Natural gas has long been touted as the “transition” fuel for economies that have relied on coal for their power needs that can fill the gap as the world transitions to renewable energy.

Its qualifications for this role are that it is plentiful, it has lower carbon dioxide emissions than coal, gas-fired power stations can be built relatively quickly, and are based on existing infrastructure.

But having gas talked about as the “transition” fuel has angered green groups, who believe that there is no need for such a thing – that the world can and should go straight to renewable energy.

Well, up to a point – the point at which, as the ramifications of the Russian invasion of Ukraine have shown, people realise that they need energy and that if they had moved straight to renewable energy, it wouldn’t be available around the clock in the supply that a modern industrial economy requires.

Much as Russia’s European gas customers might want to cut off the supply from Russia, to punish it for its actions, quite a few of them have realised that they are too reliant on it.

In desperation, European gas users have looked elsewhere for supplies; in June, for the first time in history, US LNG contributed more gas supply to Europe than pipeline gas from Russia.

Even before Russia’s decision to invade Ukraine, gas prices were on the move, with demand rising as the world recovered from the pandemic, but running into very constrained supply, with OPEC nations not reaching stated targets and US producers – those that had survived an engineered price drop by OPEC and Russia, to try to put shale gas producers out of business – being very frugal with drilling spending.

Natural gas supplies 24% of the world’s primary energy. Gas demand was hurt by the pandemic, but BP said in its 2021 Statistical Review of World Energy that global natural gas demand grew by 5.3% in 2021, recovering above pre-pandemic 2019 levels and crossing the 4 trillion cubic metres mark for the first time.

That was before Russia invaded Ukraine; now, sanctions on Russian coal and gas exports mean that there is simply not enough supply to meet demand. As a consequence, the global price of gas (and coal) has soared.

Even in Australia, given that the nation exports so much of its domestic gas resources, any additional gas for domestic consumption – to meet rising electricity demand, some energy generators have increased gas-powered generation – must be acquired from the international market.

Australia’s competition regulator warned in March that without LNG imports, the southeast market would face a shortfall from the winter of 2024. “By 2026 or 2027, we expect a shortfall over the whole east coast,” Australian Competition and Consumer Commission Commissioner Anna Brakey told a conference in March.

It is a worldwide shortfall – and it’s a good time to have gas, or to be near to being able to supply gas.

The Australian Securities Exchange (ASX) has a big cohort of gas stocks, beavering away around the globe exploring for gas, farming-in (signing deals to participate) in other companies’ wells, developing projects, and working to sign offtake deals to sell their gas once it starts to flow.

Here are 3 gas plays that I think are quite exciting.

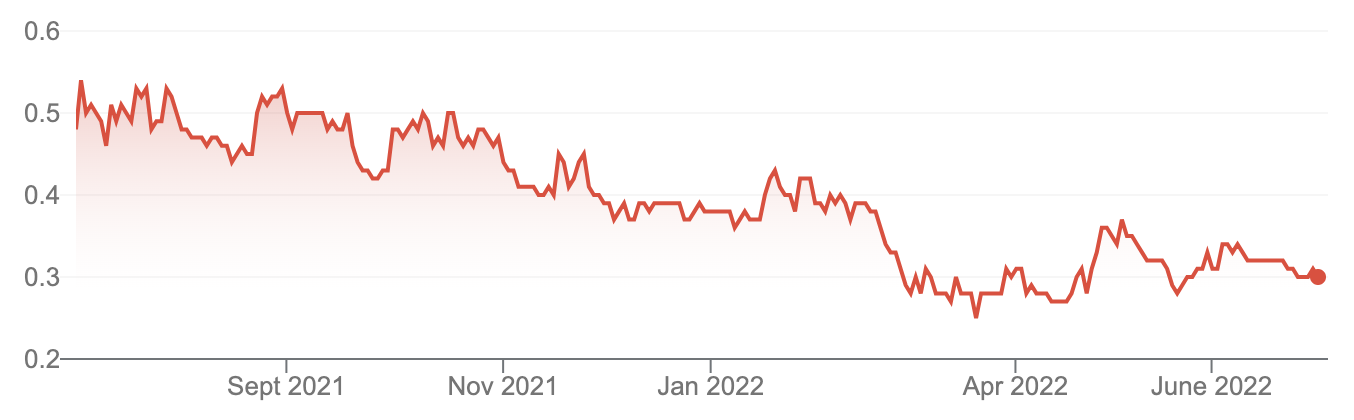

1. Galilee Energy (GLL, 29.5 cents)

Market capitalisation: $100 million

12-month total return: –47.3%

Three-year total return: –27.2 % a year

Galilee is developing its 100% owned Glenaras gas project in the Galilee Basin of Queensland, and exploring in the Surat and Bowen basins. Last month, the company completed the drilling of the sixth and final well of the 2022 drilling programme at Glenaras.

Galilee says Glenaras has enough gas to fulfil one-quarter of eastern Australian domestic market needs for more than 30 years. Right now, Glenaras is one of the largest certified, un-contracted contingent resource positions on the east coast, with an independently derived and certified contingent resource of 1C of 308 petajoules (PJ), a 2C of 2,508 PJ and a 3C of 5,314 PJ.

(These figures are “contingent” resources, defined as those quantities of petroleum that are estimated, on a given date, to be potentially recoverable from known accumulations, but which are not currently considered to be commercially recoverable. Oil and gas companies work to progress their contingent resource quantities (1C, 2C, and 3C) by further drilling to reserves, which are volumes considered to be economically recoverable using current technology.

Reserves are broken down into:

- 1P – proven reserves: those reserves claimed to have a reasonable certainty (normally at least 90% confidence) of being recoverable under existing economic and political conditions, with existing technology.

- 2P – proven and probable reserves: This includes additional reserves that are considered less likely to be recovered than proven reserves but more certain to be recovered than Possible Reserves. There should be at least a 50% probability that the actual quantities recovered will equal or exceed the 2P estimate. Considered the most relevant measure, 2P reserves are widely quoted as those needed to underpin projects such as CSG–LNG projects.

- 3P – proven and probable and possible reserves: attributed to known accumulations that have a less likely chance of being recovered than probable reserves.

- Total reserves and resources: the sum of 2P, 3P/2C and prospective resources.

Galilee is on the way to becoming a multi-TCF (trillion cubic feet) gas development company, leading to a potential initial reserves figure expected in early 2023.

Like many east coast projects, Glenaras is coal seam gas, which is natural gas found in coal deposits, typically 300–600 metres underground. Coal seam gas is held in place by water pressure: to extract it, wells are drilled through the coal seams and the water pressure is reduced by extracting some of the water. This releases natural gas from the coal. The gas and water are separated and the gas is piped to compression plants for transportation, through gas transmission pipelines.

In this way, Glenaras will have the bonus of having water as a value-adding profitable commodity from the development: analysis indicates that low-salinity water will be produced as a by-product of gas production, to be used for irrigation, delivering high-value crop yields and increasing land value.

Galilee has signed a deal with infrastructure asset manager Jemena to build a new pipeline to deliver Glenaras gas to the central Queensland coast. The company says it is strongly positioned to supply into the forecast eastern Australian domestic market gas shortfall expected from around 2023.

Galilee Energy (GLL)

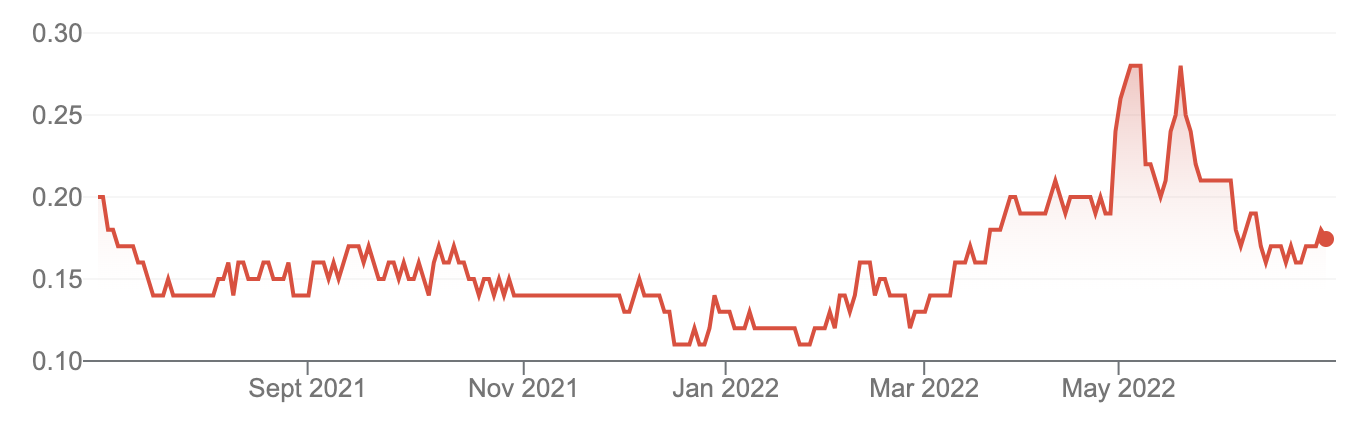

2. Invictus Energy (IVZ, 17.5 cents)

Market capitalisation: $131 million

12-month total return: –5.4%

Three-year total return: 62.2 % a year

Perth-based Invictus Energy is developing a potentially huge asset, its Special Grant (SG) 4571 licence covering 250,000 acres in the most prospective portion of the Cabora Bassa Basin in northern Zimbabwe. Previously explored by Mobil, the project contains the largest undrilled structure in onshore Africa, the Mukuyu (Muzarabani) conventional gas-condensate prospect, which has an independently estimated 8.2 trillion cubic feet (Tcf) of gas, plus 247 million barrels of condensate. Invictus has an 80% stake in SG 4571.

The project also contains the world-class Msasa conventional gas-condensate prospects, which are estimated to contain 1.05 Tcf plus 44 million barrels of condensate. Mukuyu is one of the largest targets being drilled anywhere in the world in 2022: the first well into the structure, Mukuyu-1, is starting drilling this month.

In total, Invictus is targeting a prospective resource of 9.25 TcF gas, plus 294m barrels of gas condensate (or 1.9 billion barrels of oil equivalent). To put that in context, the Bass Strait field, which has supplied the majority of domestic gas demand in Australia for more than 50 years, had reserves of about 10 Tcf at its peak. Because Invictus’ resource is prospective, it won’t turn out to be that big, but it’s an elephant in anyone’s language, with one billion barrels of oil equivalent considered to be achievable.

Mukuyu is a big enough prospect to kick-off an entirely new oil and gas industry in Zimbabwe – which is why the nation’s Sovereign Wealth Fund has signed a deal to earn a 10% equity right to SG 4571, which is exercisable within six months of a final investment decision (FID) on the project. Invictus has multiple offtake agreements signed already, with what it says are “blue-chip customers,” for up to 1.2 TCF of gas over 20 years, and says it has “multiple downstream supply opportunities in high-value markets.” Mukuyu could supply gas-hungry South Africa, it could easily provide electricity and gas utilities and industries across Southern Africa, tapping into existing infrastructure. It will also benefit from greater oil and gas demand, particularly in Europe and Asia.

From here, Invictus will focus on its current drilling program, which could be a company-maker, as well as negotiating farm-in offers from investors wanting a stake – it is considering several of these – and striking more offtake agreements for its gas.

Invictus Energy (IVZ)

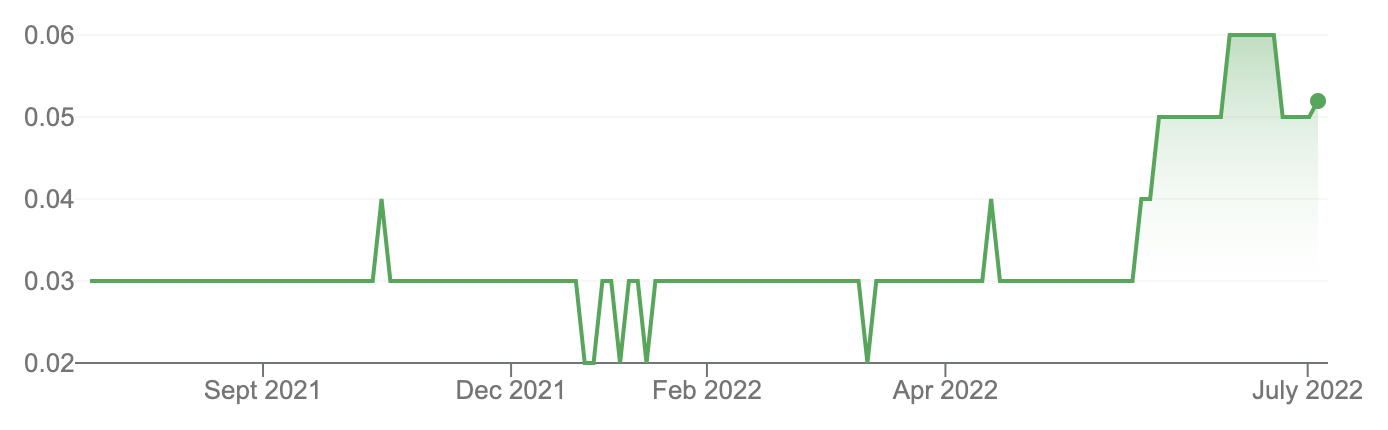

3. Po Valley Energy (PVE, 5.3 cents)

Market capitalisation: $57 million

12-month total return: 82.8%

Three-year total return: 0.8% a year

Italian gas play Po Valley Energy owns the Selva Malvezzi onshore gas development in the country’s Po River Plain, from which it expects to be producing in the first half of next year. It is poised to award the gas plant and pipeline contract for the Podere Maiar gas field at Selva Malvezzi with the Emilia Romagna regional council approving in June a local government production agreement for the field. This is a prerequisite for Italy’s ecological transition ministry to grant a final production concession, which will allow Po Valley to install the gas plant and a one-kilometre pipeline – contract negotiations are underway to complete this

Po Valley has a 63% interest in the project, while Prospex Energy PLC, which is quoted on the AIM (alternative investment market) of the London Stock Exchange (LSE), has a 37% interest. Podere Maiar is expected to flow gas at a maximum rate of 150,000 cubic metres a day, straight into Italy’s national gas grid. Given that Italy, like many European countries, is scrambling to find alternatives to Russian gas supply in the wake of Moscow’s invasion of Ukraine, it will be a very timely achievement by PVE.

Po Valley Energy (PVE)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.