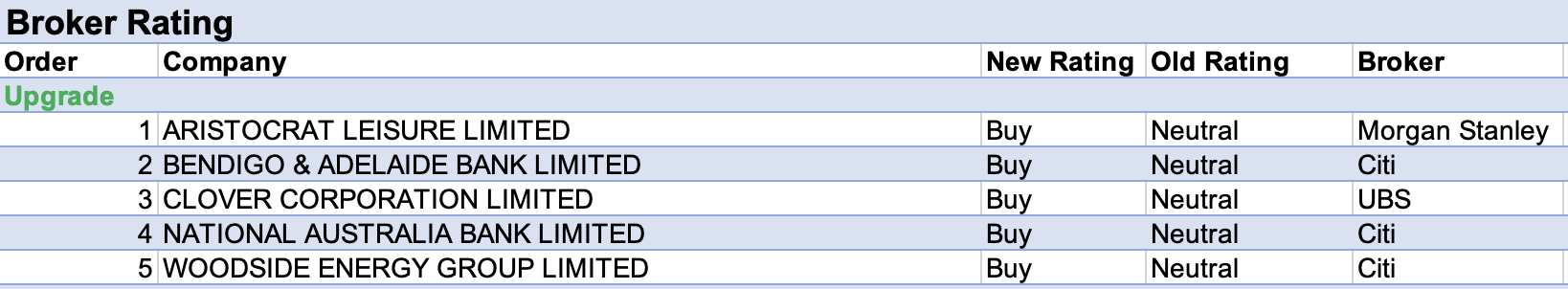

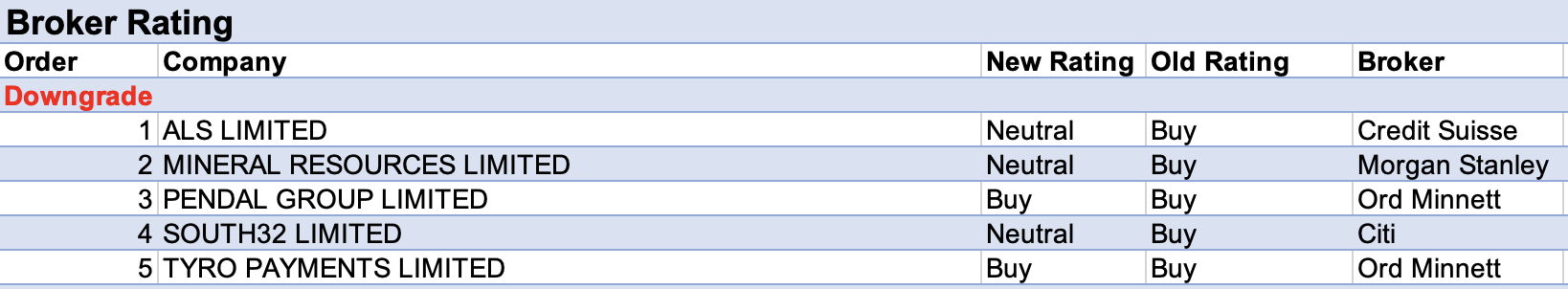

For the week ending Friday September 16 there was an equal amount (five) of upgrades and downgrades to ASX-listed companies covered by brokers in the FNArena database.

After a general review of Australian banks, Citi upgraded its ratings for both National Australia Bank and Bendigo & Adelaide Bank to Buy from Neutral after recent share price falls.

The broker noted banks are now sitting on excess liquidity build the size of which has not been seen in history, with central banks set to embark on their quickest and largest tightening seen in over 30 years.

The build of liquidity is expected to generate a material initial return on that abundant liquidity, sending FY23 net interest margins (NIMs) sharply higher by around 30bps. These margins will retract in FY25 as the excess liquidity evaporates.

The excess liquidity stems from deposit growth and the direct Term Funding Facility (TFF). The facility was provided by the Reserve Bank in covid times to support the economy via low-cost three-year funding against high-quality collateral.

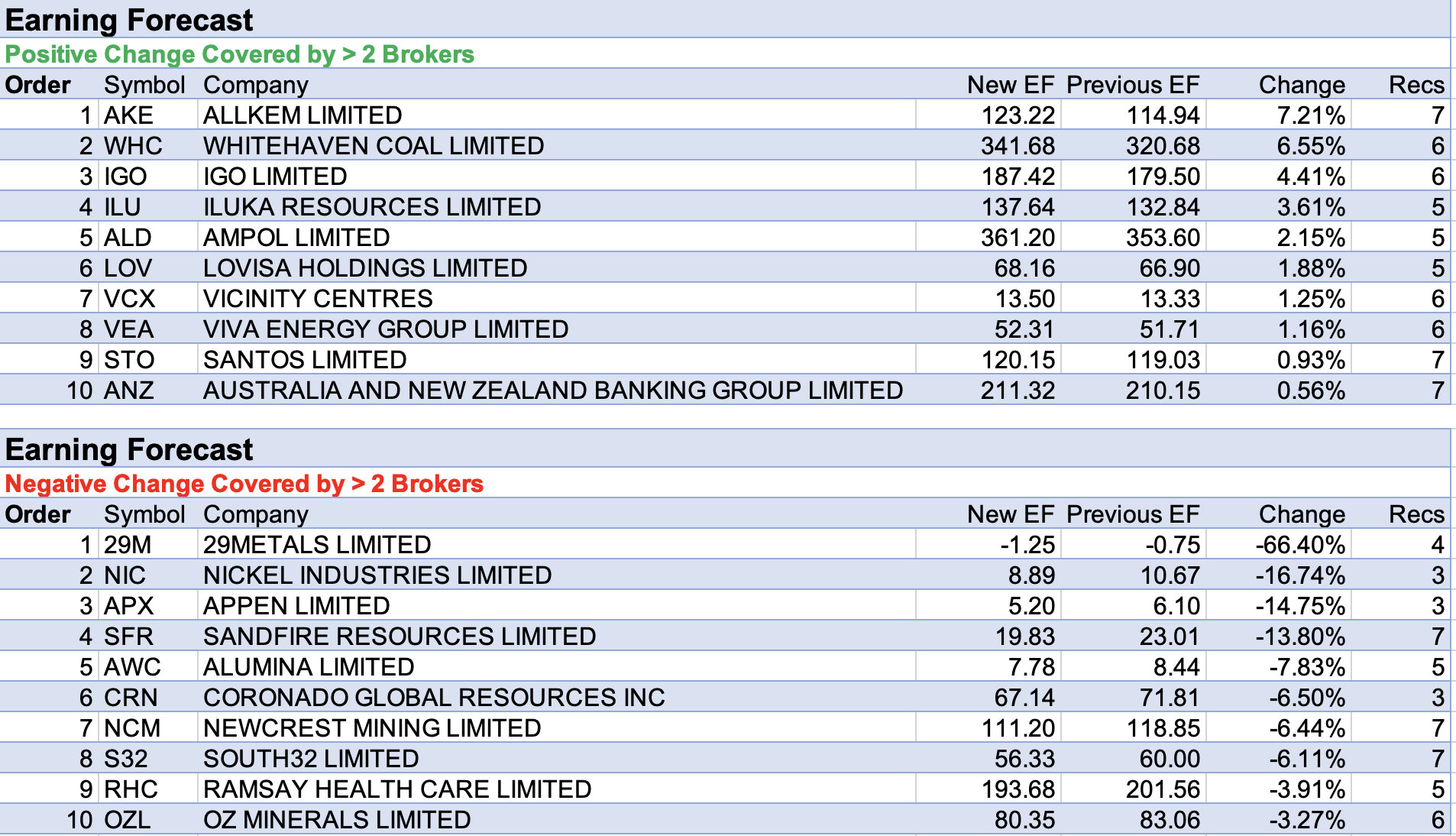

There were no material changes to target prices set by brokers last week. While target prices appear to have stabilised after reporting season revisions, changes to earnings forecasts continued.

As can be seen within the two tables below, forecast earnings changes by brokers are more material for downgrades compared to upgrades, and mining companies are largely bearing the brunt of the downgrades.

It’s interesting to note some bifurcation of forecasts occurring within the Mining sector, depending on respective commodity exposures.

The earnings forecast tables show positive broker earnings upgrades for Allkem (lithium), Whitehaven Coal (largely thermal coal), IGO (lithium, nickel, copper) and mineral sands company Iluka Resources.

On the flip side, five of the top six broker earnings downgrades related to 29Metals (copper and precious metals), Nickel Industries, Sandfire Resources (copper/gold), Alumina Ltd and Coronado Global Resources, which mines metallurgical coal.

Increased mining costs are generally weighing across the sector, and in some cases are not being countered by increased commodity price forecasts. Using 29Metals as an example, Morgan Stanley not only decreased its price forecasts for gold and copper but also raised cost forecasts.

As a result of these twin impacts, 29Metals headed up the table for the largest percentage fall in forecast earnings.

Despite cost headwinds, Morgan Stanley last week generally raised target prices across its Australian Mining coverage, with the sector generally undervalued and set to benefit from inflation.

Appen came third on the table for the largest percentage fall in forecast earnings in ongoing reaction to a weak August trading update. Macquarie recently rated the company as its least-preferred pick in its coverage of the Technology sector.

More positively, Citi last week drew some comfort from signs of optimism contained within August website traffic. As part of this, Appen China continues to see strong web traffic, climbing by 76% year-on-year in August to reach an all-time monthly high.

Total Buy recommendations comprise 55.70% of the total, versus 36.66% on Neutral/Hold, while Sell ratings account for the remaining 7.64%.

In the good books

ARISTOCRAT LEISURE LIMITED (ALL) was upgraded to Overweight from Equal-weight by Morgan Stanley, B/H/S: 7/0/0

New analysts at Morgan Stanley “assume coverage” of Aristocrat Leisure and begin with an Overweight rating and set a $45 target. While prior coverage is not referenced, this is effectively an upgrade from an Equal-weight rating. The target has risen from $43.

The broker expects a re-rating of Aristocrat Leisure shares based on the potential to become a meaningful player in i-Gaming in the US and to navigate a weaker consumer backdrop in that country. Past digital growth is also considered to be sustainable.

Apart from an attractive valuation, the analysts also see potential upside from the pursuit of M&A opportunities or capital management initiatives.

Industry View: In-Line.

BENDIGO & ADELAIDE BANK LIMITED (BEN) was upgraded to Buy from Neutral by Citi, B/H/S: 3/2/0

Citi is anticipating a shift in the tide for the banking sector in the coming year, with banks holding historic levels of excess liquidity ahead of the quickest and largest tightening in more than thirty years.

The broker notes this should generate a strong return on liquidity over the next year and drive a 30-basis point net interest margin increase before liquidity diminishes in 2024-25.

Given its recent sell-off, Citi upgrades Bendigo & Adelaide Bank to Buy from Neutral and the target price decreases to $9.75 from $10.40.

CLOVER CORPORATION LIMITED (CLV) was upgraded to Buy from Neutral by UBS, B/H/S: 2/0/0

Clover’s second-half sales surprisingly beat the top end of guidance, driven by improved China infant formula market conditions and new customers, UBS notes.

At its first-half result, Clover indicated solid early second-half trading may have benefited from order pull-forward, though this does not appear to have been the case.

The broker sees two medium-term opportunities — new customers in China and new products and omega-3 expansion beyond infant formula. An increased cost of capital takes the broker’s target down to $1.35 from $1.40 but the rating is upgraded to Buy from Neutral.

NATIONAL AUSTRALIA BANK LIMITED (NAB) was upgraded to Buy from Neutral by Citi, B/H/S: 2/5/0

Citi is anticipating a shift in the tide for the banking sector in the coming year, with banks holding historic levels of excess liquidity ahead of the quickest and largest tightening in more than thirty years.

The broker notes this should generate a strong return on liquidity over the next year and drive a 30-basis point net interest margin increase before liquidity diminishes in 2024-25.

Given its recent pullback, Citi upgrades National Australia Bank to Buy from Neutral and the target price increases to $32.75 from $32.25.

WOODSIDE ENERGY GROUP LIMITED (WDS) was upgraded to Buy from Neutral by Citi, B/H/S: 4/3/0

The Citi global commodity team significantly upgrades its global gas price forecasts, while short-term Australian east coast wholesale prices have been trimmed. It’s felt east coast gas supplies will be a priority as industry and government work together.

After mark-to-marking gas prices, the broker estimates Woodside Energy is best placed to benefit via LNG sales on the spot market. The rating is raised to Buy from Neutral, and the target is increased to $36.50 from $33.30.

In the not-so-good books

MINERAL RESOURCES LIMITED (MIN) was downgraded to Equal-weight from Overweight by Morgan Stanley, B/H/S: 4/1/0

Morgan Stanley generally raises target prices across its Australian Mining coverage, with the sector generally undervalued and set to benefit from inflation.

The broker lowers its rating for Mineral Resources to Equal-weight from Overweight after a 47% share price rally since March, though raises its target to $78.90 from $64.80.

The valuation benefits from higher forecasts for long-term iron ore and lithium prices. Industry view: Attractive.

TYRO PAYMENTS LIMITED (TYR) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 3/2/0

The bid by the Potentia Capital Management-led consortium has been rejected by the board of Tyro Payments. Ord Minnett feels further bids may eventuate, given shares are trading -77% below highs attained prior to the bid.

The rating is lowered to Accumulate from Buy, and the $1.40 target is unchanged.

Separately, Jon Davey, who has been with the business since May 2021, has been appointed as the new CEO.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.