Buying high-quality growth stocks during market corrections has been one of my favoured strategies. Waiting for a better entry point in stocks that usually trade on a high Price Earnings (PE) multiple can be rewarding.

Online advertising stocks are an example. Over the years, I’ve written columns espousing the appeal of REA Group, Seek and Carsales.com during market corrections. These stocks always look pricey, so you have to buy them during big sell-offs.

That said, I would not buy these stocks just yet. Property and car advertising has more pain ahead as higher interest rates affect those markets. This week’s jumbo-sized rate rise shows how much pain is ahead. Job advertising is a sweet spot due to a tight labour market but Seek looks fully valued at the current price.

Medical-device makers also fit my strategy. The best of them, Cochlear (COH) and ResMed Inc (RMD), trade on a high PE multiple for a reason: they are exceptional companies. They, too, are best bought during corrections when bearish market sentiment takes hold.

At $217 per share, Cochlear is trading near consensus analyst price targets, suggesting the stock is fairly priced. I like Cochlear’s recent acquisition of Oticon Medical, the hearing-implants business of Demant, a Danish company. But the consensus price target looks a little too aggressive; I’d watch and wait for better value in Cochlear.

ResMed and Fisher & Paykel Healthcare Corporation (FPH) look more interesting on valuation grounds after recent price falls. Both companies make Continuous Positive Airway Pressure (CPAP) machines to treat obstructive sleep apnea, a potentially serious medical condition where someone’s airways are blocked during sleep.

I had a CPAP machine for a few years but could never get used to air being pumped into my nose and mouth during sleep. Exercise, diet and weight loss meant I no longer needed one, but some friends swear by their CPAP machine.

Sleep apnea is a long-term growth market. On some estimates, the condition affects one in five obese people, mostly men. Sadly, obesity rates keep rising. Worldwide obesity has nearly tripled since 1975 and there were 1.9 billion overweight adults (of which 650 million were obese) in 2016, estimated the World Health Organisation.

A paper in the International Journal of Obesity estimated that by 2030, about 38% of the world’s population will be overweight and another 20% will be obese. Obesity rates in affluent developed nations seem to be levelling off, but obesity rates within sub-sections of those populations and in some developing nations are rising.

A 2019 study (funded by ResMed) estimated that almost 1 billion adults worldwide have mild-to-severe obstructive sleep apnea. Remarkably, the number of affected people is highest in China, then the United States, Brazil and India. That suggests rising demand for CPAP machines in large developing nations as their middle class expands.

Caution is needed: forecasts of gigantic global Total Addressable Markets can seduce novice investors. Often, emerging information technology and biotech companies promote the potential size of their market to wow prospective investors with big numbers. Reaching that market – and selling into it – is much harder.

Caveats aside, a rising obesity rate and higher incidence of obstructive sleep apnea (which are related) are long-established megatrends. ResMed and Fisher & Paykel Healthcare are long-established, highly profitable companies. The challenge is buying these stocks when they offer better value, such as during market corrections.

Here is a snapshot of their prospects and valuation:

1. ResMed Inc (RMD)

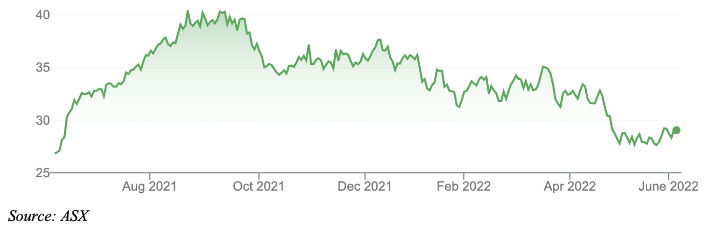

ResMed, a global leader in sleep-apnea devices, has had a tough 12 months by its standards. ResMed has slumped from a 52-week high of $40.79 to $29.07.

Like other medical-device firms during COVID-19, ResMed was affected by the global shortage of semiconductor chips. The company was unable to fill the semiconductor chip gap and had to supply devices to its most-affected patients first.

The chip shortage also meant ResMed could not take full advantage of a product recall by Phillips, a rival maker of CPAP machines. In June 2021, Phillips issued a voluntary recall notification after discovering a potential health risk related to certain devices.

Phillips expects it will take until the end of 2022 to work through the recall/repair issues with affected customers. That’s a huge sales opportunity for ResMed but it downgraded its guidance for a sales increase from the Phillips recall due to chip shortages.

Still, ResMed has years of strong growth ahead. The incidence of sleep apnea worldwide continues to grow and there is thought to be a high rate of undiagnosed illness among people who have breathing disorders during their sleep.

An average share-price target of $35.43, based on the consensus of six investment banks, suggests ResMed is undervalued at the current $29.07. The consensus target and the valuation parameters behind it look reasonable.

In the short term, ResMed should benefit as chip shortages, higher freight charges and other supply-chain snarls during COVID-19 unwind. Longer-term, ResMed should have a higher market share after the Phillips recall, in a global growth market for its device.

ResMed Inc (RMD)

2. Fisher & Paykel Healthcare (FPH)

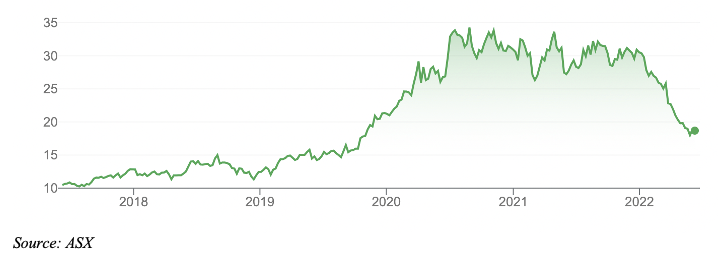

Shares in the dual-listed New Zealand company have fallen from a 52-week high of A$33.01 to $18.49 on the Australian Securities Exchange.

FPH designs, makes and markets products for acute and chronic respiratory care, surgery and the treatment of obstructive sleep apnea. A bit over two-thirds of its revenue relates to hospital products; the rest is in homecare products.

In March, FPH shares tumbled after it provided disappointing earnings guidance. The company expected FY22 revenue to fall 13-15% compared to a year ago.

Second-half revenue growth in the hospital consumables business was flat, in part due to a relatively mild flu season in the Northern Hemisphere (and thus lower requirements for respiratory interventions in hospitals).

On the cost side, elevated freight rates during COVID-19 crunched FPH’s profit margins.

When it reported its full-year FY22 result in May, FPH announced a 14% fall in revenue and a 30% fall in after-tax net profit (on a constant currency basis) from the same period a year ago. FPH shares fell further after the result.

Remarkably, FPH said it supplied $880 million of hospital hardware in the past two financial years – the equivalent of about 10 years of hardware sales before COVID-19. The business is coming off a growth spike due to the pandemic.

As COVID-19 rates fall, elevated hospital demand for consumables is normalising. Moreover, high vaccination rates in Western countries thankfully mean less demand for respiratory devices that aid breathing for affected COVID-19 patients.

Like ResMed, FPH should benefit as freight costs ease and supply-chain disruptions reduce in FY23 as life returns to normal after the pandemic.

Longer-term, FPH is leveraged to solid growth in demand for CPAP machines and other respiratory devices. The potential use of its Optiflow devices for anaesthesia, which is thought to improve oxygenation, giving anaesthetists more time to intubate, is an opportunity.

Like ResMed, FPH has a long history of innovation and an excellent reputation. It’s a quality company that has been affected by COVID-19 volatility for product demand.

An average share-price target of $21.10 implies FPH is modestly undervalued at the current $18.49. Morningstar values FPH at $22.

FPH is no screaming buy but looks attractive after share price falls this year. The market is too bearish on FPH and is underestimating its long-term growth prospects.

FPH is trading at levels last seen in late 2019, having given back all of its share-price gains during COVID-19, and then some. That’s an opportunity for long-term investors.

Fisher & Paykel Healthcare (FPH)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 7 June 2022.