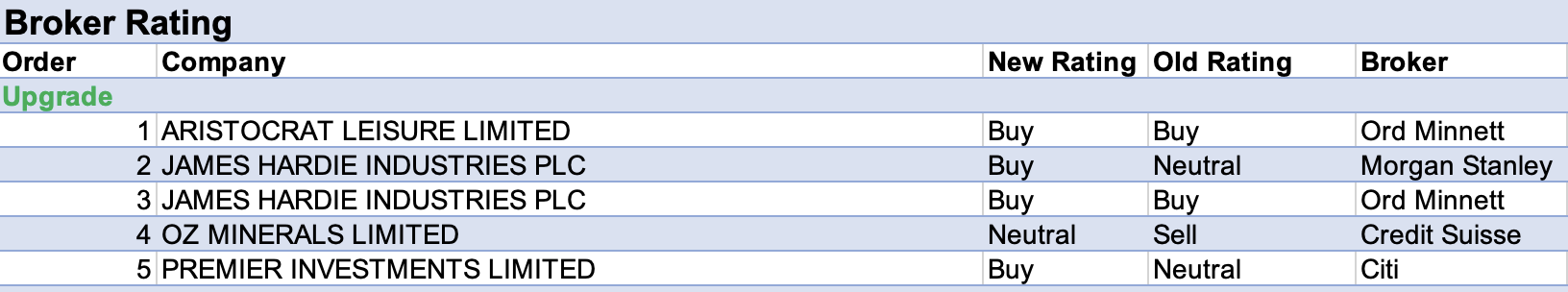

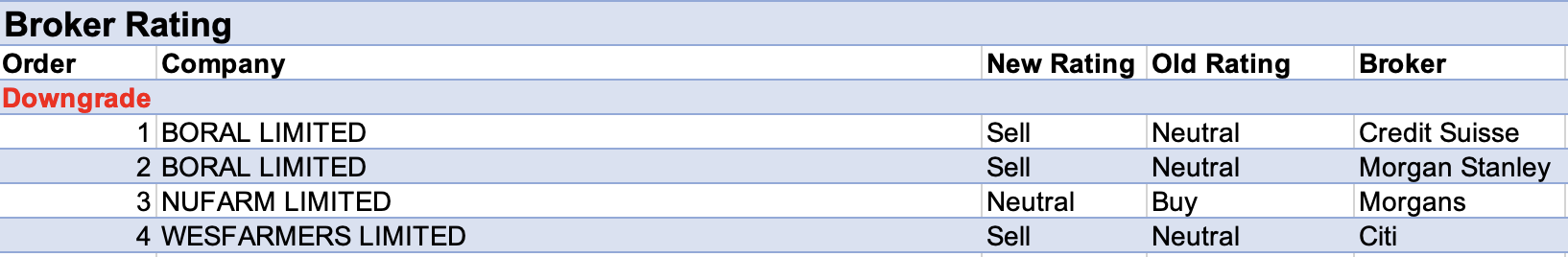

For the week ending Friday May 20 there were 5 upgrades and 4 downgrades to ASX-listed companies covered by brokers in the FNArena database.

As Boral received two downgrades from separate brokers last week, it was unsurprising to see the company heading up the table for the largest percentage decrease in target price set by brokers, as well as the largest percentage downgrade to forecast earnings.

Following management’s -$45m downgrade to full-year earnings guidance (excluding Property), Credit Suisse decreased its target price to $2.60 from $3.80 and lowered its rating to Underperform from Neutral.

The broker attributed two-thirds of the downgrade to the impact of eastern states’ rainfall, while the balance resulted from elevated energy costs. Its estimated gross energy costs could increase a further $70m in FY23 and realised prices are unlikely to provide a full offset.

In a similar vein, Morgan Stanley noted cost issues may persist for some time and was disappointed by the lack of price offset. Management also flagged transformation program benefits would be lower than prior FY22 guidance by -$15-25m, though the $200m benefit target is unchanged. The broker cut its rating to Underweight from Equal-weight and reduced its target to $2.80 from $3.20.

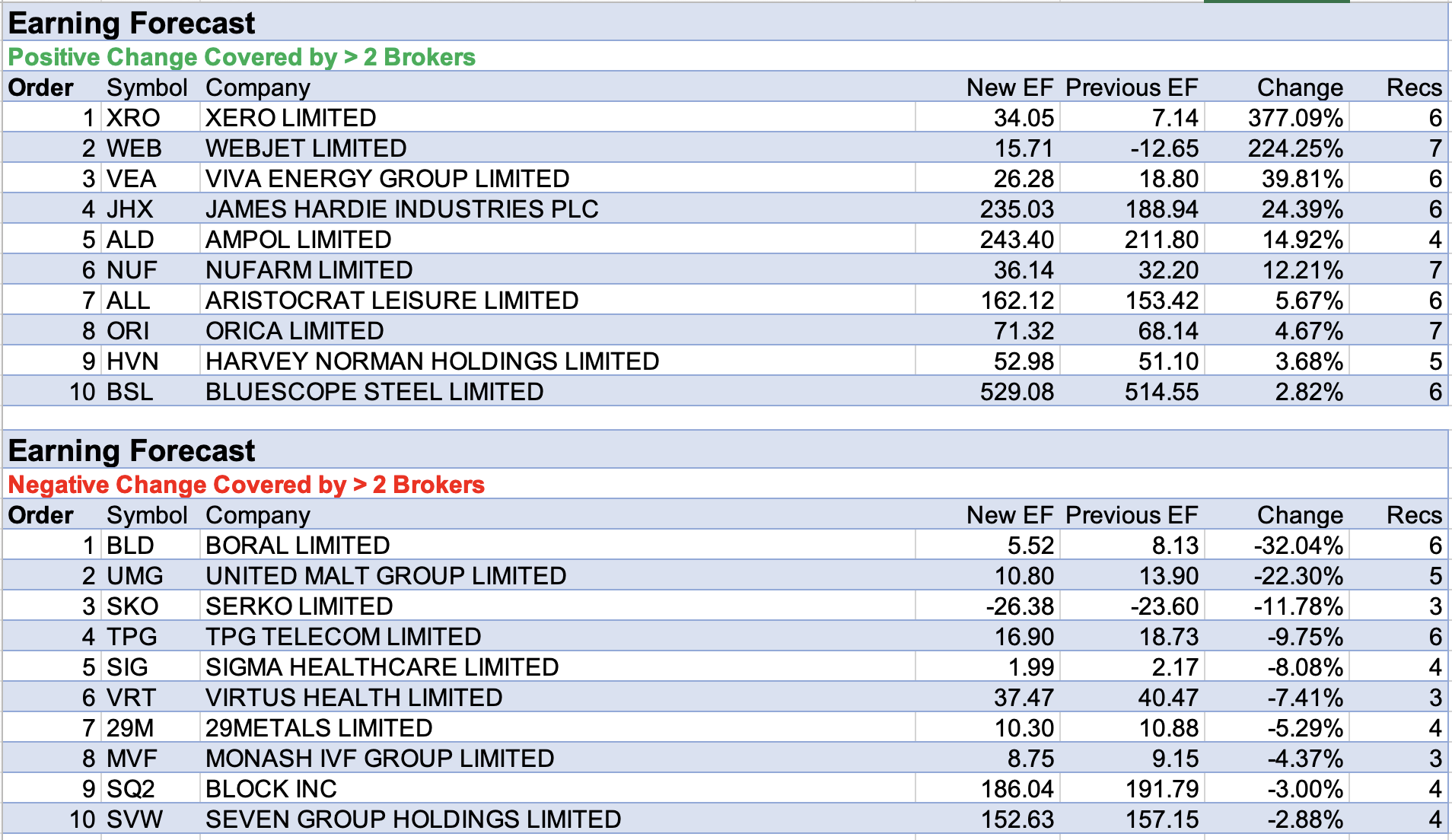

Coming second on the table for the largest percentage decrease in earnings forecasts was United Malt Group, after the release of first-half results.

First-half profit of $10m was bang on Macquarie’s estimate though a miss versus the consensus forecast of $13m, and the broker reduced its FY22 EPS forecast by around -7% to incorporate a higher-than-expected tax rate. Nonetheless, Management reiterated FY22 earnings guidance and remains confident in the outlook after FY22.

Morgans also downgraded it profit estimates due to the higher-than-expected rate of taxation and was troubled by a lack of catalysts on the horizon. A Hold rating was maintained due to above-target gearing and near-term earnings risk.

On the flipside, Xero received the largest percentage increase in forecast earnings after brokers further reviewed FY22 results released in the week prior.

Despite lower than anticipated subscriber growth in the second half, 29% full-year revenue growth beat UBS’s expectations. Even so, a lack of cash flow is thought to be a challenge and the broker retained its Sell rating and decreased its target price to $70.00 from $88.00.

Cit correlated lower than expected UK subscriber growth to increased investment by competitor Sage, yet still expects Xero can continue to deliver strong growth in the region. The broker retained its Buy rating and $108 target price.

Following the release of FY22 results. Webjet was next on the list for the largest percentage increase in forecast earnings.

Macquarie noted travel activity continues to recover though revenue and profit margins face headwinds from lagging international travel and travel mix, which is likely to persist in the first half of FY23. Nonetheless, it’s thought the company remains well placed in the medium term, underpinned by strong market share gains and a structurally lower cost base.

Citi pointed out the key metric for Webjet in the current environment is revenue, which was slightly ahead of the consensus expectation, while UBS noted all the company’s businesses were profitable in April, and May profitability is expected to be significantly higher versus April.

Viva Energy Group received forecasts earnings upgrades from Credit Suisse as Australian fuel retailers stand to benefit from exposure to elevated refinery earnings. Demand from Europe and export restrictions from China are expected to support strong refining margins through 2022.

Finally, earnings forecasts were lifted for James Hardie last week. While FY22 profit of US$621m was at the low end of the US$620-630m guidance range, 42% year on year underlying profit growth in the fourth quarter came in ahead of Ord Minnett’s forecast.

In raising its rating to Buy from Accumulate, the broker acknowledged rising interest rates will pressure the company’s PE multiple though low expectations are already factored into the share price. Price rises are also expected to counter some of the rising costs.

Morgan Stanley agreed housing market weakness has been priced-in after a recent share price de-rating, especially given the company’s skew towards the repair and remodel (R&R) markets. The broker upgraded its rating to Overweight from Equal-weight, while the target price was reduced to $51 from $57.

Total Buy recommendations take up 59.90% of the total, versus 33.53% on Neutral/Hold, while Sell ratings account for the remaining 6.58%.

In the good books

ARISTOCRAT LEISURE LIMITED (ALL) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 6/0/0

A solid result across the board from Aristocrat Leisure in its first half has reflected the resilience of the gaming sector according to Ord Minnett, delivering a significant beat to the broker’s underlying net profit forecast with a reported $530.7m compared to an anticipated $386.0m.

The broker highlighted the land-based segment was a major driver with strong year-on-year volume and fee growth but the continuing robust performance from the digital segment should quiet concerns around digital weakness.

The rating is upgraded to Buy from Accumulate and the target price decreases to $46.00 from $49.00.

In the not-so-good books

BORAL LIMITED (BLD) was downgraded to Underweight from Equal-weight by Morgan Stanley and Underperform from Neutral by Credit Suisse, B/H/S: 1/3/2

Morgan Stanley lowers its rating for Boral to Underweight from Equal-weight following another (-$45m) FY22 guidance downgrade, driven by wet weather across Eastern Australia (-$30m) and inflationary impacts.

The broker estimates the cost issues may persist for some time and a lack of price offset is disappointing. Management also flagged transformation program benefits would be lower than prior FY22 guidance by -$15-25m, though the $200m benefit target is unchanged.

The target price falls to $2.80 from $3.20. Industry view: In-Line. The analyst sees better value in the sector via Fletcher Building (FBU).

Credit Suisse notes the -$45m downgrade to Boral’s full-year earnings guidance, excluding Property, is reflective of poor pricing power in the current inflationary environment, with -$30m being attributed to Eastern states rainfall and -$15m to elevated energy costs.

Further, the broker anticipates energy costs will continue to impact in the coming financial year, estimating gross energy costs could increase a further $70m in FY23, while realised prices are unlikely to be able to fully offset.

The rating is downgraded to Underperform from Neutral and the target price decreases to $2.60 from $3.80.

NUFARM LIMITED (NUF) was downgraded to Hold from Add by Morgans, B/H/S: 3/4/0

Despite first-half results for Nufarm coming in at the mid-point of prior guidance, Morgans lowers its rating to Hold from Add. FY23 earnings are thought likely to fall when compared to the exceptional FY22.

As the analyst’s FY23 forecasts are now more reflective of normal operating conditions and price, the target price falls to $6.65 from $7.20. In-line with the company’s growth strategy, solid growth is expected to resume in FY24-26.

The broker suggests there will be material share price upside if Nufarm delivers on its FY26 aspirational targets.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.