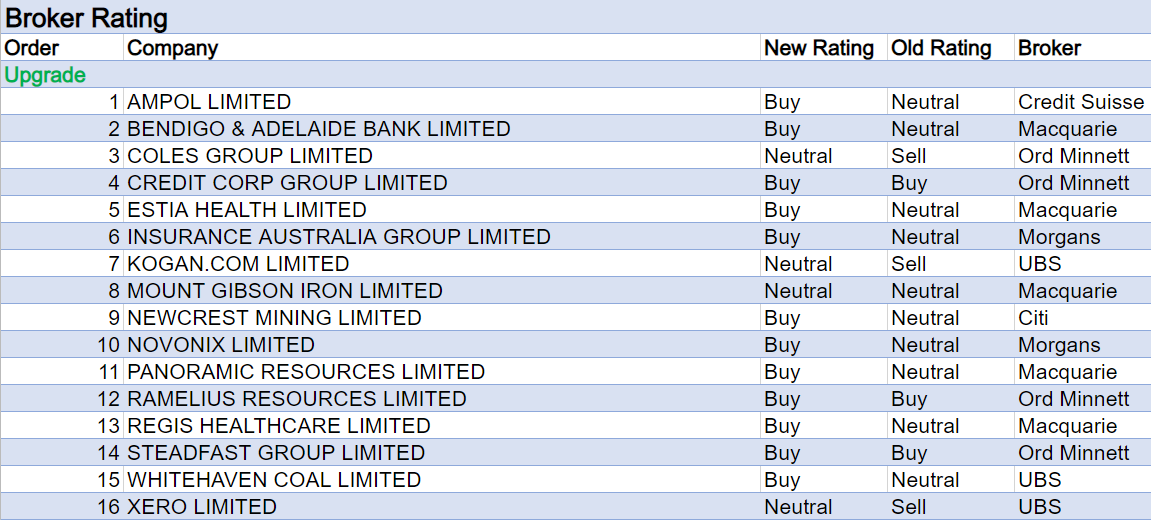

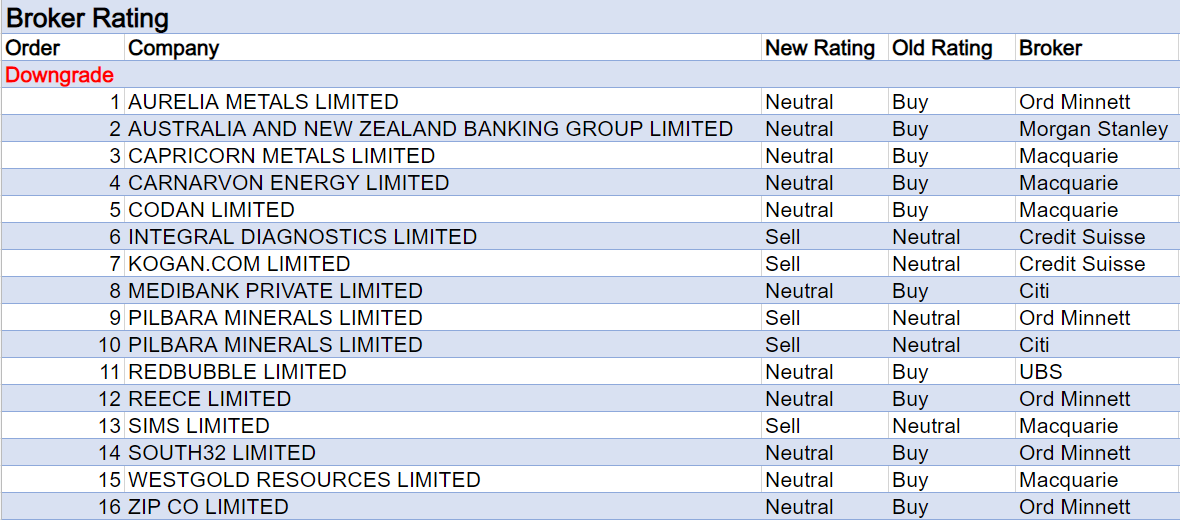

For the week ending Friday October 28 there were sixteen upgrades and sixteen downgrades to ASX-listed companies covered by brokers in the FNArena database. While ratings changes were evenly split, there were more material earnings downgrades to broker forecasts than upgrades, and half (five) of the earnings downgrades in the table below relate to the Resources sector.

Three of those five downgrades were gold-related after Ramelius Resources, Newcrest Mining and OZ Minerals issued September quarter results.

While results for Ramelius came in slightly lower than Ord Minnett’s expectations, the broker believes six-month upside more than outweighs perceived deliverability risk and upgraded its rating to Buy from Accumulate.

Citi also managed to look through a “mixed” quarterly for Newcrest and upgraded its rating to Buy from Neutral following a severe share price fall over the course of the general Gold sector de-rating. The US dollar is expected to peak over the next six months and gold is forecast to bounce back to US$1900oz in the second half of next year.

Over at OZ Minerals, gold production exceeded Neutral-rated Credit Suisse’s forecast, but management downgraded gold guidance for Prominent Hill by -9% due to lower stockpile processing and higher group costs.

Morgan Stanley (Equal-weight) also observed copper production at Prominent Hill is below year to date run rates, and an improvement will be needed in the December quarter if full-year guidance is to be met.

South32 and Iluka Resources were the other two Resource sector stocks appearing in the earnings downgrade table.

While South32’s first quarter numbers for coal, alumina and nickel underwhelmed, Morgans still maintained the business remains in “robust” shape and kept its Add rating, while its target fell to $5.30 from $5.40.

Overweight-rated Morgan Stanley observed sales now need to play catch-up to meet FY23 forecasts though considered this feat achievable.

After a hiatus on coverage of Iluka for 18 months, UBS set a Neutral rating and $10.25 target and its new earnings forecasts lowered the average in the FNArena database.

While rare earths are important for Iluka and command most attention, noted the analyst, 60% of its valuation for the company is linked to the mineral sands business.

Other brokers noted an agreement with ASX-listed rare earths junior Northern Minerals for the supply of rare earths concentrate. Iluka will invest an initial $20m to support the development of Northern Minerals’ Brown Range project through to a definitive feasibility study.

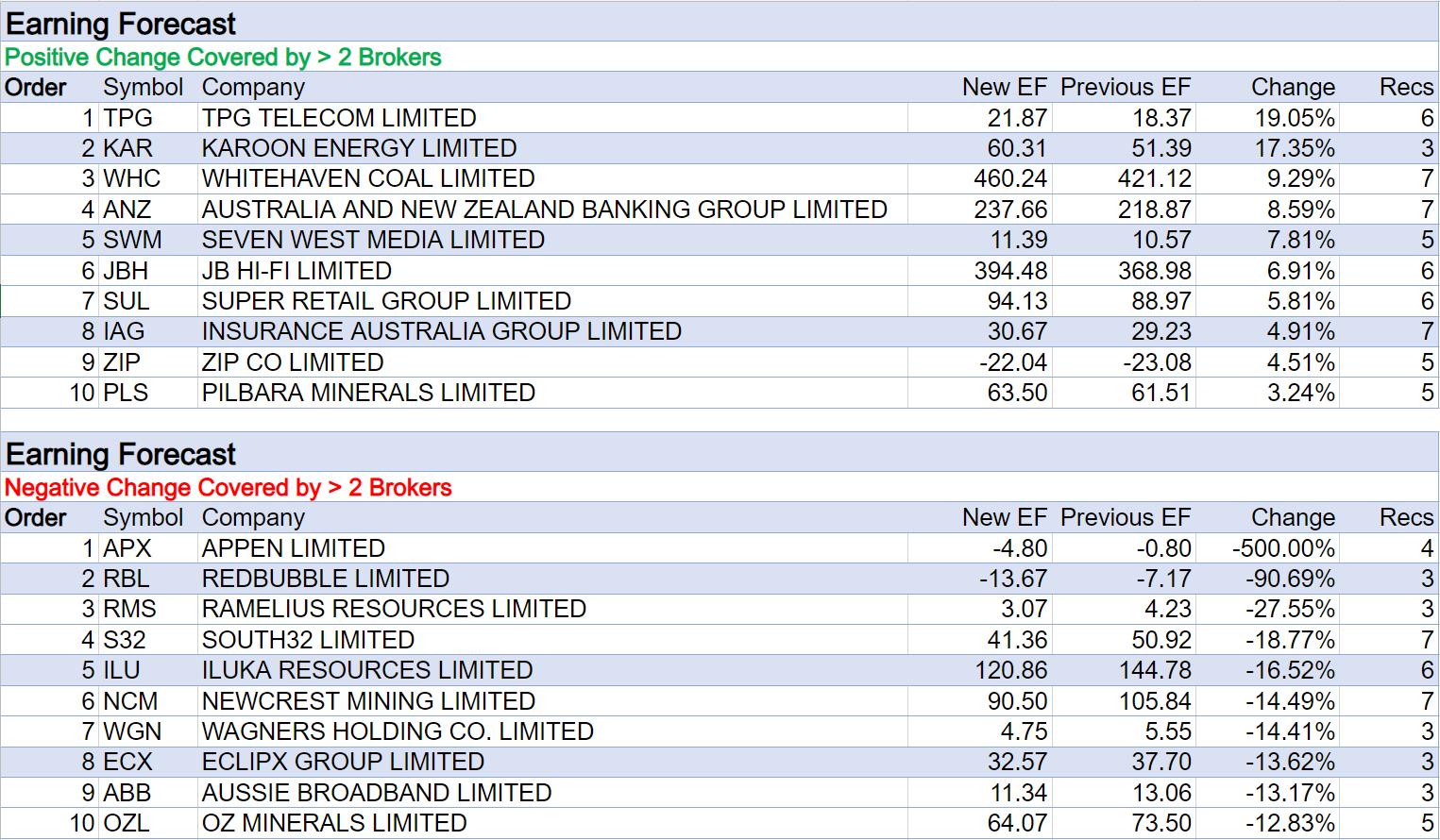

Of all the downgrades to earnings forecasts last week in the database, Appen received the largest in percentage terms after Morgan Stanley became the fourth covering broker and initiated coverage with an Underweight rating and $2.25 target price.

The broker felt competition has intensified from a number of global players (including Amazon and Sagemaker), which are creating more sophisticated platforms. The analyst noted the company’s software is not built on proprietary technology that would give it a distinctive competitive advantage.

The second largest downgrade to broker earnings forecasts went to Redbubble, which also registered the largest percentage fall in average price target in the FNArena database, following a first quarter update.

UBS downgraded its rating to Neutral from Buy and lowered its target to $0.60 from $1.55. Positive June quarter trends (like margins and improved channel mix) reversed in the September quarter, while the analyst noted free shipping and marketing spend more than offset recent price rises.

Add-rated Morgans was more forgiving around near-term margin headwinds and customer acquisition cost pressures, and noted the company is in an investment-phase with additional brand spend/headcount. The broker’s target price was reset to $1.00 from $1.65.

Next on the table was Aussie Broadband after Ord Minnett lowered its target to $3.61 from $4.03, despite an AGM trading update that revealed ongoing market share growth in the September quarter and reiteration of earnings guidance.

The broker’s EPS forecasts fell by around -3% to reflect a higher cost of capital, courtesy of rising interest rates.

Later in the week, Morgan Stanley (Underweight) issued its inaugural research on Aussie Broadband and became the fourth broker in the FNArena database covering the stock. In setting a $2.10 target price, the analyst lowered the average database target to $3.14 from $3.66.

This broker noted downside risks to consensus forecasts as upside has already been factored into the outlook. Intensifying competitive pressure in consumer broadband were also noted, which will potentially suppress average revenue per user and kick operating costs higher.

The average target price in the FNArena database for Medibank fell to $3.24 from $3.76 last week on impacts from the recent cyber security breach.

As part of a first quarter update, the company withdrew FY23 policyholder growth guidance in reaction to the event and initially assessed costs in the range of -$25-35m, though Morgans felt significant uncertainty remains for both costs and outcomes.

Ord Minnett felt the greatest immediate risk to earnings would derive from a loss of policyholders due to reputational risk, while regulatory imposts may be added at a later date.

While UBS retains its Sell rating and $0.45 target price for Zip Co following a first quarter trading update last week, Ord Minnett lowered its target to $0.70 from $1.10 and downgraded its rating to Hold from Accumulate, despite a positive trend for bad debts.

Ord Minnett had hoped management would have sold off the international operations by now though management stated the strategic review of the Rest of the World segment is “well advanced”.

It was a busy time for Pilbara Minerals with two ratings downgrades by separate brokers and also heading up the table below for the largest percentage increase in target price. These moves followed September quarter results.

While lithium production outpaced peers, operational expenditure came in at the lower end of guidance, and Citi raised its target to $4.60 from $4.30, the broker’s rating was downgraded to Sell from Neutral following recent share price strength.

The broker expects a rise in spodumene prices of 40% and 60% across FY23 and FY24.

Ord Minnett marginally increased its target to $4.20 from $4.10, but also struggled to justify the current valuation given a lack of firm growth or margin expansion plans and lowered its rating to Lighten from Hold. It’s thought a strong net cash position may lead to a positive capital management update later this quarter.

Returning to broker earnings forecasts, TPG Telecom’s position atop the table below for positive change should be ignored due to a data glitch.

Total Buy recommendations comprise 55.97% of the total, versus 36.53% on Neutral/Hold, while Sell ratings account for the remaining 7.51%.

In the good books

ESTIA HEALTH LIMITED (EHE) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 1/1/0

Improved occupancy as covid cases decline should benefit Estia Health according to Macquarie, driving near-term upgrades to the broker’s earnings assumptions. The recently announced $62m acquisition of four residential aged care homes looks to be accretive. Coupled with expectations of improved occupancy, Macquarie’s earnings forecasts lift 5%, 3% and 7% through to FY25. The rating is upgraded to Outperform from Neutral and the target price increases to $2.50 from $2.15.

KOGAN.COM LIMITED (KGN) was upgraded to Neutral from Sell by UBS, B/H/S: 0/1/1

It is UBS’s view that Kogan’s Q1 update still does not reflect a turning point in top line sales. The remainder of FY23 is seen as roughly EBITDA break-even while excess stock should be cleared by December. UBS thinks margins remain at risk depending on what the competition does. Ultimately, however, the broker does see margins recovering, providing a more positive outlook from FY24 onwards. As the share price is not far off from the $3.60 price target (up from $3.15), UBS has upgraded to Neutral from Sell.

See also KGN downgrade.

MOUNT GIBSON IRON LIMITED (MGX) was upgraded to Neutral from Underperform by Macquarie, B/H/S: 1/1/0

Despite a 1Q result weaker than Macquarie expected, with shipments impacted by fire damage, management at Mount Gibson Iron maintained FY23 guidance. The broker upgrades its rating to Neutral from Underperform on valuation, given recent share price weakness. While operations and cash generation are expected to be stronger in the 2H of FY23, commodity price headwinds are forecast. The $0.40 target price is unchanged.

NEWCREST MINING LIMITED (NCM) was upgraded to Buy from Neutral by Citi, B/H/S: 4/3/0

Citi sees an opportunity for investors as the Newcrest Mining share price has been hit hard throughout the general gold sector de-rating. The broker expects the USD to peak over the next six months while the in-house view is for gold to bounce back to US$1900/oz in the second half of next year. Arguably, says the broker, Newcrest Mining has the highest quality assets in Australia while its share price is at a 5-year low. Against all of the above, the company released a rather “mixed” quarterly, with operations at Lumberjack suspended and grades disappointing at Lihir, but with material movement at the latter setting a new record. The rating has been upgraded to Buy from Neutral. Target price remains $21.

PANORAMIC RESOURCES LIMITED (PAN) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 2/0/0

Given results were pre-released, Panoramic Resources’ first quarter production was in line Macquarie’s expectations. All-in sustaining costs were 4% higher than the broker had assumed, while C1 costs were -4% lower. The first of three shipments slated for the second quarter has already departed, with the others scheduled for mid-November and mid-December. The rating is upgraded to Outperform from Neutral and the target price increases to $0.20 from $0.17.

REGIS HEALTHCARE LIMITED (REG) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 1/1/0

Macquarie raises its rating for Regis Healthcare to Outperform from Neutral on valuation grounds after AGM commentary highlighted an improving occupancy trend. The analyst considers the medium-and longer-term outlook is favourable due to attractive industry fundamentals and increases longer-term growth assumptions. The target slips to $2.15 from $2.20.

RAMELIUS RESOURCES LIMITED (RMS) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 3/0/0

Ramelius Resources posted a “decent” quarterly result, slightly lower than Ord Minnett’s expectations. Importantly, the broker believes Ramelius is at an inflection point at which six-month upside more than outweighs perceived deliverability risk. With covid cases easing significantly and haulage improving, the broker has gained further comfort in the company’s ability to deliver to plan over FY23. On a valuation basis Ord Minnett upgrades to Buy from Accumulate. Target rises to $1.25 from $1.15.

WHITEHAVEN COAL LIMITED (WHC) was upgraded to Buy from Neutral by UBS, B/H/S: 6/0/1

UBS upgrades its rating for Whitehaven Coal to Buy from Neutral following AGM approval for a buyback of around 25% of issued capital. Should the buyback be fully implemented, the analyst estimates the total return yield (dividend and buyback) will rise to 45% and 27% for FY23 and FY24, from 22% and 12%. The $10.00 price target is unchanged.

XERO LIMITED (XRO) was upgraded to Neutral from Sell by UBS, B/H/S: 4/2/0

Off the back of a -22% share price decline since mid-August, UBS has lifted its rating on Xero. The broker attributes the de-rating to Xero flagging lower UK subscriptions driven by a delay of the second phase of Making Tax Digital, but UBS finds this to be a timing issue rather than a structural one. The broker lifts its revenue forecasts an average of 3% between FY23 and FY25, reflecting expected better UK subscriptions following Making Tax Digital compliance. The rating increases to Neutral from Sell and the target price increases to $80.40 from $70.00.

In the not-so-good books

AURELIA METALS LIMITED (AMI) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 1/1/0

Aurelia Metals’ Sep Q was a bad as forewarned and Ord Minnett sees a long road back to redemption. Whilst there is a glimmer of hope at Peak, the fact is that the key value lies in Federation, the broker notes, which is now stalled due to a lack of funding. The key question for the broker is have the operational cash losses stopped? If not, Ord Minnett does not believe a focus on Federation is possible. After increasing the risk factor on the project, the broker cuts its target to 30c from 50c and downgrades to Hold from Buy.

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED (ANZ) was downgraded to Equal-weight from Overweight by Morgan Stanley, B/H/S: 4/3/0

Morgan Stanley expects modest upgrades to consensus forecasts for ANZ Bank following FY22 results, which revealed a good exit margin and a supportive 1H FY23 margin outlook. Higher cost growth guidance provided a partial offset. However, the analyst downgrades the rating to Equal-weight from Overweight on less scope for further EPS upgrades and given a 15% share price rally since mid-July. Margins are expected to rise materially in FY23, but a reinvestment burden is expected to weigh. Cash profit was a beat of around 3% and 6%, respectively, by comparison with forecasts by the broker and consensus. The impairment charge of -$52m was significantly lower than the -$205m forecast by the analyst. The target price falls to $25.50 from $26.90. Industry view: In-line.

CODAN LIMITED (CDA) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 0/1/0

A guidance update from Codan has disappointed Macquarie’s expectations, with the company targeting first half net profits of $25-30m. Guidance was well below what the broker had expected, largely driven by the Metal Detection segment which is yet to stabilise. The company is anticipating first half sales from Metal Detection of $75-80m, compared to $138m in the previous comparable period. The Communications segment expects a more positive $123-135m for the period, compared to $118m in the previous comparable period. The rating is downgraded to Neutral from Outperform and the target price decreases to $4.10 from $9.75.

KOGAN.COM LIMITED (KGN) was downgraded to Underperform from Neutral by Credit Suisse, B/H/S: 0/1/1

Kogan’s gross sales declined -39% year on year and the business made an earnings loss of -$0.3m for the September quarter. With sales declining and no profit, it is increasingly problematic to value the business, Credit Suisse suggests. The broker downgrades earnings forecasts to reflect the materially lower sales, but assumes gross margin improvement post inventory clearance. Given poor business trends and valuation uncertainty, the broker downgrades to Underperform from Neutral. Target falls to $2.73 from $3.66.

See also KGN upgrade above..

MEDIBANK PRIVATE LIMITED (MPL) was downgraded to Neutral from Buy by Citi, B/H/S: 3/4/0

The full impact of Medibank Private’s data breach remains uncertain, and the company has withdrawn its full year policy holder guidance amid uncertainty. Citi expects the reaction of consumers will be key to Medibank Private’s outlook, but notes this is hard to predict. Marking to market, Citi has pulled back its policyholder growth assumptions -6%, -10% and -12% through to FY25. The broker anticipates some policyholder contraction in the coming two years, before recovery in FY25. The rating is downgraded to Neutral from Buy and the target price decreases to $3.00 from $4.00.REECE LIMITED (REH) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 0/3/2

Reece reported a strong Sep Q sales update, Ord Minnett notes, driven by significant price increases across its key regions and solid volumes. The US business performed exceptionally well and is a late-cycle beneficiary of housing completions. While the US operations continue to be a significant platform for growth, given the current macroeconomic environment and rise in US mortgage rates the broker expects demand to moderate. Target falls to $16.00 from $18.50, downgrade to Hold from Buy due to an elevated PE multiple.

WESTGOLD RESOURCES LIMITED (WGX) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 0/1/0

Westgold Resources Q1 production report was 9% better than forecast, while keeping costs in line, comments Macquarie, though cash generation was the disappointment as higher capex/lease payments and working capital took their toll. As market focus will now shift to cash generation, the broker believes, the rating has been pulled back to Neutral. Target price $0.90.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances