Right now investing is really challenging, with inflation and recession fears on top of question marks over what Vladmir Putin and Xi Jinping might do in 2023. Only last week we saw what the re-installed Chinese leader could do to stocks. As CommSec reported: “Shares of some Chinese companies listed in the US dropped after Beijing tightened President Xi Jinping’s grip on power. Shares of Alibaba shed 12.5%, JD.com shares slid 13% and Baidu shares dropped 12.6%.”

Meanwhile, energy stocks such as Whitehaven lost 12.2% last week but it is up 259% in the past year. Those who’ve made spectacular money have to be asking if it’s time to take profit. It sure looks like it is!

Amidst concerns over inflation and recession, the Dow racked up gains four weeks in a row and could knock out the best month since January 1976, provided nothing crazy happens next week.

If it does, it could come from the Fed’s commentary that will accompany the expected 0.75% interest rate rise over November 1-2. And then the US CPI number comes out on November 10, which could be a maker or breaker for this current rebound in stocks.

So how do you play the next two weeks? Do you buy now and gamble that the news will be good? Or do you wait and be prepared to miss out on another leg up for stocks on the basis that you’re not a speculator/trader but a long-term investor, where the trend is your friend until it bends.

This chart of the S&P/ASX 200 shows what the trend has been and what happens when a downtrend starts to turn up.

S&P/ASX 200

The history of rebounds after significant sell-offs can’t be ignored but the question you have to ask yourself is: Have we seen the bottom of this big slide in stocks, which was at its worst for the local index after a 16% slump?

On the other hand, the US market sell-off was a more significant bear market shock and these have a tendency to give birth to big rebounds.

S&P 500

That rebound after the Coronavirus crash was a case in point and partly explains why the S&P 500 had fallen around 24% at its worst. Meanwhile the Nasdaq crashed by 35% and its rebound should be a doozy when it happens, though it could be a slower train coming compared to the S&P 500.

Last Friday, the S&P 500 Index had a nice 2.46% bounce, which made it up 3.7% for the week. As I said earlier, it was up 8.8% for the month, but was mainly driven by value companies and mainly the quality tech companies that make profits.

Experts think the re-loving of tech stocks will take some time but I’d argue that once rotation happens, there’ll be a big payoff. That said, the wait could be longer than many of us would want — but that’s life in the fast lane.

So what are the plays now and going into the future?

The easy and lower return play is do nothing and wait for a good inflation result in the US and then buy the local ASX 200 index via an ETF. I suspect an easy 10% plus dividends and franking will be the payoff. I said this last week and I’m sticking to this view.

And as I’ve also said before, the gutsy play is to jump on board now with a local ASX 200 ETF and then use something like IHVV to access the S&P 500 rebound, but with hedging because the Oz dollar tends to rise when the US market surges. At the same time, if inflation is coming down, US interest rate rises will be curtailed and this will take the greenback down.

The blockbuster high risk-high return play is to punt on the Nasdaq with hedging. BetaShares has HNDQ, which goes close to fitting the bill. This is the company’s explanation of HNDQ: “HNDQ aims to track the performance of the NASDAQ-100 Currency Hedged AUD Index (before fees and expenses). The Index comprises 100 of the largest non-financial companies listed on the NASDAQ market, and includes many companies that are at the forefront of the new economy. HNDQ currently obtains its investment exposure by investing in the BetaShares NASDAQ 100 ETF (ASX: NDQ), with the foreign currency exposure hedged back to the Australian dollar.”

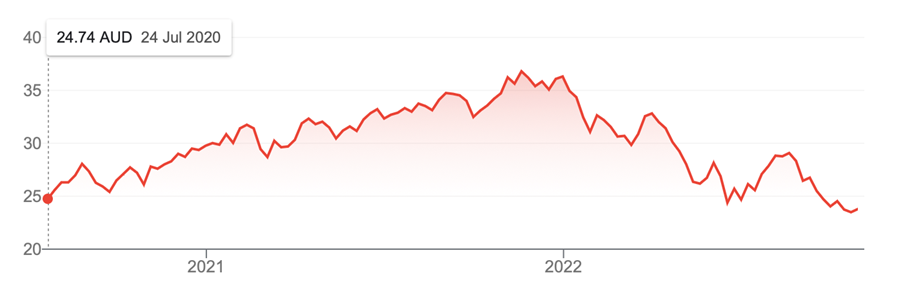

HNDQ

Between late July 2020 and November 2021, just before the tech sell-off, this hedged ETF was up 48%. Over that time, the Oz dollar rose form 69 US cents to 78 US cents, which shows the value of paying for hedging when playing US stocks when the Oz dollar is low.

Also note over the past few weeks we’ve seen our dollar dip under US62 cents, but with the recent rebound, the currency has gone as high as US 65 cents.

I can’t guarantee I’ll be right on the dollar and Nasdaq rebound but history says I’m a pretty good chance of being on the money, eventually.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.