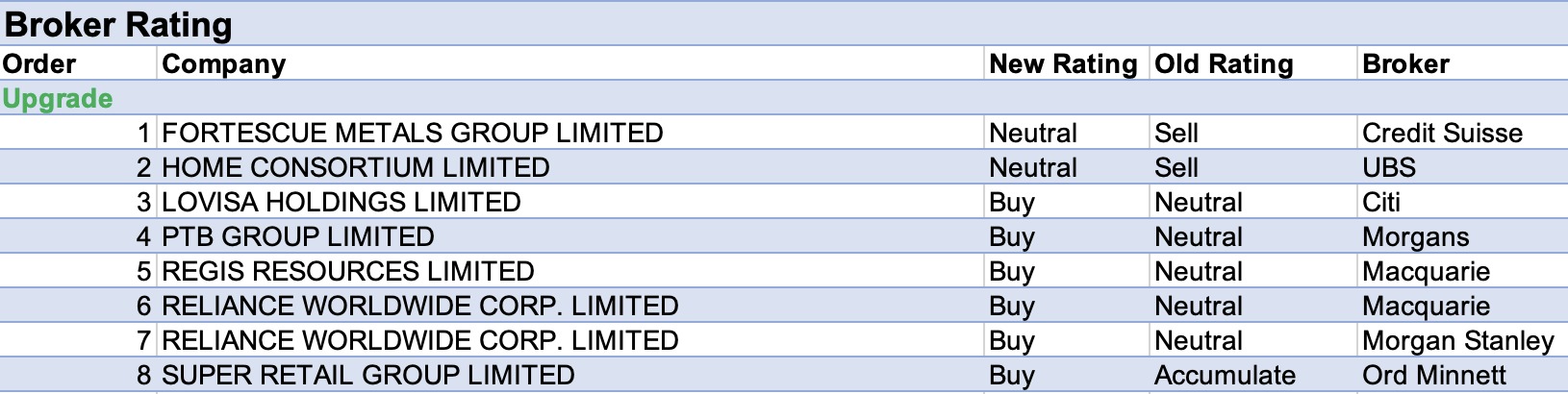

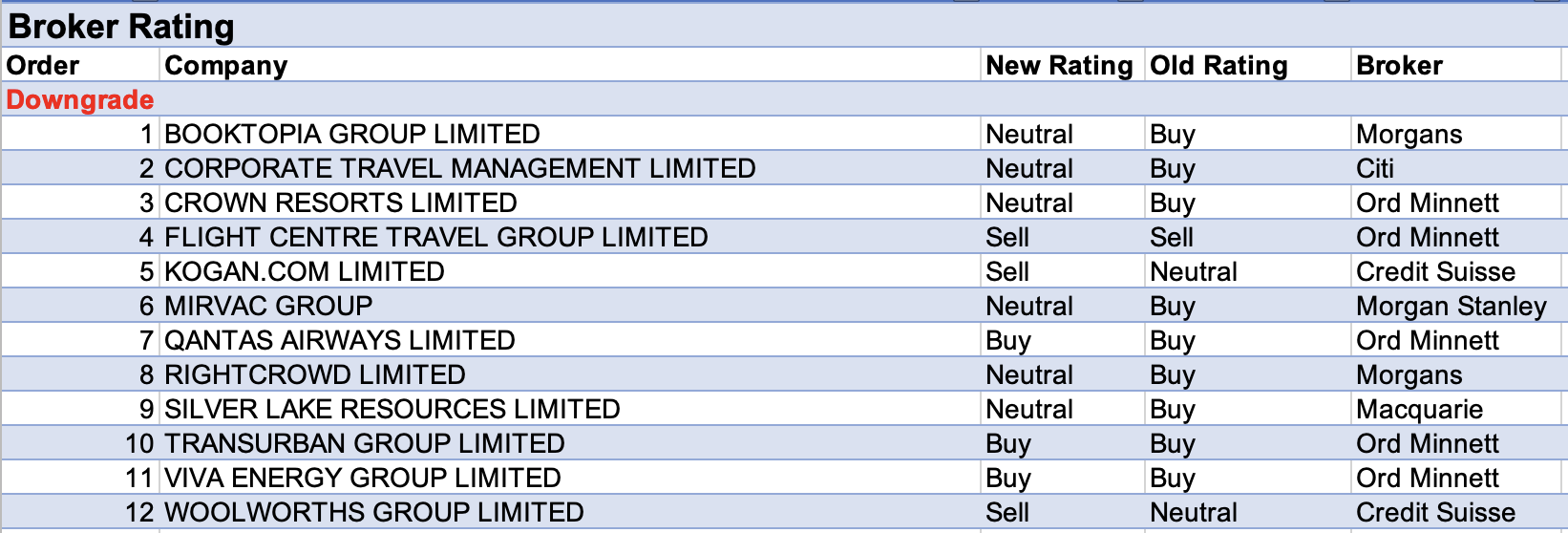

For the week ending Friday May 6 there were 8 upgrades and 12 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Reliance Worldwide received two rating upgrades from separate brokers following a third-quarter trading update. Macquarie noted strong organic revenue in the Americas has now accelerated and upgraded its rating to Outperform from Neutral, given the recent share price retreat.

Morgan Stanley suggested the share price has been unfairly marked down by association with its sector peers and upgraded its rating to Overweight from Equal-weight. The business carries the lowest weighting within the broker’s coverage of the sector to new housing construction and the main repair and renovation exposure should prove more resilient.

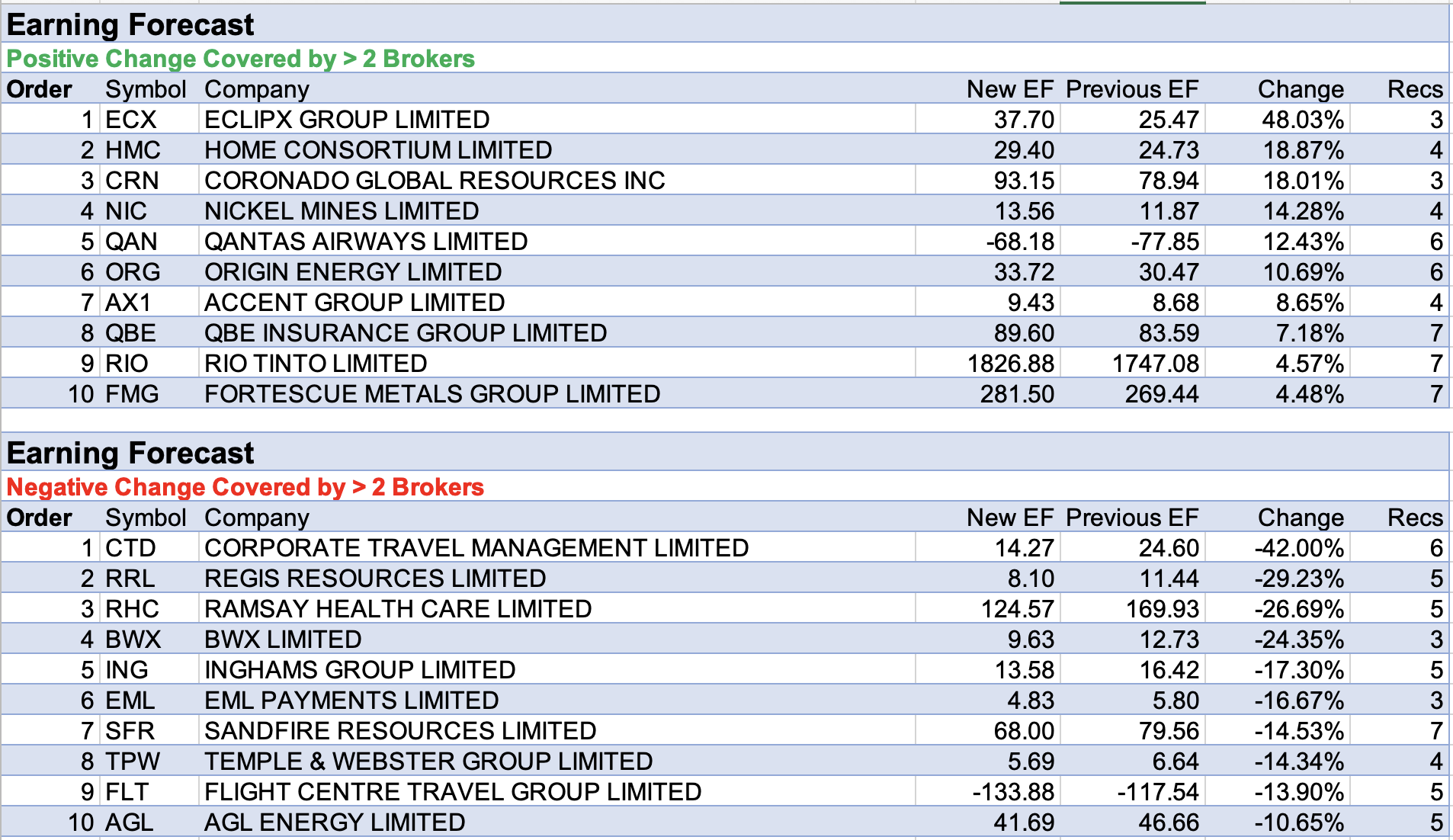

Following first-half results, Eclipx Group topped the table for the largest percentage increase in forecast earnings last week. According to Morgan Stanley, a 32% year-on-year profit increase materially de-risks its FY22 forecast.

Elevated used car prices drove record half-year earnings and strong cash generation, and Credit Suisse noted that while prices will inevitably normalise at some point, they should remain stronger for longer. Also, when the pricing normalisation occurs, it’s thought the company will experience a smoother transition due to organic growth and a strong performance for new business.

Coming second on the table was Home Consortium after UBS upgraded its rating to Neutral from Sell after management advised the market it will raise and deploy the $1.2bn from its capital raising over three years to generate an internal rate of return of 17%.

While UBS considers the strategy plausible, given the company’s recent strong execution, the broker would like to see a better cost of capital among listed REITs before upgrading from its Neutral rating.

Next up was Coronado Global Resources, after Credit Suisse’s commodities team raised its coking coal price forecasts by 11-75% through to 2026. Coal prices are expected to remain elevated in the mid-term as geopolitical conflict and trade flow constraints continue to impact on supply. As Europe and other coal consumers look to move away from Russian supply, a scarcity for high-grade thermal coal should support healthy premiums on Australian exports.

On the flipside, Corporate Travel Management received the largest percentage downgrade to earnings forecasts, as March quarter results missed the consensus forecast. After a strong run for the share price, Citi downgraded its rating to Neutral from Buy. There’s thought to be less upside risk for earnings over the next 12-18 months and management’s earnings guidance is still estimated to be materially short of the consensus forecast.

Despite the major headwind of omicron, Morgan Stanley retained its Overweight rating for the company as the quarterly update demonstrated an earnings recovery into FY23 is on track. Activity in March improved to more than 70% of pre-covid volumes in all regions except Asia, while industry feedback suggests a further recovery is coming.

Regis Resources came second on the earnings downgrade table last week, as March-quarter production and costs disappointed Macquarie, due largely to lower-than-expected grades. While management reiterated production guidance, the analyst thinks the Duketon gold project in Western Australia will have to deliver a strong performance for that to happen.

Nonetheless, the broker upgraded its rating to Outperform from Neutral, to reflect the maintained guidance and management’s view that a plant upgrade and underground mines will deliver a much stronger June quarter.

Ramsay Health Care also suffered a fall in forecast earnings by brokers following a third-quarter trading update. Credit Suisse was surprised by the extent to which earnings were impacted by covid, while Morgans noted the company still faces numerous headwinds including staff shortages, surgical restrictions, cancellations, inflationary pressures and covid-related costs.

Nonetheless, Macquarie pointed out the rationale for the $88/share bid (by a consortium led by KKR) probably lies in a favourable outlook for Australian hospital volumes over the medium to longer term. In addition, the unrealised value residing within the company’s Australian property portfolio is undoubtedly an attraction.

Meanwhile, Citi described BWX’s market update as underwhelming. The company offered weaker than anticipated full-year guidance, with the mid-point of revenue and earnings guidance a -17% and -24% miss on the broker’s forecasts.

UBS was also disappointed by management’s downgraded guidance though managed to find a positive in that Sukin and Mineral Fusion, which combined represent 56% of FY22 forecast revenues, are performing in-line with expectations.

Finally, at a conference hosted by Macquarie, Inghams Group presented a range of woes in a third-quarter trading update including war, pestilence, fires and floods which have combined to keep chook-feed costs elevated.

The analyst at Morgans poses the question: to what extent will price rises and the company’s continuous improvement program offset ongoing headwinds? Given the near-term earnings uncertainty, particularly around grain prices, the broker retained its Hold rating.

Total Buy recommendations take up 59.57% of the total, versus 34.22% on Neutral/Hold, while Sell ratings account for the remaining 6.21%.

In the good books

FORTESCUE METALS GROUP LIMITED (FMG)was upgraded to Neutral from Underperform by Credit Suisse, B/H/S: 0/5/2

Credit Suisse’s commodities team expects coal and iron ore prices will remain elevated in the mid-term as geopolitical conflict and trade flow constraints continue to impact on supply. Low output from iron ore majors have driven a global market iron ore deficit, while an energy crisis is emerging in Europe as coal consumers look to move away from Russian supply.

Upgrades to the broker’s commodity price deck saw Fortescue Metals’ earnings forecasts lift 11% and 66% in FY22 and FY23, with the broker estimating the company’s price realisation has improved to 75% and anticipating further improvement to 80% in FY23.

The rating is upgraded to Neutral from Underperform and the target price increases to $20.00 from $15.00.

HOME CONSORTIUM LIMITED (HMC) was upgraded to Neutral from Sell by UBS, B/H/S: 2/2/0

UBS upgrades HMC Capital to Neutral from Sell after management advised the market it will raise and deploy the $1.2bn from its capital raising over three years to generate an internal rate of return of 17%.

Given the company’s recent strong execution (a year UBS doubts will be repeated), the broker considers the strategy plausible, but would want to see a better cost of capital among listed REITs before committing to a higher rating.

Target price rises to $6.34 from $5.40.

LOVISA HOLDINGS LIMITED (LOV) was upgraded to Buy from Neutral by Citi, B/H/S: 5/0/0

Lovisa Holdings’ latest market update has demonstrated continued strong sales growth despite global supply constraints, although Citi anticipates growth to moderate over the coming months and forecasts sales growth of 45% over the second half.

New store rollout has been slower than expected, with 17 stores to date in the second half. Given the company had guided to a second-half rollout in line with the first half, the four stores per month in the second half compared to 7 per month in the first half has disappointed.

The Buy rating is retained and the target price decreases to $20.40 from $21.45.

PTB GROUP LIMITED (PTB) was upgraded to Add from Hold by Morgans, B/H/S: 1/0/0

Morgans upgrades its rating for PTB Group to Add from Hold as management’s upgraded FY22 profit guidance implies a 23% improvement in performance over 1H22. Improved performance at PT USA was cited as the primary growth driver.

Relatively speaking the US operations are much larger than those in Australia, and the analyst believes more opportunities will be sought out in the US. The target price rises to $1.51 from $1.23 due to the stronger revenue growth and expectations of more to follow.

RELIANCE WORLDWIDE CORP. LIMITED (RWC) was upgraded to Overweight from Equal-weight by Morgan Stanley, B/H/S: 6/0/1

Morgan Stanley believes the Reliance Worldwide share price has been unfairly marked down by association with peers. It’s noted the business carries the lowest weighting within the broker’s coverage of the sector to new housing construction.

The company’s main repair and renovation exposure should prove much more resilient, in the analyst’s opinion, in the face of rising mortgage rates.The broker raises its rating to Overweight from Equal-weight.

The price target rises to $5.40 from $5.30 after Morgan Stanley incorporates earnings forecast upgrades following a 3Q trading update by the company. Industry view: In-Line.

In the not-so-good books

FLIGHT CENTRE TRAVEL GROUP LIMITED (FLT) was downgraded to Sell from Lighten by Ord Minnett, B/H/S: 0/3/2

Flight Centre Travel’s March-quarter loss guidance does not appear to have surprised Ord Minnett, the broker noting Outbound Travel to Aussie consumers has always been where the money has been generated.

The broker sheets the market’s disappointment back to over-excitement about the reopening theme.

Meanwhile, Flight Centre hinted revenue margins could be lower for some time due to a reduction in front-end air commissions as airlines revisit low-yielding fares. Ord Minnett considers news of labour shortages problematic given it suggests the company may have to fork out for higher wages, hitting margins.

Rating downgraded to Sell from Lighten. Price target eases to $14.28 from $14.40.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.