In 1921, Australia’s Total Fertility Rate (TFR) was 3.1 babies per woman. That rose after the Second World War and peaked at 3.5 babies per woman in 1961.

By 1976, our fertility rate had fallen below the population-replacement rate. Economic and social change saw the rate steadily decline to 1.65 babies per woman in 2020.

I highlight this trend for two reasons. First, to show that predictions about a ‘baby boom’ during Covid are overstated. There might be a temporary spike in pregnancies in some states, but the long-term fertility trend in Australia continues to edge lower.

Second, to reinforce that the population growth matters more for companies such as Baby Bunting and childcare operator G8 Education.

In NSW, population growth meant the number of annual births each year was steady at 98-99,000 over the past five years, found the NSW Government’s 2021 Intergenerational Report (on fertility project). That was despite NSW TFR at a record low.

Yes, the pandemic has changed attitudes towards families for some people. The invitro-fertilisation (IVF) companies, Monash IVF Group (MVF) and Virtus Health, last year noted greater focus on families and individual wellbeing among their patients.

I wrote favourably on Monash and Virtus Group last year, partly due to those comments. The IVF providers’ data on IVF inquiries suggested rising interest in this treatment. Monash is up 47% over 12 months. Virtus (under an offer of takeover) is up 24%.

Monash IVF (MVF)

Who knows if these attitudes towards family will persist after Covid? I’d prefer to back well-established trends like population growth, higher female workforce participation, smaller family sizes and people in western countries spending more on their kids.

This bodes well for leading baby-goods retailers and childcare operators. In the short term, I can imagine cashed-up consumers after Covid spending a little more on baby goods and services. Or requiring extra childcare as more people return to work as Australia’s unemployment rate falls below 4% this year.

Long-term, population growth and high female workforce participation are powerful trends for baby-goods retailers and childcare operators. As in other developed countries, we’ll spend more on kids when they are born, more on childcare and more on schooling.

Here is a snapshot of Baby Bunting and G8 Education:

1. Baby Bunting Group (BBN)

Baby Bunting is Australia’s largest speciality retailer of maternity and baby goods, catering to parents with newborns to children under three. Many expectant parents make a trip (or several) to Baby Bunting, particularly for the birth of their first child.

Baby Bunting had 64 stores at end-December 2022. It wants at least 100 stores in Australia and 10 in New Zealand (a new market for it).

The company has an interesting position. Its main competitors (in physical stores) are Kmart, Big W and Target in the discount department stores. Also, Myer and David Jones, in the more upmarket department stores.

In terms of specialist baby stores, Baby Bunting is the only national operator and by far the largest ‘category killer’ of its kind.

Baby Bunting has plenty of online competition through Amazon, Catch.com.au, Chemist Warehouse, Kogan.com and eBay. But Baby Bunting’s online sales are growing quickly as it builds a strong omni-channel offering for its customers.

In Baby Bunting’s case, a large physical store network is an advantage for its online sales (through click-and-collect). With baby-goods purchases, expectant couples often like the reassurance of viewing the goods in-store. They might check a pram or cot in-store, order it online, then collect it at a Baby Bunting store.

Baby Bunting’s competitive position against the department stores is another attraction. Try finding someone at Kmart or Big W to provide detailed advice on a pram, cot or baby monitor. Advice is where category killers come into their own.

To my thinking, Baby Bunting has an excellent opportunity to double the size of its store network and consolidate a fragmented $2.5bn market in baby goods.

Within that, Baby Bunting can increase the proportion of goods bought online or through click-and-collect instore (24% of sales at end-December 2021). That proportion has doubled in the past three years, suggesting Baby Bunting is doing a good job in digital marketing to its 1.3 million loyalty members.

The proportion of private-label or exclusive sales at Baby Bunting was 44.5% in the first half of FY22, from 25.3% three years earlier. These sales have higher profit margins.

As Baby Bunting opens stores, it benefits from higher economies of scale. Its margins should slowly expand as more goods are sold online or as private labels. That should equate to consistent growth in earning-per-share and a higher return on equity.

It’s not all smooth sailing though. In its latest half-year result, Baby Bunting said Covid had affected the timing of its NZ store launch. In the second half of FY22, it expected spending on baby goods to be less discretionary and more focused on essentials.

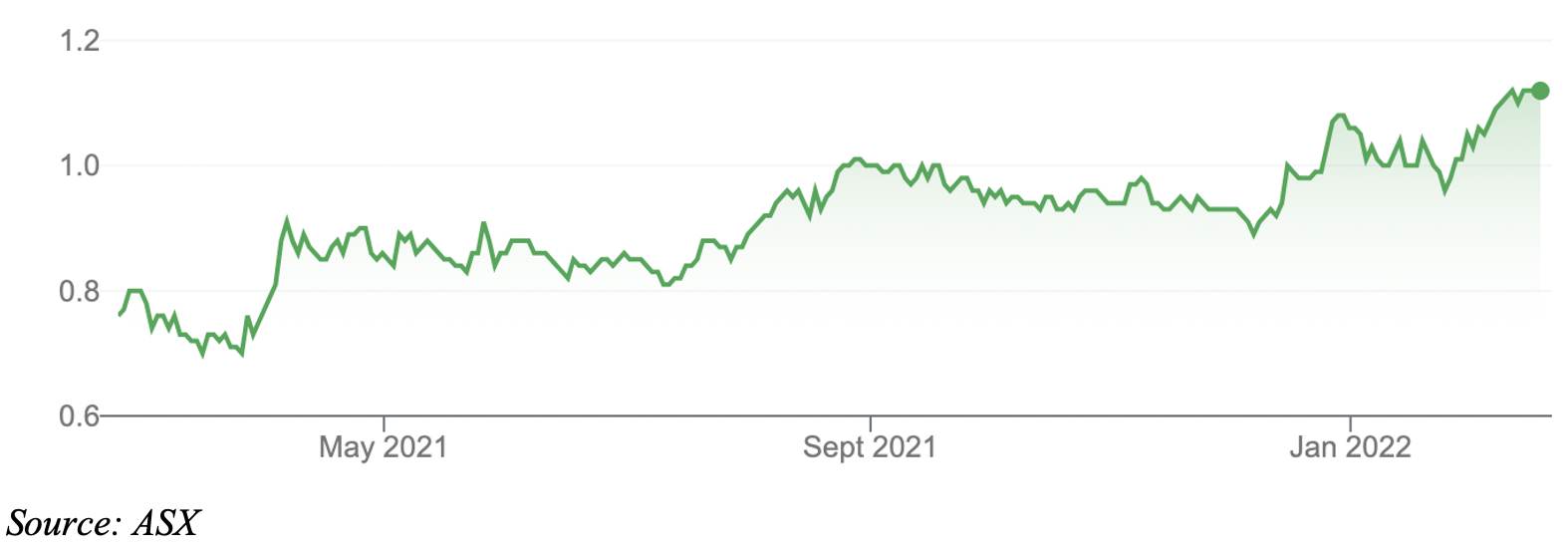

Although Baby Bunting is performing well, its total return is down 4.7% over 12 months. After almost increasing from its March 2020 lows to $6.58, Baby Bunting was due for a pullback. It now trades at $4.77.

The selling this year looks overdone. Baby Bunting is not a screaming buy but offers long-term value for investors who can see the appeal of owning a category killer that can continue to grow through new store openings in Australia and NZ.

Baby Bunting Group (BBN)

2. G8 Education (GEM)

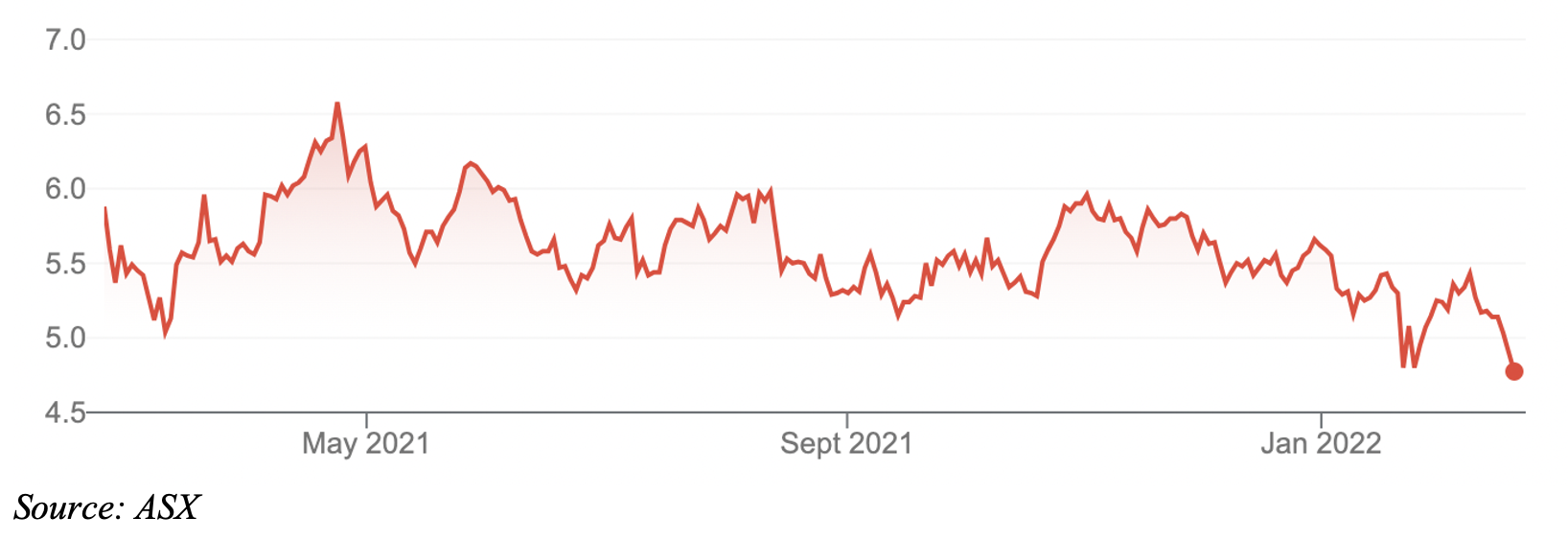

The childcare operator has been a frustrating stock over the years. I became bullish on GEM’s prospects in mid-2018, believing the market had become too negative on fears of childcare-centre oversupply.

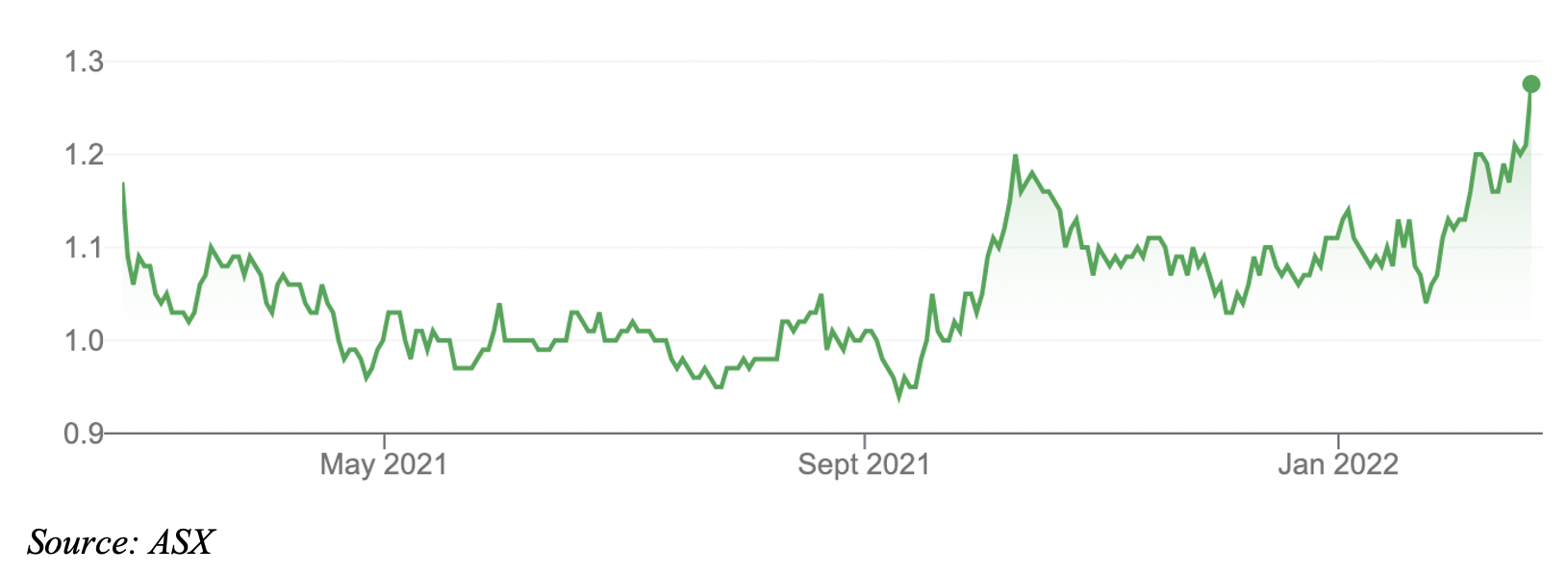

Then, when GEM almost doubled from its 52-week low to $3.60 in less than six months, I turned bearish on the stock in early 2019. In July 2021, I became positive again on G8 for this Report when it fell to $1.01. GEM is now $1.20.

I wrote last year: “As a volatile small-cap stock, G8 does not suit conservative investors (long-term investors seeking sector exposure are better off with Arena REIT). The company has had plenty of issues after arguably growing too quickly through acquisitions and underinvesting in service quality and training – something management is addressing.”

I added: “For all the Covid-related challenges, the long-term drivers of childcare are firmly intact: a growing population of young children; more kids spending more time in childcare centres; and more women entering the workforce and families needing childcare. And, hopefully, higher Federal government (childcare) assistance”.

That view still holds. GEM’s release this week of its CY21 results was well received by the market. GEM shares rose 5% on the news in a weak market (on Tuesday).

GEM’s outlook statement said current subdued occupancy at its facilities is expected to be temporary as “the impacts of Covid-19 and business normalise”.

GEM said the enquiry pipeline for childcare places was strong. That fits my view that demand for childcare places will be strong this year as more parents return to work in a vibrant labour market.

Clearly, GEM has plenty of near-term headwinds due to Covid and its impact on the childcare sector. But its sector’s long-term growth drivers – government support, increasing female workforce participation and growing awareness of the benefits of early learning – are firmly intact. If anything, these trends are likely to be stronger after Covid than before it.

G8 Education (GEM)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 22 February 2022.