Last week when the US stock market reacted crazily to a disappointing inflation number, again we were given a sneak preview of what happens when inflation is actually on the way down. The positive overreaction got me thinking about my best idea for 2023, which I might want to buy before the year is up.

Keep in mind what I’ve often tried to explain to you and it’s a direct steal from Warren Buffett: “Be greedy when others are fearful.” As long as you’re investing in quality, you could get in too early and pay a tick more than the eventual low but, over time, you will reap the rewards.

Also remember that picking the bottom of a sell-off or top of a boom is near impossible, so you’re better off being influenced by what the long-term play should be, rather than stressing yourself to get a short-term buy or sell right.

When September inflation in the US came in at 8.2% (down from 8.3%) and the core inflation number popped by 0.6% in the month, I expected a sell-off. But instead, markets surged.

Japan’s Nikkei 225 was on track for a 3.3% advance for most of the day, which would mark its biggest one-day gain in seven months, while Hong Kong’s Hang Seng surged as much as 3.6%5. All three US indexes inexplicably got excited by the inflation read, with the Dow Jones index rising 828 points (or 2.8%), recovering from a 549 point drop earlier in the session. The S&P 500 index lifted 2.6% and the Nasdaq index gained 232 points (or 2.2%).

Some experts tried to rationalise the craziness of the stocks surge by saying US rents were up in these September numbers, but are falling now. Others tried to see this month’s reading as the peak, pointing to more ‘now’ indicators that say US inflation is falling.

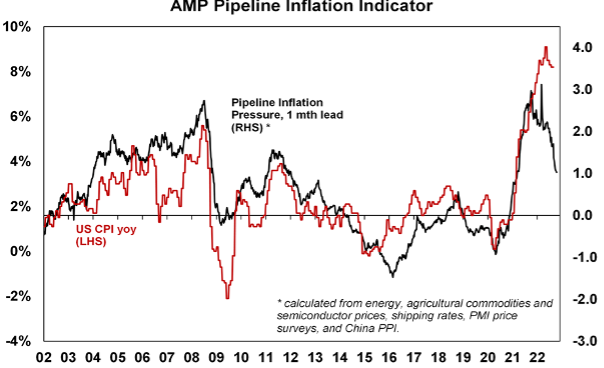

AMP’s Shane Oliver’s Inflation Pipeline Indicators have been falling for months, so some experts think the US statisticians calculations will eventually show an inflation slide, which will invoke a big markets’ rebound.

That’s a longer run view but investors now have to cope with headlines such as this from the AFR today: “Investors brace for more market mayhem.”

That’s a little too negative, but I do concede that the latest US CPI increases the chances of two more 0.75% rate rises from the Fed before Christmas, unless the official data starts to reflect what the Pipeline numbers are saying.

You can see that the black Pipeline number is falling faster than the official red CPI line, but, one day, that will change. When the red line starts to drop, stock prices will spike.

And it’s not just Shane tipping inflation has peaked, with Ken Fisher of Fisher Investments writing in The Australian, giving us added fuel to throw on the ‘inflation will fall’ fire. This is what he has seen:

1. The Baltic Dry Index, a gauge of maritime freight rates, is down 36.3% from this May’s supply-chain-suffocated high.

2. Oil in US dollars is down 29.5% from its June high.

3. In America, wheat is down 36.8% from March highs.

4. The UN’s World Food Price Index has fallen for six straight months, currently 14.7% below its March high.

5. US home price gains peaked in March, slowing sharply since as homes are taking longer to sell. Home prices routinely lead rents.

6. The S&P Global price survey for manufacturing has shown input prices at a 19-month low.

7. Shanghai Freight rates are down 62.4% since January.

I loved this from Fisher: “Today’s inflation is like a snake that just ate a big rodent. There is a big bulge in the middle – until the snake digests it one vertebra at a time”

And this too: “The world ate a lot of inflation two years ago. Digesting the bulge – which is underway – will be a major relief for both stocks and bonds globally, fuelling a rally.”

Last week, CNBC’s Jim Cramer was on a unity ticket with yours truly when he advised investors that good things would come to those who wait for the Federal Reserve to stop raising interest rates. “I always say there’s no give without a get. Right now, the give is that you get your portfolio all going down — the Fed’s bringing the pain,” he said. “The get is that you’ll eventually be rewarded with lower inflation followed by lower rates. We’re very much in the first phase though, the give phase.”

There are two ways to play this end of the Fed’s rate-rising strategy. First, you wait until it happens and miss the first surge, but then get on a rising trend. But you still could cop a profit-taking episode from smarties. Or else you bite the bullet and buy at current low levels, accept that you might be in too early but the eventual pay-off will make it worth it.

Now for my favoured play for now.

Given our dollar falls when stocks fall on worrying inflation, rising interest rates and the threat of a global recession, when all that reverses, the Oz dollar will get back into the 70+ US cents level and even the 80 US cents level.

That would turbo charge what I reckon will be a big rebound for the S&P 500, which is laden with great tech stocks that have been smashed and will certainly be re-loved again.

That’s why I like iShares hedged product IHVV exchange traded fund.

IHVV

This is down 27% year-to-date. Out of the Coronavirus crash, IHVV rose 67%, while the US market was up around 80%. But at the same time, the OZ dollar rose by 34% from 58 US cents to 78 US cents, which would’ve reduced your returns from the US market rebound if you weren’t hedged.

IHVV was up 67% over that time, and also paid a super-sized distribution.

I’m investing for both a US stock market plus an Oz dollar rebound simultaneously. I’ll test out my play with some currency experts, but, right now, it looks like a ripper of a strategy.

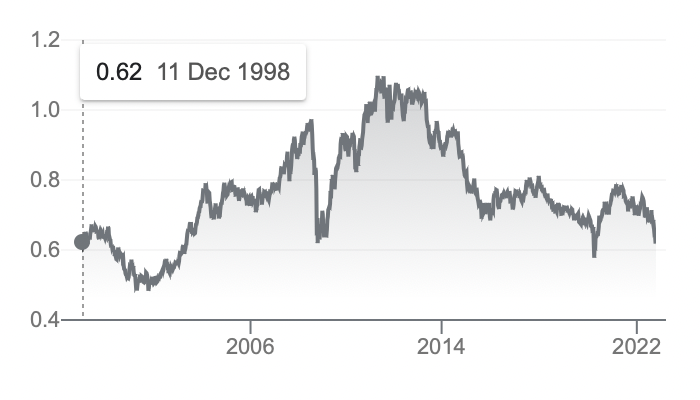

AUD

This chart shows the AUD has rebound potential from lows. We also have a history of hovering around the low 70 US cents level. And from the 62 US cents level of today, history looks to be on our side.

We just have to be patient.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.