One thing I don’t like to do is arguing with Coolabah Capital’s Chris Joye, but I have to raise doubts about his conclusion in the AFR where he argues that we’re heading for a recession!

I can buy the belief that the US is a good chance for a recession but even that’s not a done deal with the market smarties/economists who make these kinds of predictions. And anyway, recessions in the US don’t necessarily spell doom and disaster for stock markets and people like us who are investing, largely long term, as I’ll show later in this piece.

Let’s deal with the US recession first and a colleague of mine (Whitey) who wonders how I can remain optimistic in so many cases (where, by the way I’ve largely been proved right, as many of you reading this would recall). Whitey sent me a report from fortune.com featuring Greg Jensen, who’s CIO at the world’s biggest hedge fund, Bridgewater Associates, founded by legendary investor Ray Dalio.

This is what he said: “We’d expect kind of double the normal length of a recession because the Fed’s not going to be at your back for a long time, and that’s a big deal,” Jensen told Bloomberg on Friday.

He did throw in that the good news was that “there is far less leverage in the financial system compared with the period before the Great Recession of 2008, which he believes will prevent a “cascading effect” in markets that causes a deep recession,” Daniel added. “Instead, you have this long grind that’s probably a couple years,” Jensen said.

Jensen expects inflation will come down next year as a recession hits, but he argued that there will be a mixed bag of good and bad inflation reports that could weigh on stocks.

But note this — not everyone on Wall Street agrees. “Economists at Bank of America cut their inflation forecast for next year to just 2.8% on Friday, citing a “sharp drop” in goods prices,” Daniel also reported. “And Goldman Sachs is expecting just 2.7% inflation by the end of 2023.”

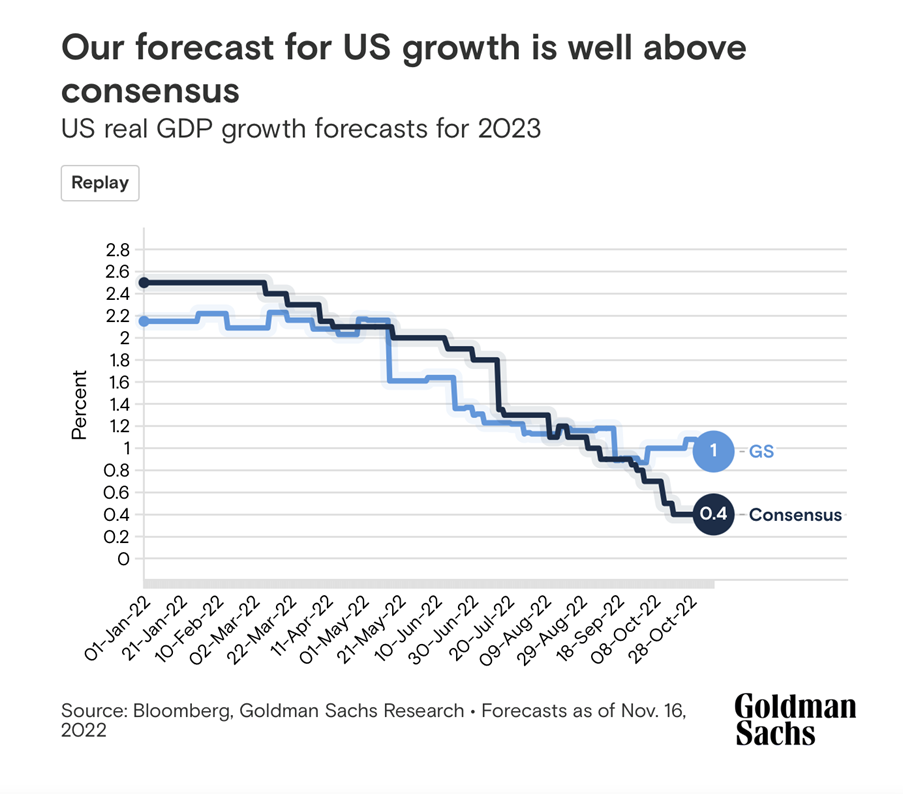

And what about this from Goldman Sachs on November 18: “Why the US is Expected to Escape Recession in 2023.”

These guys think a soft landing is possible, and so does the man who could make or break the US economy, Fed boss, Jerome Powell.

“Our economists say there’s a 35% probability that the U.S. tips into recession over the next year, an estimate that’s well below the median of 65% among forecasters in a Wall Street Journal survey,” the Goldman team argue. “The U.S. may avoid a downturn in part because data on economic activity is nowhere close to recessionary. GDP grew 2.6% (annualized) in the third quarter, according to an advance report. The country added 261,000 jobs last month.”

Personally, I can’t be certain the US will fall into a recession (no one can be) but given the strength of the US economy now and tightness of the job market, I think it could be a really mild recession. That’s what JPMorgan is guessing will happen in 2023 as this from Bloomberg shows: “JPMorgan Chase & Co. economists projected the US will enter a “mild” recession next year thanks to interest-rate hikes that could cost more than 1 million Americans their jobs, and the Federal Reserve will pivot to cutting borrowing costs in 2024.”

And if the idea is that the US will see falling interest rates by 2024, the stock market will be buying six months before and that’s why I think stocks rise in 2023, even if a recession happens. Also keeping me optimistic about stocks is the following:

- The 3rd year of a US presidency is the best for stocks, rising 82% of the time since 1928.

- Rebound years after a bear market are nearly always big and the US has been in a bear market in 2022.

- China is giving up on its zero-Covid policy and is expected to be growing faster in 2023. It’s why the outlook for iron ore remains strong.

- Inflation will fall and interest rates will stop rising and many quality tech/growth stocks will fall back into favour.

Now what about Chris Joye’s local recession? To be honest, Chris didn’t actually say that we’ll fall into recession but he took as gospel that the US will be a negative grower in 2023. His analysis is interesting and I never dispel his team’s economic research. But, as J.K.Galbraith once warned, in economics, the majority is usually wrong! I’d say, often wrong and journalists who always want to tell the scary stories are definitely often wrong!

I’m more with AMP’s Shane Oliver, when it comes to the outlook for shares:

- “2023 is likely to see easing inflation pressures, central banks moving to get off the brakes and economic growth weakening but proving stronger than feared. This along with improved valuations should make for better returns in 2023. But there are likely to be bumps on the way – particularly regarding recession risks – and this could involve a retest of 2022 lows or new lows in shares before the upswing resumes.”

- Australian shares are likely to outperform again, helped by stronger economic growth than in other developed countries and, ultimately, stronger growth in China supporting commodity prices, and as investors continue to like the grossed-up dividend yield of around 5.5%. Expect the ASX 200 to end 2023 at around 7600.

- Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks become less hawkish.

- Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of weaker share markets and higher bond yields (on valuations).

- Australian home prices are likely to fall further as rate hikes continue to impact, resulting in a top to bottom fall of 15-20%, but with prices expected to bottom around the September quarter, ahead of gains late in the year, as the RBA moves toward rate cuts.

- Cash and bank deposits are expected to provide returns of around 3%, reflecting the back up in interest rates through 2022.

- A rising trend in the $A is likely over the next 12 months, reflecting a downtrend in the now overvalued US dollar, the Fed moving to cut rates and solid commodity prices helped by stronger Chinese growth.

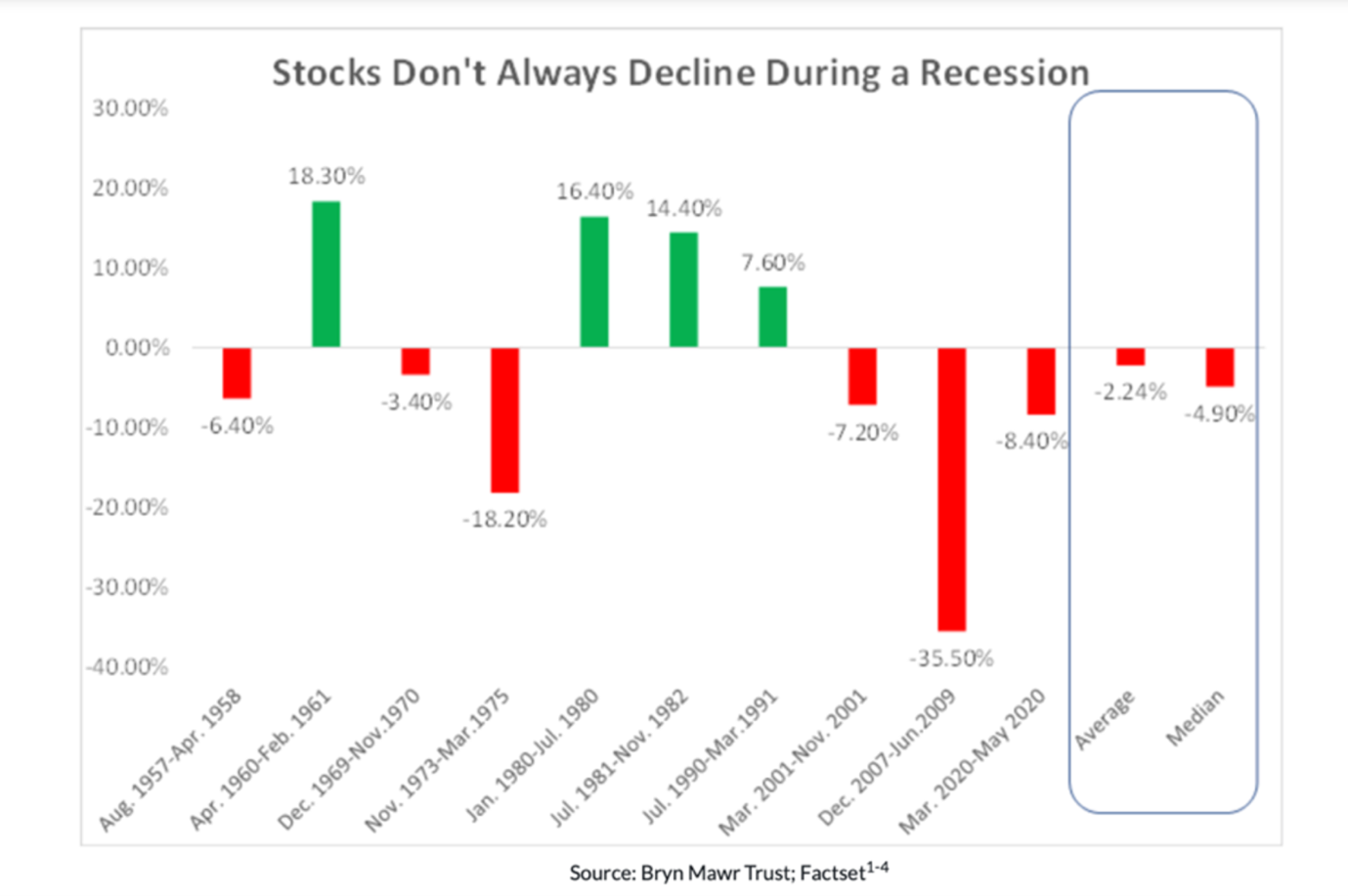

Yep, I like Shane’s crystal ball better than Chris Joye’s. And I like this about recessions and stock markets:

1. Stocks usually decline most beforea recession hits

The average decline for the S&P 500 during the past 10 recessions is only 2.2%, while the median decline is only4.9%.

2. Stocks are sometimes upduring recessions

The S&P 500 was positive in four of the past 10 recessions, including the early 1980s when the Fed was aggressively fighting inflation.

3. Stocks often begin to recover before a recession ends

The average return from the cycle’s peak (often before the recession starts) to the end of the recession is -15.3%, even if the average peak-to-trough decline is much larger (about 36% in the average bear market).

4. The average return one year after a 25% or more decline is far above average

Since 1960, there have been eight declines in the S&P 500 of 25% or more (the current decline would make it 9). One year later, the average return is nearly 23%. And this chart shows that stocks can rise during a recession. And this chart reinforces the message that a stock market can go higher, even if a recession hits.

I generally agree with many of Chris’s big calls but we once had a big barney on my old Sky News Business channel show called Switzer. He thought the RBA was right not cutting interest rates and I was bagging the Bank and its boss Glenn Stevens.

Some years later on video Chris conceded I was right and he doesn’t do that often! I expect a slowdown here, with China and resource prices likely to be a help not only to the economy but also to the Budget’s bottom line. I think the influx of migrants, students and tourists will help our economy and so will the end of rising interest rates.

And what if the Ukraine war ended in 2023? As long as you buy quality assets with a good track record of both capital gain over time and maybe good dividends as well, then investing in 2023 should be rewarding.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.