“The fundamentals of Nufarm remain attractive because of the clear (and achievable) outline of the long-term revenue growth path, continued favourable trading conditions across all markets, as well as the significant progress made to date with regard to the Omega-3 and Carinata seeds platforms, and strong balance sheet position,” Michael said.

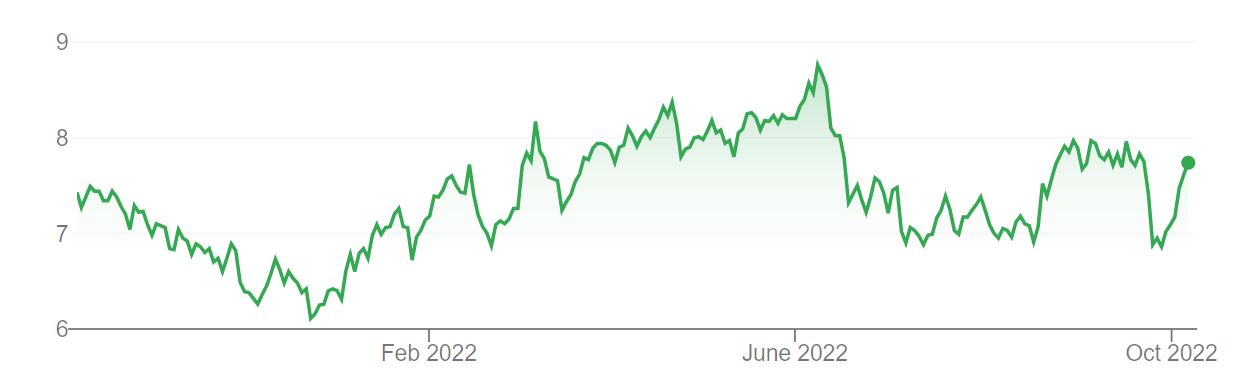

“In terms of its chart (below), it’s sitting at interesting levels here.

“After falling sharply during May/June, NUF then essentially traded sideways to build itself a base. “There appears to be a clear range now between about $4.80 and $5.50. Like the rest of the market, NUF is back at the bottom of the range.

“Because it is bouncing off support, current levels could be a buying opportunity.

“However, investors need to take into account the elevated volatility in the market here.

“This means that they should be willing to run a tight stop at the June low.

“However, if that were to fail, then the next target down will be the January low near $4.30,” Michael concluded.

Nufarm (NUF)

“STO has announced the sale of a 5% stake in PNG LNG to national petroleum company Kumul,” Raymond said.

“This is consistent with comments from CEO Kevin Gallagher in August that they would have a deal done on the 5% stake within two months.

“The agreed price of US$1.4 billion (or US$1.1billion on an EV basis) is in line with our estimate of US$1.4 billion, and consensus which seems to range between US$1.2-$1.5billion.

“This is still subject to Kumul securing regulatory approval and more importantly financing.

“This boosts Kumul’s stake to 22%, leaving STO on 37.5% (and operator Exxon on 33%).

“There are some mixed views in the market, with some clearly preferring STO does not sell any interest in its best asset.

“But I like the injection of capital into the business, and the at-valuation price achieved.

“The transaction has an effective date of 31 December 2022,” he said.

Conclusion

“Our view is this,” Raymond said.

“Santos (like the rest of resources and commodities) is getting sold off, tempering our current buying conviction (falling swords!).

“S dollar strength and global growth fears are fueling a broad sell-off of the sector.

But we see STO as trading at long-term value levels and maintain an Add rating,” he concluded.

Santos (STO)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.