I’m rarely late for meetings but missed the start of two last week. Melbourne’s traffic was horrendous. Road congestion has returned as the city emerges from lockdowns.

Recent TV reports suggest Melbourne traffic is already back to 85% of pre-pandemic levels. My guess is that congestion will be worse after the pandemic than beforehand – at least for a few months – as people worry about catching the virus on public transport.

I see more kids than usual (mine included) being dropped off at school rather than taking public transport, walking or riding their bikes. Although road congestion is terrible for commuters, it’s good for a range of large and small companies.

Obvious winners are toll-road companies that benefit from higher traffic volumes on their freeways. After lagging the share market, Transurban Group looks interesting as a play on improving traffic volume. So, too, Atlas Arteria, an owner of toll roads overseas.

There are other ways to play the traffic-recovery trend. I mentioned several car stocks and financiers of used-car purchases in this report in recent months. The logic is simple: as more people return to on-site work, many will need to upgrade their car or buy one.

Car-parts distributor Bapcor will benefit as more people service their cars again. Like many, I delayed a car service during the pandemic because my car mostly sat in the driveway. Listed panel beater AMA Group will gain car smashes as traffic volumes increase but should be considered speculative.

One of my favourite small-cap stocks, Collins Foods, will benefit as people spend more time in cars and go to fast-food drive-thrus. A large number of Collins’ KFC outlets have drive-thrus and are on main roads. KFC’s drive-thru locations are a more valuable asset after the pandemic.

In property, Australian Real Estate Investment Trusts (A-REITs) that own petrol and convenience stores have solid growth prospects, even with the transition to electric vehicles (which still seems a long way off in Australia). These A-REITs include APN Convenience REIT, Dexus Convenience REIT and Waypoint REIT.

Of course, it’s dangerous to draw too long a bow between rising traffic congestion and stocks. But there’s no doubt that people spending more time in cars each day benefits some companies. It’s also likely that resistance to using public transport among some parts of the population will outweigh the effect of more people working from home, in terms of cars on the road.

Media companies are overlooked beneficiaries of traffic congestion. More time in cars means more time listening to radio stations and their advertisements. Higher traffic volumes on the road also mean more eyeballs looking at roadside print or electronic billboard advertising.

Among small-cap media stocks exposed to these road-traffic volumes, Ooh!media, Southern Cross Media Group, GTN (a provider of traffic news to radio and TV stations) and HT&E (formerly APN Outdoor Group) stand out. Of those, Ooh!media and Southern Cross are my preferences.

Here is a snapshot of both stocks:

1. Ooh!media (OML)

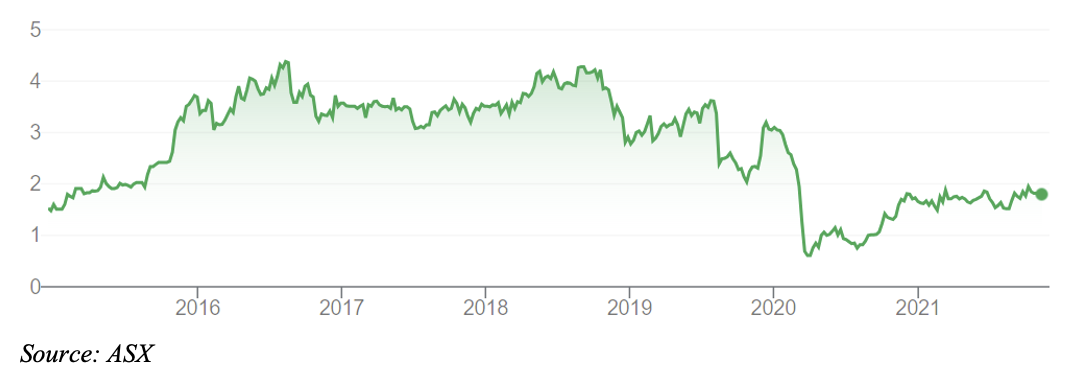

The market could not get enough of Ooh!media when it listed on ASX in December 2014 at $1.93 a share, for a $289-million market capitalisation. OML traded above $4 within two years of listing. Investors liked out-of-home advertising’s potential to increase its market share.

But OML slumped from about $3 before the pandemic to 61 cents in March 2020. Investors dumped the stock amid fears of sharply lower advertising revenue. As Australia went into lockdown, outdoor advertising on roads, and indoor advertising at airports, tanked.

OML has since recovered to $1.79 but has a lot of lost ground to make up. Over three years, OML’s annualised average total return is -18%, Morningstar data shows. Over five years, the total return is -9%. Earnings misses, management changes and other problems have weighed on a company that was once a small-cap market darling.

OML’s half-year result for FY21, released in August, had some bright spots. First-half revenue rose 23% and second-quarter revenue in FY21 was double that of a year earlier. Third-quarter revenue was pacing at 38% above the same quarter in FY20.

OML said advertisers returned quickly to the out-of-home advertising segment at the end of lockdowns. Road-related advertising revenue jumped 44%, which fits this column’s thesis that a rebound in traffic volumes will attract advertisers back to this segment.

For all the short-term challenges, out-of-home advertising has good prospects. PwC predicts out-of-home advertising will have 7.3% market share of Australia’s advertising market by 2025, versus 5% in 2020 – and grow at almost double the rate of the broader ad market.

My interest in out-of-home advertising is based on the potential of digitisation. As static advertising billboards are increasingly converted to digital billboards, new advertising opportunities emerge. More ads can be run through the same space at higher yields. Digital billboard ads can also be linked to events (for example, sunscreen ads on an extra-hot day).

As so often happens with small-caps, investors forgot about OML after its problems, even though it’s a quality company with an excellent market position. OML’s headwinds (a drop in advertising during the pandemic) will turn into tailwinds in FY22 (an ad recovery) and there is long-term structural growth in its market segment. That’s a good combination.

OML’s $1.79 share price compares to a consensus share-price target of $1.59, which implies the stock is moderately overvalued. The market is too bearish. Share-price gains will be slower from here, but there’s a lot to like about OML’s recovery prospects after Covid and its leverage to faster growth of out-of-home advertising over the next five years.

Ooh!media (OML)

2. Southern Cross Media Group (SXL)

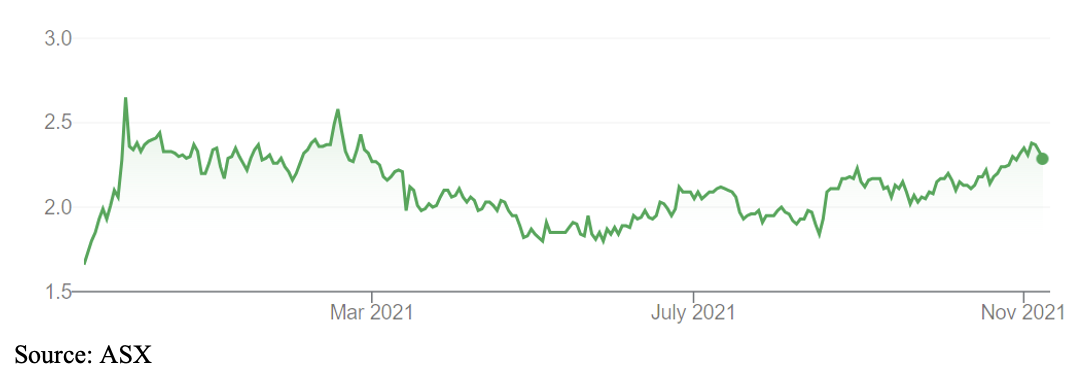

Shares in the owner of free-to-air radio, TV and online media platforms fell off a cliff during the pandemic as advertising dried up. In April 2020, Southern Cross launched a $169-mllion emergency capital raising – a smart move to shore up its balance sheet.

The Coronavirus and ensuing lockdowns crushed advertising volumes. Advertising is often the first thing companies cut during a market shock. For a small-cap media organisation like Southern Cross, the downturn in radio and TV advertising was severe. Its share price tumbled.

Southern Cross has recovered from its $1.45 low over 52 weeks to $2.28. But the stock has a lot of lost ground to make up. It’s disappointed for too long.

Yet for all its problems, Southern Cross has solid assets. It owns the male-focused Triple M network and the female-focused Hit Network. About two-thirds of its revenue comes from dozens of radio stations in metros and regional cities.

The TV business (almost a third of FY21 revenue) has several regional licences. Most of Southern Cross’s TV programming comes from its deal with the Nine Network.

In its FY21 result, released in August, Southern Cross said group audio revenues were up 20% in July and August compared to the same time a year earlier. Like other media companies, Southern Cross is benefitting from a lift in advertising as life returns to normal.

Prior-year revenue comparisons need care because they are coming off an unusually soft trading period. But the snapback in advertising after Covid appears to be stronger than the market expected, at least with Southern Cross. Moreover, the advertising recovery, which began in TV and digital channels, appears to be moving to radio.

I like radio’s long-term prospects as an advertising medium. Plenty of people have written radio off over the years, but population growth means more people in cars for longer. That’s good for radio-audience growth. The boom in podcasts is another growth driver for radio companies that repurpose their brands into long-form, play-on-demand content.

Against that, free-to-air TV has serious structural challenges, namely the boom in streaming services that are disrupting how we watch TV. But TV is a smaller part of Southern Cross’s revenue, and regional TV revenues should be stickier than those in metro markets.

Southern Cross’s share price of $2.28 compares to a consensus analyst target of $2.06, using data compiled by FN Arena. That suggests Southern Cross is a touch overvalued. Morningstar values Southern Cross at $3.50 and is among the biggest bulls on the stock.

I’m not as bullish as Morningstar but believe the consensus view is too bearish. Southern Cross has solid prospects as the advertising volumes, particularly on radio, recover after Covid. That should be the catalyst for the next leg of Southern Cross’s share-price gains, with potential for higher volatility along the way.

Southern Cross Media Group (SXL)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 9 November 2021.