There’s an old saying that I resurrect and look at its relevance nearly every year that goes like this: “Sell in May and go away, come back on St. Leger’s Day.” However, this year I reckon we should tweak it, and instead say: “Buy before May and stay!”

I argue that even though we are set to face a May federal election, which some pundits say is not good for stocks. But are they right?

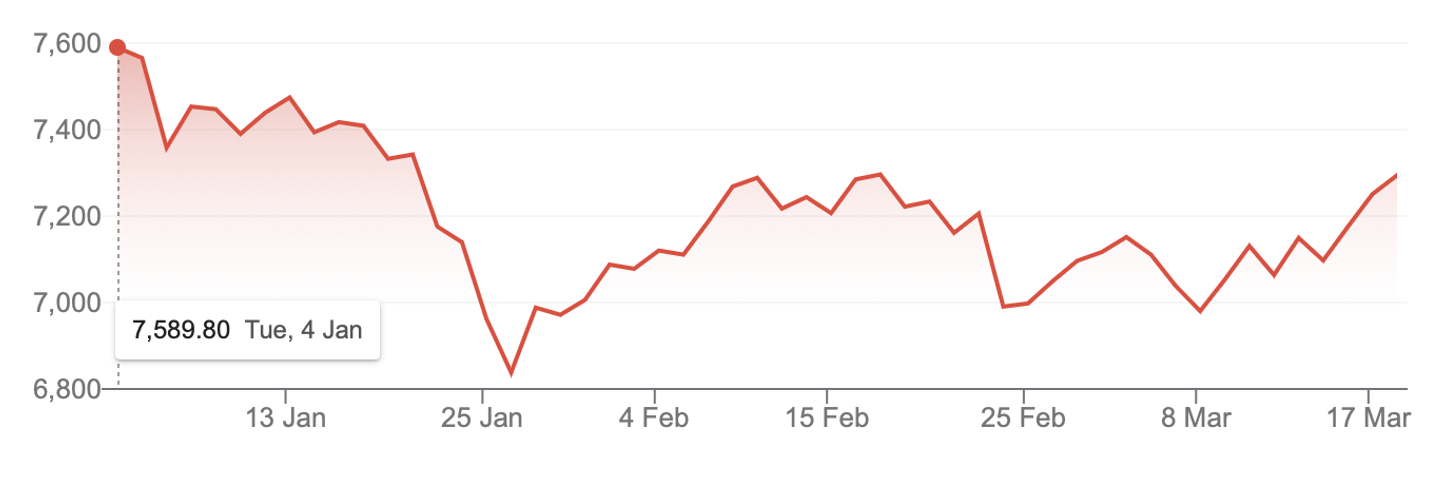

This chart shows what the early year of trading has been like and I suggest that what we see is not great or historically consistent with most years.

S&P/ASX 200 year-to-date

The S&P/ASX 200 Index is down 4%, while the S&P 500 is off 7% after rebounding 6.2% last week alone. Our market came back 3.27% over the week but it has been a negative start to the year, which isn’t usual, as the graph below shows. After analysis of the markets over a 14 year period, the average half-year returns from November to April for 37 markets is 10.96%. Meanwhile, for May to October, the return is only 0.95%. However, this year for a variety of reasons (big inflation out of the pandemic, historically-low interest rates which now need to rise, and Vladimir Putin) stocks have been negative when they are usually positive.

Even on a November-to-now basis, our market is down about 76 points or less than 1%, and I wouldn’t be surprised if over the full November-April period we end up a fair bit higher, especially if a Ukraine war solution can show up ASAP.

Source: CNBC

Interestingly, in a video address, Ukrainian President Volodymyr Zelensky called for meaningful peace talks with the Kremlin, saying it’s the “only chance for Russia to reduce the damage from its own mistakes”.

This kind of talk and Jerome Powell’s messages after the Fed did its first rate rise of the year, all helped the major US stock market averages finish with their best week since November 2020. The S&P 500 rose a big 6.1%, the Dow ended the week 5.5% higher, and the tech-heavy Nasdaq Composite was up a huge 8.1%.

Do you think we’re seeing a change of sentiment? And given a stock market is known for being a great anticipator of our economic future, these are all good and positive signs.

On Friday, US-based Goldman Sachs’ Chris Hussey argued that the market is looking ahead to brighter days and that’s why it’s bouncing. “If the pandemic reminded investors of anything, stock markets are very forward-looking, and can have the penchant to discount a very different environment, far before we experience it,” he said in a note on Friday and reported by CNBC. He suggested five reasons the market performed so well this week, despite the biggest issues in the market still being unresolved:

- People have learned to live with Covid.

- The Fed’s aggressive plan will lower inflation.

- Oil prices peaking.

- US growth is strong.

- Geopolitical risks may fade.

They are the issues facing global stock markets but we have an extra headwind, which is the upcoming election likely held in May.

Elio D’Amato, executive director and a fund manager at Lincoln Indicators, penned a piece for the AFR before the 2019 election, which was thought to be a shoo-in for Labor’s Bill Shorten — but the result eventually went to Scott Morrison’s Coalition team.

Shorten had a lot of perceived anti-business and anti-retiree policies so they should have hurt the stock market ahead of the May 19 poll but stocks actually rose!

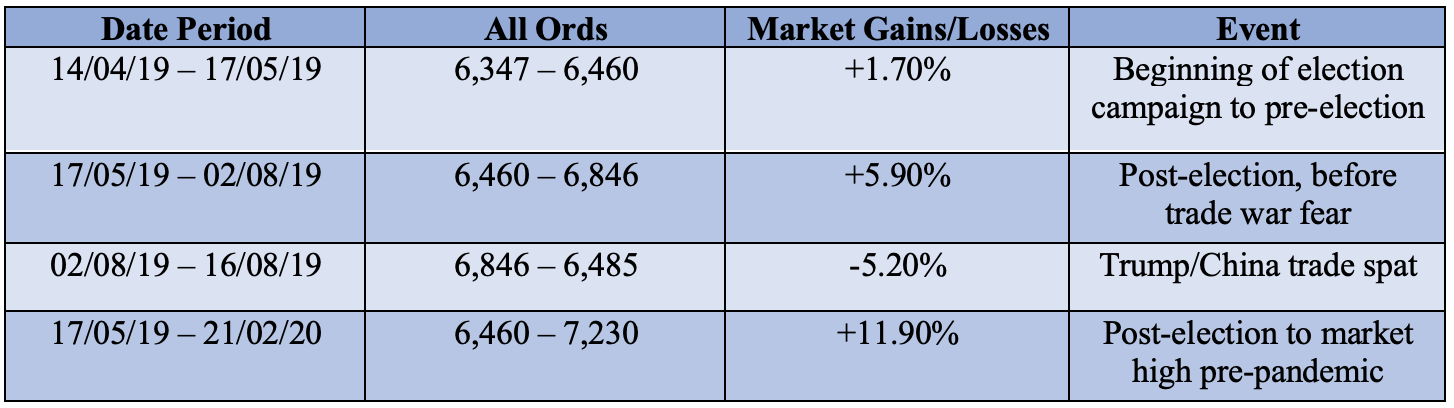

This table shows ahead of the 2019 election the stock market was rising 1.7%. After the election, it spiked 5.9% until President Trump ripped into China over currency manipulation. This led to further trade ban arguments, which took stocks down 5.2%. However, the market went strongly positive until February when the pandemic was declared, with a rise of 11.9%!

All Ords 5 years

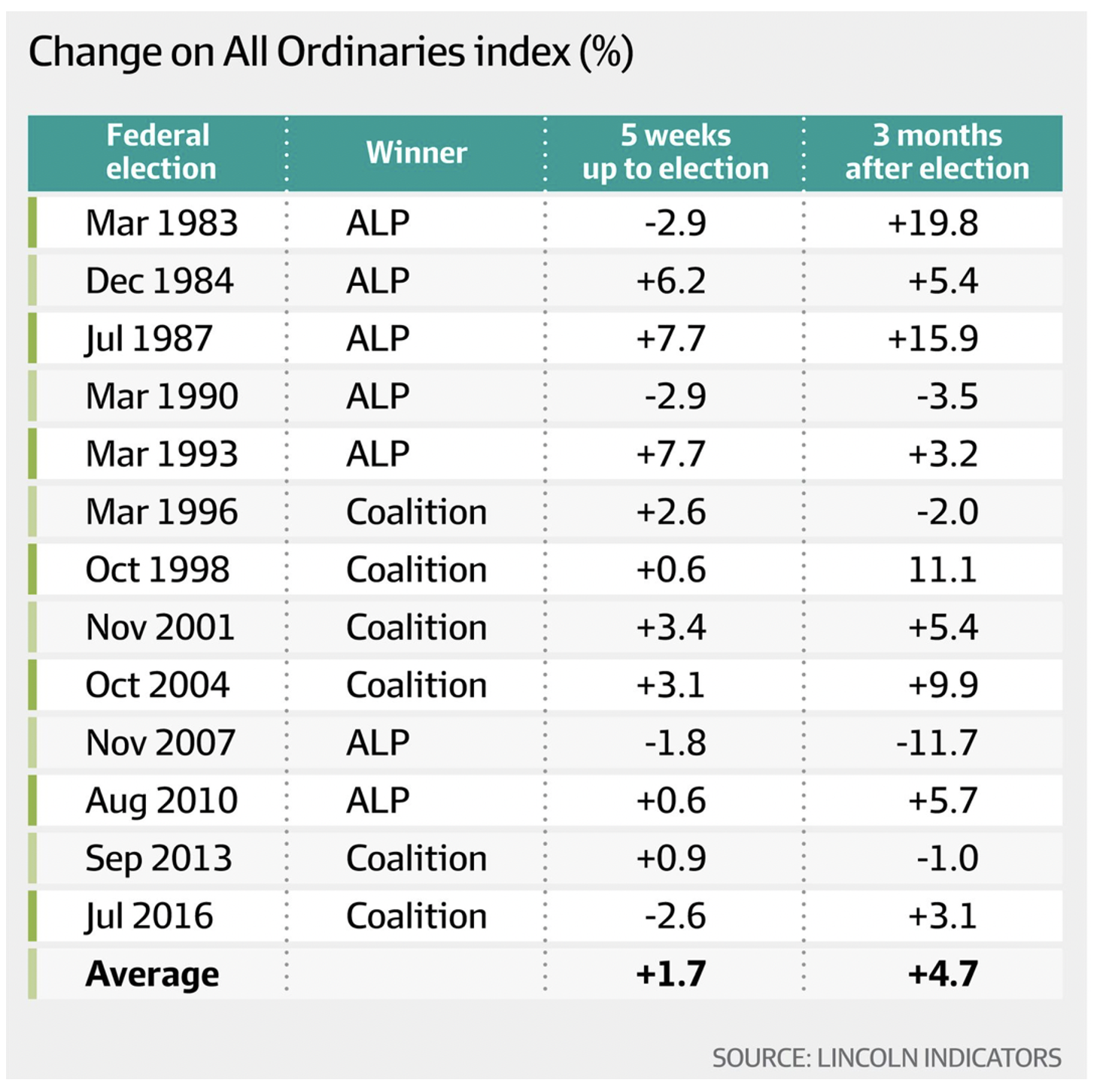

But this should not be a surprise, as D’Amato pointed out: “In the 13 elections since 1983, the average return of the market during the five-week campaigns leading to election day is +1.7 per cent. After the result, history tells us that the returns can improve, with the average return of the All Ordinaries +4.7 per cent for the three months post-election day. This would suggest that the stimulatory commitments made to woo voters flow through to a more optimistic market, as businesses tend to benefit both directly and indirectly through a happier consumer.”

The table below shows what he is basing his views on.

“Drilling into the numbers a little deeper, there have only been eight out of the 26 periods (31 per cent) where returns were negative. Most recently was before the last election where the market fell 2.6 per cent over the five weeks, but rebounded in the months afterwards,” D’Amato pointed out.

Sure, a lot can still go wrong this year, with China and its Covid problems not helping our supply chain inflation challenges. And then there are BA.2 issues that will have to be dealt with. That said, there’s a huge bank of demand from consumers and businesses eager to lash out and take their lives and profits back to pre-pandemic levels.

I’m investing now on the basis that I could be wrong being positive too early, but I reckon by year’s end I’ll be glad I bought in May and stayed.

P.S. Another positive omen was the bounceback in tech last week. Afterpay’s new owner — Block — was up 40.6% last week and PayPal was up 23.72%. Could tech and payment companies be set for a rerating? I hope so!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.