A volatile share market isn’t slowing Exchange Traded Fund (ETF) issuers. They keep launching ETFs that provide exposure to investment themes or offshore assets – and interest in index investing continues to grow.

The ETF market on the ASX was worth about $127 billion at end the end of August 2022, ASX data shows. That’s up slightly on a year earlier, which is a fair effort in a falling market.

ETF volumes rose 14% over the year to 258 funds. By my count, nine new ETFs have joined the ASX this financial year, amid turbulent market conditions.

I follow ETF launches to see where issuers have identified investment opportunities and to get a sense of how index investing is evolving in Australia and overseas.

ETF launches this calendar year have been a mix of thematic ETFs, fixed-interest ETFs, sustainability ETFs and fixed-income ETFs.

In thematic ETFs, BetaShares in August launched the BetaShares Metaverse ETF (MAV) to provide exposure to global companies developing technology for a three-dimensional internet. Think developers of headsets and other tech for a virtual world.

In fixed interest, Global X in July launched the Global X US Treasury Bond ETF Currency Hedged (USTB) and the Global X USD High Yield Bond Currency Hedged ETF (USHY).

iShares has also been active. In August, it launched four ETFs on the ASX, including the iShares Future Tech Innovators ETF (ITEK), iShares Balanced ESG ETF (IBAL) and the iShares Global Aggregate Bond ESG (AUD Hedged) ETF (AESG).

Here are three ETFs that have caught my eye in 2022.

1. BetaShares Global Royalties ETF (ROYL)

Royalties are an interesting business. Owners of assets receive an agreed payment or stream of payments from someone who uses that asset. For example, a business that uses an artist’s intellectual property (their music) in an advertisement.

Royalties in mining, biotechnology or information technology can be lucrative. Some mining companies over the years have done well from selling or licensing an asset to another company, in return for long-term royalty streams from that asset.

Royalties have three main attractions. First, they are typically revenue-based, meaning they provide exposure to an asset’s revenue, but not its operational costs.

Second, royalties can do well in an inflationary environment as prices increase. They don’t suffer from rising costs or require high capital expenditure.

Third, the best royalty companies tend to deliver reliable recurring income. They have a risk/return profile that tends to suit long-term income investors.

The ASX only has a few royalty companies of note, mostly in mining. Deterra Royalites (DRR), which manages a portfolio of resource royalties is an example. As always, most action in these niche forms of investing is overseas.

The BetaShares Global Royalties ETF is a clever idea. ROYL provides exposure to 30 global royalty stocks, mostly large-cap companies. They include Texas Pacific Land, Royalty Pharma, Universal Music Group and Warner Music Group.

About two thirds of ROYL is held in the energy and mining sectors. By country, just over half of the ETF is invested in the United States.

ROYL’s diversified exposure to royalty income streams across industries and markets should give it useful defensive qualities in a volatile market.

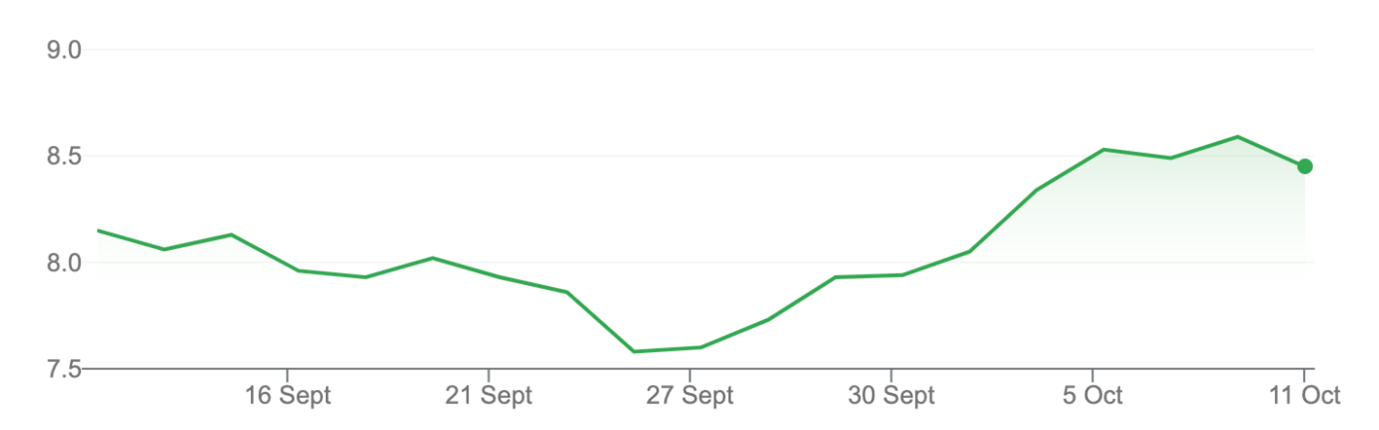

ROYL’s 12-month trailing dividend yield of 2.4% won’t excite income investors. But ROYL gives exposure to income streams not widely available here

Chart 1: BetaShares Global Royalties ETF

Source: Google Finance

2. iShares High Growth ESG ETF (IGRO)

There have been doubters over the years about the potential for multi-asset ETFs in Australia that provide diversified exposure to asset classes, through other ETFs. Vanguard led the pack with its multi-asset ETFs and other ETF issuers are launching them.

The iShares High Growth ESG ETF provides exposure to six iShares ETFs. About half of the ETF is invested in the iShares Core MSCI ex-Australia ETF, and almost a third is in the iShares ESG MSCI Australia ETF. Another 10% is in iShares ETFs over fixed income.

In one trade, IGRO effectively gives investors exposure to high-growth global and Australian equities (90%), with the rest in fixed income and cash.

This 90/10 split between growth and defensive assets won’t suit conservative investors. A more balanced portfolio split is 60/40 or increasingly 70/30 as investors are forced to have a higher weighting in growth assets in a low-rate environment.

But for younger investors who want more exposure to growth assets, such as global and Australian equities – and can withstand market volatility – IGRO is an interesting idea. Its top holdings include Apple, Microsoft Corp, Commonwealth Bank, CSL and Tesla.

An annual management fee of 22 basis points will appeal to investors who like being able to gain local and global multi-asset exposure in one trade on the ASX. As will the focus on companies with higher Environmental, Social and Governance (ESG) ratings.

Of course, higher equities exposure adds more risk in volatile markets. Currency risks add further potential volatility to IGRO returns.

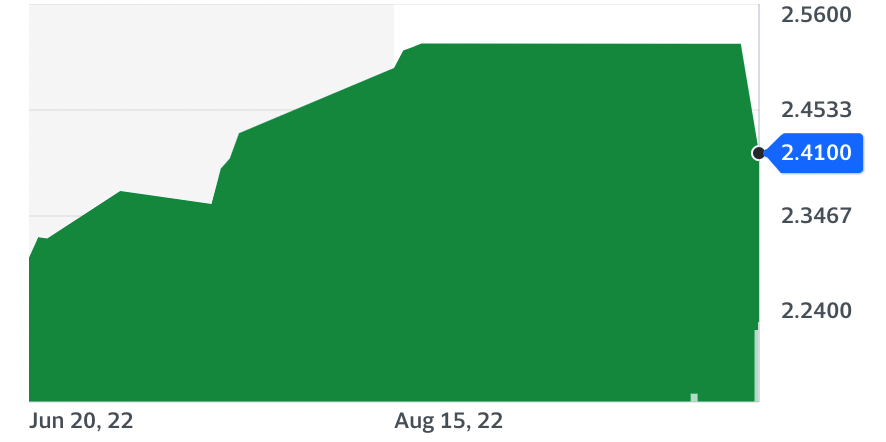

Chart 2: iShares High Growth ESG ETF (IGRO)

Source: Google Finance

3. Vaughan Nelson Global SMID Fund (Managed Fund) (VNGS)

Quoted on the ASX, this active ETF aims to outperform its benchmark index through active funds management. Unlike traditional ETFs, VNGS is not trying to replicate an index.

VNGS invests in global small- and mid-cap companies (SMID). Most retail investors in Australia wouldn’t think of including SMID companies as a sub-allocation in the global equities component of their portfolio. We tend to invest offshore for exposure to giant tech companies or in an industry not well represented here.

The global SMID index has 8,000 shares, many of them large by Australian standards. This overcomes liquidity issues that can plague some aspects of small-cap investing. The index is not as concentrated in mining as our S&P/ASX Small Ordinaries index.

Plenty of research shows global SMIDs have outperformed global large-caps over long periods, albeit with a different risk profile.

Offered by Investors Mutual, VNGS held 68 stocks (at August 2022) with an average market capitalisation of $6.31 billion. Some of these stocks would be large-cap companies (in the ASX 100) by Australian standards.

Global small-caps, like their Australian peers, have been battered this year. VNGS’s forward (next 12 months) Price Earnings multiple is 12.8 times.

That could be an opportunity for growth investors who want to add global small- and mid-cap exposure to their portfolio during market weakness and have a 3-5-year horizon. However, conservative investors should probably look elsewhere given small-cap stocks can be volatile. Currency risk is another consideration.

VNGS is down 3.6% over three months to August 2022. However, the underlying fund has outperformed its benchmark index since inception.

VNGS’s management fee of 1.12% is higher than most ETFs. That’s because it’s an active fund with managers scouring the market for undervalued small-caps.

Chart 3: Vaughan Nelson Global SMID Fund (Managed Fund) (VNGS)

Source: Yahoo Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 11 October 2022.