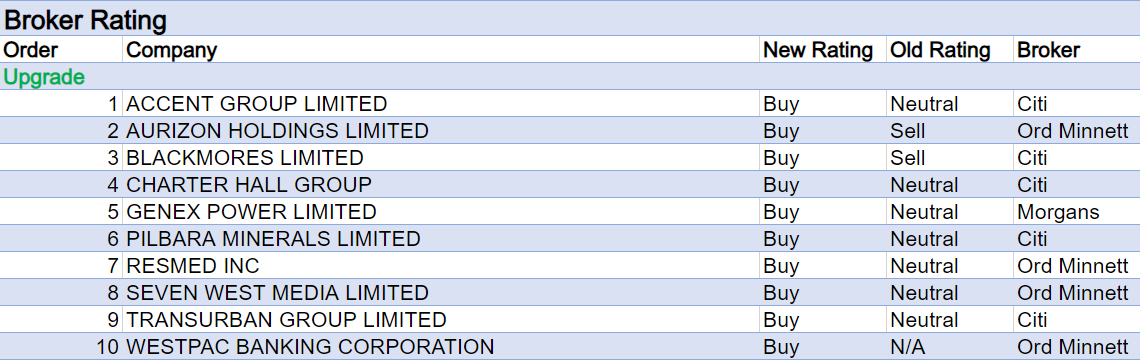

The week ending Friday, January 13th witnessed no less than 10 upgrades in stockbroker ratings and 13 downgrades for individual ASX-listed companies.

However, investors should not draw the conclusion that analysts at Australia’s major stockbrokers have returned early from their holiday break this year to make early amends.

Rather the switch at Ord Minnett to whitelabel research from Morningstar instead of that by former partner/owner JP Morgan is responsible for most changes, and the wrong impression.

Overall, research activity at stockbrokers in general has been rather tepid thus far with Macquarie and Citi the most active this early in 2023. The first look-ins for the upcoming February reporting season have already been spotted (on a few individual companies only).

Early indications are this is not about to change. Analysts like their annual break like everybody else.

For the week, all upgrades are either Ord Minnett’s or Citi’s with the latter upgrading Accent Group, Blackmores, Charter Hall and Transurban.

Two exceptions only can be spotted among the 13 downgrades; Morgans moving AGL Energy to Neutral and Macquarie similarly cooling on Westgold Resources.

The general statistics continue showing a market that is as polarised as ever with nearly 55% of all ratings in the Buy (and equivalent) basket, leaving only 36.72% for Neutral/Hold ratings and 8.34% for Sells.

Traditionally, a more ‘normal’ market sees the majority of ratings concentrated in Neutral and Hold ratings, but it has truly been a long while since we witnessed anything like it.

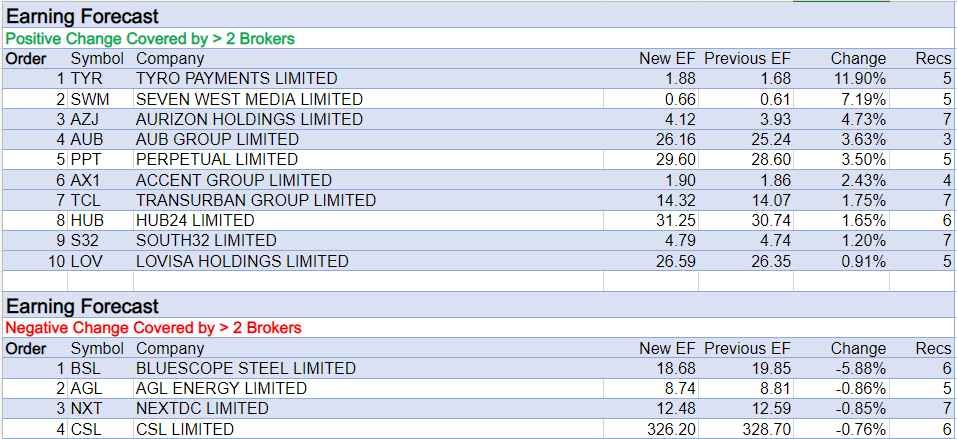

In line with early-year market optimism, most amendments to valuations and price targets are being made to the upside with the likes of Tyro Payments, Seven West Media, Aurizon Holdings, AUB Group and Perpetual all enjoying increases of 3.50% and higher.

On the negative side of the ledger BlueScope Steel stands out with a reduction of -5.88% thanks to Ord Minnett adopting a more bearish view on the sustainability of high steel prices and margins.

The overall picture looks a lot busier when one switches focus to earnings estimates with the week’s table for positive revisions led by Judo Capital (up 26.49%), NextDC (up 15.55%) and Brickworks (up 14.77%). Even Perpetual and Pendal, respectively numbers 9 and 10 for the week, still enjoy increases of nearly 3%. Both will be merging into one entity soon.

The negative side looks a lot less busy though five companies saw earnings forecasts reduced by between 37%-5%, led by Gold Road Resources, Lendlease Group, Fortescue Metals, and Origin Energy.

Once back from the holiday break, analysts will increasingly switch focus to the upcoming reporting season which only breaks open from mid-February onwards.

Insurers, banks, and small-cap lithium producers have been in focus thus far into the fresh calendar year, though one wouldn’t notice it from the overview below.

In the good books

ACCENT GROUP LIMITED (AX1) was upgraded to Buy from Neutral by Citi,.B/H/S: 3/1/0

Citi has upgraded to Buy from Neutral on the view that market consensus is too bearish on growth prospects of Accent Group. Longer term, the broker does acknowledge it is important Accent successfully proves up and develops some of its newer retail banners. EPS estimates have been reduced in reflection of higher costs for doing business. The new price target of $1.95 is a result of the broker removing its prior -15% valuation discount and instead applying a 15% premium. The premium is explained by the broker through Accent Group now expected to outperform its retail peers in Australia with more exposure to housing.

AURIZON HOLDINGS LIMITED (AZJ) was upgraded to Accumulate from Lighten by Ord Minnett, B/H/S: 2/4/1

Switching to Morningstar research has led Ord Minnett to upgrade its rating for Aurizon Holdings to Accumulate from Lighten. Your typical value-oriented Morningstar has had this company on its most preferred ideas list for quite a while. Target price jumps to $4.70 from $3.40.

BLACKMORES LIMITED (BKL) was upgraded to Buy from Sell by Citi, B/H/S: 2/3/0

Citi believes Blackmores will be a beneficiary from China re-opening and industry feedback backs up that thesis. On this realisation, the broker’s rating for the shares has been upgraded to Buy from Sell (double upgrade). Increased forecasts, against the background of a sound looking longer-term growth trajectory (Asia), have lifted Citi’s price target to $84 (was $58.85).

CHARTER HALL GROUP (CHC) was upgrade to Buy from Neutral by Citi, B/H/S: 5/1/0

2022 proved a brutal experience for A-REITs with the sector among the worst performing on the ASX. Only IT and Technology fared worse as higher bond yields required a valuation reset. While the year ahead continues to offer multiple uncertainties, sector analysts at Citi dare to be “cautiously optimistic” for the sector overall in 2023. Their preference lays with Goodman Group (GMG), Mirvac Group (MGR) and Charter Hall, hereby upgraded to Buy from Neutral, as well as with Region Group (RGN), Abacus Property (ABP), and GPT Group (GPT).

GENEX POWER LIMITED (GNX) was upgraded to Add from Hold by Morgans, B/H/S: 1/0/0

Morgans has used a general sector update, released on January 5th, to upgrade Genex Power to Add from Hold with a price target of 27c, up from a prior 20c.While still considered a risky proposition, the broker is of the view the share price has fallen too deeply after corporate suitors decided not to proceed with their intention to acquire the company.

PILBARA MINERALS LIMITED (PLS) was upgraded to Buy from Neutral by Citi, B/H/S: 3/1/2

Following a serious correction in the share price, Citi has upgraded Pilbara Minerals to Buy from Neutral with an unchanged price target of $4.70. While acclaiming the share price action is “overdone”, the analysts also highlight the fact that, on current estimates, Pilbara Minerals looks set to make more cash in FY23/24 than any other stock in the broker’s gold/metals coverage universe.

RESMED INC (RMD) was upgraded to Accumulate from Hold by Ord Minnett, B/H/S: 4/2/0

Ord Minnett has switched to Morningstar research and this has led to an upgrade in rating for ResMed to Accumulate from Hold. The price target has slightly improved to $38 from $37.50.

SEVEN WEST MEDIA LIMITED (SWM) was upgraded to Accumulate from Lighten by Ord Minnett, B/H/S: 3/1/1

Ord Minnett has switched to Morningstar research and the immediate effect has been an increase in price target; to 62c from 40c. The rating for Seven West Media has been lifted to Accumulate from Lighten. The upgrade follows the observation that the shares are trading well below the new target. While forecasts have been trimmed, the analyst does make the point the balance sheet is in much better position versus previous cycles, while also highlighting several positives, including new content agreements that benefit 7plus. The previous assumption Seven West Media would start paying a dividend from FY24 onwards has been removed.

TRANSURBAN GROUP LIMITED (TCL) was upgraded to Buy from Neutral by Citi, B/H/S: 4/3/0

Citi started the new calendar year with an upgrade to Buy from Hold for Transurban Group, communicated to its clientele on January 3rd. The moves seems to have been inspired by growing concerns, worldwide, that inflation might prove stickier in 2023, and Transurban should be a primary beneficiary as its operations offer protection. Equally important, while debt costs are rising, the analysts highlight Transurban’s longer debt maturity of circa 8 years means the full impact will take multiple years before impacting on the financial numbers. Target price increased to $15.70 from $14.52.

WESTPAC BANKING CORPORATION (WBC) was upgraded to Accumulate from Hold by Ord Minnett, B/H/S: 5/2/0

Ord Minnett’s switch to Morningstar research has shifted preference to the cheapest of the major banks, Westpac, which is hereby upgraded to Accumulate. Target price is $29

In the not-so-good books

AGL ENERGY LIMITED (AGL) was downgraded to Hold from Add by Morgans, B/H/S: 2/3/0

Morgans has used a general sector update, released on January 5th, to downgrade AGL Energy to Hold from Add. As the broker also lowered forecasts, the target price has dropped to $7.88, down by -11%. The broker holds a relatively positive view on AGL inside the sector, but highlights higher investment uncertainty in the sector makes it harder to identify upside for shareholders.

ANSELL LIMITED (ANN) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 3/3/0

With whitelabeled research now derived from Morningstar, Ord Minnett’s rating for Ansell has fallen to Accumulate from Buy. The price target of $32 has remained unchanged.

AUB GROUP LIMITED (AUB) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 3/0/0

The switch to Morningstar research continues to trigger changes in the coverage universe of Ord Minnett. There’s no other reason behind the downgrade to Accumulate from Buy. Target price of $28 compares with $26 previously.

BLUESCOPE STEEL LIMITED (BSL) was downgraded to Lighten from Buy by Ord Minnett, B/H/S: 3/2/0

Ord Minnett has downgraded BlueScope Steel to Lighten from Buy (two steps down on the broker’s ladder) as renewed analysis is suggesting steel prices had previously been artificially pushed to unsustainable levels, and spreads are expected to fall “markedly” in 2023. It is the broker’s view that steelmaking spreads will revert towards midcycle assumptions consistent with historical levels in nominal terms. Target price cut to $13 from $20. Judging by the layout of today’s report, the research stems from Morningstar. BlueScope Steel is also still awaiting the size of a penalty after a court found it guilty of cartel behaviour late last year. Today’s research update is suggesting a fine of $10m will be awarded.

BRAMBLES LIMITED (BXB) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 4/2/1

Brambles’ rating has been pulled back to Accumulate from Buy as a result of the switch to Morningstar research. Ord Minnett’s target price has improved to $14 from $13.40.

CSL LIMITED (CSL) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 5/1/0

Putting Morningstar in charge of whitelabeled research has led to a downgrade in Ord Minnett’s rating for CSL shares; to Hold from Accumulate. The price target has lost some potential too, now at $315 versus $330 previously.

HUB24 LIMITED (HUB) was downgraded to Neutral from Buy by Citi, B/H/S: 5/1/0

Citi continues to hold a positive view for small cap operators of wealth platforms in Australia. Further market share gains should be on the agenda. But while forecasts have been upgraded, the broker has also downgraded Hub24 to Neutral from Buy, on share price strength and a deteriorating risk-reward offering. Price target has lifted to $29.45 on higher forecasts.

LOVISA HOLDINGS LIMITED (LOV) was downgraded to Neutral from Buy by Citi, B/H/S: 4/1/0

Citi has downgraded Lovisa Holdings to Neutral from Buy despite the fact the analysts believe Lovisa is likely to surprise positively with the release of interim financials in February. Lovisa might prove more resilient than most of its consumer-oriented peers, suggests the broker, but the retailer remains exposed to consumers that face headwinds this year. The risk versus reward proposition would change with a share price in the low $20s, argues the broker. New price target is $25.20.

NEXTDC LIMITED (NXT) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 6/1/0

The broker seems to have switched its research relationship with JP Morgan to Morningstar. One of the immediate impacts is a light downgrade for NextDC; to Accumulate from Buy. Today’s update makes the point the downgrade has nothing to do with operational prospects which seem to still be thought of as positive. NextDC, the update surmises, continues to operate well in a sector that remains in a secular uptrend. The analyst also doesn’t think there will be any problems the data centres operator will be strapped for cash or face financial difficulties, while the business should not be heavily affected by any economic downturns. Price target $11. The stock has suffered partially because it doesn’t pay a dividend, is one of the suggestions made.

PERPETUAL LIMITED (PPT) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 3/2/0

The switch to Morningstar research has triggered a downgrade in rating for Perpetual with Ord Minnett now rating the fund manager as Accumulate; a downgrade from the previous Buy rating. There’s positive news for the price target which has lifted to $35 from $30.

SOUTH32 LIMITED (S32) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 5/2/0

The aluminium sector is turning ‘green’ and Credit Suisse believes this means structurally higher prices are necessary to facilitate this change. For South32, however, the future is all about how best to halve emissions. On Credit Suisse’s assessment, the company could well spend -US$1.2bn pre FY35 to structurally decarbonise its operations. Such projections have a negative impact on forecasts for free cash flow in the years to come. The broker has also incorporated the latest insights on short-term commodity prices. Credit Suisse has downgraded its rating for South32 to Neutral from Outperform. Price target has lifted to $4.50 from $4.10.

TYRO PAYMENTS LIMITED (TYR) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 3/2/0

Ord Minnett had only resumed coverage in December but now, having made the switch to Morningstar research, the recommendation has been pulled back to Accumulate from Buy. Target price has been pulled back to $2.60 from $2.80. The analyst has decided to lower the anticipated progress on market share gains for the company in core verticals health, hospitality and retail. While retaining scepsis about cost cutting and whether this might actually help larger competitors (banks) to narrow the gap with Tyro Payments, the underlying thesis of achieving profitability and free cash flows from 2025 onwards remains in place. The broker points out the above is not in line with management’s guidance this can be achieved in FY23 (positive free cash flow).

WESTGOLD RESOURCES LIMITED (WGX) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 0/1/0

Macquarie has downgraded Westgold Resources to Neutral from Outperform following strength in the share price. The broker does acknowledge the positive news from recent drilling and continues to see more positive catalysts on the horizon. Westgold’s upcoming quarterly report may prove one such catalyst, suggests the broker, as cost cutting and progress on strategy may please investors. Earnings forecasts have been lifted, with the price target lifting to $1.10 from 90c.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.