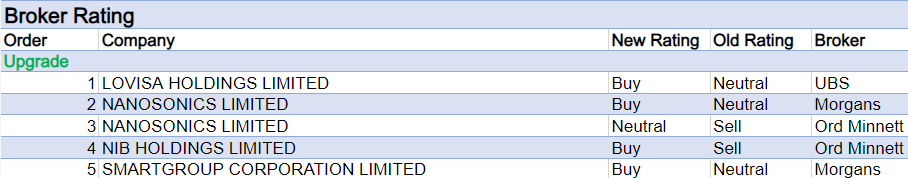

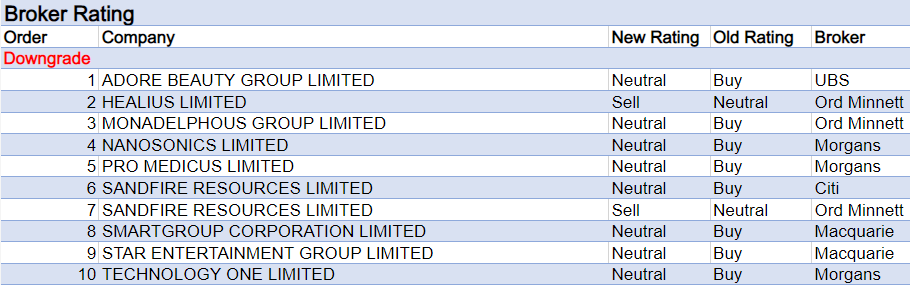

For the week ending Friday November 25 there were five upgrades and ten downgrades to ASX-listed companies covered by brokers in the FNArena database.

It was a busy week for Nanosonics, which received two ratings upgrades and one downgrade.

Morgans was originally ahead of the game by upgrading its forecasts for the company prior to a four-month trading update on November 18, which revealed a 42% increase in revenue, along with an increase in the installed base.

In reaction to the positive share price response to that AGM update, the broker began last week by downgrading its rating to Hold from Add. Then, as the share price swooned by around -20% in subsequent days (to sit around -23% below the broker’s $4.91 target price), the rating was upgraded to Add from Hold.

Ord Minnett also upgraded its rating to Hold from Lighten in the belief Nanosonics is on track to beat its FY23 sales growth guidance. The analyst’s target was also increased to $4.00 from $3.60 given an increased valuation, potential for a rise in FY23 guidance and prospects for the company’s second product, Coris, once it is launched.

On the other hand, Sandfire Resources received two ratings downgrades from separate brokers last week, after management announced an entitlement offer to raise $200m at $4.30 per share for “balance sheet flexibility”.

Citi pointed to potential for substantial downside in base metals prices over the next three-to-six months. While copper is now pricing a major near-term recovery in demand growth, this is considered unlikely to materialise before the June quarter next year.

This broker lowered its rating to Neutral from Buy and marginally lowered its target price, while Ord Minnett downgraded to Sell from Hold, following a 43% share price rally from October lows.

Ord Minnett liked the rationale for the equity raising, given Sandfire’s indebted financial structure and raised its target to $3.60 from $3.30.

In line with consensus expectations, Monadelphous guided to -10-15% lower first half sales compared to the previous corresponding period. However, brokers recognised the impact of timing issues on past contract wins and raised the average target price in the FNArena database to $14.31 from $12.91 in the expectation of contract wins going forward.

As a result, the group had the only material (and positive) target price change in the database last week, despite ranking second on the table below for the largest average percentage decline in earnings forecasts by brokers.

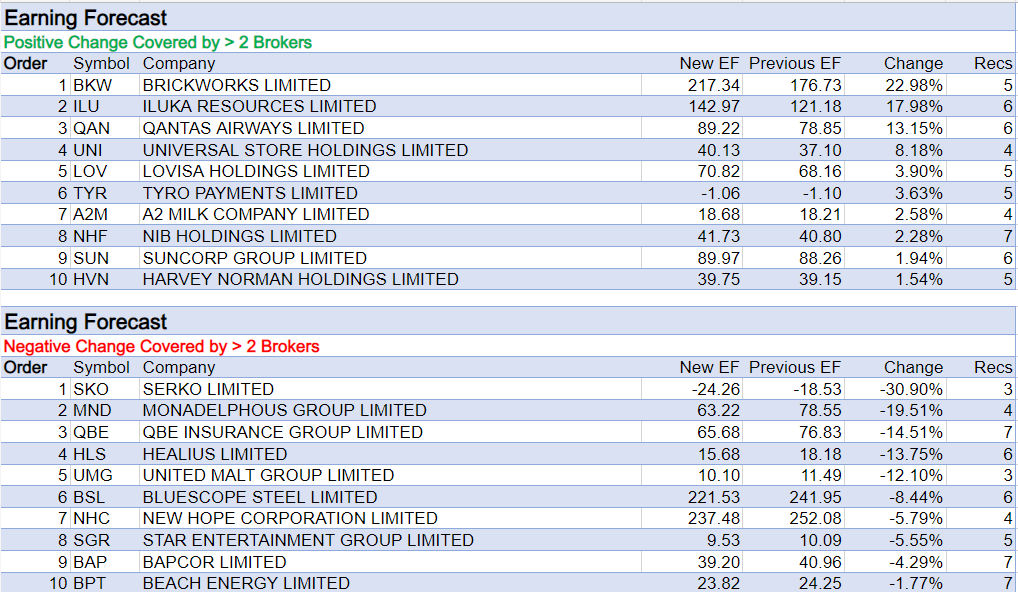

Coming first on that table (for earnings downgrades) was Serko. While the company’s first half results were ahead of consensus forecasts and FY23 guidance was reaffirmed, management was cautious on the economic outlook.

Macquarie downgraded its rating to Neutral from Outperform and felt a lack of momentum in key growth projects may take six-to-twelve months to rectify. The average target price in the FNArena database fell materially after Macquarie and Citi lowered their targets by -64% to NZ$2.67 and by -28% to $3.65, respectively.

QBE Insurance also received lower earnings forecasts last week following a third quarter trading update though all seven brokers in the FNArena database remained Buy-rated, or equivalent, and the average target rose to $16.03 from $15.65.

Management noted premium volumes and rates remain buoyant but warned catastrophe costs, inflation and running yields will weigh on FY22 results. While UBS acknowledged the catastrophe budget will need to be raised, a bumper FY23 is still anticipated.

On the flipside, Brickworks received the largest percentage increase in forecast earnings last week after two brokers refreshed research following first quarter results. However, Macquarie noted its FY23 forecasts were inflated by an accounting adjustment.

The Neutral-rated broker felt the outlook is becoming increasingly uncertain though acknowledged firm first quarter US and Australian trading for the Building Products division. UBS (Buy) also pointed to proactive price increases within this key division to offset inflationary pressures, even though labour and trade availability constraints have eased somewhat.

Iluka Resources also received higher forecasts earnings last week, particularly from UBS (Neutral), which raised its 2023 and 2024 forecasts by 18% and 62%, respectively. While September-quarter sales fell a touch shy of the broker’s forecasts, price expectations remain high, and a boost is expected via China’s reopening.

Citi, which is also Neutral-rated, suggested the greatest risk to near-term earnings for Iluka is a faster-than-anticipated fall in rutile and synthetic rutile prices.

The positive trend for Qantas Airways continued with increased earnings forecasts by brokers following upgraded profit guidance for the second time in two months. Five of the potential six brokers in the FNArena database issued updated research and the average target price rose to $7.58 from $7.19.

As a result of an ongoing windfall from increased travel demand, Ord Minnett suggested capital management is possible, as the balance sheet has deleveraged faster than expected.

Morgan Stanley noted an acceleration in revenue inflow and a delay in capex will result in around -$900m lower net debt for Qantas than prior management guidance.

Total Buy recommendations comprise 55.69% of the total, versus 36.77% on Neutral/Hold, while Sell ratings account for the remaining 7.54%.

In the good books

NANOSONICS (NAN) was upgraded to Hold from Lighten by Ord Minnett, B/H/S: 1/1/1

Ord Minnett believes Nanosonics is on-track to beat its FY23 sales growth guidance, having last week reported a 42% lift in sales for the first four months of FY23. As a result of this view, the broker’s rating is upgraded to Hold from Lighten. The target also rises to $4.00 from $3.60 given the analyst’s increased valuation, potential for a rise in FY23 guidance and prospects for the second product, Coris, once it is launched.

SMARTGROUP CORPORATION LIMITED (SIQ) was upgraded to Add from Hold by Morgans, B/H/S: 2/3/0

Morgans downgrades FY22 and FY23 profit (NPATA) estimates by -8.3% and -11.9%, respectively, and reduces its target for Smartgroup Corp to $5.65 from $7.40. The broker’s lower forecasts were in reaction to new FY22 profit guidance that missed the consensus estimate by -8%. Guidance implied 2H profit would fall by -10-13% half-on-half due to lower settlement volume from ongoing vehicle supply constraints. Morgans decides to upgrade its rating to Add from Hold given the company’s strong balance sheet, solid forward revenue pipeline, contract opportunities and potential for high electric vehicle lease demand.

See downgrade below

In the not-so-good books

SMARTGROUP CORPORATION LIMITED (SIQ) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 2/3/0

Smartgroup Corp has downgraded guidance (-6% to -8% short of consensus and Macquarie’s forecasts) as supply-chain constraints on new-vehicle deliveries continue to hamper growth, despite signs of growing demand for novated leases. On the upside, the company has renewed its salary packaging and novated lease contract with NSW Health, in a deal that runs until 2028. EPS forecasts fall -8% in FY22; -16.5% in FY23; and -16.6% in FY24. Rating downgraded to Neutral from Outperform. Target price falls to $4.75 from $7.10.

See upgrade above

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.