My time-weary memories of Woodstock, not the actual event but the movie that followed, came back to me when I thought about the big market event coming up this week. The rock event that has never been topped on so many levels, gave inspiration to some very cool dude saying: “Three days man, three days.”

And it’s three important days that you might need to hold your breath for, before August 10 brings us the news about the July reading of US inflation. If it’s good, Wall Street and all the dependent stock markets worldwide, including ours, will head higher.

Why? It should reinforce the view that was a tad rattled on Friday when the US economy created 528,000 jobs rather than the 258,000 number that was expected. This strong number weakened the growing belief that the Fed was poised to either reduce the size of its interest rate rises or could even be ready to pause to assess how its monetary tightening is actually working.

This job number gave the lie to the statistical revelation that the US had entered into a technical recession. And while economists like the former Fed boss and now US Treasury Secretary Janet Yellen argued that the US economy wasn’t really in a recession, the bond market looked more convinced, with bond yields diving.

Their collective action even created a negative yield curve, which is said to have near magical powers in being able to foresee a real recession. Media scribes love to believe this so-called indicator but history has shown it’s not as accurate as some would have us believe.

So this is the backdrop for the main event on Wednesday, US time (Thursday for us). That’s when we should see if this recent rally is a bear market rally or a turning point rally when bulls show bears the door.

For my part, I have no 100% accurate way of telling when the CPI in the US will head down convincingly but I suspect we’re close. I’d love to see it on Thursday our time, when we start trading, after Wall Street and the Nasdaq on Times Square have reacted to the inflation statistic for July.

Get this, if the number shows a significant fall, tech stocks will spike. If it’s a disappointing figure, they could sell off on fears that the Fed will go with another 0.75% hike when they next meet on 20-21 September.

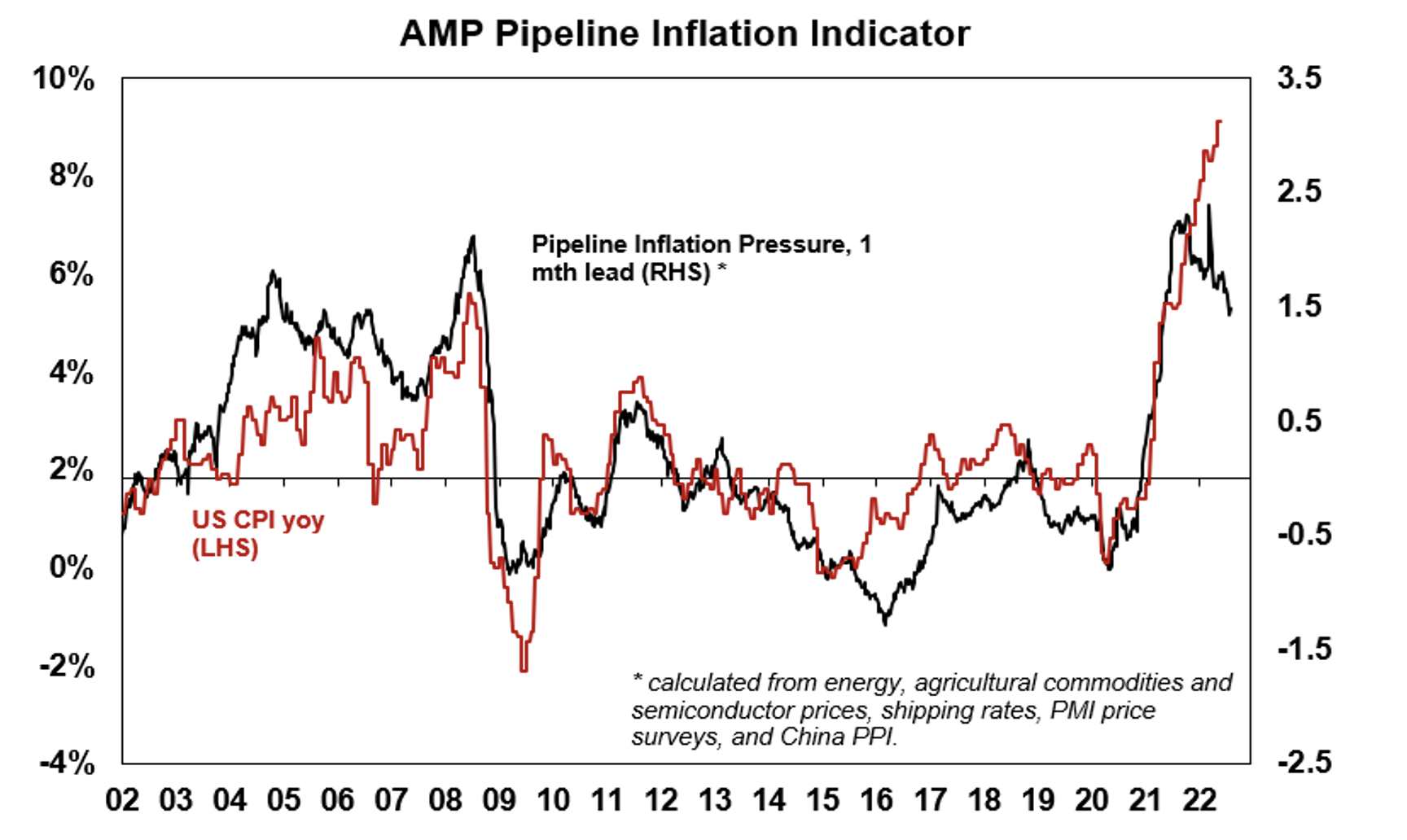

AMP’s Shane Oliver says inflation in the US is heading in the right direction but it could take time for the CPI to catch up with reality.

“Global inflation pressures may be at or close to peaking (excepting Europe with its specific energy issues)”, he wrote on Friday. “Our US Pipeline Inflation Indicator is continuing to trend down reflecting a combination of a falling trend in work backlogs, freight rates, metal prices, grain prices and even oil prices. This was also evident in the ISM business survey showing falling delivery times, order backlogs and price pressures.”

Here are the inflation numbers to watch:

- Headline inflation falls to 8.8% year-on-year from 9.1%.

- Core inflation to rise 6.1% year-on-year from 5.9% in June.

If the headline is lower than 8.8% and the core inflation actually falls instead of rising, then markets will love the news. I don’t need to tell you what will happen if the reverse occurs and both headline and core inflation rates rise.

So, how will I play it if the news isn’t as positive as I’d like?

Well, I’ll argue that it will simply be one or two steps back ahead of many steps forward for stocks later in the year. And do you reckon I was lifted by this headline from CNBC: ‘Stifel raises S&P 500 forecast, recommends growth stocks because inflation to fall “sharply”‘.

Stifel is a diversified global wealth management and investment banking company based in New York. Its market strategist Barry Bannister has joined the growing chorus of investment experts seeing better times ahead for stock players.

He’s lifted his end-of-year target for the S&P 500 from 4200 to 4400, which implies a 6.1% gain from Friday’s close. “Cyclical growth … has a strong relief rally as inflation slows, Fed expectations are pulled back, and the economy has the balance sheet and momentum in 2022 to mitigate recession risk,” the chief equity strategist wrote in a note.

He argues the sell-off earlier this year was over-the-top and it’s being reversed. He thinks earnings per share will be better than the consensus on the Street and the bond market tracking of what the Fed is likely to do has probably peaked. That’s code for: what the bond market thought before about how high rates might be raised by the Fed is now being lowered and that’s a plus for stocks.

All these pluses are important, but the really important Bannister call is on inflation, which he sees is set to tumble in coming months. This is where he and I are in total agreement. “Inflation is likely to sharply decline soon in a (highly unusual, COVID policy-shaped) non-recession slowdown,” he told CNBC.

So what stocks did he like? Cyclical growth stocks in sectors such as software, media and entertainment, tech hardware, retail and semiconductors.

For those who invest overseas, here’s his preferred group of stocks:

- Microsoft

- Alphabet

- Apple

- Amazon

- Nvidia

- Visa

- Meta

- Cisco

- Broadcom

- Home Depot

If you want to use this list to target local equivalents, think of quality tech and companies that have pricing power and that we use every day.

Will all this potentially good news come soon? Thursday could be the start of something great for stocks but it would be happening ahead of time, according to my timetable. I always expected better inflation news in September or October that would set us up for a great December quarter for stocks.

I still expect that, but I won’t complain if my Christmas stock ‘gifts’ come earlier than expected.

That said, if those strong job numbers on Friday are followed up by another persistently high inflation reading in three days’ time, then we could see a sell-off which will be my cue to start buying ahead of the Christmas shopping madness.

On that subject, a great Chrissie gift for me would be a DVD of the Woodstock movie, but do they still do DVDs anymore?

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.