People on the street often ask me for a stock tip but I don’t see myself as a tipster. I’m more like someone who takes an educated approach to finding stocks that look like good value, especially when the short-term drivers of share prices take a set against a company or a sector. When that happens, I position myself for the eventual rotation back into that sector. At the same time I like to see what the analysts who are paid to monitor companies closely think about the company/business.

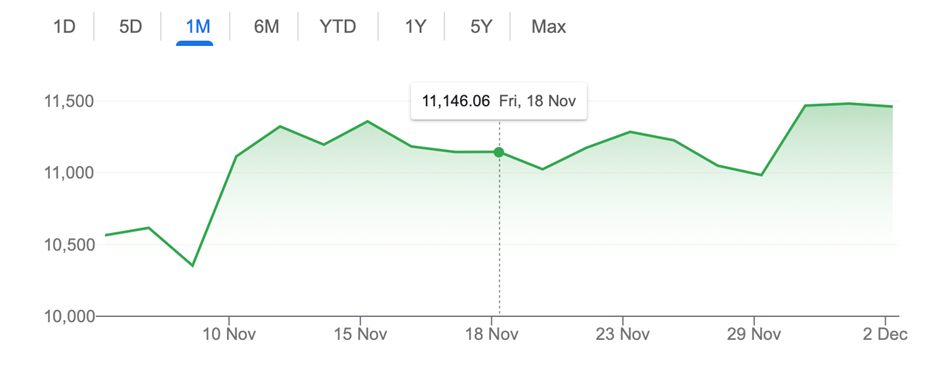

For most of this year I’ve argued that I was expecting to see some notable progress on bringing down inflation in the December quarter. We saw exactly that in both the US and Australia, which set up November as good month for stocks and ‘risk on’ assets generally. This chart for the S&P 500 over the last four weeks shows this clearly, with a 6.96% rise.

S&P 500

Over the same time, our market spiked 5.3%. For the past 12 months, we’re actually up 0.78% but for the year-to-date, we’re down 3.8%. Of course, dividends and franking pushes investors in the index up since the start of January.

If anyone doubted my call that tech would eventually get ‘forgiven’ by the market, have a look at this 8.49% gain for the tech-laden Nasdaq Composite.

Nasdaq Composite

However, there’s still a lot of market comeback to happen, given that this index is still down 27.6%, which means it’s still in a bear market for year-to-date. And that means there are a lot more gains in the pipeline for tech stocks, provided inflation keeps falling, China embraces more reopening of its economy and the Fed doesn’t create a US recession by being over-zealous with its rate rises.

Against these headwinds is the history of the third year of a US presidency being great for stocks. Back in 2019, the third year for Donald Trump, ai-cio.com told us: “In the third year, which is of course 2019, the S&P 500 has been up 81.8% of the time since 1928, according to research firm Bespoke Investment Group. The fourth year, namely when the election happens, is in the black 72.7% of the time. But the first and second years are ahead an identical 56.5%.”

That year (2019) saw stocks rise close to 34%!

Throw into the mix that interest rates are expected to peak in early 2023. Even if a recession evolves, the Fed would be likely to cut interest rates, which historically is good for stocks. And as 2023 is a rebound year, especially for Wall Street, which has been in a bear market for most of this year, the history about rebound years needs to be appreciated.

Newsobserver.com put rebound years into historical context: “Investors can look forward to strong returns once the bear market ends. According to the Wells Fargo Investment Institute study, the average 12-month return after the end of a bear market is 43.4%.”

I could go on, but as you can see, there’s a reasonable case that 2023 will be a good year for stocks, even if there’s a slow start for share market gains. The slow start could come from inflation reductions being slower than hoped but eventually they will happen, especially if China gets fully out of lockdowns and that damn Putin comes up with a B-plan!

As this rebound happens, there’ll be a rotation back into growth/tech stocks. We were given a really big sneak preview of this with those November stock market gains.

To get reinforcement, let’s look at local tech/growth stocks and see what the company experts who analyse these companies see ahead over the year:

Company November Gain Average expected rise Biggest tipped rise

Megaport 21% 46.8% 102% (UBS)

Xero 2.5% 11.5% 30% (Citi)

CSL 8.9% 8.3% 13.6% (Macquarie)

Seek 6.0% 29% 55% ( Morgan Stanley)

Many of our tech stocks have already taken off, with the likes of Audinate (AD8) up 16.7% over the past six months and Wisetech (WTC) rising 38.2% over that same time. We’ve started the rotation early because our inflation and interest rate rising threats were lower than the US. But over 2023, I’m betting the Yanks rediscover their interest in quality tech names before more blue sky players get loved in 2024 — the fourth year of a presidency, which is the second best for stocks.

Since November 7, our local Atlassian, which is seen as quality tech, gained 18.26% but is still down nearly 60% for the year. That number is bound to be a lot smaller by this time next year. And yes, I’m betting on it.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.