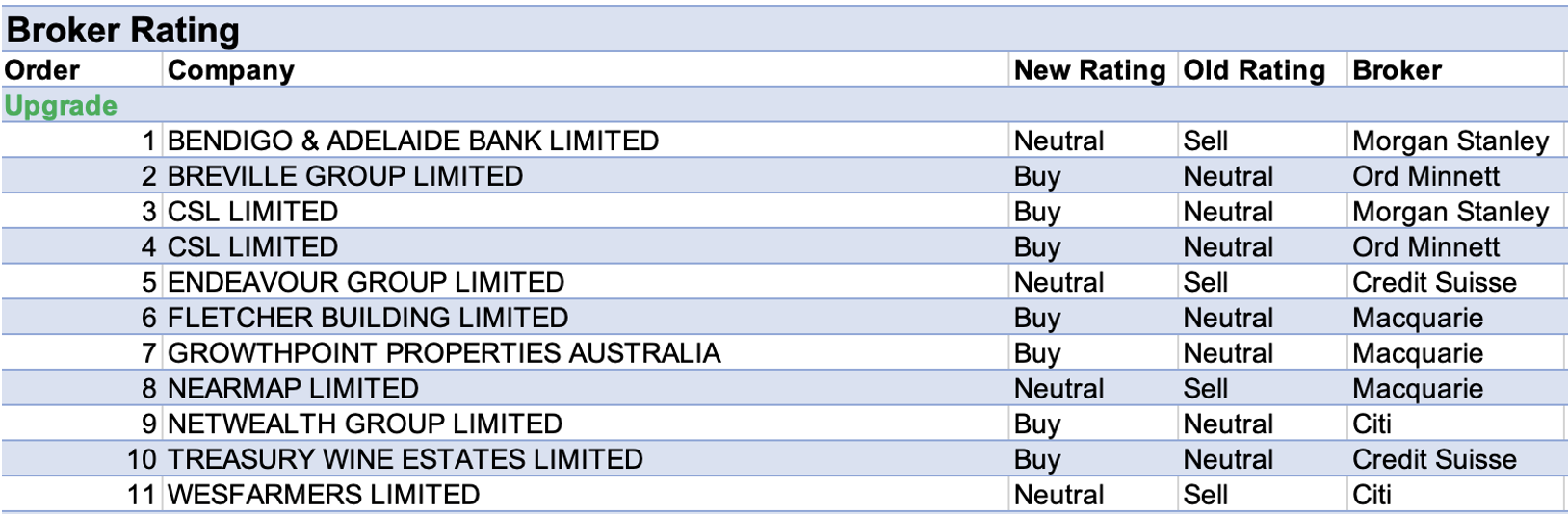

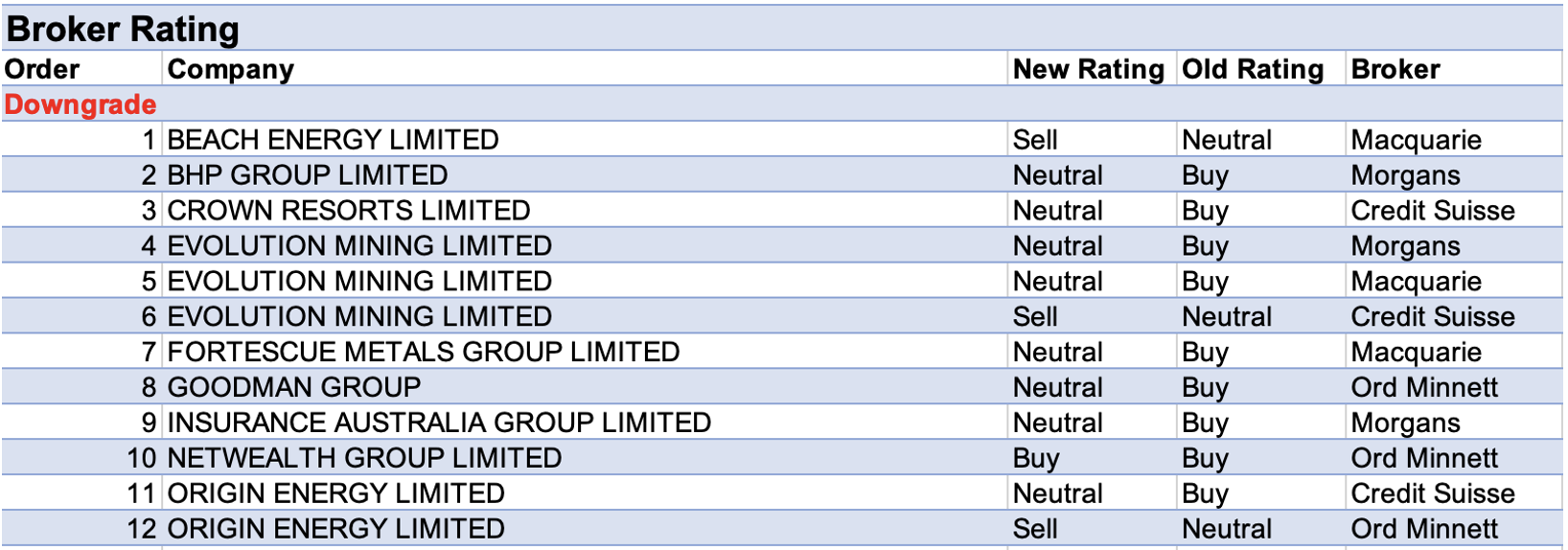

For the week ending Friday February 18, there were eleven upgrades and twelve downgrades to ASX-listed companies covered by brokers in the FNArena database.

CSL received an upgrade by Morgan Stanley (Overweight from Equal-weight) and by Ord Minnett (Accumulate from Hold) on expectations for a plasma-earnings rebound.

Ord Minnett also approved of interim results thanks to a doubling of royalties, rising plasma collections and a sharp rise in flu vaccine earnings, which pushed earnings back to pre-pandemic levels. According to Credit Suisse, the outcome was delivered via better Behring cost management and a stronger Seqirus performance.

On the flipside, Evolution Mining received three ratings downgrades from separate brokers in the FNArena database last week, following first half results that were largely in-line with expectations,

Credit Suisse has concerns over minimal cash flows and elevated gearing, while Morgans considers Red Lake a key risk and costs a further wildcard. Macquarie agrees on costs though notes management has flagged a stronger operational performance and dividend in the second half.

Meanwhile, Origin Energy’s interim result was met with two broker downgrades. Credit Suisse attributes a miss versus the consensus expectation to an exploration write-off in Integrated Gas and higher operating costs in Energy Markets. Moreover, LNG cargo timing issues tipping operating cash flow into the negative.

However, most focus was upon the announcement that the Eraring coal-fired plant will be closed early. While some brokers liked the staunching of cash outflows and positive ESG ramifications, Ord Minnett expects a negative impact on the market’s estimate of value, while wholesale prices may be driven higher.

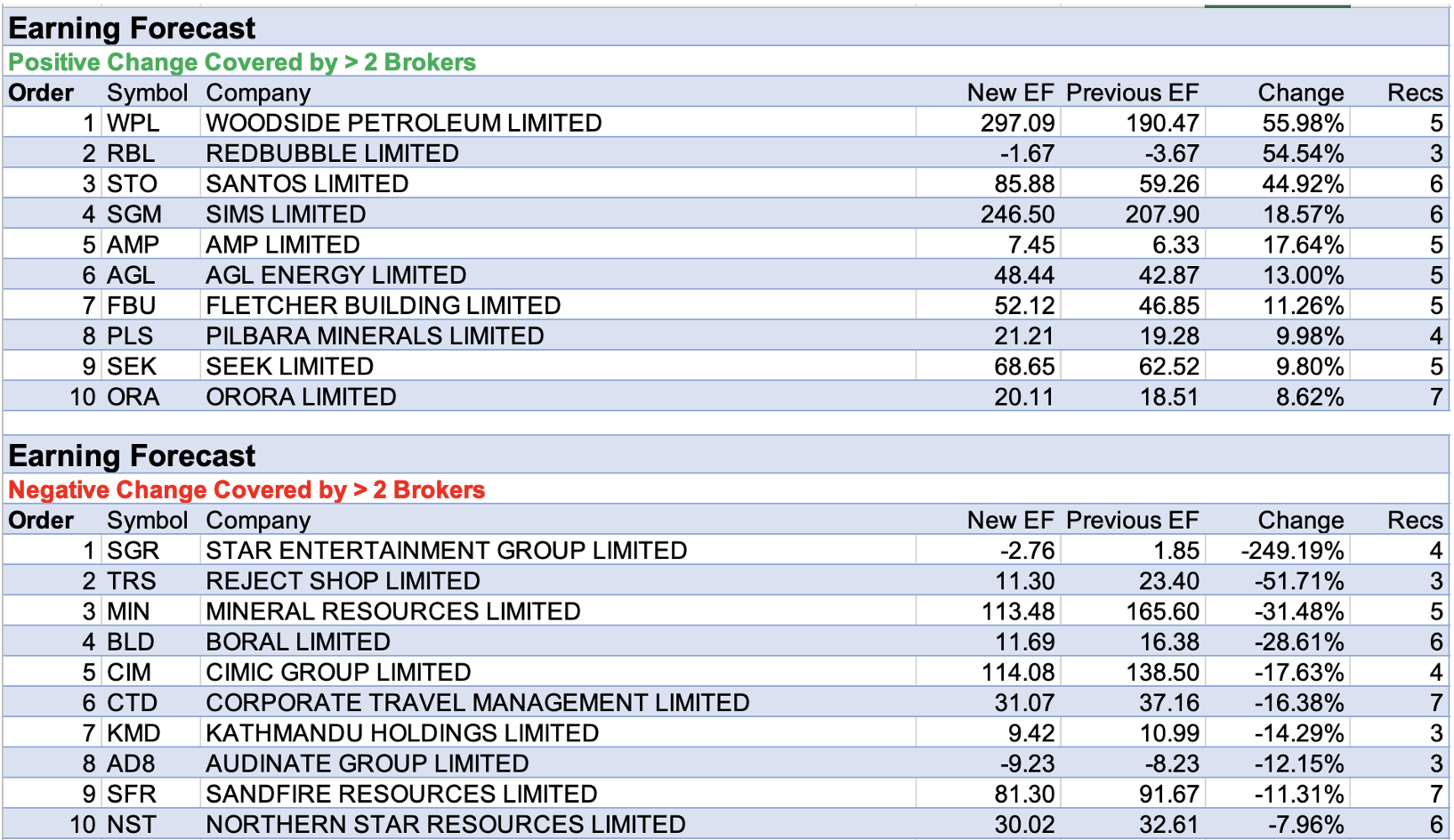

Regarding target prices set by brokers, Boral had the largest percentage fall last week, despite an interim result that generally exceeded expectations. This was due to some brokers playing catch-up on the early-February new capital structure following a $3bn return of surplus capital to shareholders.

The second largest percentage fall in target price went to Cimic Group as brokers continue to appraise FY21 profit results that generally missed expectations. UBS points out a 6% beat for Construction earnings was insufficient to counter a miss for Thiess equity accounted profits.

Unsurprisingly, both Cimic Group and Boral appeared among the leaders in the table for the highest percentage fall in forecasts earnings last week.

Atop the table was Star Entertainment Group after December-half results showed the effects of covid casino lockdowns. As commentary by management suggested January and February revenues are still being impacted, Credit Suisse lowers its FY22-25 EPS forecasts by -7%-20%. Other brokers in the FNArena database prefer to focus on the positives of broadly in-line results that contained few surprises. Macquarie says investors have already moved on and are looking forward to a catalyst rich FY23.

Next up was The Reject Shop, where brokers are bracing for worsening second half conditions despite first half results that were considered either in-line or a slight beat versus expectations.

On the positive side of the ledger, Woodside Petroleum had the largest percentage upgrade to forecast earnings, following a first half results beat.

According to Credit Suisse, company metrics are outpacing peers on political risk, valuation, spot gas exposure, carbon, balance sheet and production trajectory. Meanwhile, Morgan Stanley feels higher dividends are in prospect over the medium term.

Finally, Santos had an increase in earnings forecasts last week following second half results that met the consensus forecast. Morgans believes the buoyant oil price should easily enable funding of 2022 capital expenditure demands, while gearing should be reduced via asset sales. Morgan Stanley also feels there will be future capacity for a material lift in dividend payments.

Total Buy recommendations take up 58.52% of the total, versus 34.90% on Neutral/Hold, while Sell ratings account for the remaining 6.58%.

In the good books

BREVILLE GROUP LIMITED (BRG) was upgraded to Buy from Hold by Ord Minnett, B/H/S: 5/1/0

Breville Group’s December-half result outpaced Ord Minnett by 4%, thanks to double-digit sales growth from three geographies.

While supply constraints hit top-line growth, the sudden growth spurt caused Breville to postpone expansion and product launches and boost its inventory, suggesting further upside ahead, says the broker.

FY21 forecasts rise 4.1%, FY23 forecasts rise 5.6% and FY24 forecasts rise 7.5%.

Target price rises to $33 from $30.50. Rating upgraded to Buy from Hold.

CSL LIMITED (CSL) was upgraded to Accumulate from Hold by Ord Minnett and Overweight from Equal-weight by Morgan Stanley, B/H/S: 5/0/0

CSL’s December-half result seriously outpaced Ord Minnett’s estimates, thanks to a doubling of royalties, rising plasma collections and a sharp rise in flu vaccine earnings, which pushed earnings back to pre-pandemic levels. Guidance was reiterated.

Ord Minnett believes the tide has turned for CSL, expecting a plasma-earnings rebound in FY23, and upgrades to Accumulate from Hold.

Target price rises to $295.00 from $285.00.

Morgan Stanley raises its rating to Overweight from Equal-weight on expectation of a bottom for both plasma collection and costs. The recent share price underperformance was also taken into account.

Plasma collections are now approaching pre-pandemic levels. Recent management guidance points to a gross margin trough in

2H22/1H23 with improvement in 2H of FY23 onwards, explains the analyst. The proposed acquisition of Vifor is also seen as a positive.

The target price rises to $302 from $280. Industry view: In-Line.

ENDEAVOUR GROUP LIMITED (EDV) was upgraded to Neutral from Underperform by Credit Suisse, B/H/S: 0/4/0

Ahead of Endeavour Group’s 1H results, Credit Suisse lifts its rating to Neutral from Underperform in anticipation of outperformance in Retail liquor and an improving trend for Hotels. Valuation is also expected to lend support.

The target price is adjusted to $6.20 from $6.19.

FLETCHER BUILDING LIMITED (FBU) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 5/0/0

Fletcher Building reported first half earnings 16% ahead of Macquarie. FY guidance is 23% ahead of the broker, and includes a 5% NZ covid contingency.

The dividend of 18c is 50% up year on year and towards the top of the payout range, compared to the broker’s 13c forecast.

The result went some way to assuaging some of the broker’s structural concerns, and despite incorporating conservative assumptions, Macquarie upgrades to Outperform from Neutral. Target rises to NZ$7.70 from NZ$7.20.

GROWTHPOINT PROPERTIES AUSTRALIA (GOZ) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 1/2/0

Having delivered first half funds from operations of 13.6 cents per share, equating to 7% growth on the previous comparable period, Macquarie was surprised by Growthpoint Properties Australia’s reiteration of full year guidance of at least 27.0 cents per share.

The broker sees little downside risk in the second half. Growthpoint Properties has around 8% of expiries in FY22, but 5% of these are tied to the Woolworths Larapinta lease where a notice of intention to exercise a 5-year option has already been issued.

Macquarie further highlights guidance does not include the Camberwell Road settlement which it expects to add 0.4 cents per share to guidance. Earnings per share forecasts increase 2.8%, 4.5% and 4.9% through to FY24.

The rating is upgraded to Outperform from Neutral and the target price increases to $4.45 from $4.22.

NEARMAP LIMITED (NEA) was upgraded to Neutral from Underperform by Macquarie, B/H/S: 2/1/0

Nearmap’s first half revenue growth was stronger than Macquarie expected primarily driven by stronger than forecast North American business segments seeing already high sales team contribution ratio improvement.

Stronger than forecast revenue growth could lead to positive operating leverage and positive earnings revisions over the medium term, the broker suggests.

This is nevertheless offset by near-term risk from legal proceedings which may result in greater than forecast cash burn if a resolution is not reached. That said, the broker lifts its target to $1.40 from $1.30 and upgrades to Neutral from Underperform.

NETWEALTH GROUP LIMITED (NWL) was upgraded to Buy from Neutral by Citi, B/H/S: 4/1/0

Netwealth’s interim market update disappointed through higher costs but an emphatic Citi responds with: higher-than-expected costs in one half does not change the investment thesis.

To prove its conviction, Citi has upgraded to Buy from Neutral. Target price falls to $15.25 from $17.05.

Citi sees potential upside from fund flows plus Netwealth should exhibit leverage to higher cash rates. In addition, the broker observes Praemium ((PPS)) shares are trading at -23% discount to Netwealth’s offer price.

See downgrade below

TREASURY WINE ESTATES LIMITED (TWE) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 4/2/0

Treasury Wine Estates’ December-half result outpaced Credit Suisse’s forecasts thanks to a successful reallocation from China to South East Asia of $100m of the $200m sales lost in FY2021, and management says the company has built a strong foundation in the region and that the market is greater than estimated.

The broker raises EPS forecasts 10% in FY22 and FY23 accordingly.

The premium brand business and margins were strong and pricing pressure is expected to emerge on grape prices in FY23, which, combined with inflation, reopening trade and cost savings, prompts the broker to raise margin forecasts to 12.5% by FY24 from 7.5% in FY21.

Strong inventory draw-down over the half translated into strong cash conversion. Broker upgrades to Outperform from Neutral. Target price rises to $13.50 from $12.45.

WESFARMERS LIMITED (WES) was upgraded to Neutral from Sell by Citi, B/H/S: 1/5/0

Only in a parallel universe does Bunnings fail to beat expectations, but Citi admits it overestimated the contribution Bunnings would make to Wesfarmers’ earnings to offset January guidance of a -58% earnings decline for Kmart/Target. Net earnings missed the broker by -3%.

The broker remains positive on Bunnings given its dominant market share puts it in an excellent position to pass on higher costs within ongoing strength of renovation activity and housing churn. Kmart/Target foot traffic will improve as omicron subsides.

With the stock trading near the broker’s unchanged $50 target, the rating is upgraded to Neutral from Sell.

In the not-so-good books

EVOLUTION MINING LIMITED (EVN) was downgraded to Underperform from Neutral by Credit Suisse, Hold from Add by Morgans and Neutral from Outperform by Macquarie, B/H/S: 2/4/1

Following 1H results for Evolution Mining, Credit Suisse lowers its rating to Underperform from Neutral on valuation, and concerns over minimal cash flows and elevated gearing. This is despite a 5% beat for earnings (EBITDA) versus expectations.

The analyst was surprised by a 3cps dividend, as only 1cps was expected, though downside risk is predicted for the final dividend (see concerns above). The target falls to $3.60 from $3.70.

Evolution Mining’s soft December-half result met Morgans’ low expectations (the production report was weak), and management reiterated guidance to a strong half.

Gold Resources rose 12% and the Reserve rose 5% and copper inventories increased following the Ernest Henry acquisition.

The broker tinkers with earnings and awaits the March-quarter production report for greater certainty, with Red Lake a key risk and costs a further wildcard.

Morgans downgrades the company to Hold from Add. Target price inches up to $4.21 from $4.20.

Evolution Mining’s interim profit was in line with Macquarie, but the 3c dividend beat the broker’s conservative assumption. Year on year reserve and resource growth was primarily driven by three acquisitions over 2021.

While management has flagged a stronger operational performance and dividend in the second half, comments around widely experienced cost pressures could begin to weigh on the long-term outlook, the broker warns.

Target falls to $4.30 from $4.70. Downgrade to Neutral from Outperform.

FORTESCUE METALS GROUP LIMITED (FMG) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 0/3/4

Well the money had to come from somewhere, and in the end it is the shareholders having to cough up. Fortesuce Metals reported earnings in line with Macquarie’s forecast, but a cut in the payout ratio led to a -12% miss on dividend.

The broker now assumes a cut in payout ratio to 70% from 80% in the long term, with cash reallocated to Fortesuce Future Industries. This, along with higher assumed costs for Iron Bridge, leads to earnings forecast downgrades.

Fortescue’s earnings upgrade momentum at spot prices remains strong, however given the material reduction in cash returns to shareholders, the broker downgrades to Neutral from Outperform. Target falls to $19.70 from $21.00.

GOODMAN GROUP (GMG) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 4/2/0

Goodman Group’s interim profit was well ahead of Ord Minnett’s forecast, underpinned by a 42% increase in development earnings. The broker downgrades its rating to Hold from Accumulate on valuation grounds, while the target price remains set at $25.

Management increased FY22 guidance and Ord Minnett observes growth of 27% in the first half is well above revised guidance for 20% operating EPS growth.

The outlook for development earnings is very strong, according to the broker, with rising work-in-progress in the past two years and continued margin expansion. It’s also noted the company has $240m of earnings earned but not yet realised.

NETWEALTH GROUP LIMITED (NWL) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 4/1/0

Netwealth’s December-half result met Ord Minnett’s forecasts, excluding a $1.9m non-cash equity grant cost. Net flow guidance was reiterated and the company reclaimed its No.1 ranking in Investment Trends.

Operating costs were sharply higher than forecast but are expected to moderate from FY23, says the broker.

News the company is likely to back away from the Praemium ((PPS)) acquisition has Ord Minnett switching focus to organic growth.

EPS forecasts are cut -2% in FY22 and -5% in FY23. Target price falls to $15 from $19.50.

See upgrade above

ORIGIN ENERGY LIMITED (ORG) was downgraded to Neutral from Outperform by Credit Suisse and Lighten from Hold by Ord Minnett, B/H/S: 3/2/0

Origin Energy’s December-half result fell -8% short of consensus forecasts and -6% short of Credit Suisse forecasts due to an exploration write-off in Integrated Gas, higher operating costs in Energy markets, and LNG cargo timing issues tipping operating cash flow into the negative.

Credit Suisse believes Eraring early closure notice is a plus, creating an ESG option.

Management anticipates rising gas prices will offset increased costs.

Target price eases to $6 from $6.10. Rating downgraded to Neutral from Outperform.

Ord Minnett lowers its rating for Origin Energy to Lighten from Hold following in-line interim results, and decreases its target price to $5.50 from $6.05.

The broker believes the result will be overshadowed by the announcement that Eraring will be closed early, and questions what competitive advantage Origin now has in retailing.

The largest coal-plant in NSW is now expected to terminate by FY25 and the analyst expects this to have a negative impact on the market’s estimate of value, while likely driving wholesale prices higher.

Management has upgraded FY22 guidance, but Ord Minnett says that’s all about the price of oil, and well-known among investors. More importantly, operating conditions remain challenging for Energy Markets, which might prove of greater significance.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.