Woodside Petroleum (WPL) has always had the potential to be a great Australian company. Investing billions of dollars in incredibly complex, long lead time oil and gas projects that involve huge feats of engineering. Doing it for Australia.

Unfortunately, it has struggled to live up to this for shareholders. Over its 40+ years of being a listed company, it has disappointed more often than it has delivered. Shell tried to take it over in 2001, but then Treasurer Peter Costello famously knocked it back on “national interest grounds”. Shell eventually exited its minority stake, selling down in 2010, 2014 and 2017. At least Shell achieved prices ranging from $42.23 to $31.10 per share – today Woodside wallows around $22 per share.

Last week, after more than three years of investigation and analysis (some might say procrastination), Woodside announced the final investment decision (green light) for the US$12 billion Scarborough LNG project. This followed confirmation that BHP and Woodside would merge their oil and gas interests, and the announcement in August that Meg O’Neill would take over as Woodside CEO.

With these three “uncertainties” out of the way, what is the future for Woodside? Let’s start with the Scarborough project.

Let’s talk Scarborough

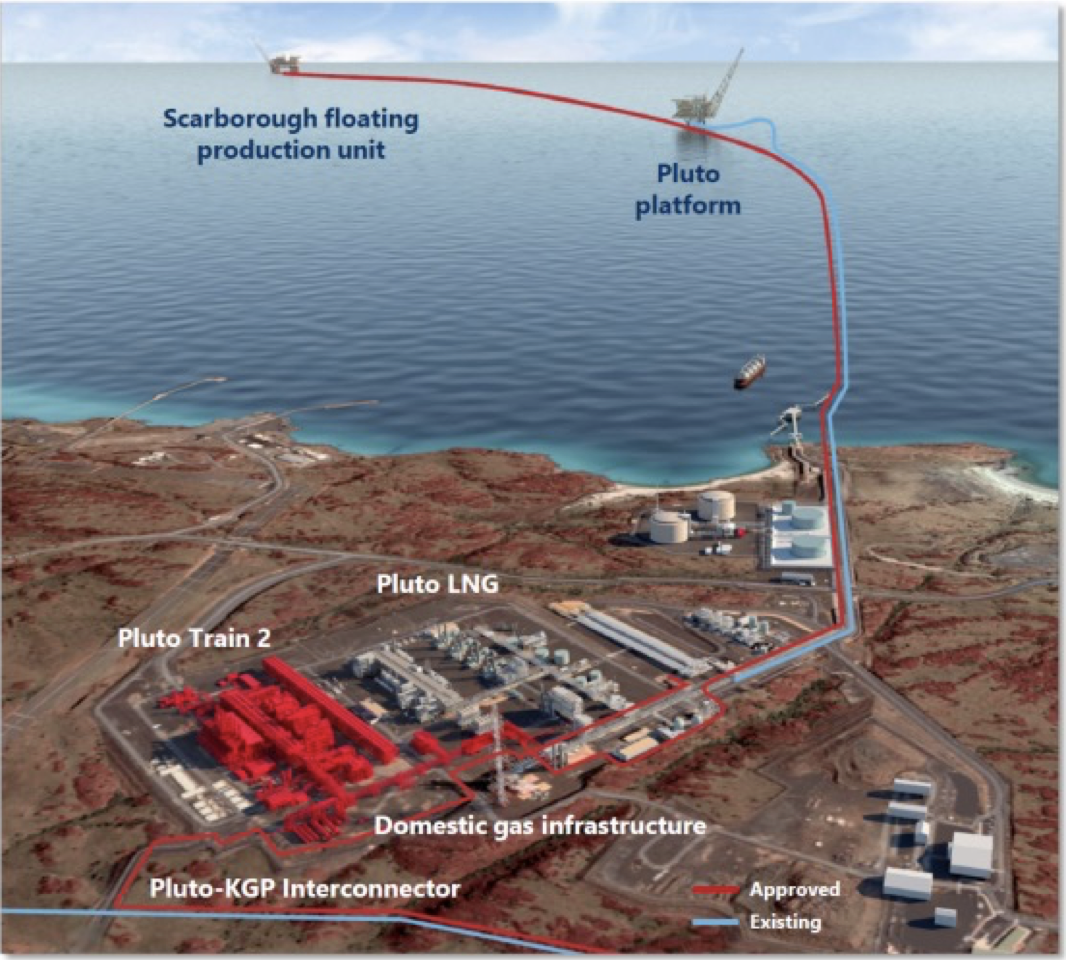

The Scarborough field is located 375km off the coast of Western Australia and is estimated to contain 11.1 trillion cubic feet of dry gas. Development of Scarborough will include the installation of a floating production unit with eight wells drilled in the initial phase and 13 drilled over the life of the field. The gas will be transported to the existing Pluto LNG facility near Karratha in the north-west of Western Australia through a new trunkline of approximately 430km.

The existing Pluto LNG facility is a ‘single-train’ on-shore processing facility that delivered its first gas in 2012. It will be expanded with the construction of Pluto Train 2, associated domestic gas processing facilities, and modifications to Pluto Train 1 to allow processing of the Scarborough gas (which is dryer than the gas it currently processes from the offshore Pluto platform).

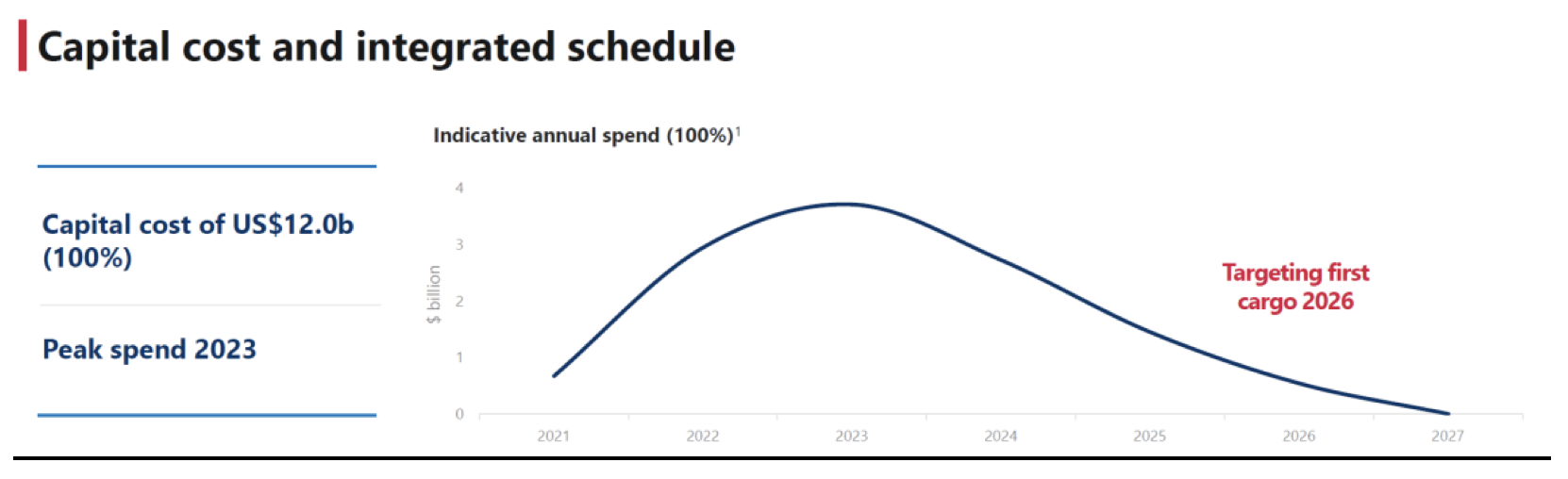

All up, the project is estimated to cost US$12bn, US$5.7bn for the offshore component and US$6.3bn for the onshore component. Woodside’s current share of this is US$6.9bn, with Global Infrastructure Partners taking a 49% interest in Pluto Train 2 and BHP owning 26.5% of the Scarborough field.

First cargo is targeted for 2026 with peak spending in 2023.

In terms of execution risks, Woodside says it has taken a number of steps to mitigate these, including front-end loading the scope definition and execution planning, locking in 75% of the steel pricing, agreeing with contractors the “labour rise and fall mechanisms” and executing lump sum or fixed rate contracts. Federal and State Government environmental approvals are also in place.

Scarborough is expected to produce 8 Mtpa of LNG and 225 TJ/day of new domestic gas. Woodside says that 60% of the gas is contracted to customers, but when the merger with BHP is completed and it owns 100% of Scarborough, this drops below 50%. That said, the cost of supply of US$5.80 per MMBtu is considered to be globally competitive.

Financially, Woodside says the project has an internal rate of return of 13.5% and a payback period of six years. This assumes a Brent oil price (in real terms) of US$65 per barrel. It is expected to generate US$26bn of net cash flow.

On the ESG/carbonisation front, Scarborough is forecast to be one of the lowest carbon intensity LNG projects for LNG delivered to customers in North Asia.

BHP & Woodside

BHP and Woodside have signed a binding share sale agreement for the merger of BHP’s oil and gas portfolio with Woodside. This will create a global ‘top 10’ independent energy company by production and the largest energy company listed on the ASX.

The combined company will have a high margin oil portfolio, including assets in the Bass Strait, Gulf of Mexico, Trinidad and Tobago and Algeria; long life LNG assets; and improved financial resilience to navigate the energy transition. BHP will transfer its petroleum assets on a cash and debt-free basis. Synergy benefits of more than US$400 million per annum are forecast.

Woodside will acquire the entire share capital of BHP Petroleum International in exchange for the issue of approximately 901.5 million Woodside shares. The new Woodside shares will be distributed to BHP shareholders as an “in-specie” fully franked dividend.

Existing Woodside shareholders will own approximately 52% of the expanded Woodside, and BHP shareholders 48%.

Woodside shareholders will get to vote on the proposal in the second quarter of calendar 2022, with the merger due to be implemented on 1 July 2022.

What do the brokers say?

Overall, the brokers are a little nervous about Woodside’s ability to execute Scarborough at the price, but positive about the merger with BHP. “Transformational” is a word that is used by several of the brokers.

FNArena’s precis of Morgans’ view sums it up nicely:

“It is Morgans’ view that mega-project Scarborough has an average return profile, expecting a 13.5% internal rate of return, while budget and scheduling risk leaves little error margin, and that Woodside Petroleum may be better served by turning focus to higher return assets.

More positively, the broker notes the BHP Group ((BHP)) Petroleum merger should boost Woodside Petroleum’s earnings power and add necessary market and geographical diversity, and outweighs risks presented by Scarborough.”

There are 3 “buy” recommendations, 2 “neutral” recommendations and 2 “no rating”. The consensus target price is $26.62, approximately 23.3% higher than Friday’s closing price of $21.60. The table below shows the individual ratings and target prices:

On multiples, the brokers have Woodside trading on the relatively undemanding 11.6x FY21 earnings and 8.7x FY22 earnings and paying a dividend yield of over 6.3%. Santos, as a comparison, was trading at 11.3x forecast FY21 earnings and 8.5x forecast FY22 earnings, but yielding only 2.6%. (Both companies’ financial year ends on 31 December).

Bottom line

The best thing about the “green light” for Scarborough is that it has removed an “uncertainty” for Woodside. There are five years of “execution” risk to navigate before “sales and pricing” risk comes to the fore, so the market is going to be sidelined on this project for some time. But it is better to have a decision announced, and the risk is probably towards upside “surprise”.

The merger with BHP is another matter and my sense is that the market will come to view this as Woodside shareholders getting a bit of a bargain (BHP was arguably somewhat of a forced seller). However, 901.5 million of new Woodside shares will hit the market in July 2022 and create a temporary supply issue, which may limit upside gains.

As Woodside is fundamentally cheap, portfolio holders should hang on. Investors will see the current prices as attractive but will need to be patient.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.