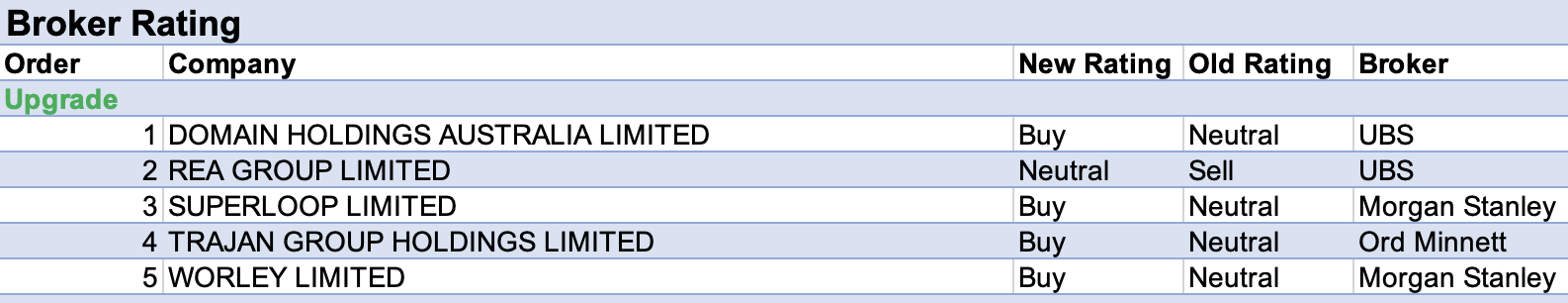

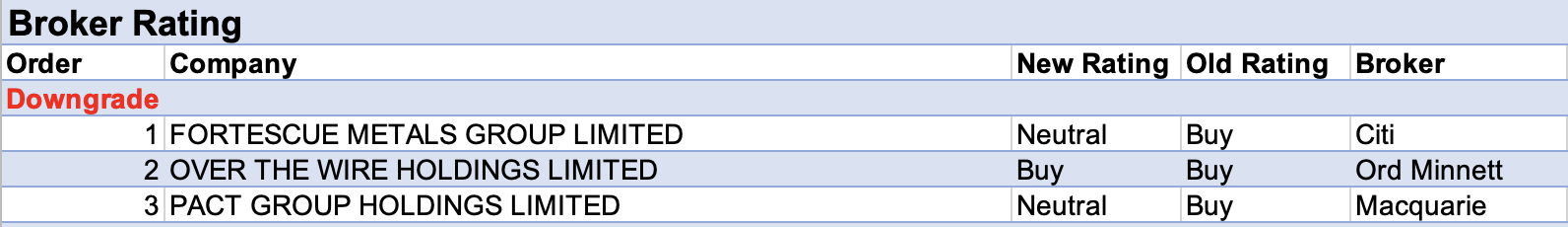

For the week ending Friday December 3, there were five upgrades and three downgrades to ASX-listed companies covered by brokers in the FNArena database.

In the only material change to forecast target prices last week, Morgan Stanley upgraded its rating for Superloop to Overweight from Equal-weight and lifted its 12-month target price to $1.45 from $1.10. Management’s medium-term target of doubling revenue share to 4%-5% from 2% today is considered highly achievable.

After leadership renewal, divestment of non-core assets, balance sheet repair and the Exetel acquisition, the broker feels the company represents a turnaround story. There’s thought to be upside from leveraging the company’s fibre network either organically or inorganically.

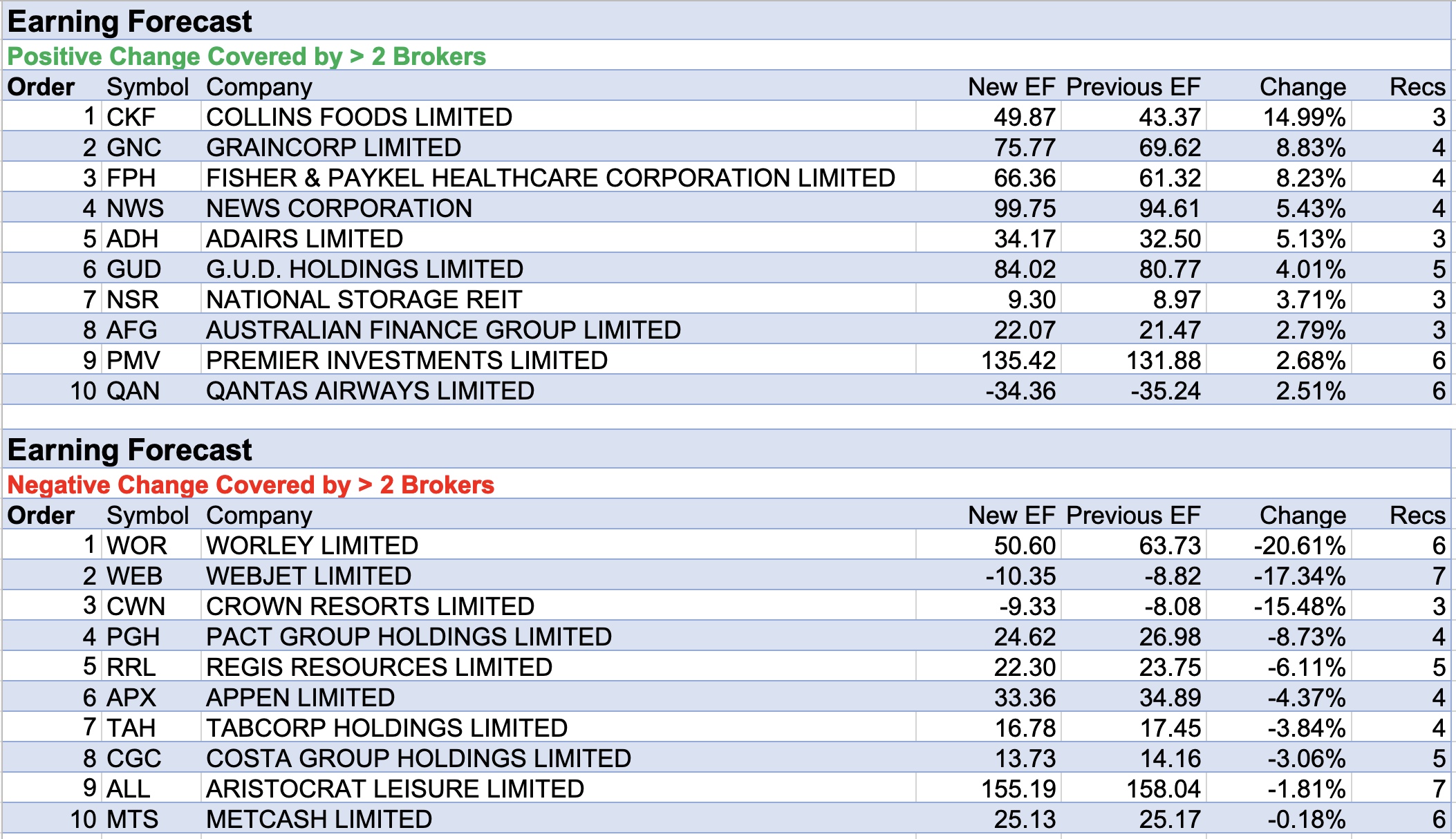

Three brokers weighed in with research on Collins Foods last week, which resulted in the largest percentage rise in forecast earnings. This followed first half results that beat expectations thanks to a strong performance from KFC Europe, which achieved 5% same-store-sales growth compared to the 9% estimated by Morgan Stanley.

Management guided to 17%-plus margins in Australia and UBS anticipates upside as store rollouts continue globally. Moreover, it’s noted like-for-like sales in the first six weeks of the company’s second-half remain strong.

On the flipside, Worley had the largest percentage fall in forecast earnings. Commentary around the shift to sustainability projects at the company’s investor day couldn’t distract from the 47% of revenue still tied to hydrocarbons, according to Ord Minnett. Management guided to disappointing first-half earnings though Citi expects a recovery in the second half.

It was certainly not all bad news. Morgan Stanley saw fit to raise its rating to Overweight from Equal-weight and lift its target price to $12 from $11. The broker sees Worley as a beneficiary of the complexity of the energy transition, and feels macroeconomic indicators of activity are turning in the company’s favour.

Finally, Webjet was next on the table for the largest percentage fall in earnings forecasts. As mentioned in last week’s article, Credit Suisse pushed out its timeline for a full travel recovery to the second half of FY23. This was even prior to the advent of omicron.

In the near-term, the broker feels the company is at the mercy of government travel restrictions. However, Morgans remains upbeat and still expects the company to exceed FY19 underlying earnings in FY24.

Total Buy recommendations take up 56.17% of the total, versus 37.02% on Neutral/Hold, while Sell ratings account for the remaining 6.81%.

In the good books

DOMAIN HOLDINGS AUSTRALIA LIMITED (DHG) was upgraded to Buy from Neutral by UBS, B/H/S: 3/4/0

UBS upgrades Domain Holdings to Buy from Neutral after CoreLogic reported a 34% jump in November listings, compared with a 25% jump in September; and in response to the company’s share-price retreat.

The broker believes the CoreLogic data signals an acceleration in volumes heading into year-end and upgrades Domain’s FY22 earnings forecasts 2%.

UBS spies room to grow revenue above the rate of listing and potential upside from stamp duty reforms.

REA GROUP LIMITED (REA) was upgraded to Neutral from Sell by UBS, B/H/S: 2/5/0

UBS upgrades REA Group to Neutral from Sell after CoreLogic reported a 34% jump in November listings, compared with a 25% jump in September; and in response to the company’s share-price retreat.

The broker believes the CoreLogic data signals an acceleration in volumes heading into year-end and raises REA’s FY22 volume estimates to 6.5% from 5%.

But UBS’s long-term view is unchanged. Outside of stamp duty reforms, the broker finds it hard to discern which mechanism outside of price increases, the company can use to increase revenue.

WORLEY LIMITED (WOR) was upgraded to Overweight from Equal-weight by Morgan Stanley, B/H/S: 4/2/0

Morgan Stanley believes Worley will be a beneficiary of the complexity of the energy transition and feels macroeconomic indicators of activity may be improving. The broker lifts its target to $12 from $11 and upgrades its rating to Overweight from Equal-weight. Industry view: In-Line.

The analyst feels the company is close to its last earnings downgrade, after being under pressure in 2021.

In the not-so-good books

OVER THE WIRE HOLDINGS LIMITED (OTW) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 1/1/0

Over The Wire Holdings has agreed to be taken over by Aussie Broadband ((ABB)) for $5.75 in cash or 1.15 Aussie Broadband shares, or a combination of both. Ord Minnett lowers its rating to Accumulate from Buy and reduces its target price to $5.75 from $5.80.

The analyst estimates cost synergies of $8-12m over the next two to three years will provide potential upside for investors who choose Aussie Broadband scrip as part, or all of the consideration.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.