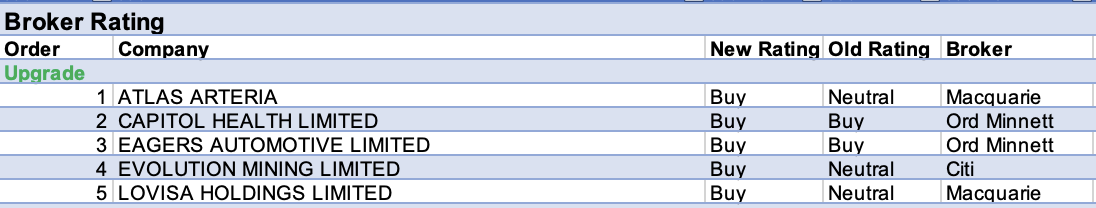

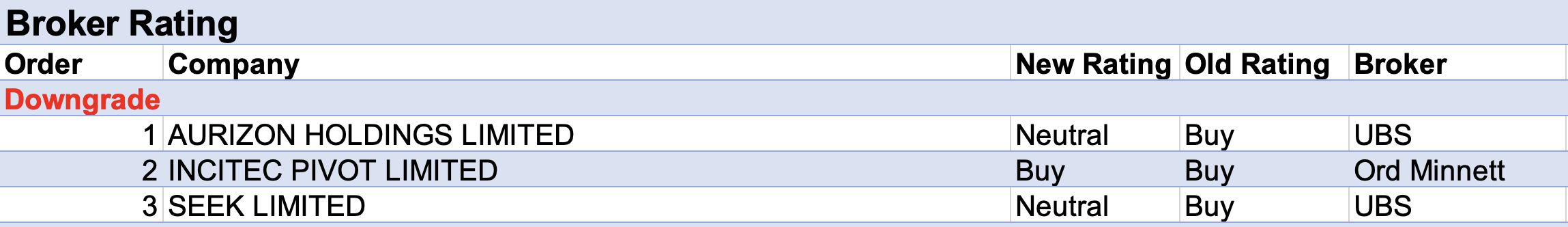

For the week ending Friday November 19, there were five upgrades and three downgrades to ASX-listed companies covered by brokers in the FNArena database.

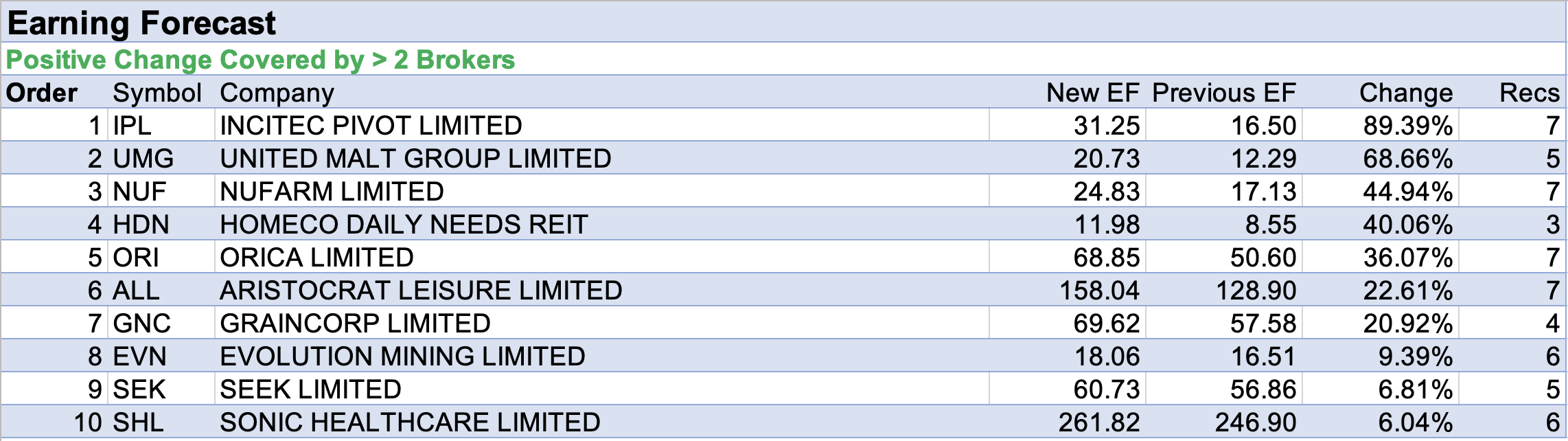

There are seven brokers updated daily in the database, and their combined research propelled Incitec Pivot to the top of the tables for both the largest percentage rise in forecast target price and forecast earnings. Following FY21 results, Credit Suisse believes consensus forecasts underestimated the impact of fertiliser pricing. Underlying profit rose 91% to $358.6m, well ahead of the consensus estimate for $296.6m.

UBS expects further benefits will accrue from a global recovery in agricultural conditions and fertiliser pricing, as well as tightening supplies of ammonia, phosphate and nitrogen. While the company’s rating was downgraded to Accumulate from Buy by Ord Minnett, it was only in reaction to recent share price strength.

Macquarie is excited by the experience of the incoming CEO at Lovisa, who has previously grown brands and stores in both China and India. While a long term target of 1200 stores globally is already priced in, there’s upside risk for over 1400 stores in China and India alone, according to the analyst. The broker lifted its target price to $25 from $17, thereby ensuring second place on the table for the largest percentage rise in forecast target prices.

Second place on the equivalent table for forecast earnings went to United Malt Group. This arose despite a FY21 profit result that missed the consensus forecast, largely due to covid restrictions and export disruptions, explains Morgans. Citi expects processing volumes will exceed pre-covid levels after the March quarter, as UK whisky exports hold and US on-premise beer consumption recovers.

Nufarm was next on the table after its FY21 profit result outpaced Macquarie’s estimate and consensus forecasts.

Finally, Orica’s forecast earnings received a boost after a review of recent FY21 results by Ord Minnett. After combining an increased earnings outlook with a re-rating in the ASX200 Industrials Index, the broker lifted its 12-month target price to $15.25 from $13.00.

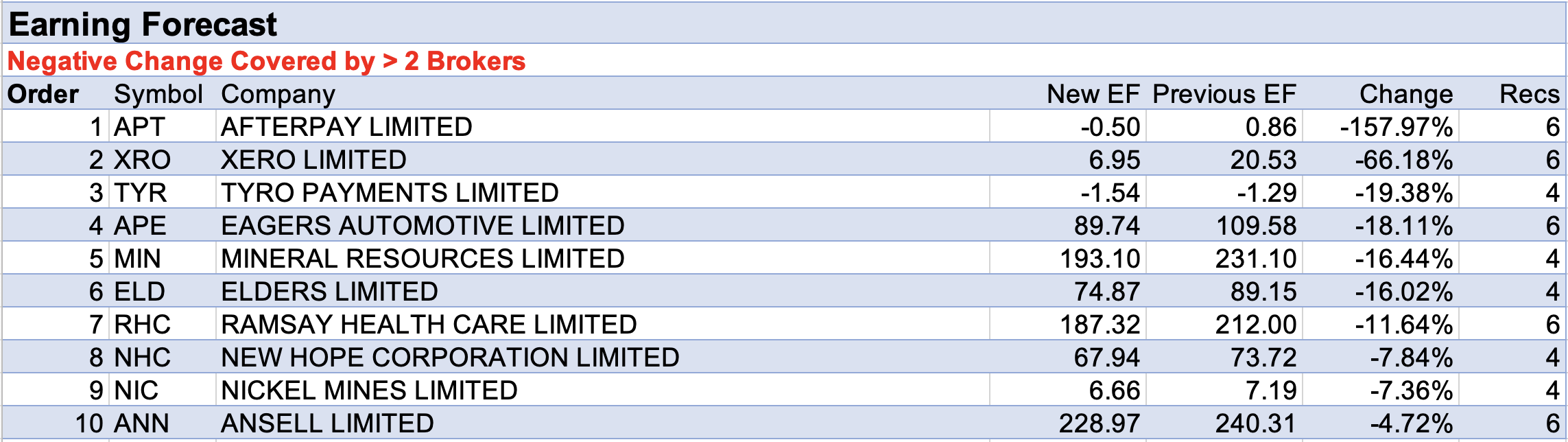

On the flipside, Afterpay received the largest percentage downgrade to forecasts earnings last week. While generating increased November app downloads in the US, Morgan Stanley noted competitor Affirm had a greater rate of increase.

Next up was Xero. Despite strong first half results, UBS finds the valuation is too high to offer fair reward for risk to investors.

UBS lowered its FY21 EPS forecast by -7% for Eagers Automotive following revised FY21 guidance. However, demand is considered to remain strong despite recent lockdown impacts and management pointed to ongoing strong growth for Easyauto123. Morgan Stanley also remains upbeat as pent-up demand has led to a growing order book and believes the company is well placed going into 2022.

Finally, AGM commentary by Mineral Resources implied to Morgan Stanley that margins could come under pressure.

Total Buy recommendations take up 55.60% of the total, versus 37.80% on Neutral/Hold, while Sell ratings account for the remaining 6.60%.

In the good books

ATLAS ARTERIA (ALX) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 4/1/0

Macquarie upgrades Atlas Arteria to Outperform from Hold, noting the company is trading slightly below fair value, and that the APRR concession and likely improved certainty towards Greenway should combine with the attractive dividend to spur desire.

Target price rises 35c to $6.87 to reflect improved cash flow and a -30 basis point cut in bond forecasts.

Macquarie tinkers with Atlas Arteria’s earnings estimates, shaving -1.2% off FY21, adding 0.2% to FY22; and cutting -2.8% from FY24, expecting the improved Greenway traffic outlook will fall foul of the currency outlook.

The company’s investor day met expectations, the 100% distribution policy intact, and the company continuing to adopt a legislation solution to the Greenway toll-road-to-concession settlement.

October inflation fell at 2.6%, compared to the broker’s forecast 2.1%, which should boost toll revenue.

EAGERS AUTOMOTIVE LIMITED (APE) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 5/1/0

Lockdowns in the second half of FY21 are set to cause up to an estimated -$25m impact on Eagers Automotive full-year earnings guidance of $390-395m, with Ord Minnett noting demand continues to exceed supply capabilities.

The company has grown its order bank for sixteen consecutive months, providing near-term earnings confidence with revenue to be recognised on the backlog upon delivery of vehicles, and some suggestion that supply chain congestion could ease in the next six months.

The rating is upgraded to Buy from Accumulate and the target price increases to $18.50 from $18.00.

EVOLUTION MINING LIMITED (EVN) was upgraded to Buy from Neutral by Citi, B/H/S: 2/4/0

Evolution Mining’s $1bn deal with Glencore that will see it take ownership of the Ernest Henry operation gets the approval of Citi, supported by the broker’s bullish view on copper.

Citi believes the deal is accretive to Evolution and should enable management to continue its track record of cost-out at a site previously owned by a major.

On that basis, Citi upgrades to Buy from Neutral. The target price gains 50c to $4.70.

Citi’s in-house view is for a multi-year, electrification driven bull market for copper with long term prices of US$4.08/lb or US$9,000/t. Ernest Henry will lift Evolution Mining’s copper output to circa 60ktpa, points out the broker.

In the not-so-good books

INCITEC PIVOT LIMITED (IPL) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 5/2/0

Following the released of Incitec Pivot’s FY21 metrics and a strong earnings result, Ord Minnet has increased earnings before tax forecasts by 8% for FY21 and 35% for FY22.

The broker expects elevated fertiliser pricing to persist for at least another six months.

Given recent share pricing, the rating is downgraded to Accumulate from Buy while the target price increases to $3.50 from $3.20.

SEEK LIMITED (SEK) was downgraded to Neutral from Buy by UBS, B/H/S: 2/3/0

After reviewing Seek’s “solid” trading update, UBS downgrades its rating to Neutral from Buy. It’s thought $1bn of revenues in A&NZ over the next 5 years have already been priced in by the market. The target price rises to $36 from $35.

While admitting forecasting remains difficult, Seek management expects to achieve the top-end of the FY22 existing guidance range for underlying revenue, earnings (EBITDA) and profit.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.