Three really good stocks that have been sold off recently look poised to have a good 2022 and their economic stars seem to be aligning. The best bit is that not only does fundamental analysis point to decent prospects for these companies, their charts are showing signs I always like to see.

One of my favourite plays is to buy a quality company that has been beaten up by the market, and the best time to buy in is when there has been a 5% plus lift-off what looks like a bottom for the stock.

An additional plus to make me want to part with my hard-earned income to go long a stock is when the analysts are giving the company a strong thumbs up. Of course, these guys can be wrong — they can be fooled by a curveball, such as a screwy Chinese policy or Coronavirus —but they have a pretty good record.

I especially like it when the upside is big so even if they’re half-right, then I’m still in for a decent return.

And let me say that in this game of investing I like to think my selection can average 10% or better because an ETF for the S&P/ASX 200 is 10% per annum over a decade.

The companies I think are ripe for the plucking are BHP, Rio Tinto and Fortescue Metals Group. Why?

Well, even if inflation is set to remain higher for longer than I think (along with a host of smart economists and central bankers), then commodity prices look likely to head higher.

CNBC talked to the respected National Securities chief market strategist Art Hogan, who reflected on the best performing major S&P equities sector last week, which was materials. This sector is an inflation play that gained more than 2.5%. But even without inflation, Hogan said he expects stocks to continue to rise. “I think we continue to grind higher. We did the larger reset that we needed, which was six weeks – in September and two weeks of October,” he said. “The good news is demand hasn’t been destroyed. It’s been delayed.”

Hogan agrees with the likes of JPMorgan Chase CEO Jamie Dimon, who says supply chain issues should get sorted out. “I should never do this, but I’ll make a forecast,” Dimon said at a conference held by the Institute of International Finance. “This will not be an issue next year at all. This is the worst part of it. I think great market systems will adjust for it like companies have.”

Interestingly, he speculated that “…supply chain disruptions may end up merely elongating the recovery rather than derailing it.”

Other pluses for iron ore producers seem to be the recent noises coming out of China. First the Evergrande paying of three tranches of bond debt last week helped commodity prices and related stocks sneak higher. The thinking here is that if Evergrande gets through this pickle, Chinese economic growth won’t be derailed, and that’s an important number for our iron ore producers.

Last week the state broadcaster CCTV reported that Xi at the APEC meeting said that China would “unswervingly” expand its opening up to the outside world and share China’s development opportunities with the world and Asia-Pacific countries.

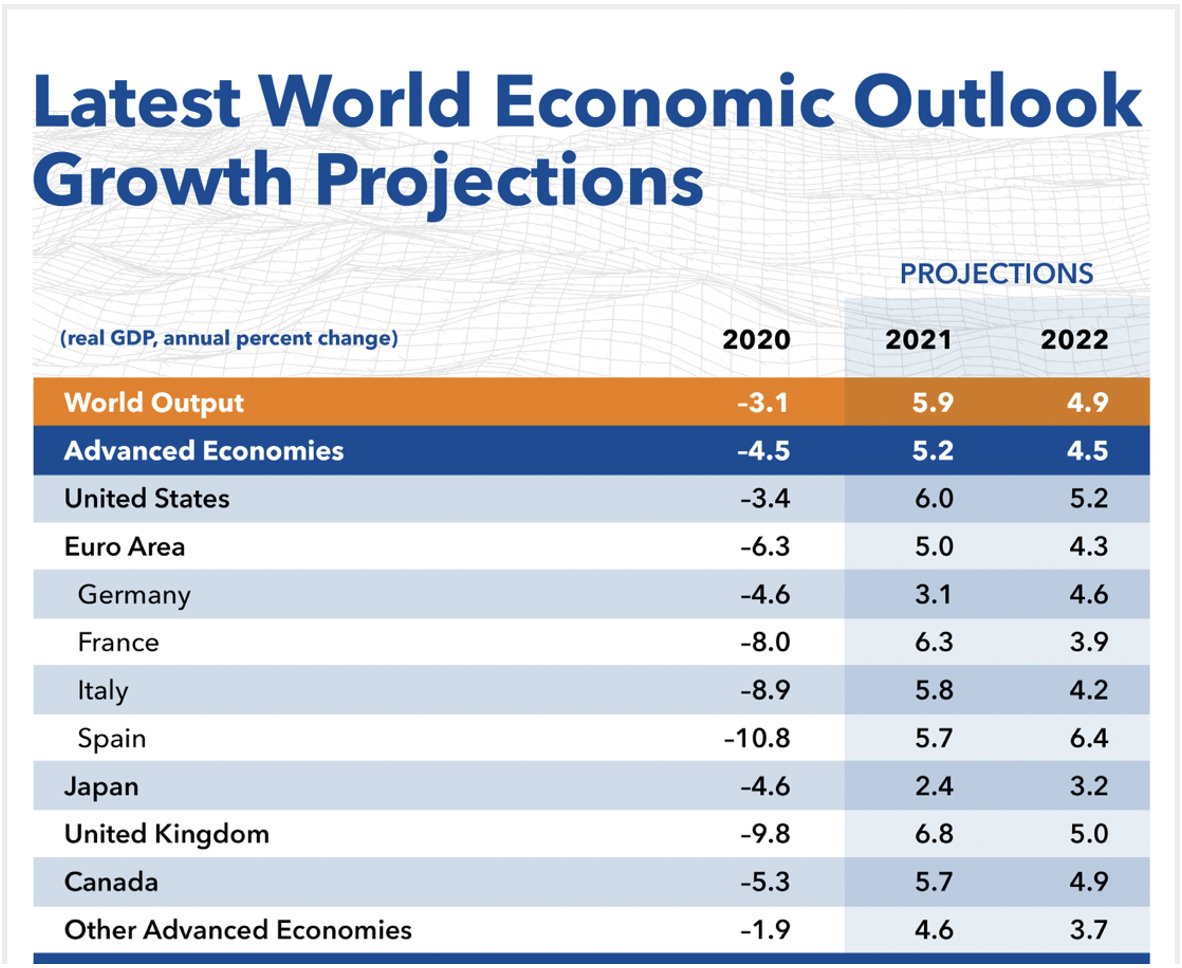

Meanwhile, the economic outlook for the global economy is looking very solid and this should be good for commodity prices, as well.

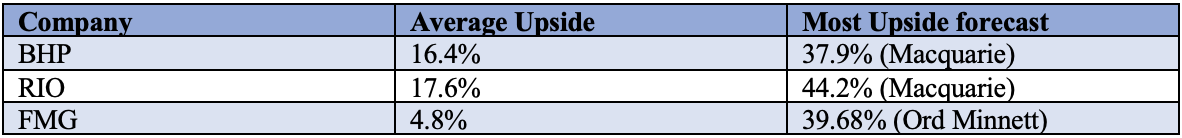

And I suspect these positive numbers for 2022 explain why many of the analysts like the iron ore producers. I especially like Macquarie’s strong share price views on the likes of BHP.

This table shows why I’m happy to play the big iron ore miners:

Now let’s look at the charts to see if they’re screaming that these stocks are on the way up!

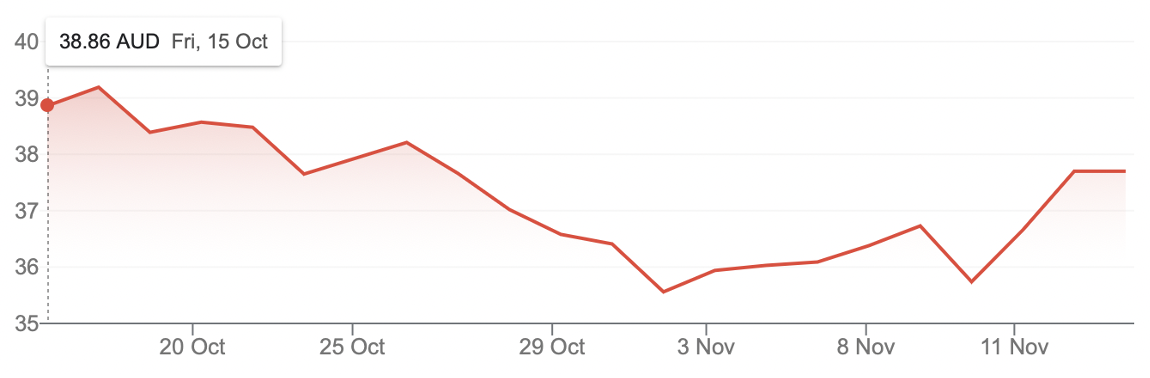

BHP one month

BHP has seen a 6% rise since November 6, which is a good start.

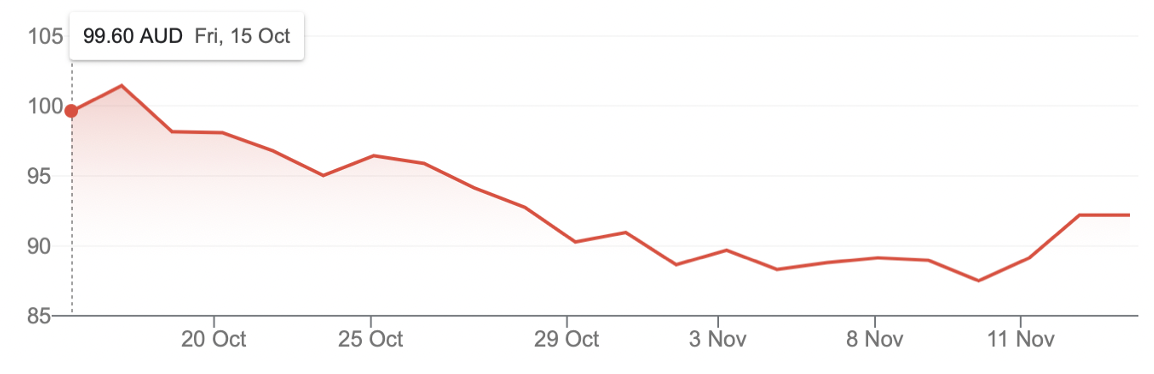

Rio Tinto one month

Rio is up 5.3% since November 10 but has been building a base since November 2, which is the exact same day that BHP was building its base.

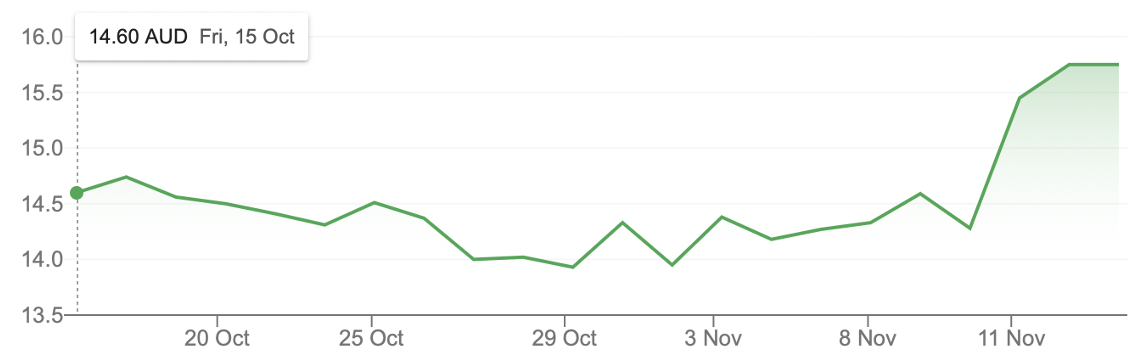

FMG

Fortescue has had a much better month being in the green and is up 7.88% for the month. It started building its base around October 27 but the real momentum picked up around November 2, with last week bringing a 10.14% surge.

Two days ago, Stockhead.com.au reported that “BHP CEO Mike Henry said on a media call after the iron ore giant’s AGM yesterday that the “outlook for economic growth in China and elsewhere does remain very positive.”

He also threw in the following:

- Iron ore prices are still high, they’re just not at the record highs that give you a sense of the support in terms of underlying supply and demand for iron ore.

- The Chinese steel industry will produce over a billion tonnes of steel for the third year running.

- Another factor for prices coming off record highs was the rising supply out of Brazil and Australia, not just a drop-off in demand.

- In the near term, the CEO thinks there’s a bit of support for iron ore prices.

Finally, the IMF in October told us that “the global economy is projected to grow 5.9 per cent in 2021 and 4.9 per cent in 2022, 0.1 percentage point lower for 2021 than in the July forecast. This is partially offset by stronger near-term prospects among some commodity-exporting emerging market and developing economies.”

Those growth numbers are big by historical standards and I will take that view on commodity-exporting economies as a good leg up for iron ore miners and their share prices.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.