Last week, local tech darling Megaport (MP1) copped it on the market when tech stocks really had a good week. Of course, tech companies will be under pressure because of the better-than-expected jobs report in the US on Friday, which sent the Nasdaq down 1.59%, though it still ended the week up 4.3%.

In recent weeks, while MP1 benefitted from positivity in the US for tech stocks, a recent report update wasn’t well-received, again, and sent the stock down nearly 20%!

Over the past month, I’ve been commenting on the great relove for tech stocks, with the Nasdaq up 13.6% in a month. Last week saw some of our battling tech stocks put in a good one as well. Xero was up 6.19% to $81.99, Wisetech up 5.53% to $62 and even Appen gained 5.84% to $2.72. And healthcare play CSL, which gets treated like a tech stock for reasons best explained by the market, rose 6.54% to $313.81.

But this week we’ll see if Wall Street resets its relove of tech stocks. What Jerome Powell says in a scheduled speech will have a big bearing on what tech stocks do. If he gets more negative or hawkish because of the 517,000 jobs that were created in January rather than the 187,000 predicted, then the belief that the interest rate peak is close could be pushed back, and that won’t be good for tech stocks in the short term.

That said, what we’ve seen over the past month tells us that when that peak looks certain and close, stocks will surge and tech companies will be big winners.

So that makes me comfortable about investing in the tech sector for the long term. But what about MP1?

I’ve liked Megaport and have a small exposure, but I must work out whether I want to dollar cost average and bring down my overall per unit cost of the stock.

Friday’s sell-off didn’t help my confidence but I am one who has always invested in quality companies when the market decides to smash them. I often remind you of what great value CBA was at $58 on the 27 March 2020 (that’s my birthday for anyone who wants to take note!).

But can we compare MP1 to CBA? No!

However, you must ask whether Megaport is a quality tech company. Most experts/fund managers have given it a quality thumbs up, but they’ve thrown in the fact that the company still must prove that it can grow consistently.

Last week, Goldman Sachs gave the company the thumbs down, for the short term. This is what it said after last week’s MP1 report to the market: “Although this result was in-line to ahead of Goldman Sachs estimate (2Q23 sales +3% vs. GSe), the key disappointment was the weakness in the operational trends….Although requiring further analysis, part of this appears to be driven by (1) broader macro concerns causing a deferral in decisions (as is occurring globally); and (2) ‘proof of concept’ customers pausing services before potentially re-engaging.”

However, Motley Fool says Goldman still likes the company. Given what it predicts for its future share price, there’s still 40% uplift potentially out there for the game investor.

This is what Goldman Sachs said about the company’s future: “All in we revise FY23-25 revenues -1% to -15%. However, from an earnings perspective, given a greater focus on profitable growth, MP1 has stepped up the cadence of its July 22 headcount reduction, and is now expecting $8-10mn cost reduction through FY24. Given the still strong revenue trends, this cost out has driven a step up in our near term (FY23-25) EBITDA of +35% to +4%.

“Finally with the stronger near-term EBITDA profile, specific guidance for capex to fall in 2H23/FY24, and the A$25mn debt facility, we still see ample headroom room for MP1 to achieve FCF breakeven by 2Q24.”

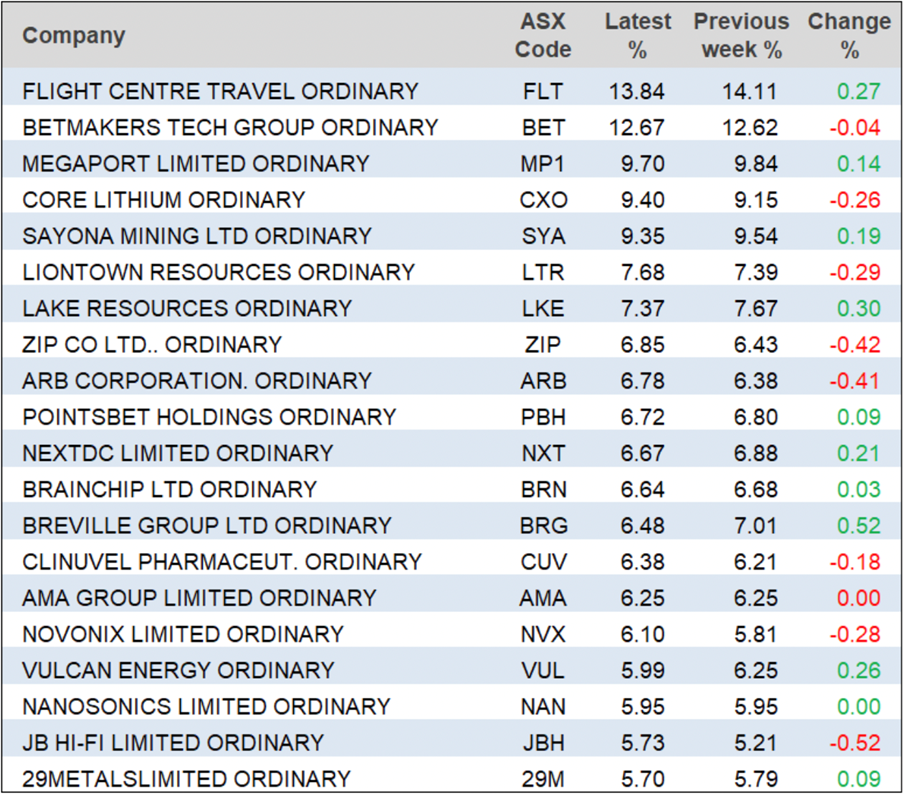

That’s Goldman’s view on MP1. What are the chorus of analysts on FNArena saying? This table says a lot:

That’s a pretty emphatic support for the company with Ord Minnett (up 150.84%) and UBS (up 113.21%) huge fans of the business!

And seven out of seven experts see a positive future, with an average consensus rise of 69.6% tipped by the group company analysers.

On the flipside, MP1 is heavily shorted by the smarties who look for companies with problems, even if only for the short term.

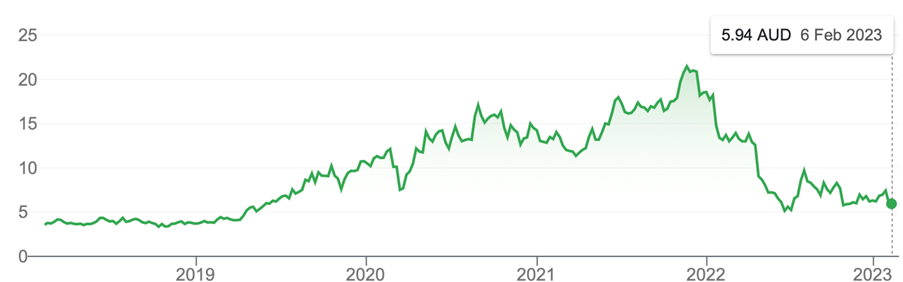

MP1’s current share price is $5.90. It hasn’t been that low for 44 months. You must ask the question: could the analysts in the FNArena survey table above been that wrong?

Megaport MP1

The average price of the consensus is $10.14 and Ord Minnett’s analysts’ calculator thinks the company is worth $15!

While I think the company is worth a ‘punt’, right now it really looks like a ‘punt’, not a well-considered investment.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.