Last week, shareholders voted overwhelmingly to “unify” BHP. This means one company with one primary listing on the Australian Stock Exchange (ASX), rather than two companies with two separate listings.

When BHP merged with the South African based Billiton in 2001, the company adopted a dual listing structure with two separate legal entities. BHP Group Limited, listed on the ASX, and BHP Group Plc, listed on the London Stock Exchange (LSE) and Johannesburg Stock Exchange (JSE). Although BHP operated as one economic entity, the assets were split between the two companies and at the time, about 40% of the earnings were attributed to Plc assets.

Roll on 20 years and this has fallen to less than 5%, largely due to the rise in the importance of iron ore to BHP, plus some divestments and the demerger of S32 (mainly former Billiton assets). Further, the costs of unification (stamp duties and other taxes) have fallen by some US$1.2bn since 2017. It will still cost shareholders between US$350 million and US$450 million to unify.

But the real pressure for unification has come from shareholders, particularly Plc shareholders, who were tired of seeing their Plc shares trading at a discount to the Ltd shares. Unification was one of the main calls by activist shareholder Elliott Associates when it launched its short selling attack on BHP in 2017.

The price discount is resolved as shareholders in the old Plc company will exchange their shares for new shares in the Ltd business. These will be tradeable on the LSE and JSE through a secondary listing.

Unification has some important market impacts.

Firstly and most importantly, BHP’s market weight in the benchmark S&P/ASX 200 index will rise from about 6.5% to over 10%. This will occur at the close of business on Friday 28 January, taking effect from Monday 31 January.

It will clearly be Australia’s largest company, and some index funds and other investment managers will need to buy additional BHP shares to ensure that their portfolios are “market weighted”. With BHP’s weight going up, other companies will come down – so there will be minor negative weight changes for the likes of CBA, CSL, Westpac etc.

The materials sector will also rise in importance, from about 19% to over 23% of the S&P/ASX 200 sector. It will still be the second-largest sector, but the gap to the largest, financials, will close considerably. Financials will probably come in at about 28%.

Offsetting the Australian index weight change is a change in the UK, where BHP will drop out of the FTSE 100 index. While there will be no overall weight change in global indices, some overseas fund managers who benchmark to the FTSE 100 will not need to own BHP shares.

Finally, with the discount set to be eliminated, the massive short position in BHP shares will close. Currently, BHP Ltd is the most shorted stock on the ASX with 10.0% of the shares on issue (294 million) sold short. Most of this position was taken out by hedge funds and other market professionals when the unification proposal was announced to take advantage of the pricing discount. They bought the UK listed Plc shares, sold short the ASX listed Ltd shares – knowing that when unification occurred, their Plc shares would be exchanged for Ltd shares, allowing them to close their short position and book a tidy profit.

Legal unification and the exchange of shares is still some months away, but the index changes next week. This is potentially a huge positive to BHP’s share price. The challenge is to estimate how much of this “action” has already happened, but if recent examples when CBA, CSL and Macquarie were witnessing rising index weights is anything to go by, the buying support is likely to be there for some weeks.

Another big change for BHP this year will be the demerger of its offshore oil assets into Woodside, with BHP shareholders receiving shares in the enlarged Woodside group. In June, BHP shareholders will own shares in BHP and shares in woodside.

Typically, demergers are good for share prices (the sum of the parts is greater than the whole), but it can take some months for this to be achieved. Often, there is short term selling pressure on the “unloved” entity. This might be a little different, with some of the ESG (environmental, social and governance) pressure easing on BHP, and the deal viewed by the market as a “positive” for Woodside.

What do the brokers’ say

Index weightings don’t impact valuations, so the analysts really aren’t that interested in “unification”. They are more interested in what happens to the iron ore price, how BHP is managing production and is controlling costs.

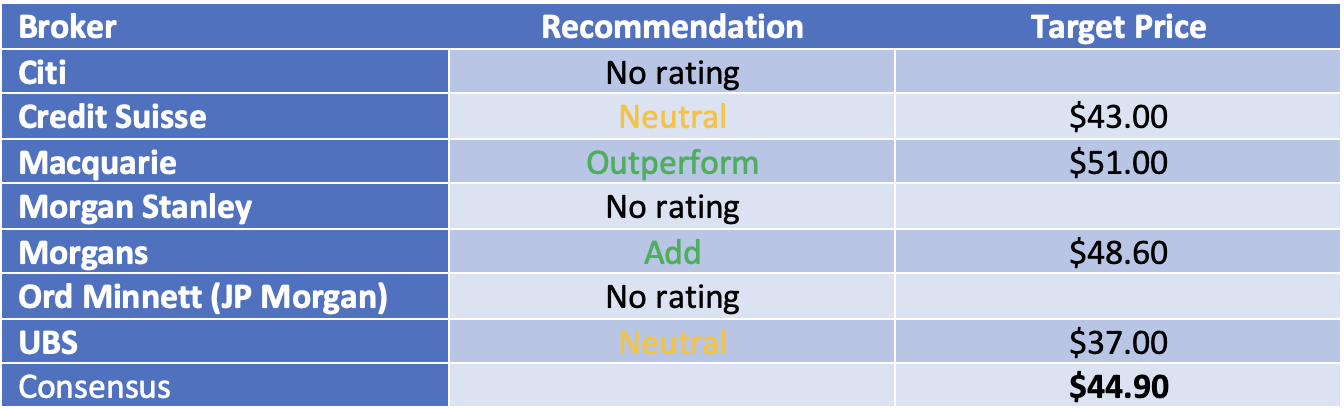

Three of the major brokers are on “research restrictions”, but the others are moderately bullish. According to FNArena, there are 2 ‘buy’ recommendations and 2 ‘neutral’ recommendations. The consensus target price is $44.90.

On consensus, they have BHP trading on a multiple of 9.1 times forecast FY22 earnings and 12.1 times forecast FY23 earnings. The forecast dividend yield is 8.3% for FY22, falling to 6.0% for FY23.

Bottom line

My sense is that ‘unification’, together with the demerger with Woodside, will continue to act as positive catalysts for BHP’s share price. But if the iron ore price tanks, BHP investors won’t stand in the way of the train.

However, we are in a commodities super cycle and with China taking steps to stimulate its economy, resource stocks are in vogue. BHP is the most diversified of our leading resource companies and has been very focused on shareholder returns. It remains my preferred pick. Buy in weakness.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.