Investing in a royalty company isn’t one of the most glamorous investment ideas, but it is an interesting proposition for income seekers, particularly when the yield on offer is 7% fully franked. But like any investment, royalty investments carry risk.

Globally, listed royalty and streaming companies have a market capitalisation in excess of US$63 billion. Most earn their royalty from the production of gold and other precious minerals, with the largest being Wheaton Precious Metals and Franco-Nevada. Typically, they own the mining rights, or provide the capital, to a producing company and in return earn part of the sales revenue.

The non-gold royalty and streaming market has a market cap of about US$6bn. Deterra Royalties (DRR) is the second largest globally and the major royalty company listed on the ASX. There are other royalty companies on the ASX including High Peak Royalties (HPR), Emmerson Resources (ERM), Gullewa (GUL) and Fitzroy River Corporation (FZR), but they are dwarfed by Deterra.

Deterra was spun out of Iluka Resources (ILU) through a demerger in November 2020. Iluka maintained a 20% holding, with the balance of shares being dispersed on a 1:1 basis to existing Iluka shareholders.

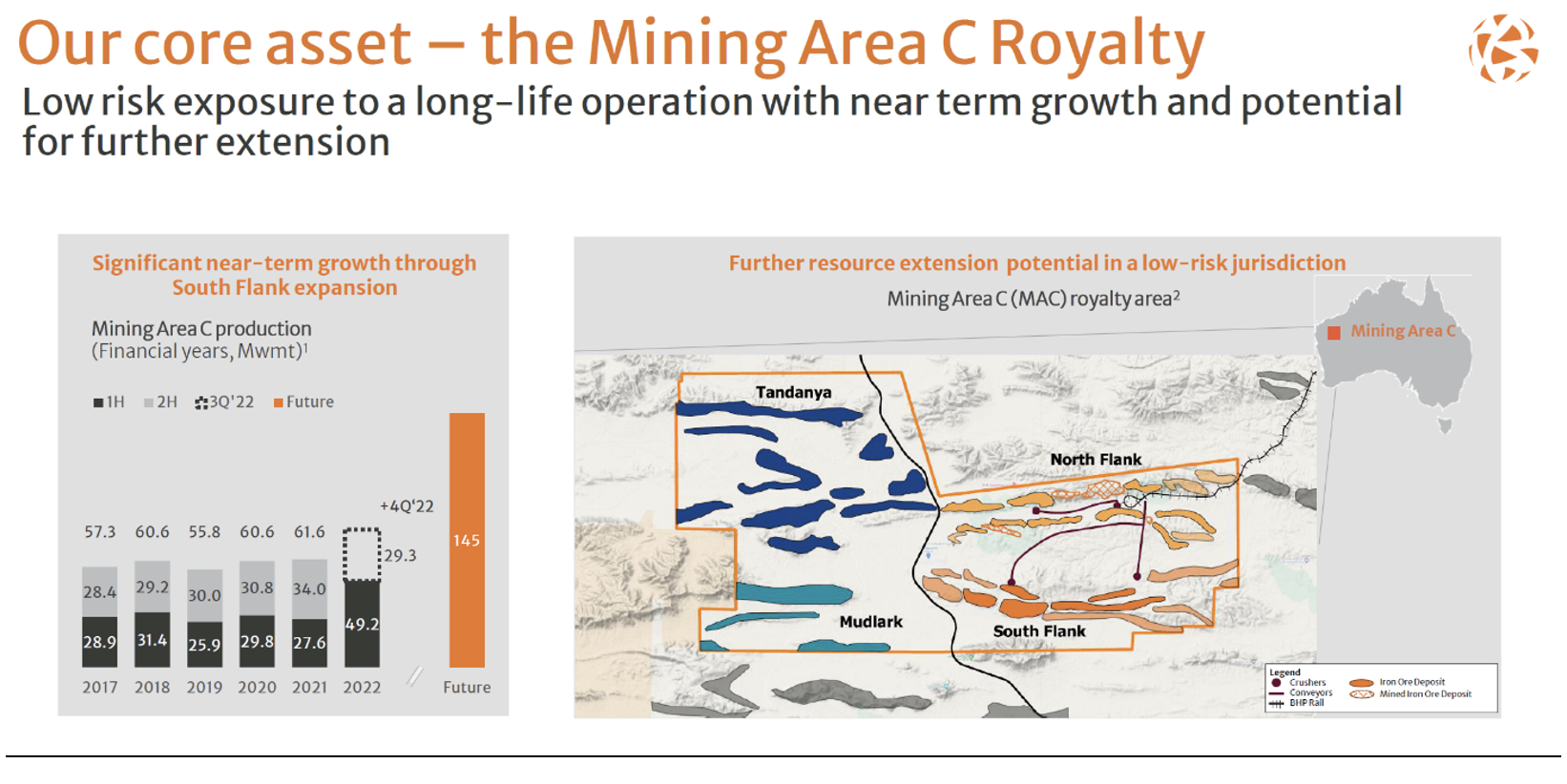

Deterra’s major royalty asset is ‘Mining Area C’ or MAC, an iron ore producing area in the Pilbara in Western Australia. MAC is home to the North Flank and BHP’s South Flank mines and will become the largest operating iron ore hub in the world with a capacity to produce up to 145 Mtpa (million tonnes per annum).

This forecast 2.4 times expansion in production (compared to FY21) is one of the things that makes MAC so interesting to a royalty company. It gets paid a royalty of 1.232% of MAC product revenue, plus $1 million per one million tonne increase in annual production above a pre-determined capacity level, which for FY23 has been set at 105Mdmt. And because the miners are producing iron ore at a cost that puts them in the bottom quartile globally, the risk of reduced production is low.

The company also has five other small royalty assets.

For the 12 months to 30 June, the company earned $265.2 million in royalties. This was up 83% on FY21 and included a final quarter capacity payment of $46 million. June quarter royalty revenue was up 13.3% on the March quarter.

In terms of growth, the company has a targeted strategy focussing on “value accretive investment”. It is seeking to create new royalties by providing project capital and balance sheet repair to bulk, base and battery metal miners at or nearing production (target $100 million to $300 million), and to acquire existing royalties. But these activities are still in the early stages as MAC accounts for more than 99% of the revenue.

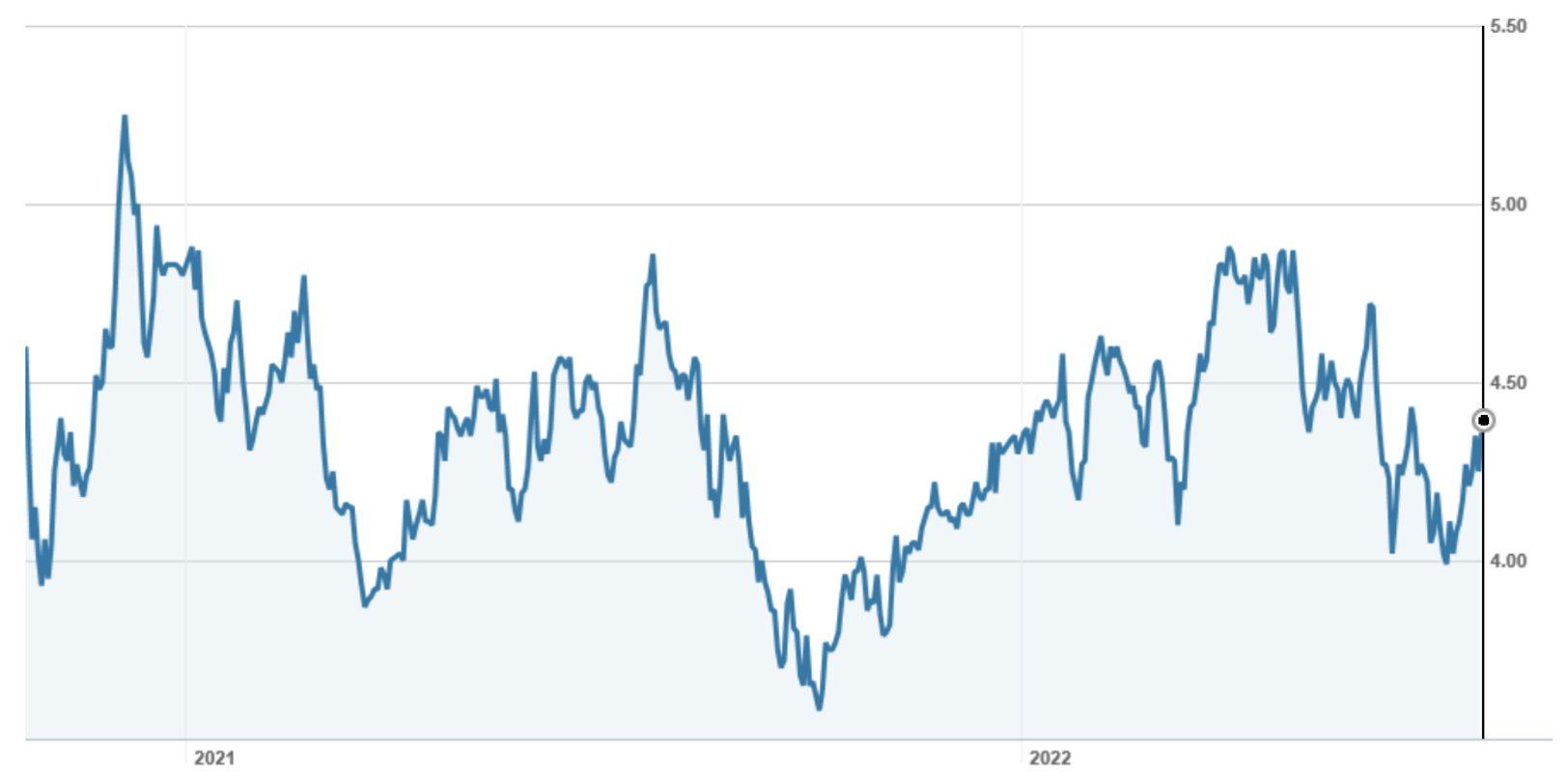

Since listing in November 2020, Deterra’s share price has traded in a relatively narrow band, with movements in the iron ore price being the major drivers of change. On Friday, the shares closed at $4.32.

Deterra Royalties (DRR)

What do the brokers say?

The brokers are in the main positive on the stock, with 2 buy recommendations and 3 neutral recommendations. According to FNArena, the consensus target price is $4.93, about 14.1 higher than Friday’s closing price of $4.32. The range is from a low of $4.10 from Citi to a high of $5.25 from Morgan Stanley.

While forecasts on the iron ore price largely drive their view on Deterra Royalties, most note that Deterra has no direct exposure to project operating costs, has no capital cost obligations and its high margin gives it protection against cost inflation.

For income seekers, the brokers forecast total dividends for FY22 of 32.7c. It has already paid an interim dividend of 11.7c, so this implies a final dividend of 21.0c. This represents a yield of 7.5%, fully franked. For FY23, the brokers forecast a total dividend of 35.3c, putting it on a prospective yield of 8.2%.

What are the risks?

With 99% of Deterra’s revenue coming from MAC, its number one risk is the iron ore price. That’s because its main royalty is based on the Australian dollar sales price that the miners achieve. It is not involved in production, so it doesn’t have any production or mining risks, however, it is exposed to the output that the miners produce. In this regard, it is reasonably well positioned because the mining area is a world-class, low-cost operation.

Deterra itself is a lean company, with outsourced corporate functions and a very modest working capital facility. Its policy is to pay 100% of NPAT to shareholders.

Bottom line

I like the look of Deterra, at the “right price”. It is arguably a lower-risk way to invest in resources because you don’t have to worry about production issues. You enjoy less capital and operating risk than with typical mining exposures, but retain some exposure to the upside.

What’s the right price? That’s the $64 question, but if you are marginally positive on the iron ore price, then around current levels (say up to $4.50) looks reasonably attractive. Certainly, the high dividend yield helps to provide a buffer against a weakening iron ore price.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.