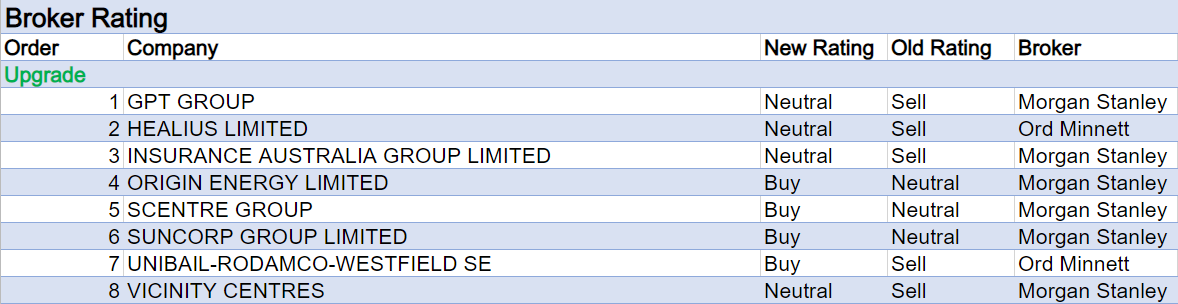

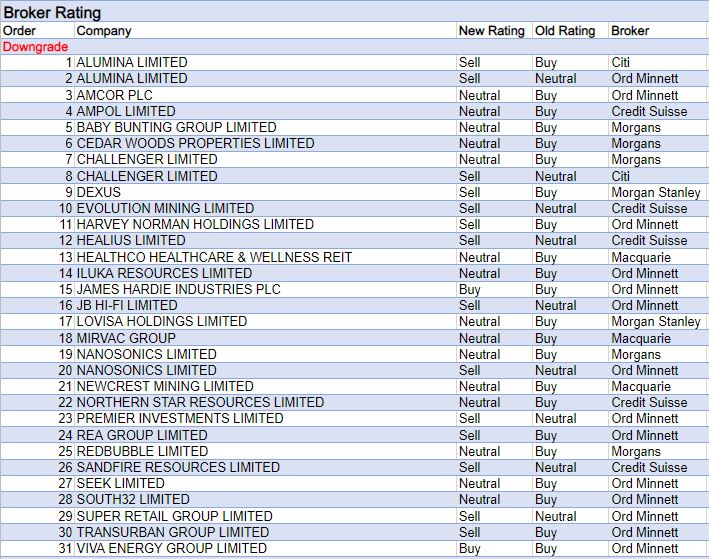

Following the holiday break, the level of stockbroker research has now bounced back strongly and for the week ending Friday January 20 there were eight upgrades and thirty-one downgrades to ASX-listed companies in the FNArena database.

More than half of those downgrades were made by Ord Minnett, which began the year whitelabeling research from Morningstar instead of that by former partner/owner JP Morgan.

This change has created several distortions for the tables below. Every time a Morningstar analyst produces first-time research for a particular stock in 2023, one-off adjustments to forecasts and price targets occur from the old (JP Morgan) research. In addition, Morningstar has implemented a number of analyst changes, and fresh ideas have led to an (outsized) number of ratings changes.

ASX sector reviews by brokers also tend to inflate the number of forecast and target price changes.

Last week Morgan Stanley reviewed large regional Retail malls and concluded they offer safety, security and growth over the next 12-18 months, which led to higher ratings for GPT Group and Vicinity Centres (both upgraded to Equal-weight from Underweight) and a new Overweight rating for Scentre Group, up from Equal-weight.

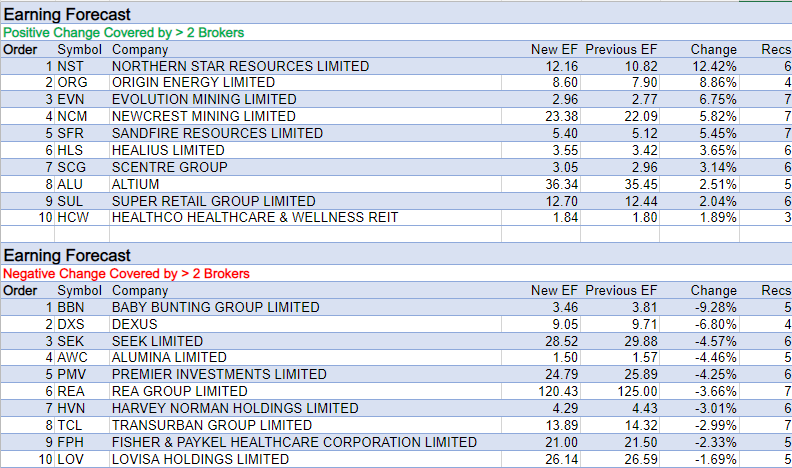

Over at Macquarie, gold stock target prices were raised by 6-20% due to the emergence of material earnings upgrade potential to spot gold prices. Northern Star Resources is the broker’s preferred large cap gold name due to relatively lower-risk production growth and balance sheet strength compared to both Newcrest Mining and Evolution Mining.

On the other hand, Credit Suisse lowered its rating for Northern Star during the week to Neutral from Outperform and forecasts the year-on-year gold price will remain largely flat. This broker prefers exposures to Newcrest and St Barbara.

A lift in target to $14 from $12 by Macquarie was sufficient to elevate Northern Star to the head of the positive price target change table. Other target increases had a distinctive Resource-sector flavour, with Origin Energy (Utilities sector), Evolution Mining, Newcrest and Sandfire Resources all receiving a greater than 5% boost by brokers on average.

The top ten target decreases ranged from circa -2% to the around -9% for Baby Bunting, after preliminary December-half results fell well shy of consensus. Sales were weaker and operating expenses rose, leaving Neutral-rated Citi cautious around increased competition and concerned over a sharp fall in the number of 12–16-week ultrasounds.

Given the above-mentioned disruption caused by newly sourced research by Ord Minnett, only selective stocks will be referred to in the negative change earnings forecast table below.

Macquarie lowered its earnings forecasts for 29Metals after reviewing the weaker-than-expected 2023 guidance issued in late December, caused by a reduction in milling rates at the Capricorn copper operations in QLD in order to manage tailings storage capacity.

After five brokers submitted new research on Northern Star Resources following its second quarter production report, the average earnings forecast in the FNArena database slipped by -17%.

Morgans also lowered its earnings estimates for Link Administration by -8% in FY23 and -12% in FY24 after removing Pexa Group earnings from forecasts (post the in specie distribution) and reduced profit assumptions.

The research changes at Ord Minnett were misleadingly responsible for Alumina Ltd heading up the table for the largest percentage increase in forecast earnings in the FNArena database last week. Citi actually lowered its rating for Alumina Ltd to Sell from Neutral as a result of AWAC JV partner Alcoa’s latest market update, in which the company lowered its guidance for 2023.

Both Citi and Morgan Stanley now suggest a second half dividend is unlikely. Despite this outlook, Morgan Stanley retained an Overweight rating as 2022 finished with the alumina market in balance, and lower 2023 global production should result in a tighter market and rising prices.

In the Retail sector, brokers raised earnings estimates for both JB Hi-Fi and Super Retail Group last week.

JB Hi-Fi’s preliminary first half earnings and profit exceeded consensus forecasts by 14.3% and 15.2%, respectively, though Underperform-rated Macquarie remained cautious on the coming year as cost-of-living pressures increase.

Of the seven brokers in the FNArena database, two have a Buy or equivalent rating for JB Hi-Fi, three are Hold and two have Sell ratings.

Convictions are slightly stronger for Super Retail Group with four Buys, one Neutral and a Sell, after a December-half trading update sharply outpaced consensus forecasts.

Outperform-rated Credit Suisse suspects capital management may soon be on the cards, including a special dividend which would take the dividend yield to roughly 10%.

Less positively, Ord Minnett (Sell) is concerned by looming competition from Amazon, while Macquarie (Neutral) remains somewhat cautious given the group is facing tough comparables over the remainder of the fiscal year.

Total Buy recommendations comprise 53.77% of the total, versus 37.15% on Neutral/Hold, while Sell ratings account for the remaining 9.08%.

In the good books

GPT GROUP (GPT) was upgraded to Equal-weight from Underweight by Morgan Stanley, B/H/S: 3/2/0

Morgan Stanley believes large regional Retail malls will offer safety, security and growth over the next 12-18 months. The analysts feel investors will come to appreciate the relative strength of Retail REITs compared to other mainstream sectors such as Office. It’s also thought landlords are well placed to cope with potential consumer headwinds from higher interest rates. The broker points out market rent has declined around -10% in the past three years, while retail sales across the key specialty categories (eg cafe, clothing) have increased circa 8% on a three year compound annual growth rate (CAGR) basis to October 2022. Morgan Stanley upgrades its rating for GPT Group to Equal-weight from Underweight. Office exposure makes up 35-40% of GPT’s portfolio, which mitigates against a higher rating. The target rises to $4.84 from $4.50. Industry view: In-Line.

INSURANCE AUSTRALIA GROUP LIMITED (IAG) was upgraded to Equal-weight from Underweight by Morgan Stanley, B/H/S: 4/2/1

Morgan Stanley upgrades Insurance Australia Group to Equal-weight from Underweight on stronger earnings forecasts as premium price increases are expected to outpace rising input costs. The broker points out the company’s multiples are undemanding, La Nina has likely ended and longer-term action on climate resilience has commenced. Suncorp Group is preferred by Morgan Stanley over QBE Insurance and Insurance Australia Group. An updated target price is awaited (last $4.20). Industry View: In-Line.

SCENTRE GROUP (SCG) was upgraded to Overweight from Equal-weight by Morgan Stanley, B/H/S: 3/2/1

Morgan Stanley believes large regional Retail malls will offer safety, security and growth over the next 12-18 months. The analysts feel investors will come to appreciate the relative strength of Retail REITs compared to other mainstream sectors such as Office. It’s also thought landlords are well placed to cope with potential consumer headwinds from higher interest rates. The broker points out market rent has declined around -10% in the past three years, while retail sales across the key specialty categories (eg cafe, clothing) have increased circa 8% on a three year compound annual growth rate (CAGR) basis to October 2022. Morgan Stanley upgrades its rating for Scentre Group to Overweight from Equal-weight. Capitalisation rate analysis shows the group is now trading at similar cap rates to 2012-14, the last time bond yields were at current levels, suggesting to the broker relatively less downside. Scentre Group is Morgan Stanley’s most preferred Retail REIT, given asset values have already been marked down by around -9% since early 2000 and around 60-70% of income is linked to CPI. The target rises to $3.55 from $3.00. Industry View: In-line.

SUNCORP GROUP LIMITED (SUN) was upgraded to Overweight from Equal-weight by Morgan Stanley, B/H/S: 7/0/0

Morgan Stanley upgrades Suncorp Group to Overweight from Equal-weight on stronger earnings forecasts as premium price increases are expected to outpace rising input costs. The broker points out the company’s multiples are undemanding, La Nina has likely ended and longer-term action on climate resilience has commenced. Suncorp Group is preferred by Morgan Stanley over QBE Insurance and Insurance Australia Group. An updated target price is awaited (last $11.30). Industry View: In-Line.

VICINITY CENTRES (VCX) was upgraded to Equal-weight from Underweight by Morgan Stanley, B/H/S: 0/6/0

Morgan Stanley believes large regional Retail malls will offer safety, security and growth over the next 12-18 months. The analysts feel investors will come to appreciate the relative strength of Retail REITs compared to other mainstream sectors such as Office. It’s also thought landlords are well placed to cope with potential consumer headwinds from higher interest rates. The broker points out market rent has declined around -10% in the past three years, while retail sales across the key specialty categories (eg cafe, clothing) have increased circa 8% on a three year compound annual growth rate (CAGR) basis to October 2022. Morgan Stanley upgrades its rating for Vicinity Centres to Equal-weight from Underweight. The target rises to $2.26 from $1.90. Industry view: In Line.

In the not-so-good books

AMPOL LIMITED (ALD) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 3/2/0

While suggesting near-term risks are potentially to the upside, Credit Suisse downgrades its rating for Ampol to Neutral from Outperform on valuation. The near-term outlook is considered supportive for refining and fuel retail margins The broker assesses the 4Q update was solid, though refining margins (the relatively volatile component of earnings) caused a miss versus the consensus forecast. Management pointed to improvements in Convenience Retail and Fuels & Infrastructure. The target falls to $29.72 from $30.49.

AMCOR PLC (AMC) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 0/6/0

Ord Minnett has cut its rating for Amcor to Hold from Accumulate on valuation. Ord Minnett has switched to whitelabeling research by Morningstar. The target falls to $17 from the last entry of $19.30 (by JP Morgan) in the FNArena database in early-November last year.

CEDAR WOODS PROPERTIES LIMITED (CWP) was downgraded to Hold from Add by Morgans, B/H/S: 0/1/0

Morgans expects lower demand across key greenfield land markets for residential property developer Cedar Woods Properties as the market eases back from a strong 2021/22 and rising interest rates weigh. The broker lowers its rating to Hold from Add though points out the company should benefit in the medium term from increased migration and the ongoing lack of affordable housing. The analyst suggests buying shares when either they approach $4.00 (currently $4.46) or when Morgans identifies lower risks to earnings forecasts. The target falls to $4.80 from $4.98.

HEALTHCO HEALTHCARE & WELLNESS REIT (HCW) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 1/2/0

Macquarie reassesses the outlook for HealthCo Healthcare & Wellness REIT. The broker forecasts FY23 guidance is likely to be achieved with higher funding costs offset by the earnings addition from recent acquisitions. However, reported liquidity concerns around GenesisCare which accounts for 12% of portfolio income could remain a negative for the group. Although the stock is trading at a -12% discount to the reported $2.01 NTA, Macquarie expects a fall in asset values and higher corporate costs will offset the benefits of any development revaluations. The rating is downgraded to Neutral from Outperform and the target is adjusted to $1.76 from $1.66 due a change in cap rate assumptions.

HARVEY NORMAN HOLDINGS LIMITED (HVN) was downgraded to Lighten from Buy by Ord Minnett, B/H/S: 2/1/2

Taking into account new competition from online pure players, Ord Minnett lowers its rating for Harvey Norman to Lighten from Buy. The broker points out domestic competitors in the online space (where Harvey Norman is under-indexed) now have to compete against international prices. Amazon Australia is expected to become a formidable opponent in the medium term. Ord Minnett has switched to whitelabeling research by Morningstar. The target falls to $3.90 from the last entry of $4.80 (by JP Morgan) in the FNArena database in early-December last year.

ILUKA RESOURCES LIMITED ((ILU)) Downgrade to Hold from Buy by Ord Minnett, B/H/S: 2/3/1

Ord Minnett updates its commodity price assumptions across the Resources sector following a general rise in prices over the final quarter of 2022. Over this period, the impetus from further China stimulus and government support for the property sector outweighed the impact of rising global interest rates, explains the broker. Despite higher mineral sands prices (which offset a stronger currency), a change of analyst results in a cut to the rating of Iluka Resources to Hold from Buy. Ord Minnett has switched to whitelabeling research by Morningstar. The target remains at $11.00 which is also the last target (by JP Morgan) in the FNArena database set in late-October last year.

NANOSONICS LIMITED (NAN) was downgraded to Hold from Add by Morgans and Downgrade to Lighten from Hold by Ord Minnett, B/H/S: 0/1/1

Following a strong 1H trading update by Nanosonics and revised FY23 guidance, Morgans raises its near-term forecasts though lowers its rating to Hold from Add after recent share price strength. Management increased FY23 guidance for total revenue growth to 36-41% from 20-25%, yet the analyst remains at the bottom end of this range, awaiting more detail. The split of the upgrade between currency, direct sales mix and consumables is considered unclear. Regardless, the broker feels the update will alleviate concerns regarding the transition to direct sales away from the pass-through relationship with General Electric. The target rises to $5.19 from $4.91. Ord Minnett cuts its rating for Nanosonics to Lighten from Hold on valuation, despite evidence of improvement within stronger-than-expected pre-announced 1H results. The broker expects the rate of growth in installed base units will slow over the next five years to average 6.8% from the five-year historical average of 16.2% as a result of an increasingly mature North American market. In addition, the analyst expects increasing competition once the Trophon device patent expires in 2025. Ord Minnett has switched to whitelabeling research by Morningstar. The target remains at $4.00, unchanged from the price set by JP Morgan in the FNArena database in late-November last year.

REDBUBBLE LIMITED (RBL) was downgraded to Hold from Add by Morgans, B/H/S: 0/3/0

Following Redbubble’s 2Q trading update and revised FY23 guidance, Morgans lowers its FY23-25 earnings (EBITDA) forecasts by -10-25%. The target slumps to 70c from $1.00 and the rating is downgraded to Hold from Add. While 1H total marketplace revenue (MPR) was in line with consensus, the company altered the terms of its guidance. Now MPR is expected to be in line with FY22, compared to the prior “revenue growth is expected in FY23”. The analyst notes increasing competitive intensity and a more value conscious customer, which necessitated additional promotional spend. Management will now be undertaking some cost-out initiatives.

SOUTH32 LIMITED (S32) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 4/3/0

Ord Minnett updates its commodity price assumptions across the Resources sector following a general rise in prices over the final quarter of 2022. Over this period, the impetus from further China stimulus and government support for the property sector outweighed the impact of rising global interest rates, explains the broker. Despite stronger aluminium, alumina and manganese prices, a change of analyst results in a cut to the broker’s rating for South32 to Hold from Buy. Ord Minnett has switched to whitelabeling research by Morningstar. The target rises to $4.40 from the last entry of $4.10 (by JP Morgan) in the FNArena database in mid-December last year.

VIVA ENERGY GROUP LIMITED (VEA) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 4/2/0

While the 4Q 2022 sales volume and refiner margin for Viva Energy exceeded Ord Minnett’s expectations, no longer-term implications are drawn. All segments of Viva’s business performed strongly, yet a new analyst decides to downgrade the company’s rating to Accumulate from Buy, without elaboration. At the same time the broker’s FY23 EPS forecasts is increased by 23% after a recent material increase in Singapore refiner margin futures. Ord Minnett has switched to whitelabeling research by Morningstar. The target falls to $3.20 from the last entry of $3.30 (by JP Morgan) in the FNArena database in late-October last year.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.