J.P.Morgan’s Elana Dure recently gave the investment house’s outlook for 2023 and signalled that bonds and equities in the healthcare, tech and industrial space could be the place to be.

Last week I focused on industrial stocks that the analysts really liked. This week, I’m looking at what the experts like in tech and healthcare.

With healthcare, the big names are:

- CSL

- Resmed

- Ramsay

- Cochlear

- Sonic

Many of our healthcare stocks behave more like growth stocks because they are big export-earners and are global standout businesses.

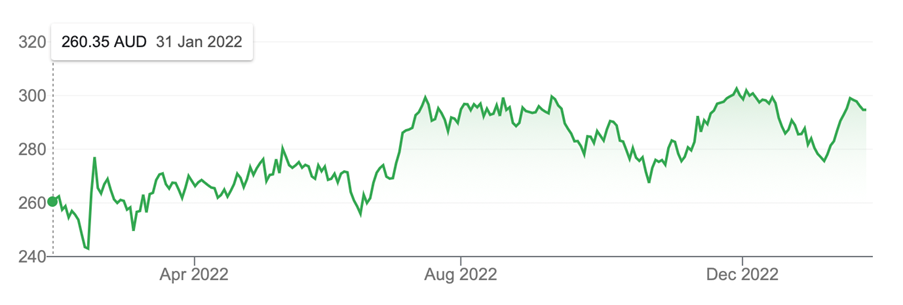

1. Let’s kick off with CSL

CSL had a real up and down year in 2022 but finished up 13.9% for the past 12 months. That said, it hasn’t convincingly beaten the $300 mark, but analysts think it will happen this year.

CSL

The average consensus rise is 11.7% but Morgan Stanley see CSL’s share price potentially going from the current price of $294 to $354. No analyst sees downside. I predict if tech stocks do have a healthy rebound, CSL (a blood business!) won’t be doing any bleeding, stock price-wise.

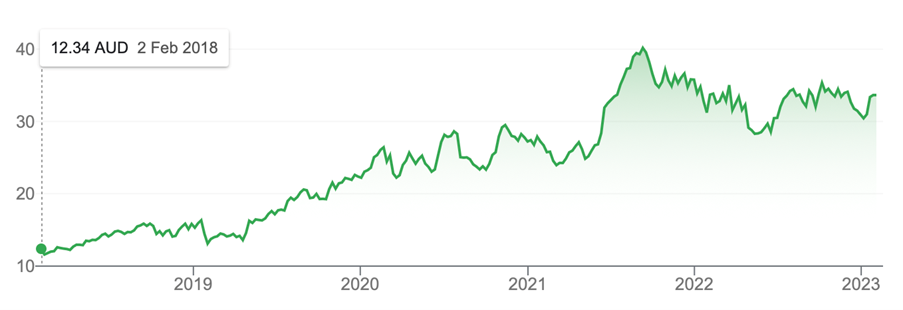

2. View on Resmed (RMD)

Another global top performer is Resmed. Here the analysts surveyed by FNArena can see an average 9% rise ahead. Ord Minnett is the most positive with a 12.93% gain expected and only one out of six analysts sees a small fall of 3.4%.

Resmed (RMD)

Historically, I’ve found this to be a rebound stock. The chart shows that when it sells off, it creates a nice buying opportunity. That pattern is likely to work this year. Notice how it has gone up and down on a rising trend. It rose 5.49% in 2022.

3. Let’s talk Cochlear (COH)

Cochlear rose 7.26% over the past 12 months and the analysts can see a small 4.5% rise ahead. But Morgans is looking for a 14.61% rise in the next year.

4. A few words on Sonic (SHL)

Sonic Healthcare has gained friends in the analysts’ space in recent years. The average expected gain is 9.2%, though Credit Suisse’s team sees more than others with an 18.93% rise expected. There’s only one dissenting voice i.e. Macquarie, but the fall tipped is only 0.73%.

5. Ramsay Health Care (RHC)

Ramsay has been on the outer with analysts ever since a takeover $30 billion offer from KKR fell through. That said, fund managers (like Jun Bei Liu (from Tribeca Investment Partners) still like the hospital business. The average expected rise is 0.2% but Morgans tips an 11.58% rise. On the other hand, three out of six experts on the company see a price fall of around 7%.

Let’s talk tech

Let’s go to tech businesses now. While I like steady, old stagers such as REA, Seek and Car Sales, I want to look at the real tech businesses that have been smashed along with their US cousins in the technology space. These are:

- Megaport (MP1).

- Audinate (AD8).

- Xero (XRO).

- Next DC (NXT).

On Thursday, Tesla helped US stocks rise. A number of analysts think the market is underestimating the rebound potential of mega-tech, which ultimately will lead the way for the whole sector. I think this tech rebound will happen this year and will get more serious in 2024.

Last week, as Tesla reminded many that tech isn’t dead, Megaport (MP1) rose 7.22% on Friday and is up 19.65% in a month, after dropping 44.55% in the past year, like a lot of quality tech companies have both here and overseas. The analysts now tip a 37.7% upside but both Citi and UBS are big believers, with 88% and 89% calls out there!

Another tech darling is Audinate (AD8). The gain for this audio company that outperforms the likes of Bluetooth technology, is tipped to be 28.4% on average. However, Macquarie’s crystal ball sees a 35.8% rise ahead.

Of course, MP1 and AD8 are more speculative, smaller company plays but what about steady performers such as Xero (XRO) and Next DC (NXT)?

I can’t find a fund manager who wants to bag Xero but the average gain has trimmed down in recent months. The average gain is expected to be 10%, but two out of six analysts see a small fall, while Morgan Stanley and Citi have 20% plus gains pencilled in.

Meanwhile, Next DC has a 29% average gain tipped, but UBS and Morgan Stanley have rises of 43% and 45% respectively. This company has to be in any diverse tech-portfolio but the market can be hard on this business.

By the way, seven out of seven analysts like Next DC and the smallest predicted rise is 12.9%. So if the analysts know what they’re talking about, this looks like real goer.

One final point needs to be looked at, if you can believe my point that 2023 will eventually be seen as a good year for stocks.

J.P.Morgan’s report featured this research-based observation about markets: “Historical evidence suggests that the real economy suffers the greatest damage after interest rates have already risen, but markets may have already reacted to higher rates and their consequences.”

We are nearing the end of the rate rise cycle and it looks like markets are now starting to react.

A few months ago, I suggested IHVV, which is now up 5.12% in the past month. And HNDQ, which is a hedged play on the top 100 stocks on the Nasdaq, is up 8.65%.

These are positive signs for a tech rebound, which I expect will take root over 2023. It might not happen overnight, but it will happen!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.