Staring in 1966, Australian-based company Newcrest Mining (NCM) engages in the exploration, development, mining and sale of gold and the froth flotation product, gold-copper concentrate. Its operations have expanded beyond Australia. Newcrest’s primary gold and copper production in Australia is at Cadia East Ridgeway and the second is in the Pilbara region of Western Australia. Newcrest also operates two mines in Papua New Guinea and two in Canada.

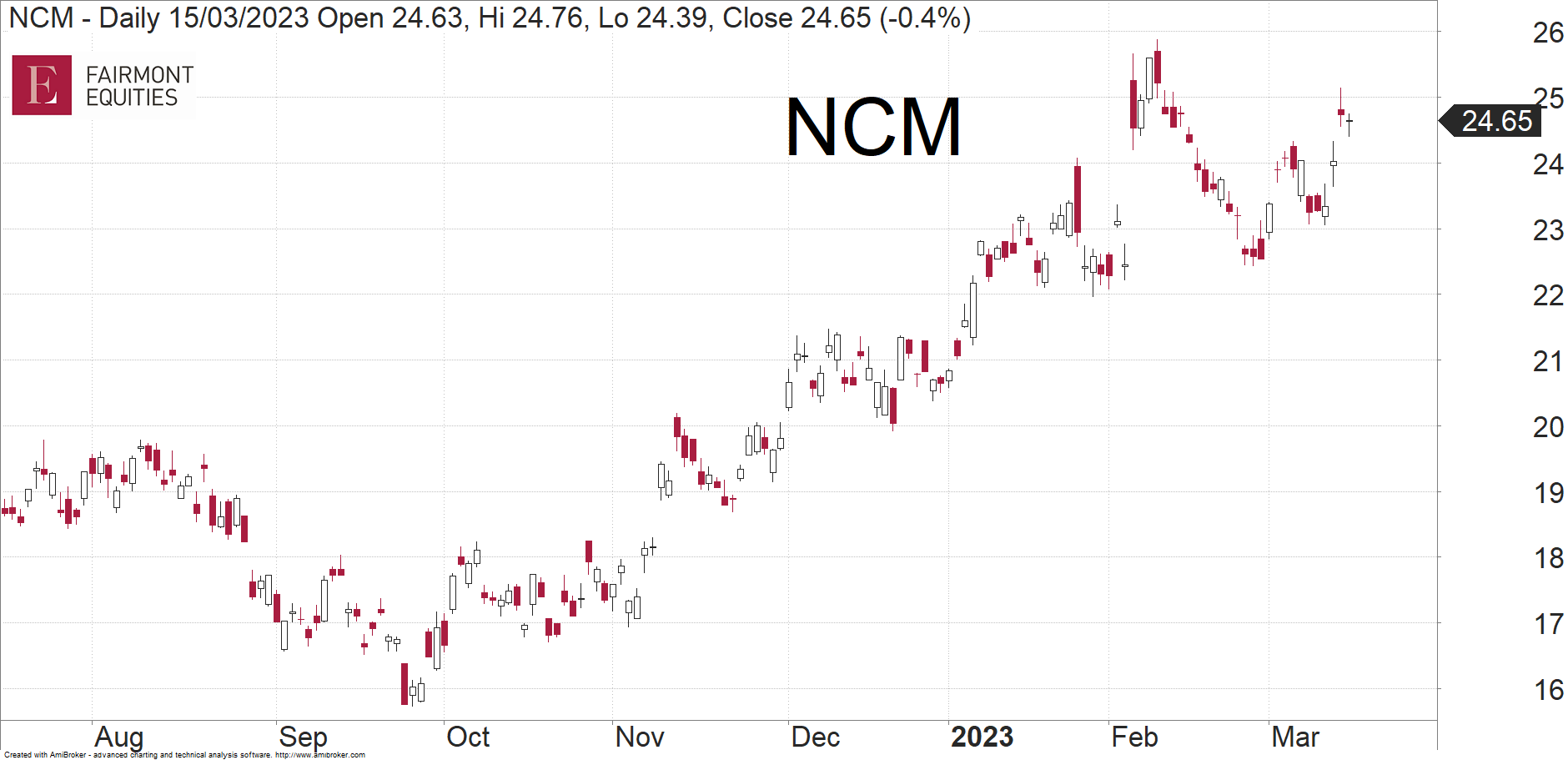

“Newcrest Mining is a stock that I looked at back in December,” Michael said.

“Based on the charting pattern, I suspected that it had found a low and was starting a new uptrend.

“The share price has managed to continue heading higher, helped no doubt by the recent takeover bid from Newmont (an American gold mining company based in Colorado and the world’s largest gold mining corporation).

“When I look at the way NCM has been trading, it looks to me as though this uptrend can be sustained.

“To do that, I look at how the share price moves during each up and down swing.

“On the way up, the moves seem forceful, which is good.

“But it has not rallied too strongly which would be a cause for concern.

“On the way down, we can see some profit taking, but the pullbacks are not deep.

“When heading backwards, it needs more time to retrace those previous moves higher.

“The bulls are therefore still in control.

“The uptrend for NCM looks very sustainable to me and I would be happy to continue holding,” Michael said.

(See also Paul Rickard’s response below to a subscriber’s question about Newcrest.)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.