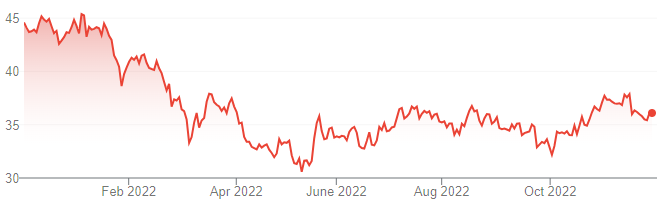

“Aristocrat Leisure (ALL) is an underperformer, despite its recent market rally. Let’s take this opportunity to review the investment case for ALL,” Raymond said.

“First up, here are the negatives.

“Last week, ALL recorded impressive earnings growth of 24.7%, however it was still 1.5% below market expectations.

“Growth in ALL’s digital gaming division (Pixel United) has stalled from its COVID lockdown highs.

“Remember, this business was growing at 22% between financial years 2018 and 2021.

“In the financial year 2022, ALL only made flat sales growth.

“The market was hoping ALL would make fresh acquisitions – especially in the digital space. But no acquisitions have been announced.

“Financing costs are a bit higher than what we expected.

“Despite the negatives, we like ALL for the following four reasons:

- It has an attractive valuation. ALL’s PE has significantly de-rated from over 30x to now just 20x. We forecast ALL will maintain double digit earnings growth for the next two years.

- Global re-opening will benefit the casinos that will replace the gaming machine. ALL will benefit from this trend.

- ALL is better capitalised than many of its competitors. As such, it’s just a matter of time for ALL to identify the right acquisitions for shareholders.

- Given its significant US business, the high US dollar is a tailwind for ALL’s business,” Raymond concluded.

Aristocrat Leisure (ALL)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.