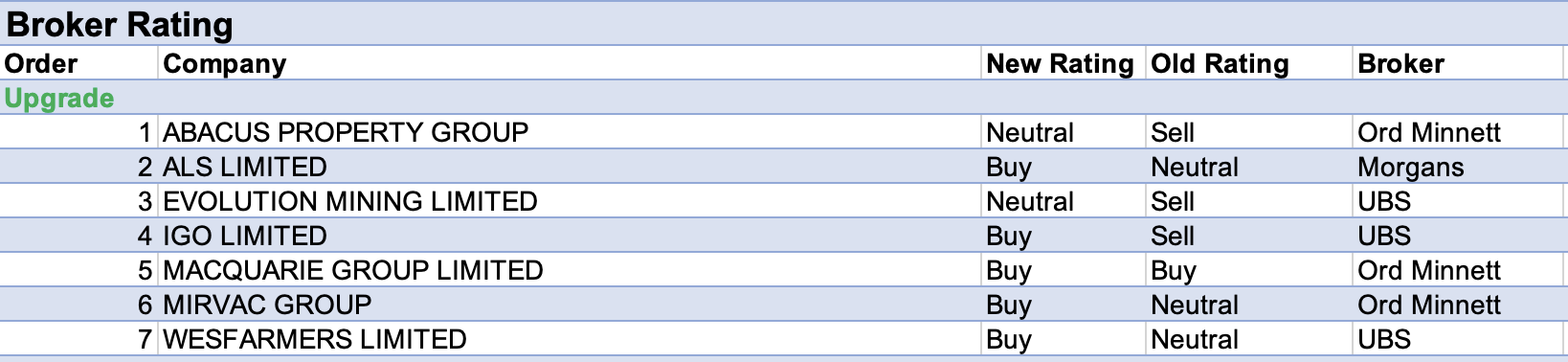

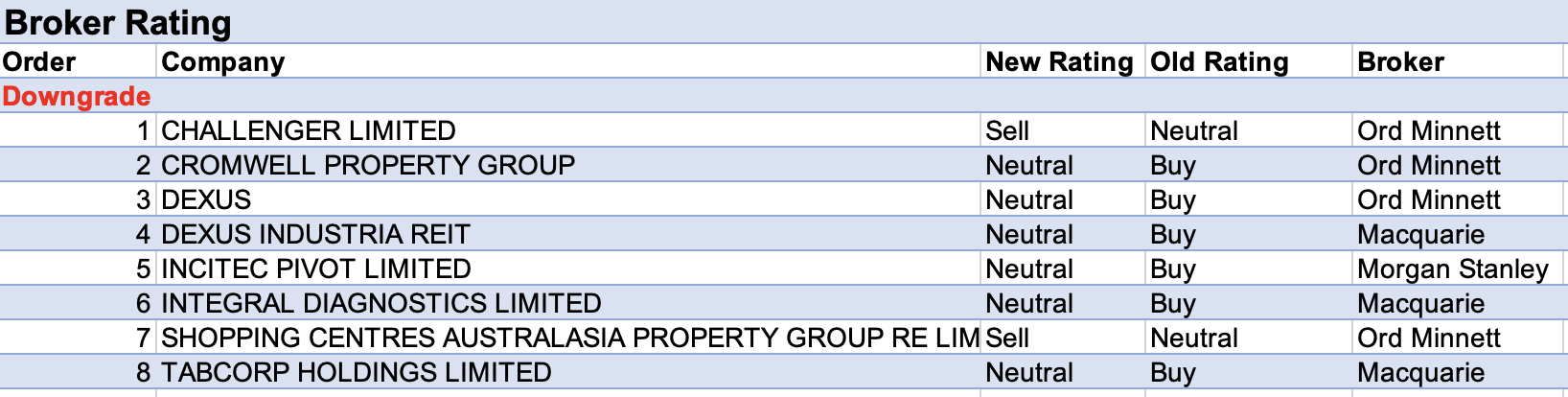

For the week ending Friday May 27 there were 7 upgrades and 8 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Following the demerger of The Lottery Corp, brokers last week were busy removing forecasts for the Lotteries & Keno spin-off from financial models for Tabcorp. Thus, it was not surprising to see the company atop the tables for the largest percentage reduction in target price, and the largest percentage fall in forecast earnings by brokers last week.

Tabcorp is now a wagering, media and gaming business, and while the stock price is initially trading below expectations Credit Suisse maintained its Outperform rating and has faith in a potential transformation.

On the other hand, Macquarie was less sanguine and downgraded its rating to Neutral from Outperform in the belief investors will be cautious around structural challenges. It’s thought additional capital may be required for license renewals and the WA TAB tender.

Nonetheless, the broker is hopeful a covid recovery will drive near-term growth and earnings will stabilise in FY23 prior to attaining 2% long-term annual growth.

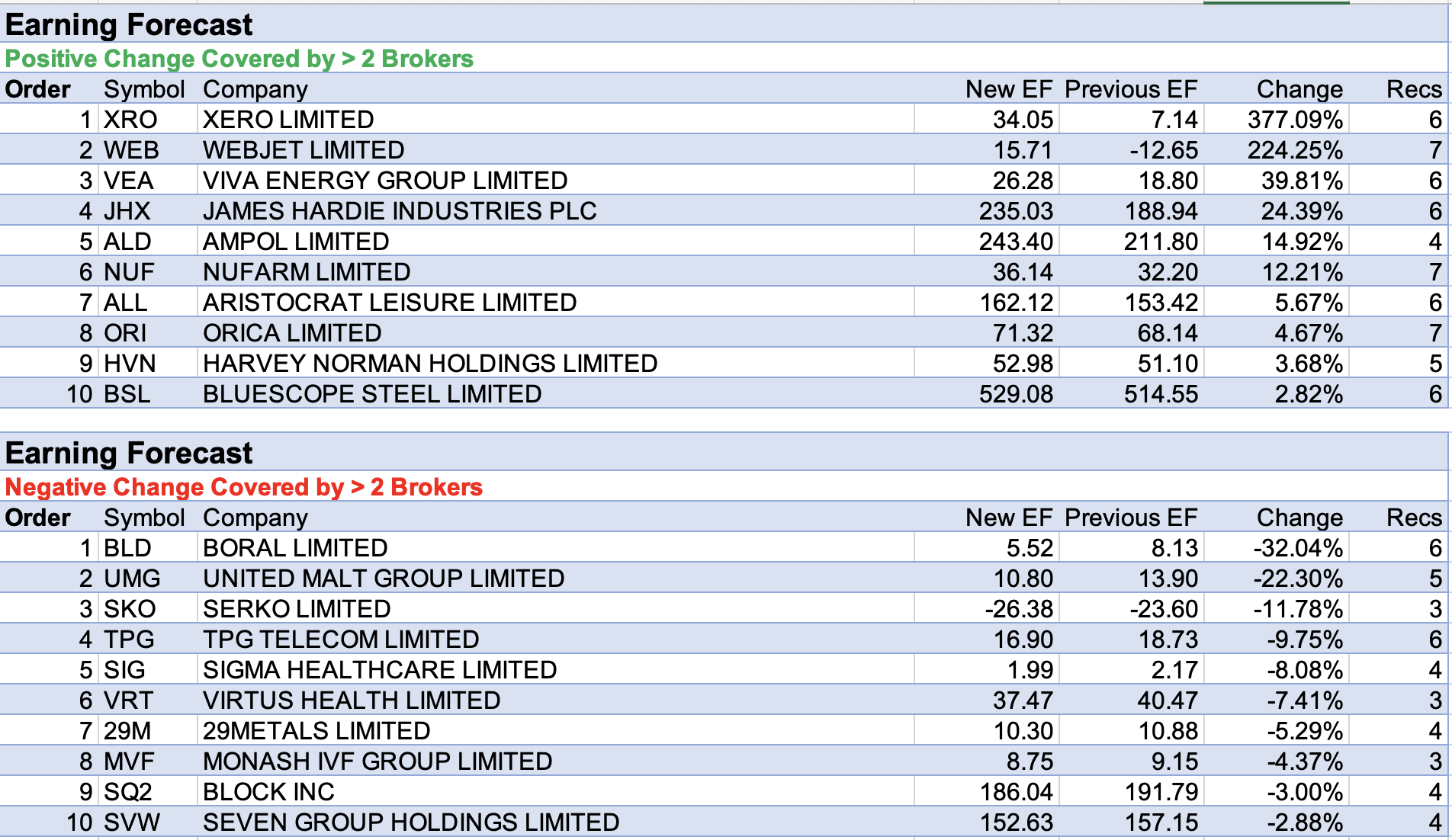

Following the release of FY22 results in the prior week, brokers continued to update forecasts for Webjet, and the company topped the list for the largest percentage increase in forecast earnings last week. Morgan Stanley’s FY24 estimates are above 2019 levels and incorporate market share gains that management has referenced.

Citi pointed out in last week’s article that the key metric for Webjet in the current environment is revenue, which was slightly ahead of the consensus expectation. Meanwhile, UBS noted all the company’s businesses were profitable in April, and May profitability is expected to be significantly higher versus April.

Next on the earnings table was Superloop, following a trading update that showed strong organic sales momentum in the core business, according to Morgans. In addition, earnings accretion is expected in FY23 from the acquisition of Melbourne-based white-label platform and managed service company Acurus.

While FY22 results were in-line with prior guidance, ALS had the third-largest percentage increase in forecast earnings, ousting Serko from that position on the table below, following a data glitch.

Despite few surprises in the result, Morgans believed shares were looking cheap and upgraded its rating to Buy from Hold. Organic revenue growth in Life Sciences and a strong outlook for volumes were considered highlights of the result.

Morgan Stanley assessed inflationary pressures are being handled well and management continues to target margin expansion via increased pricing (especially in Commodities) and procurement savings.

After a halving of share price in the last nine months, Nanosonics received forecast earnings upgrades from Morgans. As part of a trading update, management now expects the consensus estimate for FY22 revenue will be met.

The transition to a direct sales model with GE is on-track, according to the Add-rated broker. The company has expanded its sales and clinical applications team to meet an end-of-June transition completion date.

Total Buy recommendations take up 60.07% of the total, versus 33.41% on Neutral/Hold, while Sell ratings account for the remaining 6.52%.

In the good books

ABACUS PROPERTY GROUP (ABP) was upgraded to Hold from Lighten by Ord Minnett, B/H/S: 2/2/0

Ord Minnett sees emerging value in the REIT sector due to a stabilisation of long-term bond yields and moderating market cash rate assumptions over the past few weeks.

The broker upgrades its rating for Abacus Property to Hold from Lighten on relative valuation grounds after outperformance in 2022. The $3.20 price target is unchanged.

ALS LIMITED (ALQ) was upgraded to Add from Hold by Morgans, B/H/S: 3/3/0

Morgans believes ALS looks cheap on recent share price weakness and upgrades its rating to Add from Hold following a FY22 result that contained few surprises. Underlying profit met the upper end of the guidance range and was in line with the consensus estimate.

A highlight for the analyst was 13.4% organic revenue growth in Life Sciences and a strong outlook for volumes.

Overall, while inflation pressures were offset by price rises and strong volume leverage via additional capacity, the broker expects margin contraction in FY23. Target rises to $14.38 from $13.57.

MIRVAC GROUP (MGR) was upgraded to Accumulate from Hold by Ord Minnett, B/H/S: 4/1/0

Ord Minnett sees emerging value in the REIT sector due to a stabilisation of long-term bond yields and moderating market cash rate assumptions over the past few weeks.

In looking at large-cap relativities, the broker now prefers Mirvac Group (upgraded to Accumulate from Hold) over Dexus (DXS), which is downgraded to Hold from Buy.

The target price for Mirvac Group slips to $2.50 from $2.60.

MACQUARIE GROUP LIMITED (MQG) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 3/2/1

Following recent results for the major banks, Ord Minnett revises its interest rate forecasts and increases its EPS estimates, despite higher cost inflation and the potential for normalisation of impairments over FY23 and FY24.

Net interest margins (NIM) stabilised in the 2Q, lending more confidence to guided 2H increases for NIMs, explains the analyst. Of the four majors, CommBank (CBA) is estimated to have the greatest interest rate leverage.

Outside of the majors, Ord Minnett upgrades its rating for Macquarie Group to Buy from Accumulate on valuation grounds and retains its $218 price target.

In the not-so-good books

CROMWELL PROPERTY GROUP (CMW) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 0/2/0

Ord Minnett sees emerging value in the REIT sector due to a stabilisation of long-term bond yields and moderating market cash rate assumptions over the past few weeks.

Nonetheless, the broker downgrades its rating for Cromwell Property to Hold from Buy on relative valuation grounds after recent underperformance and reduces the target to $0.85 from $0.95.

DEXUS (DXS) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 2/2/0

Ord Minnett sees emerging value in the REIT sector due to a stabilisation of long-term bond yields and moderating market cash rate assumptions over the past few weeks.

In looking at large-cap relativities, the broker downgrades its rating for Dexus to Hold from Buy and now prefers Mirvac Group (MGR), which is upgraded to Accumulate from Hold.

The target price for Dexus also falls to $12.00 from $12.50.

SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP RE LIMITED (SCP) was downgraded to Lighten from Hold by Ord Minnett, B/H/S: 0/3/0

Ord Minnett sees emerging value in the REIT sector due to a stabilisation of long-term bond yields and moderating market cash rate assumptions over the past few weeks.

Nonetheless, the broker downgrades its rating for Shopping Centres Australasia Property to Lighten from Hold on relative valuation grounds after recent underperformance. The $3.00 target price is unchanged.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.