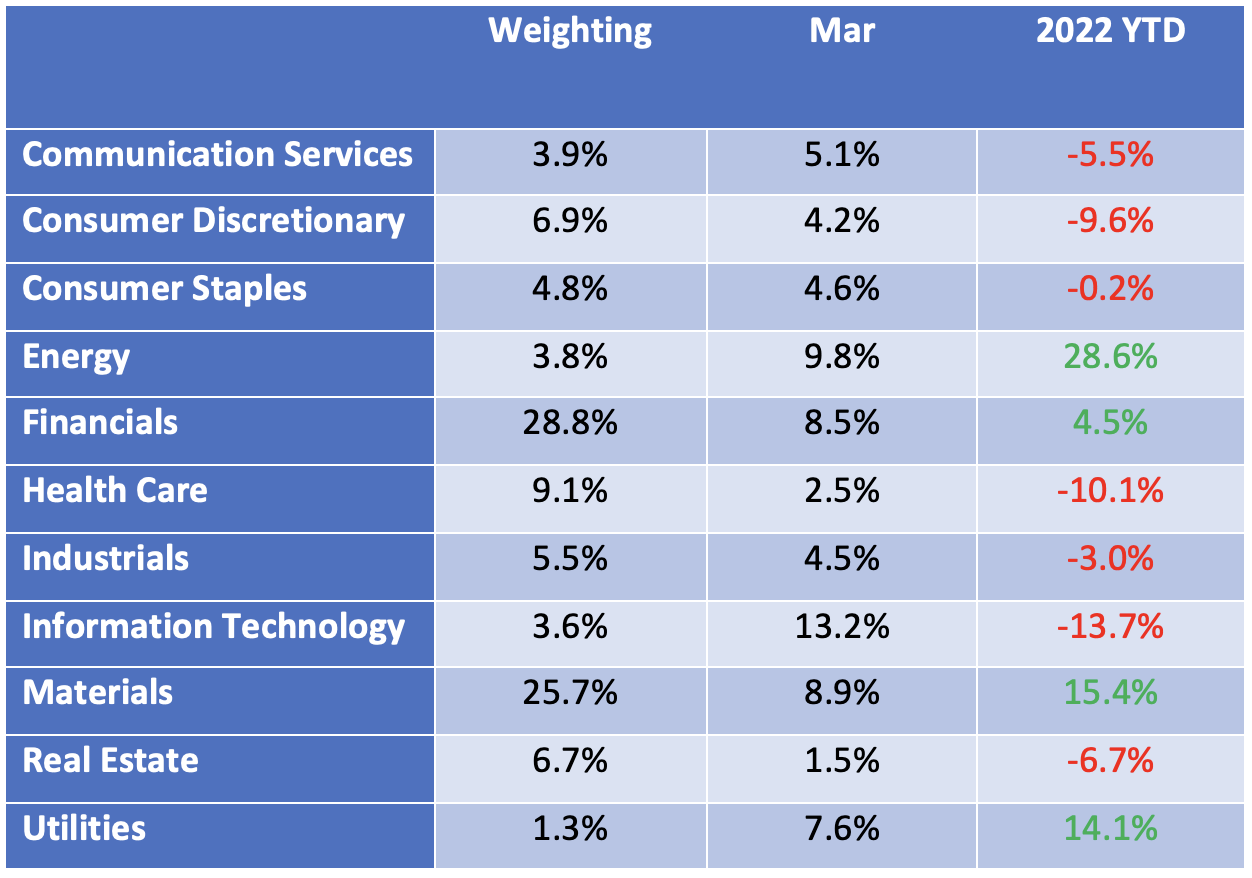

The tech sector continues to be the worst-performing sector on the ASX. At the end of March, it showed a year to date loss of 13.7%. The biggest ASX sector, financials, which has a weighting of almost 29% of the S&P/ASX 200 index, was showing a positive return of 4.5%. Not surprisingly, energy and materials led the way with double-digit returns.

ASX Sector Performance to 31 March

But with bond rates rising again in April, the tech sector has moved back into the red. By the close of business on Tuesday, it had lost another 5.2% taking cumulative losses to 18.2% in 2022.

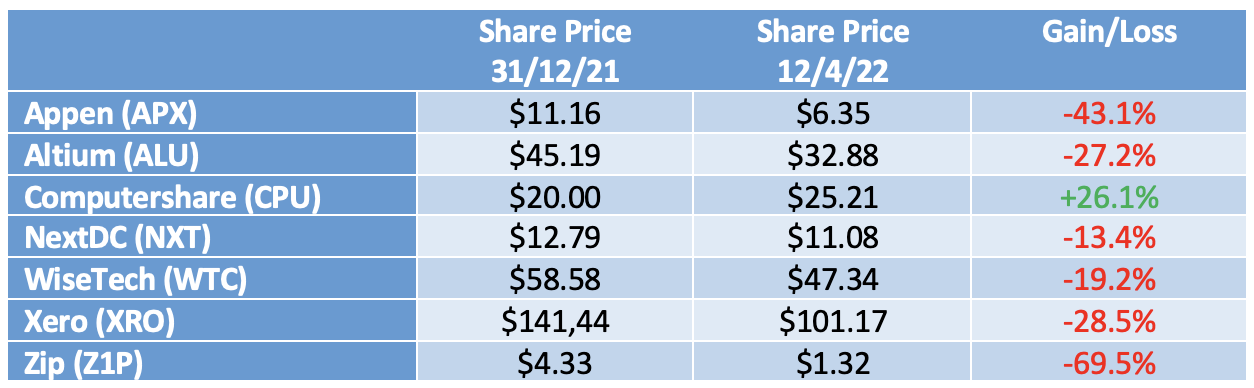

The pain has not been even. Some tech stocks, particularly in the payments space, have been savaged. Zip (Z1P), for example, has shed almost 70%. On the other hand, global registry and transfer services provider Computershare, which is a winner from higher rates because it earns a margin on clients’ funds, has seen its share price rise by 26% this year.

Performance of Leading Tech Companies in 2022

Higher bond yields hurt tech stocks because more of their earnings are “into the future”. While share prices are ultimately determined by buyers and sellers, they are considered as an input to their purchasing or selling decisions and company valuations. Theoretically at least, a share price is the present-day value of a company’s future profits.

Most tech stocks are not profitable, or where they can be, choose to re-invest aggressively into the business so that their present-day profits are low. They hope to make big profits one day. When valued, these profits into the future are typically discounted by applying the bond rate. For example, a profit in 5 years’ time is discounted by the 5-year bond rate to bring it back to “today’s dollars”.

While all companies are valued on the same basis, established companies tend to have more of their profits in the short to medium term (they are growing, but slowly), whereas tech and other high growth companies have more of their profits into the future. When bond rates rise and discount rates increase, this has a bigger negative impact on the valuation of tech and other growth companies compared to established, low growth companies.

Fortunately for our tech stocks, it looks like the rise in US bond rates may have paused. While Tuesday’s headline inflation reading of 8.5% in the US was a new 40-year high, the core inflation for the month of 0.3% was better than the expected outcome of 0.5%. The annual core rate, which excludes food and energy, came in at 6.5%. As a result, US bond yields pulled back, with the 10-year rate falling to 2.72%.

Quoting Andrew Hunter from Capital Economics, CNBC reported: “The big news in the March report was that core price pressures finally appear to be moderating.” Hunter said he thinks the March increase will “mark the peak” for inflation as year-over-year comparisons drive the numbers lower and energy prices subside.

The rise in bond rates has been rapid, with the last half of one per cent coming in not much more than one week following confirmation that QT (quantitative tightening) was firmly on the agenda with the US Federal Reserve. Suggestions that the Fed could reduce its balance sheet each month by US$95 billion (initially by letting bonds mature and not re-investing, then also by selling bonds) scared US bond investors, The Australian bond market followed suit, with our 10-year bond rate rising above 3.0%. Only a few months back, the Reserve Bank was acting in the market to keep the 3-year bond rate at 0.10% – today it sits closer to 2.5%.

But the news on US core inflation is encouraging. The bond market rout has been driven by the rise in inflation, so any signs of stabilisation will be seen as a positive. Of course, one month’s figures aren’t enough by themselves – but they are a step in the right direction.

And the technology sector is not going to turn around just because bond rates could be stabilizing. There has been a genuine rotation out of tech into other sectors, with some investors incurring heavy losses. But there will be “bargain hunters” and others looking to play the “long game”.

So where do you look? While the most “beaten-up” can look attractive, I would stick with the majors. The market always buys “quality” first. In that category, I would include names such as Xero, NextDC and potentially Altium and WiseTech.

Here is what the major broking analysts have to say about the potential upside (or downside) of some of the leading stocks (that is, their 12-month target price compared to the current ASX price).

Leading Tech Companies – Broker Consensus Target Prices

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.