I’m writing this for my financial planning clients and subscribers who are feeling frightened about what the stock market might do in coming weeks and months. Over that time, the new economic data, the upcoming reporting season, the central banks’ interest rate hikes and China’s growth (as well as its progress in escaping pandemic lockdowns) will be vital for determining when stock markets turn around and head up.

I’m leaving out of my analysis the biggest potential gamechanger for stock prices i.e. an end to the Ukraine war because I’m just too rational to understand the mental machinations of a megalomaniac.

In case you haven’t committed to memory my scenario for stocks for the rest of the year, let me restate it.

I’m expecting the December quarter to be the turnaround time for stock markets, though I wouldn’t be surprised if we see optimists outnumbering pessimists even as early as September. That said, I could be wrong about the December quarter for the equities comeback. The worst could already be behind us with the S&P 500 up 6.3% since June 16 so the comeback could be earlier than December. And if the flow of data says inflation is falling and recession is becoming less of a threat, then stocks could sneak higher from here, albeit with a series of ups and downs but on a rising trend.

This is a less expected scenario but can’t be ruled out. Timing the market (i.e. when it pulls out of a slump or when it gives up on a boom) is nearly impossible to predict with certainty. I’d like to say I’m an expert on timing the market but genuinely no one is!

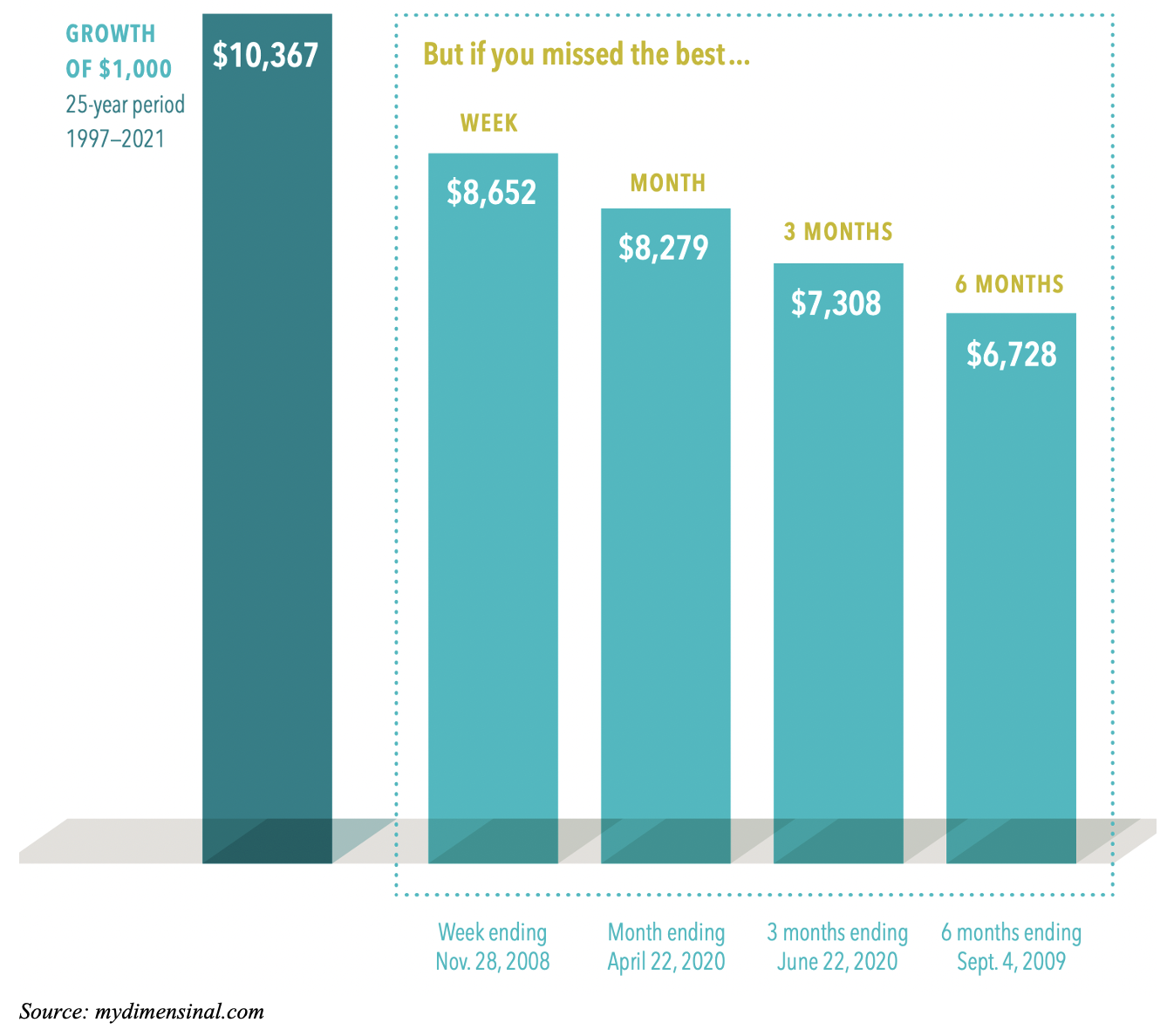

This chart below shows what happens to returns if you run away from the market because you’re scared, and then you miss out on a big market bounceback.

This chart looks at a hypothetical $1,000 investment made in 1997, which turns into $10,367 for the 25-year period ending 31 December 2021. Over that 25-year period, if you missed the Russell 3000 index’s best week that ended 28 November 2008, the value would shrink to $8,652. Miss the best three months for this index that ended 22 June 2020 and the total return would fall to $7,308.

And while I won’t rule out a quicker recovery of stocks than my December quarter call, I have to throw into this analysis that the low for the S&P 500, from where this bounce started, was 3666. For those biblically inclined or superstitious, 666 has been called the devil’s number! (Who said I’m always optimistic?)

Between here and the end of September we have about 11 weeks, so what do markets have to deal with that could send stocks up or down, and what’s the latest news about these key drivers of our portfolios?

Here goes:

- US June inflation numbers are out this Wednesday but our market will react to it on Thursday. A number less than 8.6%, which the CPI was in May, would be good for stocks and vice versa.

- Our inflation number is out on July 27 and a small increase on the latest reading of 5.1% would help stocks.

- The next two Fed meetings on interest rates will be market critical. They come on July 26-27 and September 20-21. The size of the interest rate rise and the comments will impact on stocks.

- Our RBA will make important decisions on interest rates on the first Tuesdays in August and September. Once again the size of these rises and the commentary will be crucial for stocks.

- Reporting seasons in the US start on July 15, while ours dominates August. Here the outlook statements from these companies will have a big bearing on what stock prices do.

- China’s reopening post-lockdowns will not only boost global GDP but add to confidence. Local stocks were boosted by news that China is considering allowing local governments to sell 1.5 trillion yuan ($327 billion) of special bonds this year to help boost economic growth and that’s why mining stocks had a better day on Friday.

- Tracking the recession threats in Europe and the US will be a big watch for financial markets, with the better-than-expected jobs numbers for June in the US questioning those ‘experts’ who have already claimed that the world’s biggest economy is already in recession.

- The yields coming out of the bond market will also be important as the bond players there will send yields down on recession fears and pump them up on inflation, and stocks will largely fall on big moves either way. Ideally, bond yields stabilizing will say the Fed has engineered a soft landing with no prolonged inflation and no serious recession.

In a perfect world for investors, we want to see economic data and company reporting telling us that both inflation and recession outlooks are heading in the right direction and the June jobs report in the US did that on Friday.

Economists expected 250,000 jobs to be created while 372,000 showed up, which was a big enough number to tone down recession fears but not over-excite those tipping inflation is on the rise. It was a Goldilocks result, and that’s why the Dow and the S&P 500 hardly fell on the news and the Nasdaq actually rose 0.12% to be up over 4% for the week. And our market added over 2% in last week’s trading.

Right now, it’s the fear of bigger-than-expected inflation, interest rate rises and recession that has captured stock markets, but the actual news, especially here in Australia, is pretty good.

Today The Australian surveyed prominent CEOs and Chairs of leading companies and they generally said their companies (so you’d have to say their customers) are not rattled by the interest rate rises so far.

I especially like this from CBA’s boss Matt Comyn: “Many CBA customers had a ‘natural buffer’ with $250 billion-$260 billion in aggregate savings nationally.” And he also told the Oz that some three-quarters of loans and therefore their borrowers are approximately two years ahead on repayments, on average.”

Meanwhile, Gerry Harvey admitted sales might have been down this year but that’s compared to a year before when lockdowns made it easy for retailers to sell stuff.

He put it in perspective this way: “If you get the media out there and they look at results of companies that have got turnovers down 5 or 10 per cent on last year, they say this is a disaster, but it really isn‘t because it’s up 15 or 20 per cent on 2019”.

Other reasons for me to believe we’ll see a stocks comeback before the year is out (and that it would be crazy to go to cash or super defensive) are summed up below:

- Bond fund manager Chris Joye says bond fund managers, after one of the worst years for defensive bond funds ever, should have a good year.

- JPMorgan’s chief global markets strategist, who was ranked the No. 1 equity-linked strategist in last year’s Institutional Investor survey, recently tipped a 27% rebound of the S&P 500 by year’s end.

- Legendary US Professor at Penn Uni, Jeremy Siegel recently counselled investors three weeks ago that “We’ve had bigger shocks in the past … There may be another 5%, who knows, there may be another 10%, but that means for me, moving forward, that just raises the return on the market looking forward … [so] … Hold in there. If you got cash, begin to employ it. You won’t be sorry a year from now”.

- And in the AFR last week, 32 out of 32 economists ruled out a recession for the Australian economy, which should be seen as a good sign for our companies and their share prices rolling into 2023.

- Finally, why do you think one of the greatest investors of all time told us to “be greedy when others are fearful and fearful when others are greedy?” It’s because history has proven that quality portfolios can have bad years but that’s not when you sell quality assets — it’s when you buy more of them.

As the investing team at the US-based Dimensional Fund Advisors, who manage $881 billion in money, have concluded: “There’s no proven way to time the market — targeting the best days or moving to the sidelines to avoid the worst — so the evidence suggests staying put through good times and bad.”

There could be some more nervous months ahead but this will give way to a stock market recovery. After the GFC, the bounceback was over 50% in one year following the turnaround of the bear market. And after the Coronavirus crash, the one-year rebound was 40%. I’d hate you to miss the likely stocks surge from the December quarter rolling into 2023.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.