“Back in financial year 2019, TWE was a growth story. Then, Covid and Chinese tariffs sent the stock into an extended downtrend,” Raymond said.

“Since, TWE’s management team has reacted with a transformational program.

“Fast forward to the second half of financial year 2022 and TWE was now generating strong double-digit EPS growth and a new strategy in place to maintain that double-digit growth.

“The new business model focus on BRAND (e.g. its Penfold division), providing de-merger type benefit.

“More importantly, TWE has now replaced all lost sales from China with new distribution to the rest of the world.

“TWE is creating a much better business than just relying on China for growth.

“Lastly, TWE is actively cutting down its supply chain cost and looking for Capital Management opportunities,” Raymond concluded.

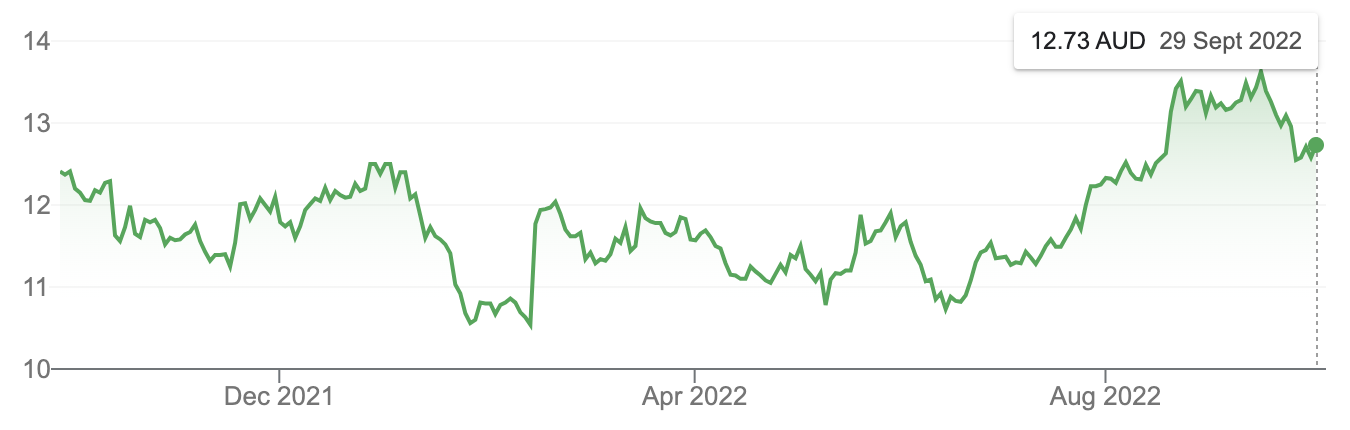

Treasury Wine Estates Limited (TWE)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.