My final column for the Switzer Report in mid-December 2022 listed 13 small-cap stocks that can outperform. Several are off to a good start, albeit in a rallying market.

To recap, the stocks were:

- Omni Bridgeway

- EQT Holdings

- IPH

- Kelsian Group

- Johns Lyng Group,

- IVE Group

- Data3

- MMA Offshore

- IMDEX

- Perenti

- Lindsay Australia

- Janison Education Group

- Frontier Digital Ventures.

No doubt I’ll add others to this list as the year progresses. Some beaten-up retailers look interesting as the market convinces itself that consumer Armageddon is a certainty in 2023 as interest rates rise (I’m not so sure). More on those stocks in a coming column.

Early standouts from my small-cap list for 2022 include:

- Lindsay Australia

- Perenti

- IMDEX

- MMA Offshore

- Omni Bridgeway.

The main disappointments so far are:

- Johns Lyng Group

- IPH

Both offer better value after recent price falls.

Of course, it’s too soon to form a view on these small-cap ideas. In a rising market, you’d expect that these stocks would be up, on balance. Most pleasing is that a few have announced earning upgrades or other positive news since that report.

In that December 2022 column, I explained my positive view on small-caps for 2023. After horrendous underperformance, small-cap industrials traded at an unusually wide discount to large-caps. Few investors wanted to know small-caps.

That’s a good sign. When the “crowd” stops looking at a part of a market, you know it’s time to dig deeper. Nobody makes money standing on the same side of the boat as everybody else. You have to think independently.

The usual rules with my small-cap ideas apply. For the most part, investors don’t buy small-cap indices (though it’s possible through Exchange Traded Funds). Small-cap investing is always about stock picking. Doing so requires an appetite for higher risk.

Caveats aside, it’s been interesting watching some small-cap stocks come to life in the past few months. As it becomes clearer that central banks will eventually tame inflation and that interest rates are close to peaking, small-cap industrials could be better relative performers compared to large-cap industrials.

The question is not what will happen with inflation or rates, but when. Nobody knows for sure, but it’s a good bet that we will see the bottom for equities this year. When risk appetite returns, some out-of-favour small-cap industrials will star. Yes, there could be persistent higher volatility as the market grapples with the timing of the interest-rate cycle. The interim and full-year reporting seasons this year could be littered with earnings downgrades due to the fallout from interest-rate rises.

But the market always looks forward.

By this time next year, the market will be getting ready for rate cuts and conditions for small-cap industrials will be improving. As such, a modest portfolio allocation to small-cap companies in 2023 makes sense.

Here are two small-caps that have stood out since that December 2022 column:

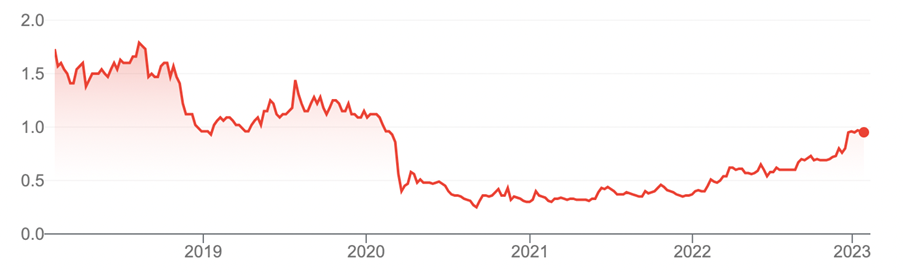

1. MMA Offshore (MRM)

The marine-services stock rallied from 79 cents in December to a 52-week high of $1, thanks to a positive trading update. MMA has since eased to 95 cents.

On December 19, MMA said its first-half underlying earnings (EBITDA) for FY23 would be $30-$32 million, up about 70% on the second half of FY22.

Market conditions in the first half of FY23 were stronger than MMA expected, thanks to buoyant activity in the oil and gas sectors. Offshore wind developments in South East Asia also drove demand for MMA’s services. Fleet utilisation at 82% for the first five months of FY23 impressed.

MMA said market conditions for the second half of FY23 were encouraging. Activity in the third quarter is traditionally quieter for MMA because of the monsoon season. Also, the company is yet to contract several of its larger vessels to energy projects.

Perhaps most encouraging was MMA noting that “visibility is continuing to improve”. My sense is MMA is getting more confident that sales momentum from first-half FY22 will continue into the second half, based on recent activity in its market.

I wrote in mid-December that MMA is “benefitting from buoyant conditions in the energy sector and building a strong foothold in renewables, such as wind farms.” A stronger balance sheet and operational progress were other highlights.

MMA’s trading update confirms that view. I suspect that current momentum in energy and renewables projects will lead to more contract extensions at its projects (MMA announced a few contract extensions in its latest trading update).

Capitalised at $351 million, MMA is barely covered by stockbroking analysts or the media. Too many investors forget about small-caps after years of horrible underperformance and believe they will never recover. Or overlook recent gains.

That could be the case with MMA this year as utilisation of its 18-vessel fleet remains elevated and as demand for its subsea services grows.

Chart 1: MMA Offshore

Source: Google Finance

2. Perenti (PRN)

From one beaten-up resource-services stock to another. Like MMA, Perenti has disappointed investors over the past few years. Earnings downgrades in FY21 and FY22 and other problems shook the market’s confidence in Perenti.

As more investors gave up, Perenti in November 2022 upgraded its earnings guidance for FY23 after a solid result. On December 19, Perenti provided another operational update and upgrade for its FY23 earnings guidance.

The exploration and production-drilling company said it had secured better terms for work across several of its Australian and African projects, including for completed work.

In another good sign, the Perth company’s Barminco subsidiary secured new contracts with Evolution Mining and Regis Resources at key mines.

In the space of a month, Perenti lifted guidance of $215-$230 million (EBIT) for FY23 to $230-$250 million. Revenue guidance rose from $2.6-$2.7 billion to $2.7-$2.9 billion. Net capital expenditure remains unchanged after the upgrade.

The company said in December: “… Perenti has navigated a period of unprecedented uncertainty and, whilst challenges still exist, we are now seeing the significant effort of our people translate into value upside to our shareholders”.

That is what investors want to see with mining-services stocks: better terms and margins on existing works, contract wins with prominent customers, and steady capital expenditure. Perenti has rallied from $1.08 in mid-December to $1.30.

I recall some savvy small-cap fund managers telling me last year that Perenti was among the cheapest mining-services stocks on ASX. But they hesitated to buy, fearful that large mining companies would revise contract terms for service providers (which lacked pricing power) in a weakening market. Also, that mining-services companies would suffer from higher wage costs and labour-market shortages.

In hindsight, those fears look overblown, judging by Perenti’s two recent earnings upgrades and general strength in mining activity and commodity prices.

Perenti is probably due for consolidation or a share-price pullback after recent gains. But there’s much to like about its latest trading updates.

For the first time in a long time, Perenti has some decent operational momentum behind it. If the recovery continues, more investors will take note. Many will need convincing: Perenti has had a poor average Return on Equity over the past five years.

Moreover, mining-services stocks can be volatile, meaning they suit experienced active investors. They are not set-and-forget investments and are best traded through mining cycles. For risk-tolerant investors who understand the features, benefits and risks of small-cap investing, mining services could provide more opportunities in 2023.

Chart 2. Perenti

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 25 January 2023.