working capital in May/June. Given these looming disclosures, the stock is not considered a clean way to play lithium.

Management recently lifted capital expenditure requirements and flagged a subsequent funding shortfall, which will be secured before the end of the fiscal year. According to Citi, options for funding the gap include debt, equity and potential direct shipping ore sales.

The company started open pit mining at Kathleen Valley in early February, and while earnings from direct shipping ore sales are not included in Citi’s base case forecasts, they present upside potential to valuation.

In the good books

AMPOL LIMITED ((ALD)) was upgraded to Accumulate from Hold by Ord Minnett

B/H/S: 3/2/0

Following recent share price weakness, Ord Minnett upgrades its rating for Ampol to Accumulate from Hold on valuation. The broker’s forecasts are unchanged and the $34.50 target is maintained.

BENDIGO & ADELAIDE BANK LIMITED ((BEN)) was upgraded to Accumulate from Hold by Ord Minnett

B/H/S: 3/3/0

Following recent share price weakness, Ord Minnett upgrades its rating for Bendigo & Adelaide Bank to Accumulate from Hold on valuation. The broker’s forecasts are unchanged and the $10.20 target is maintained.

CHALLENGER LIMITED ((CGF)) was upgraded to Accumulate from Hold by Ord Minnett

B/H/S: 1/5/1

Following recent share price weakness, Ord Minnett upgrades its rating for Challenger to Accumulate from Hold on valuation.

The broker’s forecasts are unchanged and the $7.90 target is maintained.

COMPUTERSHARE LIMITED ((CPU)) was upgraded to Accumulate from Hold by Ord Minnett

B/H/S: 6/1/0

Following recent share price weakness, Ord Minnett upgrades its rating for Computershare to Accumulate from Hold on valuation. The broker’s forecasts are unchanged and the $24.00 target is maintained.

GRAINCORP LIMITED ((GNC)) was upgraded to Hold from Lighten by Ord Minnett. B/H/S: 3/2/0

Ord Minnett upgrades its rating for GrainCorp to Hold from Lighten on valuation after a recent share price fall. No changes are made to the broker’s forecasts and the $6.70 target is maintained.

INGHAMS GROUP LIMITED ((ING)) was upgraded to Accumulate from Hold by Ord Minnett

B/H/S: 3/2/0

Following recent share price weakness, Ord Minnett upgrades its rating for Inghams Group to Accumulate from Hold on valuation. The broker’s forecasts are unchanged and the $3.50 target is maintained.

NEW HOPE CORPORATION LIMITED ((NHC)) was upgraded to Accumulate from Hold by Ord Minnett

B/H/S: 4/1/0

Following New Hope’s recent share price fall, Ord Minnett upgrades its rating to Accumulate from Hold on valuation. No changes are made to forecasts and the broker’s $6.50 target is maintained.

NEWS CORPORATION ((NWS)) was upgraded to Accumulate from Hold by Ord Minnett

B/H/S: 3/1/0

Following News Corp’s recent share price fall, Ord Minnett upgrades its rating to Accumulate from Hold on valuation. No changes are made to forecasts and the broker’s $29 target is maintained.

PERPETUAL LIMITED ((PPT)) was upgraded to Buy from Accumulate by Ord Minnett

B/H/S: 5/1/0

Following Perpetual’s recent share price fall, Ord Minnett upgrades its rating to Buy from Accumulate on valuation. No changes are made to forecasts and the broker’s $33 target is maintained.

QBE INSURANCE GROUP LIMITED ((QBE)) was upgraded to Hold from Lighten by Ord Minnett. B/H/S: 6/1/0

Ord Minnett upgrades its rating for QBE Insurance to Hold from Lighten on valuation after a recent share price fall. The broker’s $13.00 target is unchanged.

SKY NETWORK TELEVISION LIMITED ((SKT)) was upgraded to Accumulate from Hold by Ord Minnett

B/H/S: 2/0/0

Following SKY Network Television’s recent share price fall, Ord Minnett upgrades its rating to Accumulate from Hold on valuation. No changes are made to forecasts and the broker’s $2.75 target is maintained.

SUPER RETAIL GROUP LIMITED ((SUL)) was upgraded to Lighten from Sell by Ord Minnett

B/H/S: 3/2/0

Following Super Retail’s recent share price fall, Ord Minnett upgrades its rating to Lighten from Sell on valuation. No changes are made to forecasts and the broker’s $9.50 target is maintained.

WORLEY LIMITED ((WOR)) was upgraded to Neutral from Underperform by Credit Suisse

B/H/S: 3/1/0

Not sure what’s going on at Credit Suisse (not the parent company bailed out yet again, the local research department). After a long hiatus, the rating for Worley has been upgraded to Neutral from Underperform. The target price has been lifted to $14 from the prior $10.70. The decisions seem to be a delayed response to the interim results released in February. Those results, Credit Suisse asserts, proved a positive surprise. The broker surmises Worley could prove a solid inflation hedge should the company continue to avoid margin compression, let alone see expansion.

In the not so good books

CLOVER CORPORATION LIMITED ((CLV)) was downgraded to Neutral from Buy by UBS

B/H/S: 0/1/0

Despite a 1H sales beat of 26% by Clover compared to the UBS forecast, the broker lowers its rating to Neutral from Buy. The analyst awaits further evidence of the company’s ability to monetise its market opportunities and is cautious over timing uncertainties of customers achieving the GB Standard licensing requirements. Guobiao Standards (GB) are food safety standards issued by the Standardised Administration of China (SAC). FY23 sales guidance of $80-90m implies to the broker a smaller 2H skew than usual. The $1.35 target price is unchanged.

PUSHPAY HOLDINGS LIMITED ((PPH)) was downgraded to Neutral from Buy by UBS

B/H/S: 1/1/0

UBS downgrades its rating for Pushpay Holdings to Neutral from Buy and lowers its target to NZ$1.42 from NZ$1.50 to align with an increased takeover bid by the BGH and Sixth Street consortium (from NZ$1.34). In the first scheme arrangement of its kind, notes the broker, a differential price has been accepted. Seven New Zealand shareholders have accepted the NZ$1.42 price and 10.6% of shareholders have accepted the original NZ$1.34 offer price to help fund the new bid. The next step in April is a new scheme meeting and amended independent expert report, explains the analyst.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.